Earnings summaries and quarterly performance for REGENERON PHARMACEUTICALS.

Executive leadership at REGENERON PHARMACEUTICALS.

Leonard Schleifer

President and Chief Executive Officer

Andrew Murphy

Executive Vice President, Research

Christopher Fenimore

Executive Vice President, Finance and Chief Financial Officer

Daniel Van Plew

Executive Vice President and General Manager, Industrial Operations and Product Supply

George Yancopoulos

President and Chief Scientific Officer

Jason Pitofsky

Vice President, Controller

Joseph LaRosa

Executive Vice President, General Counsel and Secretary

Marion McCourt

Executive Vice President, Commercial

Board of directors at REGENERON PHARMACEUTICALS.

Arthur Ryan

Director

Bonnie Bassler

Director

Christine Poon

Lead Independent Director

Craig Thompson

Director

David Schenkein

Director

George Sing

Director

Huda Zoghbi

Director

Joseph Goldstein

Director

Kathryn Guarini

Director

Michael Brown

Director

N. Anthony Coles

Director

Research analysts who have asked questions during REGENERON PHARMACEUTICALS earnings calls.

Salveen Richter

Goldman Sachs

9 questions for REGN

Tyler Van Buren

TD Cowen

9 questions for REGN

Akash Tewari

Jefferies

8 questions for REGN

Evan Seigerman

BMO Capital Markets

8 questions for REGN

Terence Flynn

Morgan Stanley

8 questions for REGN

Alexandria Hammond

Wolfe Research

7 questions for REGN

Brian Abrahams

RBC Capital Markets

7 questions for REGN

David Risinger

Leerink Partners

7 questions for REGN

Carter L. Gould

Barclays

6 questions for REGN

Cory Kasimov

Evercore ISI

6 questions for REGN

Christopher Schott

JPMorgan Chase & Co.

5 questions for REGN

Geoff Meacham

Citigroup Inc.

4 questions for REGN

Christopher Raymond

Piper Sandler

3 questions for REGN

William Pickering

Sanford C. Bernstein & Co.

3 questions for REGN

Chris Raymond

Raymond James

2 questions for REGN

Jeffrey Meacham

Citi

2 questions for REGN

Mohit Bansal

Wells Fargo & Company

2 questions for REGN

Simon Goodwin

Rothschild & Co. Redburn

2 questions for REGN

Taylor Hanley

JPMorgan Chase & Co.

2 questions for REGN

Tazeen Ahmad

Bank of America

2 questions for REGN

Tim Anderson

Bank of America

2 questions for REGN

Alice Natelton

Bank of America

1 question for REGN

Chris

Morgan Stanley

1 question for REGN

Trung Huynh

UBS Group AG

1 question for REGN

Recent press releases and 8-K filings for REGN.

- Regeneron will showcase new Phase 3 results for EYLEA HD (aflibercept 8 mg) at the Angiogenesis meeting on February 7, 2026, highlighting its unparalleled durability and comparable efficacy/safety to EYLEA 2 mg with fewer injections.

- Data from the QUASAR trial will include final long-term outcomes through 64 weeks, confirming the first every-two-month treatment option for RVO patients who previously required monthly injections.

- ELARA Phase 3b interim data will be presented, showing that patients switched to monthly EYLEA HD from other anti-VEGF therapies experienced improved visual acuity and better anatomic control.

