Earnings summaries and quarterly performance for WATERS CORP /DE/.

Executive leadership at WATERS CORP /DE/.

Udit Batra

President and Chief Executive Officer

Amol Chaubal

Senior Vice President and Chief Financial Officer

Jianqing Bennett

Senior Vice President, TA Instruments Division and Clinical Business Unit

Keeley Aleman

Senior Vice President, General Counsel and Secretary

Robert Carpio III

Senior Vice President, Waters Division

Board of directors at WATERS CORP /DE/.

Research analysts who have asked questions during WATERS CORP /DE/ earnings calls.

Tycho Peterson

Jefferies

9 questions for WAT

Catherine Schulte

Baird

8 questions for WAT

Puneet Souda

Leerink Partners

8 questions for WAT

Jack Meehan

Nephron Research LLC

7 questions for WAT

Daniel Brennan

TD Cowen

5 questions for WAT

Brandon Couillard

Wells Fargo & Company

4 questions for WAT

Casey Woodring

JPMorgan Chase & Co.

4 questions for WAT

Doug Schenkel

Wolfe Research LLC

4 questions for WAT

Sung Ji Nam

Scotiabank

3 questions for WAT

Vijay Kumar

Evercore ISI

3 questions for WAT

Dan Arias

Stifel Financial Corp.

2 questions for WAT

Daniel Arias

Stifel, Nicolaus & Company, Incorporated

2 questions for WAT

Matthew Sykes

Goldman Sachs Group Inc.

2 questions for WAT

Matt Larew

William Blair & Co.

2 questions for WAT

Rachel Vatnsdal

JPMorgan Chase & Co.

2 questions for WAT

Subbu Nambi

Guggenheim Securities

2 questions for WAT

Eve Burstein

Goldman Sachs

1 question for WAT

Matt Sykes

Goldman Sachs Group, Inc.

1 question for WAT

S. Brandon Couillard

Wells Fargo Securities, LLC

1 question for WAT

Recent press releases and 8-K filings for WAT.

- Waters CEO Udit Batra characterizes the acquired BD bioscience and diagnostics businesses as high-margin (~60%), well-branded and talent-rich but lacking execution precision; BD’s Q4 revenue fell 11%, though it was roughly flat after excluding three nonrecurring items (lost licensing revenue, a weak flu season –$30 M, China export shutdown) and recurring DRG headwinds in China.

- For 2026, BD revenue is guided to decline 2.5% in Q1, improve to flat–low-single-digit growth in Q2–Q3, and reach low- to mid-single-digit growth in Q4; the full year includes a 200 bps revenue haircut (~$65 M) for Chinese DRG pressures, with the prior EPS target maintained.

- Core Waters standalone organic growth is forecast at 6.25% for 2026, underpinned by stable end markets; chemistry is modeled at 6–7%, service at 7–8%, and instruments at 5–5.5% growth.

- BD’s standalone operating margin is set at 22.4% for the full year, with Q1 margin ~200 bps below the annual average and Q3 ~300 bps above; planned tariff actions (+60 bps) and cost‐savings initiatives (+120 bps in H2) lay a foundation for further margin expansion.

- Udit Batra highlights BD’s strong brands and ~60% gross margins but notes execution gaps, prompting region-by-region precision reviews since the deal closed three weeks ago.

- BD’s Q4 sales fell ~10% due to three non-recurring items and DRG headwinds; 2026 guidance assumes -2.5% Q1 growth improving to low/mid-single digits by Q4, with a $65 million revenue haircut and EPS commitment intact.

- Core Waters standalone organic revenue growth is guided to 5.5%–6.25% in 2026, backed by stabilized end markets, strong funnels, and recurring chemistry (6%–7%) and service (7%–8%) revenue.

- The LC-MS replacement cycle is in mid-innings, expected to peak by mid-2027 with high-single-digit growth, then normalize to ~5%, with potential reshoring benefits beyond 2027.

- BD margin enhancement actions include +60 bps from tariff implementation and +120 bps from cost realignment, targeting a 22.4% operating margin, with further upside from pricing and operational discipline.

- Three weeks post-close, Waters is integrating BD’s flow cytometry and microbiology businesses—each with ~60% gross margins—and notes strong R&D engagement but needs greater execution precision across sales and pricing functions.

