Earnings summaries and quarterly performance for Veris Residential.

Executive leadership at Veris Residential.

Board of directors at Veris Residential.

Research analysts who have asked questions during Veris Residential earnings calls.

Eric Wolfe

Citi

5 questions for VRE

Jana Galan

Bank of America

5 questions for VRE

Steve Sakwa

Evercore ISI

4 questions for VRE

Tom Catherwood

BTIG

4 questions for VRE

John Pawlowski

Green Street

2 questions for VRE

Sanket Agrawal

Evercore ISI

2 questions for VRE

Anthony Paolone

JPMorgan Chase & Co.

1 question for VRE

David Segall

Green Street

1 question for VRE

Michael Lewis

Truist Securities, Inc.

1 question for VRE

Nick Kerr

Citigroup Inc.

1 question for VRE

William Catherwood

BTIG

1 question for VRE

Recent press releases and 8-K filings for VRE.

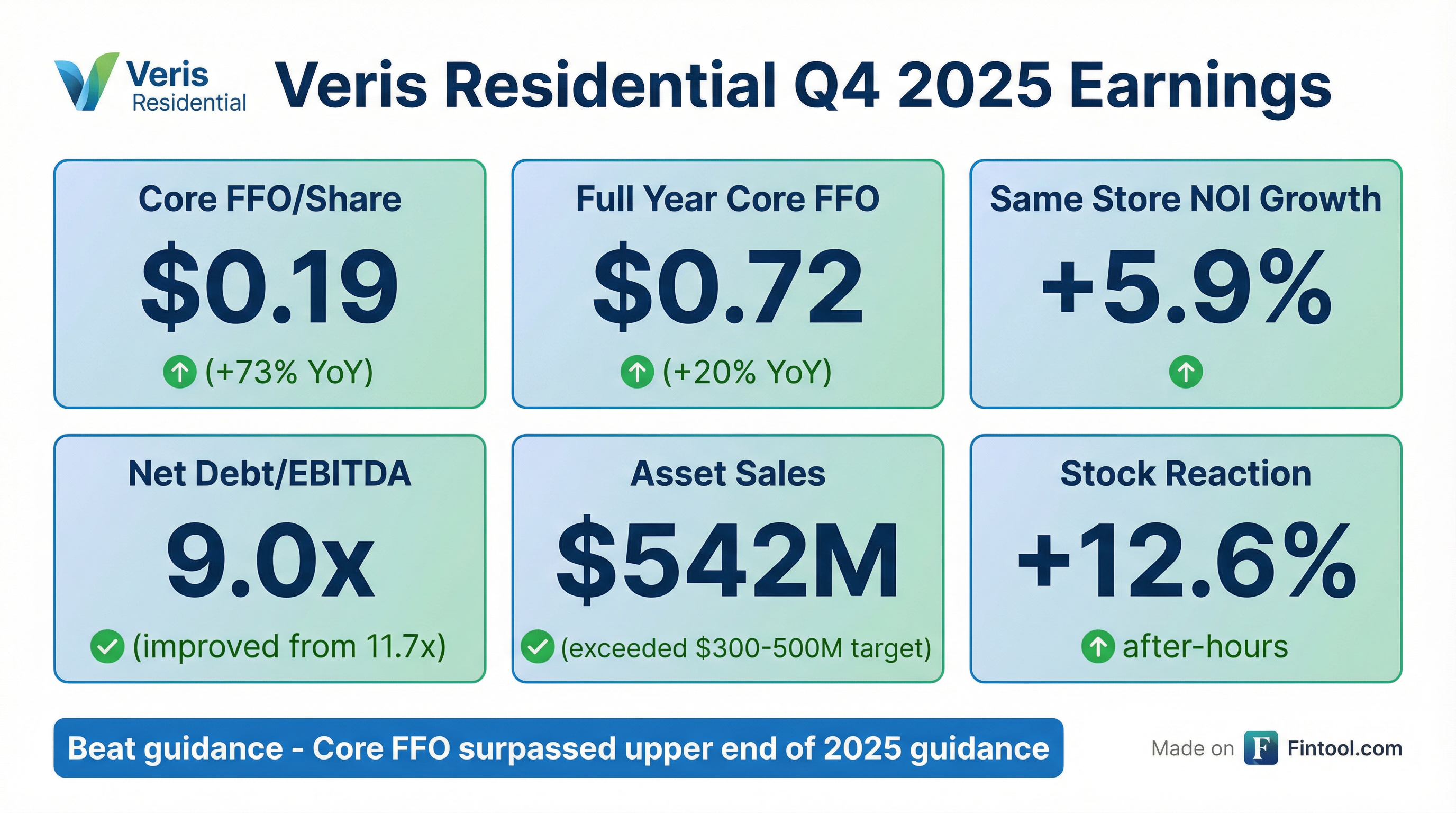

- Veris Residential, Inc. sold its 4.2-acre Harborside 8/9 land parcel in Jersey City, New Jersey, for $75 million, with estimated net proceeds of $69 million.