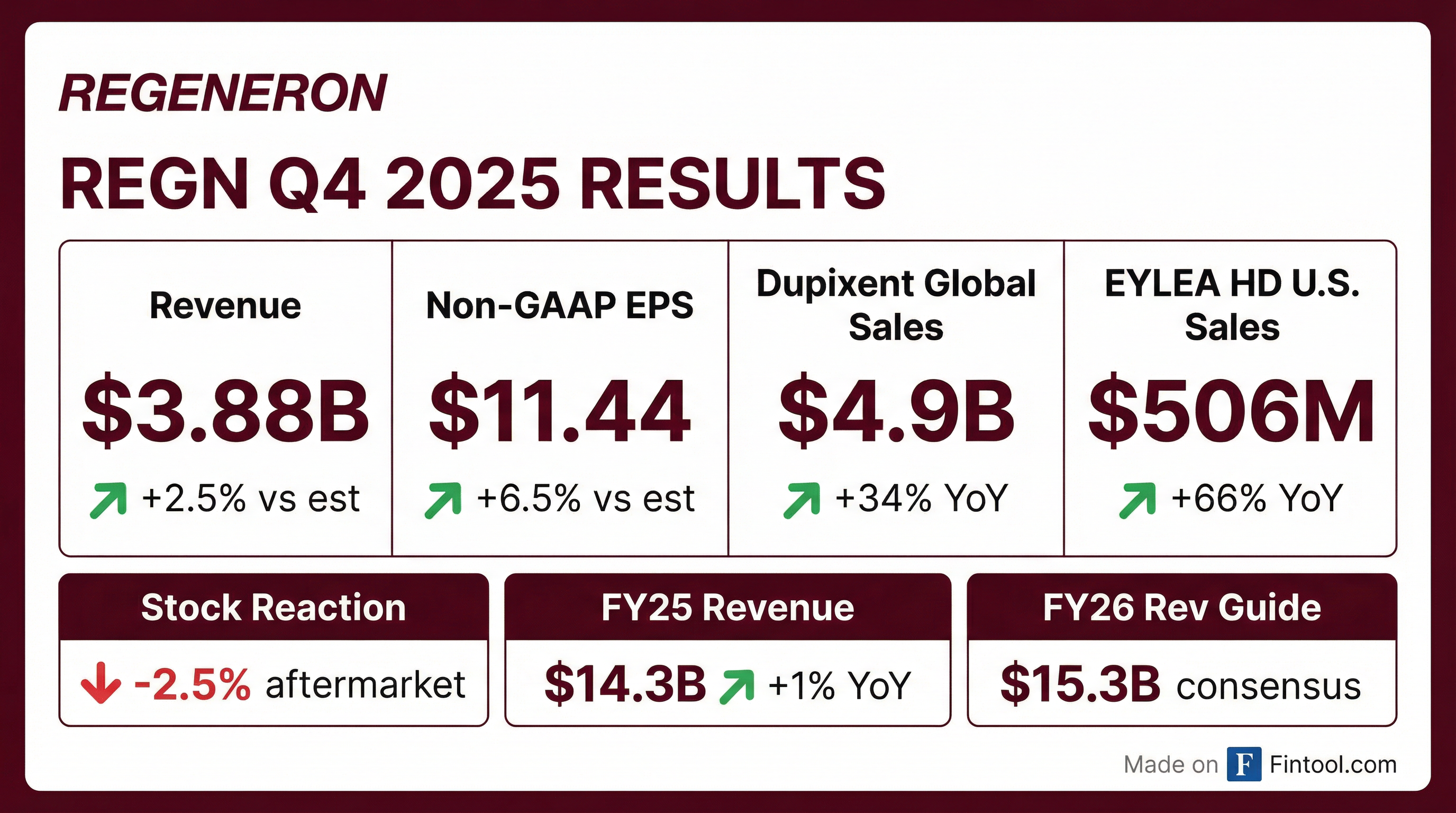

- Q4 total revenues of $3.9 billion, up 3% year-over-year; diluted EPS of $11.44 on net income of $1.2 billion.

- Key product sales: Libtayo net sales of $425 million; EYLEA HD net sales of $506 million (combined U.S. EYLEA franchise of $1.1 billion); DUPIXENT global net sales of $4.9 billion.

- Generated $4.1 billion in free cash flow; cash and marketable securities less debt of $16.2 billion; returned $3.8 billion to shareholders (including $3.4 billion in share repurchases) and declared a quarterly dividend of $0.94 per share (annualized $3.76).

- 2026 guidance: R&D spend of $5.9–6.1 billion; SG&A of $2.5–2.65 billion; gross margin 83–84%; capex $1.1–1.3 billion; effective tax rate 13–15%.

- Regeneron posted Q4 2025 total revenues of $3.9 B and non-GAAP EPS of $11.44.

- Dupixent net sales of $4.9 B in 4Q25 (+32% YoY), with >1.4 M patients on therapy; approvals in CSU (EU) and pediatric asthma (Japan) broaden label.

- LIBTAYO sales rose 13% YoY to $425 M in Q4, driven by adjuvant CSCC and NSCLC uptake.

- Key pipeline milestones: sBLA priority review for AFRS (PDUFA Feb 2026), BLA submission for DB-OTO in genetic hearing loss (decision 1H 2026), garetosmab FOP submissions.

- Q4 2025 total revenue was $3.9 billion, up 3% year-over-year; diluted EPS of $11.44 on net income of $1.2 billion.

- Key product sales in Q4 2025: Dupixent $4.9 billion (+32% YoY), EYLEA HD US net sales $506 million (+66%), Libtayo $425 million (+13%).

- Generated $4.1 billion free cash flow in 2025 and returned $3.8 billion to shareholders via $3.4 billion in share repurchases (with $1.5 billion remaining authorization) and a $0.94/share quarterly dividend.

- 2026 guidance: R&D spend of $5.9–6.1 billion, SG&A $2.5–2.65 billion, gross margin 83–84%, CapEx $1.1–1.3 billion, and effective tax rate 13–15%.

- Pipeline outlook includes at least four FDA approvals (three new molecular entities plus EYLEA HD prefilled syringe) and initiation of 18 Phase 3 studies (targeting ~35,000 patients).

- Regeneron delivered $3.9 billion in Q4 2025 revenues, up 3% year-over-year, with non-GAAP diluted EPS of $11.44.

