Earnings summaries and quarterly performance for StandardAero.

Executive leadership at StandardAero.

Russell Ford

Chief Executive Officer

Alexander Trapp

Chief Strategy Officer

Anthony Brancato

President, Engine Services - Business Aviation

Daniel Satterfield

Chief Financial Officer

Gregory Krekeler

President, Component Repair Services

Kimberly Ernzen

Chief Operating Officer

Lewis Prebble

President, Engine Services - Airlines & Fleets

Malisa Chambliss

Chief Human Resources Officer

Marc Drobny

President, Engine Services - Military, Helicopters & Energy

Steve Sinquefield

Chief Legal Officer

Board of directors at StandardAero.

Research analysts who have asked questions during StandardAero earnings calls.

Seth Seifman

JPMorgan Chase & Co.

6 questions for SARO

Gavin Parsons

UBS Group AG

5 questions for SARO

Krista Friesen

CIBC

5 questions for SARO

Sheila Kahyaoglu

Jefferies

5 questions for SARO

Kristine Liwag

Morgan Stanley

3 questions for SARO

Doug Harned

Bernstein

2 questions for SARO

Douglas Harned

Sanford C. Bernstein & Co., LLC

2 questions for SARO

Kenneth Herbert

RBC Capital Markets

2 questions for SARO

Michael Ciarmoli

Truist Securities, Inc.

2 questions for SARO

Myles Walton

Wolfe Research, LLC

2 questions for SARO

Ron Epstein

Bank of America Corporation

2 questions for SARO

Steve Stryakos

RBC Capital Markets

2 questions for SARO

Gregory Dahlberg

Wolfe Research, LLC

1 question for SARO

Jordan Lyonnais

Bank of America

1 question for SARO

Ronald Epstein

Bank of America

1 question for SARO

Recent press releases and 8-K filings for SARO.

- StandardAero reported a record year in 2025, with revenue increasing 15.8% year-over-year to $6.059 billion and Adjusted EBITDA growing 17% to $808 million.

- The company generated $209 million in Free Cash Flow for the full year 2025, a significant improvement from a $45 million use in 2024, and reduced its Net Debt to Adjusted EBITDA Leverage Ratio from 3.1 to 2.4 times.

- For fiscal year 2026, StandardAero forecasts total company revenue between $6.275 billion and $6.425 billion and Adjusted EBITDA between $870 million and $905 million, implying approximately 10% year-over-year growth at the midpoint.

- Adjusted EPS is projected to grow 18% at the midpoint in 2026, from $1.19 in 2025 to a range of $1.35 to $1.45, with Free Cash Flow expected to increase by 36% at the midpoint to $270 million to $300 million.

- Growth in 2025 was driven by strong demand and key programs like LEAP, which saw 60 engine inductions and revenues approximately 2.5 times higher in the second half of 2025 compared to the first half, with LEAP and CFM56 DFW programs expected to reach profitability in the first half of 2026.

- StandardAero reported a record 2025, with revenues increasing 16% year-over-year and Adjusted EBITDA up 17% to $808 million, while generating $209 million in Free Cash Flow.

- Strategic highlights for 2025 included a substantial ramp-up in the LEAP program with 60 engines inducted, facility expansions, and the restructuring of customer contracts to eliminate $300 million-$400 million of low-margin revenue.

- The company's Net Debt to Adjusted EBITDA Leverage Ratio improved to 2.4 times, and a $450 million share repurchase program was authorized in December.

- For fiscal year 2026, StandardAero forecasts total company revenue between $6.275 billion and $6.425 billion, Adjusted EBITDA between $870 million and $905 million, and Adjusted EPS between $1.35 and $1.45, anticipating continued double-digit earnings growth and margin expansion.

- StandardAero reported strong financial results for fiscal year 2025, with revenue growing 16% to $6,063 million and Adjusted EBITDA increasing 17% to $808 million.

- The company achieved $209 million in Free Cash Flow for FY 2025, a year-over-year improvement of $254 million, and significantly improved its leverage ratio to 2.4x.

- For fiscal year 2026, StandardAero provided guidance projecting Adjusted EBITDA between $870 million and $905 million, Adjusted EPS between $1.35 and $1.45, and Free Cash Flow between $270 million and $300 million.

