Earnings summaries and quarterly performance for Sally Beauty Holdings.

Research analysts who have asked questions during Sally Beauty Holdings earnings calls.

Oliver Chen

TD Cowen

8 questions for SBH

Olivia Tong

Raymond James

4 questions for SBH

Olivia Tong Cheang

Raymond James Financial, Inc.

4 questions for SBH

Simeon Gutman

Morgan Stanley

4 questions for SBH

Susan Anderson

Canaccord Genuity Group

4 questions for SBH

Sydney Wagner

Jefferies

4 questions for SBH

Korinne Wolfmeyer

Piper Sandler & Co.

3 questions for SBH

Alec Legg

Canaccord Genuity

2 questions for SBH

Ashley Helgans

Jefferies

2 questions for SBH

Lauren Englund

Morgan Stanley

2 questions for SBH

Lauren Ng

Morgan Stanley

2 questions for SBH

Ashley Helen

Jefferies

1 question for SBH

Linda Bolton-Weiser

D.A. Davidson & Co.

1 question for SBH

Stephen Wagner

Jefferies

1 question for SBH

Recent press releases and 8-K filings for SBH.

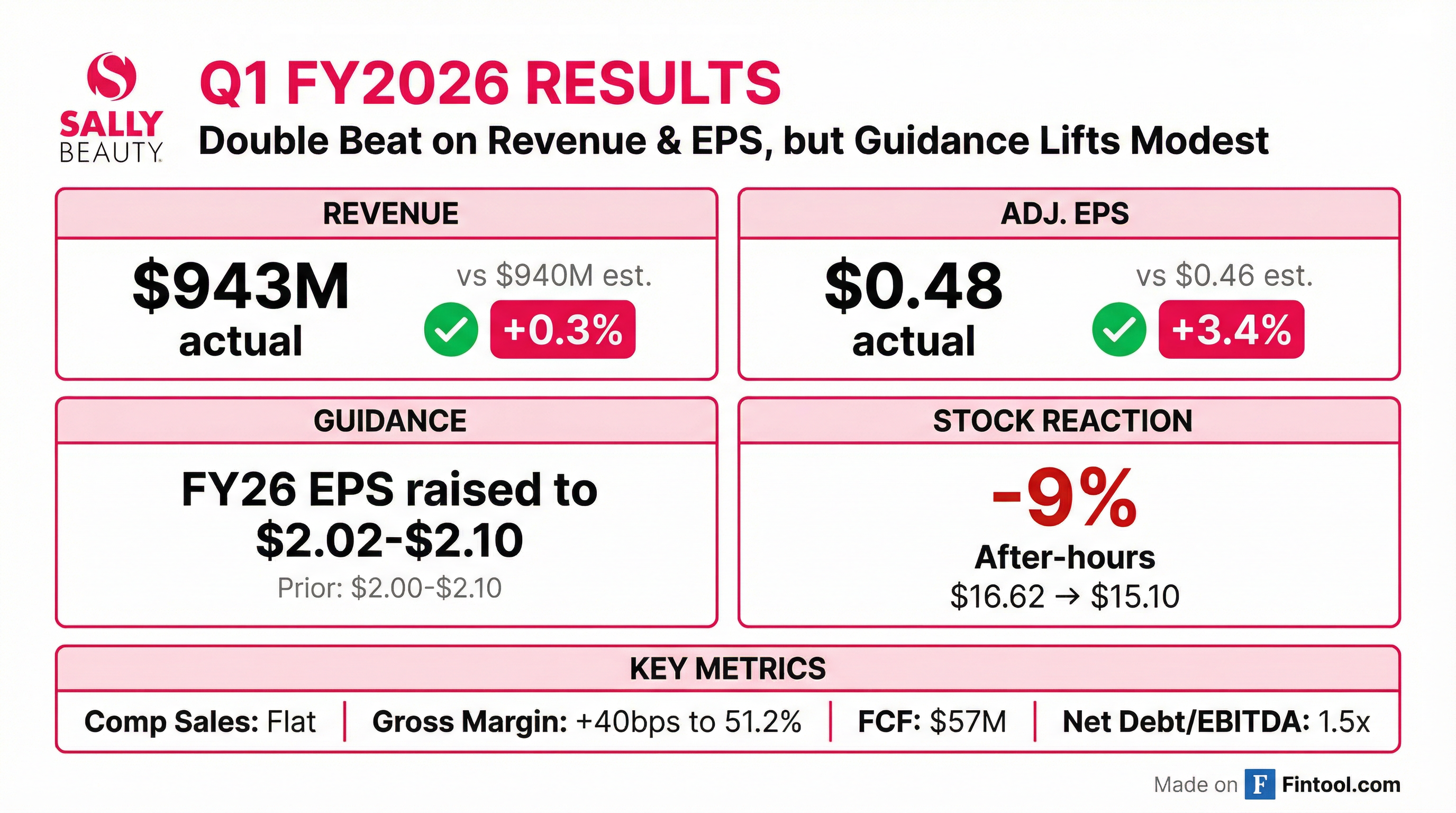

- Sally Beauty Holdings reported Q1 fiscal year 2026 results with total sales of $943 million and adjusted diluted earnings per share of $0.48, marking a 12% increase year-over-year. Comparable sales were flat.

- The company generated $93 million in cash flow from operations, deploying $20 million for debt reduction and $21 million for share repurchases.

- For fiscal year 2026, the low end of the adjusted diluted EPS guidance was raised to $2.02-$2.10 per share, with consolidated net sales guidance reiterated at $3.71-$3.77 billion.

- Strategic initiatives, including the Fuel for Growth program, contributed $14 million in pre-tax benefits in Q1, with $45 million expected for the full year. The company also expanded its fragrance category to 1,000 Sally U.S. stores and completed 8 Sally Ignited store refreshes in Q1.

- Sally Beauty Holdings reported Q1 2026 total sales of $943 million and adjusted diluted earnings per share of $0.48, an increase of 12% year-over-year.

- The company generated $93 million in cash flow from operations, deploying $20 million to debt paydown and $21 million for share repurchases.

- The Fuel for Growth program contributed $14 million in pre-tax benefits in Q1, and is on track to capture $45 million for the full fiscal year, with cumulative run rate savings of $120 million by the end of fiscal 2026.

- Strategic initiatives like the Sally Ignited store refreshes are showing positive KPIs, including a mid to high single-digit increase in new and reactivated customers, and the fragrance category, introduced in 1,000 Sally U.S. stores, will expand to 2,000 stores in Q2.