- Dupixent Q4 net sales reached $4.9 billion (+32% yoy), Eylea HD US net sales were $506 million (+66% yoy), and Libtayo net sales were $425 million (+13% yoy).

- 2026 guidance expects R&D spend of $5.9 billion–$6.1 billion and SG&A of $2.5 billion–$2.65 billion.

- Returned $3.8 billion to shareholders in 2025 (share repurchases of $3.4 billion, dividends of $400 million) and initiated a quarterly dividend of $0.94 per share.

- Fourth quarter 2025 revenues increased 3% to $3.9 billion, and full year revenues rose 1% to $14.3 billion; Q4 GAAP EPS was $7.86 and non-GAAP EPS $11.44, while FY GAAP EPS was $41.48 and non-GAAP EPS $44.31

- Dupixent global net sales reached $4.9 billion in Q4 (+34%) and $17.8 billion for the year (+26%); EYLEA HD U.S. net sales grew 66% to $506 million in Q4

- The company repurchased $671 million of stock in Q4 and $3.5 billion in FY 2025, with $1.5 billion remaining under its buyback program

- 2026 guidance includes GAAP R&D of $6.45 billion–$6.68 billion, GAAP gross margin on net product sales of 79%–80%, and capital expenditures of $1.1 billion–$1.3 billion

- A cash dividend of $0.94 per share was declared, payable March 5, 2026

- Achieved Q4 2025 revenues of $3.884 billion (+3% YoY) and full year 2025 revenues of $14.343 billion (+1%)

- Dupixent global net sales rose 34% to $4.9 billion in Q4 and 26% to $17.8 billion for the full year

- Posted GAAP EPS of $7.86 and non-GAAP EPS of $11.44 in Q4 2025

- Returned capital with $3.5 billion of share repurchases in FY 2025 and declared a $0.94/share dividend payable March 5, 2026

- Global market to rise from USD 3.24 Billion in 2025 to USD 6.93 Billion by 2031 at a 13.5% CAGR

- Expansion driven by reduced sequencing costs via high-throughput systems (e.g., Illumina shipped 352 NovaSeq X units in 2023) and large public programs (NIH’s All of Us released 245,388 genomes)

- Regeneron’s genetics center sequenced its two millionth exome in 2024, illustrating rapid data growth in the industry

- Key challenges include computational/storage bottlenecks and data governance issues: 54% of experts cite unstructured data and 48% note lack of metadata standardization

- Market trends favor long-read sequencing (PacBio shipped 173 Revio systems in FY 2023) and increased adoption of whole exome sequencing in oncology (Guardant Health test volumes up 20% YoY to 46,900)

- Platform and pipeline: Regeneron’s proprietary platforms have yielded 45 clinical candidates across six therapeutic areas and 14 internally discovered approvals, averaging one approval per year over the past 15 years.

- Eylea HD growth: In Q4 2025, U.S. net sales of Eylea HD were $506 million, up 66% YoY and 18% sequentially, with label expansion and an FDA filler decision expected in Q2 2026 to support further uptake.

- Dupixent performance: Dupixent now treats over 1.3 million patients, with annualized global net sales exceeding $19 billion as of Q3 2025, growing 27% YoY.

- Key upcoming readouts: Phase 3 data anticipated H1 2026 include the fianlimab + Libtayo melanoma trial , linvoseltamab’s broad MRD negativity in multiple myeloma , and pivotal cemdisiran + pozelimab results in PNH and myasthenia gravis.

- Strategic investments and innovations: Regeneron plans $6 billion in R&D and $7 billion in capital investments for 2026; advancing novel programs such as an OLA + Praluent obesity combo, DB-OTO gene therapy for deafness, and Garetosumab for FOP with potential approvals in 2026.

- Regeneron highlighted its science-first, big data-driven strategy, leveraging proprietary platforms (VelocImmune, VelociAb) to support a pipeline of 45 clinical candidates across six therapeutic areas and 14 internally discovered approvals over the past 15 years.

- In Q4 2025, the Retina franchise generated $1.1 billion in U.S. net sales (Eylea HD + Eylea), with Eylea HD at $506 million (+66% YoY, +18% QoQ), while Dupixent reached >1.3 million active patients and $19 billion annualized net sales.

- The company plans $6 billion in R&D investment and $7 billion+ in U.S. capital expenditures for 2026, and returned $3.8 billion to shareholders in 2025 via share buybacks and the initiation of a dividend.

- Key upcoming catalysts include pivotal readouts for the fianlimab + Libtayo melanoma combo, linvoseltamab monotherapy in first-line myeloma, cemdisiran/pozelimab in PNH and MG, Factor XI antibody anticoagulants, obesity therapy combinations, and data for gene therapy DB-OTO and Garetosumab in rare diseases.

Quarterly earnings call transcripts for REGENERON PHARMACEUTICALS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more