- StandardAero authorized a $450 million share repurchase program as part of its capital allocation strategy.

- StandardAero reported full year 2025 revenue of $6.059 billion , an increase of 15.8% year-over-year, with Adjusted EBITDA of $808 million, up 17%, and Adjusted EPS of $1.19 per share. The company also generated $209 million in Free Cash Flow.

- For fiscal year 2026, the company forecasts revenue between $6.275 billion and $6.425 billion, Adjusted EBITDA of $870 million to $905 million, and Adjusted EPS of $1.35 to $1.45. This guidance includes the elimination of $300 million to $400 million of low-margin pass-through revenue.

- The LEAP program is expected to see revenues double year-over-year in 2026 and is anticipated to reach profitability in the first half of 2026.

- StandardAero's Net Debt to Adjusted EBITDA Leverage Ratio improved from 3.1 to 2.4 times during 2025, placing it within its target range.

- The Component Repair Services (CRS) segment's performance in Q4 2025 and Q1 2026 was affected by a small fire at its Phoenix facility and the U.S. government shutdown.

- StandardAero reported a record year in 2025, with revenue increasing 15.8% year-over-year to $6,062.5 million and Adjusted EBITDA growing 17.0% to $808.2 million.

- For Full Year 2025, Diluted EPS was $0.83 and Adjusted Diluted EPS was $1.19, with Free Cash Flow of $209.0 million and a Net Debt to Adjusted EBITDA Leverage Ratio of 2.4x as of December 31, 2025.

- In the Fourth Quarter 2025, revenue increased 13.5% year-over-year to $1,600.0 million and Adjusted EBITDA grew 12.7% to $209.7 million.

- The company initiated Full Year 2026 guidance, forecasting revenue between $6,275 and $6,425 million, Adjusted EBITDA between $870 and $905 million, and Adjusted Earnings Per Share between $1.35 and $1.45.

- StandardAero reported a record year in 2025, with revenue increasing 15.8% year-over-year to $6,062.5 million and Adjusted EBITDA growing 17.0% year-over-year to $808.2 million.

- For the full fiscal year 2025, Adjusted Diluted EPS was $1.19.

- The company highlighted sustained strength across the global engine aftermarket and disciplined execution as key drivers for its performance.

- StandardAero initiated Full Year 2026 guidance, projecting revenue between $6,275 to $6,425 million, Adjusted EBITDA of $870 to $905 million, and Adjusted Earnings Per Share of $1.35 to $1.45.

- On January 29, 2026, StandardAero, Inc. completed an underwritten public offering of 57,500,000 shares of its common stock by selling stockholders at a price of $31.00 per share. The company did not receive any proceeds from this sale.

- Concurrently on January 29, 2026, the company repurchased 1,637,465 shares of its common stock from a GIC-affiliated selling stockholder at $30.535 per share, pursuant to an existing stock repurchase program.

- StandardAero announced the pricing of a secondary offering of 50,000,000 shares of common stock by affiliates of The Carlyle Group Inc. and GIC at $31.00 per share.

- The Selling Stockholders will receive all net proceeds from this offering, with no shares being sold by StandardAero.

- Concurrently, StandardAero will repurchase $50 million of its Common Stock from a Selling Stockholder at the offering price, a move approved by its board in December 2025.

- Both the offering and the share repurchase are expected to close on January 29, 2026.

- StandardAero announced a secondary offering of 50,000,000 shares of common stock by affiliates of The Carlyle Group Inc. and GIC.

- The Selling Stockholders will receive all proceeds from this offering, and StandardAero will not receive any proceeds.

- Concurrently with the offering, StandardAero plans to repurchase $50 million of its common stock from a Selling Stockholder in a private transaction, under its existing stock repurchase program approved in December 2025.