- The company intends to use the proceeds to reduce debt, which is expected to improve Net Debt-to-EBITDA (Normalized) to approximately 9.0x from 10.0x in the third quarter and 11.7x at year-end 2024.

- This transaction is anticipated to be accretive by approximately $0.04 per share to Core FFO on a run-rate basis.

- Veris Residential has exceeded its original asset sales target for the year, achieving $542 million in non-strategic asset sales year to date, and has raised its sales target to $650 million.

- Veris Residential, Inc. raised its 2025 Core FFO per share guidance range to $0.67-$0.68 from the previous $0.63-$0.64, as of November 12, 2025.

- The company has made significant progress in non-strategic asset dispositions, with $467 million sold to date and an additional $75 million under contract, increasing its high-end sales target from $500 million to $650 million.

- Veris Residential has reduced its Net Debt-to-EBITDA (Normalized) by 15% year-to-date to 10.0x as of Q3 2025, anticipating a further reduction to approximately 9.0x upon the sale of Harborside 8/9 and around 8.0x by year-end 2026.

- For Q3 2025, the company reported an occupancy rate of 94.7% and a blended net rental growth rate of 3.9%, while same-store NOI growth for the quarter was (2.7)%.

- Veris Residential Inc. reported Core FFO per share of $0.20 for Q3 2025 and net income available to common shareholders of $0.80 per fully diluted share.

- The company raised its full-year 2025 Core FFO guidance for the second consecutive quarter to $0.67 to $0.68 per share, reflecting 12% to 13% year-over-year growth.

- Veris Residential exceeded its initial non-strategic asset sale target, having sold or entered contracts for $542 million of assets, and has now raised the target to $650 million.

- These asset sales contributed to a 15% reduction in net debt to EBITDA since the beginning of the year, bringing it to 10 times as of September 30, with a potential to decrease to below 8 times by the end of 2026.

- Operational performance for Q3 2025 included blended net rental growth of 3.9% and occupancy (excluding Liberty Towers) of 95.8% as of September 30.

- Veris Residential Inc. reported Core FFO per share of $0.20 for the third quarter of 2025 and raised its full-year core FFO guidance to $0.67-$0.68 per share, representing 12%-13% year-over-year growth.

- The company has sold or entered contracts for $542 million of non-strategic assets, exceeding its initial target, and has now raised its asset monetization target to $650 million.

- These sales contributed to a 15% reduction in net debt to EBITDA since the beginning of the year, reaching 10x as of September 30th, with a further reduction to approximately 9x expected upon the closing of the Harborsight transaction.

- Operational performance remained strong, with blended net rental growth of 3.9% for Q3 2025 and occupancy (excluding Liberty Towers) at 95.8% as of September 30th.

- Veris Residential, Inc. reported Net Income per Diluted Share of $0.80 and Core FFO per Diluted Share of $0.20 for the third quarter ended September 30, 2025.

- The company significantly advanced its deleveraging efforts, completing or putting under contract $542 million in non-strategic asset sales year to date and reducing debt by $394 million during Q3 2025.

- Net Debt-to-EBITDA (Normalized) was reduced to 10.0x, with a target of approximately 9.0x upon the sale of Harborside 8/9, anticipated to close in Q1 next year, and potentially below 8.0x by year-end 2026.

- Veris Residential raised its 2025 Core FFO per share guidance to a range of $0.67 to $0.68, reflecting $4 million recognized from tax appeal refunds.

- The company also reported a year-over-year Same Store Blended Net Rental Growth Rate of 3.9% for Q3 2025 and 1.6% year-to-date Same Store NOI growth.

- Veris Residential released its 2024 Sustainability Report on September 22, 2025, highlighting how strategic sustainability investments are generating measurable returns and strengthening its competitive position.

- The company achieved GRESB's highest U.S. listed residential multifamily score in 2024 and a third-consecutive 5 Star Rating, with 79% of its managed multifamily portfolio now green-certified.

- Veris Residential secured sustainability-linked financing with a 5-basis-point margin reduction and has reduced Scope 1 & 2 emissions by 58% below 2019 levels.

- This report is the first to reflect almost exclusively its multifamily portfolio performance, following the divestiture of its office portfolio in March 2024.

- Veris Residential reported strong Q2 2025 financial and operating performance, including a year-over-year Same Store NOI growth of 5.6% for the quarter and 4.4% year to date, and an increased operating margin of 67.5%.

- The company secured an amendment to its credit facility, leading to an immediate 55-basis-point interest rate reduction and paid off a $200 million Term Loan using asset sale proceeds subsequent to the quarter end.

- Veris Residential has sold or has under binding contract $448 million of non-strategic assets this year, significantly reducing leverage and targeting a Net Debt-to-EBITDA (Normalized) of approximately 10.0x by year-end 2025 and below 9.0x by year-end 2026.

- The company provided revised 2025 guidance, with Core FFO per Share projected to be between $0.63 and $0.64, representing a growth of 5.0% to 6.7%.

Fintool News

In-depth analysis and coverage of Veris Residential.

Quarterly earnings call transcripts for Veris Residential.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more