- BD’s Q4 revenue fell ~10%, driven by three non-recurring items (bioscience licensing, flu-season slowdown, China export pause) and recurring DRG headwinds; excluding non-recurring factors, growth was flat. For 2026, Waters guides BD to

–2.5% in Q1, flat to low-single-digit in Q2/Q3, and low- to mid-single-digit in Q4, with a full-year top-line reduction of 200 bp ($65 M) while upholding EPS targets. - Core Waters standalone is guided to 6.25% organic growth in 2026, backed by ~5% instrument growth, high-single-digit LC-MS replacement peaking mid-2027, 7–8% service growth, and 6–7% chemistry growth—boosted by new bioseparations product launches.

- BD standalone operating margin is targeted at 22.4%, reflecting revenue-phasing effects, a 60 bp tariff lift and 120 bp cost-structure adjustments; further upside is expected from enhanced pricing and operational improvements.

- On February 9, 2026, Waters finalized the reverse Morris Trust transaction combining with Becton, Dickinson’s Biosciences & Diagnostic Solutions unit to form a global life sciences and diagnostics leader.

- Claire M. Fraser, Ph.D., joined the Waters Board of Directors, increasing the board size to 11 members.

- The combined company is structured into four divisions: Waters Analytical Sciences, Waters Biosciences, Waters Advanced Diagnostics, and Waters Materials Sciences.

- BD shareholders received 38,541,851 shares of Waters common stock (0.1353431484 shares per BD share), representing 39.2% of the combined company on a fully diluted basis; former Waters shareholders hold 60.8%.

- Waters has closed its Reverse Morris Trust transaction to combine with BD’s Biosciences & Diagnostic Solutions businesses, creating a global life sciences and diagnostics leader with Waters shareholders owning 60.8% and BD shareholders owning 39.2% of the combined company on a fully diluted basis.

- BD shareholders will receive 0.135 shares of Waters common stock for each BD share held as of the February 5, 2026 record date, with cash paid for fractional shares.

- The transaction establishes four strategic divisions—Waters Analytical Sciences, Waters Biosciences, Waters Advanced Diagnostics, and Waters Materials Sciences—to drive growth in regulated high-volume testing and adjacent markets.

- Claire M. Fraser, Ph.D., has been appointed to the Waters Board, expanding it to 11 members, bringing extensive genomics and molecular diagnostics expertise.