- For fiscal year 2026, the company raised the low end of its adjusted diluted EPS guidance to a range of $2.02-$2.10 and expects consolidated net sales between $3.71-$3.77 billion.

- Sally Beauty Holdings achieved a strong start to fiscal year 2026, with Q1 total sales of $943 million and comparable sales flat to last year.

- The company reported adjusted diluted earnings per share of $0.48, an increase of 12% year-over-year, and adjusted operating income of $80 million, both at or above expectations.

- Sally Beauty Holdings generated $93 million in cash flow from operations, used $20 million to pay down debt, and repurchased $21 million of shares.

- The low end of the full-year fiscal 2026 adjusted diluted EPS guidance was raised to $2.02-$2.10 per share.

- Strategic initiatives, including the Fuel for Growth program, contributed $14 million in pre-tax benefits in Q1 and are on track for $45 million in benefits for the full year, aiming for $120 million in cumulative run rate savings by fiscal year-end.

- Sally Beauty Holdings, Inc. reported Q1 Fiscal 2026 consolidated net sales of $943 million, an increase of 0.6%, with comparable sales remaining flat.

- Adjusted Diluted EPS for Q1 Fiscal 2026 increased by 12% to $0.48, while GAAP diluted EPS decreased by 22% to $0.45.

- The company generated $93 million in cash flow from operations and $57 million in Free Cash Flow in Q1 Fiscal 2026, utilizing these funds for $20 million in term loan repayment and $21 million in share repurchases.

- Sally Beauty Holdings raised the low end of its Fiscal 2026 Adjusted Diluted EPS guidance to a range of $2.02 to $2.10.

- Sally Beauty Holdings reported Q1 Fiscal 2026 consolidated net sales of $943 million, an increase of 0.6%, with flat comparable sales.

- For Q1 Fiscal 2026, adjusted diluted EPS increased by 12% to $0.48, while GAAP diluted EPS decreased by 22% to $0.45.

- The company generated $93 million in cash flow from operations and $57 million in free cash flow during Q1 Fiscal 2026, which was used to repay $20 million in term loan debt and repurchase $21 million in shares.

- Sally Beauty Holdings raised the low end of its Fiscal 2026 Adjusted Diluted EPS guidance to a range of $2.02 to $2.10 from the prior guidance of $2.00 to $2.10.

- SBH reported strong Q4 and full-year 2025 results, with Q4 adjusted diluted EPS increasing 10% to $0.55 and full-year adjusted diluted EPS growing 12% to $1.90 on $3.7 billion in revenue.