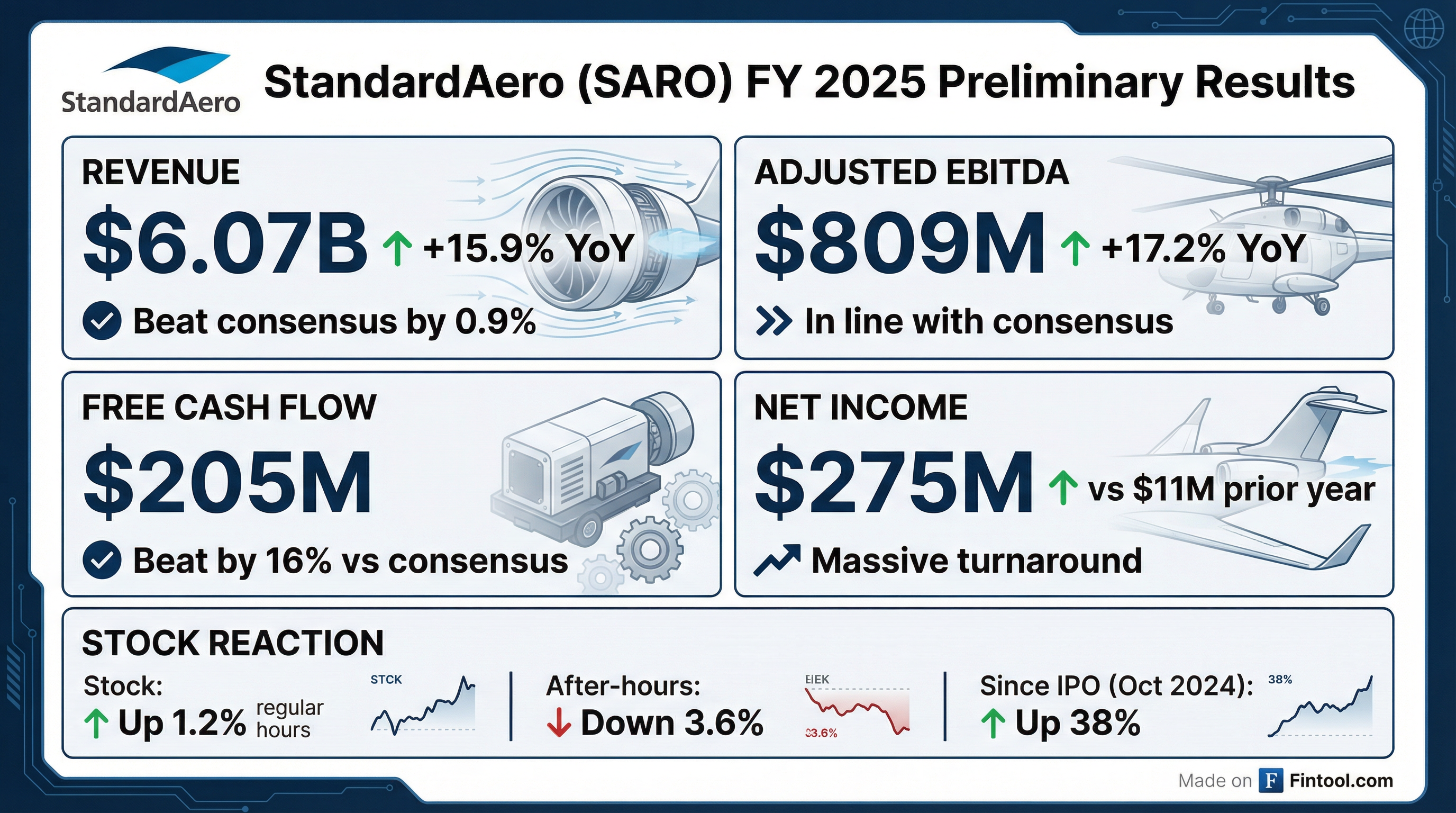

- StandardAero announced unaudited preliminary estimated results for the year ended December 31, 2025, noting that these results are subject to revision.

- Revenue for FY 2025 is expected to be between $6,053.0 million and $6,083.0 million, representing an increase of 15.6% to 16.1% compared to the prior year's $5,237.2 million.

- Net Income is estimated to be between $270.0 million and $280.0 million for FY 2025, a significant increase from $11.0 million in the prior year.

- Adjusted EBITDA is projected to be between $806.0 million and $812.0 million, an increase of 16.7% to 17.6% over the prior year's $690.5 million.

- Cash Flow from Operations is expected to be between $310.0 million and $320.0 million, and Free Cash Flow between $200.0 million and $210.0 million for FY 2025.

Quarterly earnings call transcripts for StandardAero.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more