- The company provided fiscal year 2026 guidance, expecting consolidated net sales between $3.71 billion and $3.77 billion and adjusted diluted EPS in the range of $2.00-$2.10.

- SBH introduced long-term financial targets through fiscal year 2028, projecting annual net sales growth of 1%-3%, adjusted operating earnings growth of 3%-5%, and adjusted diluted EPS growth of at least 10%.

- The "Fuel for Growth" program generated $46 million in incremental benefits in fiscal 2025, bringing cumulative run rate benefits to $74 million, with an expectation to reach $120 million by the end of fiscal 2026.

- The company demonstrated strong capital allocation, generating $275 million in operating cash flow and $216 million in free cash flow in FY2025, which supported $119 million in debt paydown and over $50 million in share repurchases.

- Sally Beauty Holdings (SBH) reported strong Q4 2025 results, with consolidated net sales increasing 1.3% to $947 million and adjusted diluted earnings per share (EPS) growing 10% to $0.55. For the full fiscal year 2025, the company achieved $3.7 billion in revenue and adjusted diluted EPS of $1.90, representing 12% growth.

- The Fuel for Growth program delivered $46 million in incremental pre-tax benefits in FY 2025, accumulating $74 million in run rate benefits since its inception. The company expects an additional $45 million in run rate savings in fiscal 2026, targeting $120 million in cumulative run rate savings by the end of FY 2026.

- For fiscal year 2026, SBH projects consolidated net sales between $3.71 billion and $3.77 billion, comparable sales to be flat to up 1%, and adjusted diluted EPS in the range of $2.00 to $2.10.

- Looking ahead to fiscal year 2028, the company introduced long-range targets including annual net sales growth of 1%-3%, adjusted operating earnings growth of 3%-5%, and adjusted diluted EPS growth of at least 10%, with approximately 50% of free cash flow allocated to share repurchases.

- Sally Beauty Holdings (SBH) reported strong Q4 2025 results, with comparable sales growth of 1.3%, gross margin expanding 100 basis points to 52.2%, and adjusted diluted EPS increasing 10% to $0.55. For the full fiscal year 2025, the company delivered $3.7 billion in revenue, positive comparable sales, and adjusted diluted EPS of $1.90, representing 12% growth.

- The Fuel for Growth program generated an incremental $46 million in benefits in fiscal 2025, bringing cumulative run rate benefits to $74 million, exceeding the original expectation of $70 million. The company expects cumulative run rate savings to reach approximately $120 million by the end of fiscal 2026.

- In fiscal 2025, SBH generated $275 million in operating cash flow and $216 million in free cash flow, which was used to repay nearly $120 million of term loan debt and repurchase over $50 million of shares. The net debt leverage ratio at year-end was 1.6 times.

- For fiscal year 2026, SBH provided guidance including consolidated net sales in the range of $3.71 billion-$3.77 billion, comparable sales flat to up 1%, and adjusted diluted EPS in the range of $2-$2.10 per share.

- The company also introduced long-range financial targets for the three-year planning horizon ending fiscal 2028, expecting annual net sales growth of 1%-3%, adjusted operating earnings growth of 3%-5%, and adjusted diluted EPS growth of at least 10%.

- Sally Beauty Holdings, Inc. reported Q4 2025 consolidated net sales of $947 million, an increase of 1.3%, and adjusted diluted EPS of $0.55, up 10% over the prior year.

- For the full fiscal year 2025, consolidated net sales were $3.70 billion, a decrease of 0.4%, while adjusted diluted EPS increased 12% to $1.90.

- The company generated $275 million in cash flow from operations and $216 million in free cash flow for fiscal year 2025, using these funds for $119 million in term loan repayments and $53 million in share repurchases.

- Sally Beauty Holdings, Inc. provided fiscal year 2026 guidance, projecting consolidated net sales between $3.71 billion and $3.77 billion and adjusted diluted EPS between $2.00 and $2.10.

- Sally Beauty Holdings reported a 1.3% increase in consolidated net sales to $947 million and a 10% increase in adjusted diluted EPS to $0.55 for the fourth quarter ended September 30, 2025.

- For the full fiscal year 2025, consolidated net sales were $3.70 billion, a 0.4% decrease from the prior year, while adjusted diluted EPS increased 12% to $1.90.

- The company generated $275 million in cash flow from operations and $216 million in free cash flow for fiscal year 2025, utilizing $119 million for term loan repayments and $53 million for share repurchases.

- For fiscal year 2026, Sally Beauty Holdings expects consolidated net sales between $3.71 billion and $3.77 billion and adjusted diluted EPS between $2.00 and $2.10.

Quarterly earnings call transcripts for Sally Beauty Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more