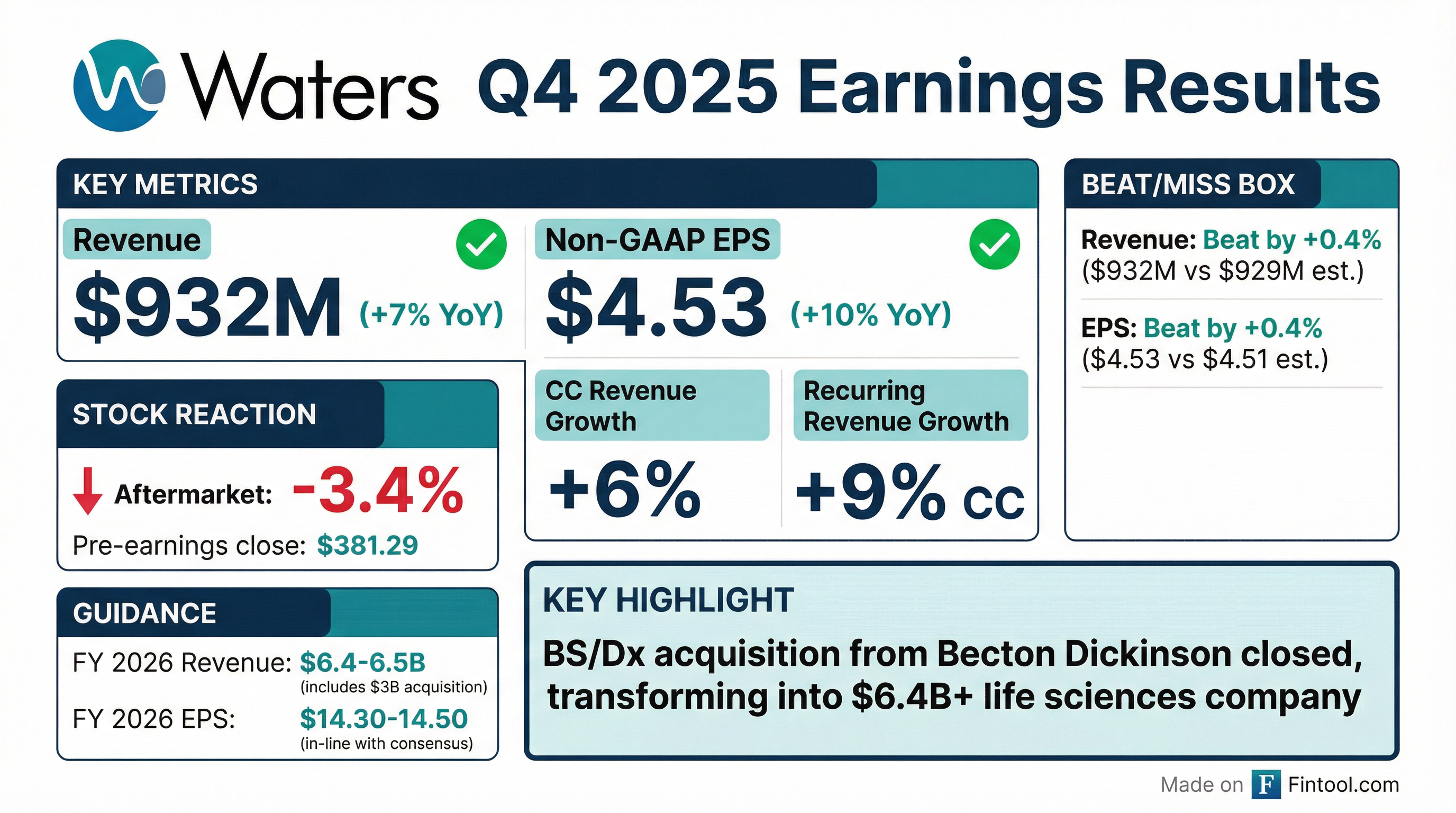

- Q4 2025 revenue up 7% reported (6% constant currency) and adjusted EPS of $4.53 (GAAP EPS $3.77); full year sales +7%, adjusted EPS $13.13 (+11%)

- Acquisition of BD’s Biosciences and Diagnostic Solutions business closed, adding $3 billion expected revenue in 2026 and targeting >5% of combined cost base in synergies

- 2026 guidance: combined company revenue of $6.405–$6.455 billion, adjusted EPS of $14.30–$14.50; standalone Q1 revenue $1.198–$1.211 billion, EPS $2.25–$2.35

- Restructuring into four divisions (Analytical Sciences, Biosciences, Advanced Diagnostics, Material Sciences) to drive $50 M revenue and $55 M cost synergies

- Waters delivered $932 million in Q4 sales, up 7% year-over-year, with adjusted EPS of $4.53.

- Completed the acquisition of BD’s Biosciences and Diagnostic Solutions business, obtaining full operational control and initiating integration plans.

- For FY 2025, sales grew 7%, recurring revenue rose 8%, and adjusted EPS increased 11% to $13.13.

- 2026 combined guidance calls for reported revenue of $6.405–6.455 billion (≈5.3% growth) and adjusted EPS of $14.30–14.50, underpinned by $55 million of cost synergies and $50 million of revenue synergies.

- Q4 2025 revenue was $932 M, up 7% reported and 6% constant currency year-over-year.

- Q4 2025 non-GAAP EPS was $4.53.

- FY 2025 revenue reached $3,165 M, up 7% reported and 7% constant currency, with non-GAAP EPS of $13.13.

- FY 2026 guidance includes organic constant currency revenue growth of 5.5%–7.0%, total reported revenue of $6.405 B–$6.455 B, and non-GAAP EPS of $14.30–$14.50.

- Waters delivered 7% reported sales growth (6% constant currency) and $4.53 adjusted EPS in Q4 2025, with recurring revenue up 9%.

- Completed acquisition of BD’s Biosciences & Diagnostic Solutions business and expects $55 M cost and $50 M revenue synergies in 2026.

- Fiscal 2025 sales rose 7% (reported & constant currency) and adjusted EPS increased 11% to $13.13, driven by chemistry growth and high single-digit LCMS instrument growth.

- 2026 guidance calls for $6.405 B–$6.455 B combined revenue (+5.3% midpoint) and $14.30–$14.50 adjusted EPS, with an adjusted operating margin of 28.1%.

- Expanding idiosyncratic growth drivers to include biologics and informatics, targeting informatics revenue growth from ~$300 M to ~$500 M by 2030.

- Q4 sales of $932 million grew 7% as reported (6% constant currency); GAAP EPS was $3.77 and non-GAAP EPS was $4.53, up 10% year-over-year.

- Full-year 2025 sales of $3.165 billion grew 7%; GAAP EPS was $10.76, non-GAAP EPS was $13.13, up 11%.

- 2026 guidance calls for total reported revenue of $6.405–$6.455 billion (including ~$3 billion from the BD Biosciences acquisition and synergies), organic constant currency growth of 5.5%–7.0%, and non-GAAP EPS of $14.30–$14.50.

Fintool News

In-depth analysis and coverage of WATERS CORP /DE/.

Quarterly earnings call transcripts for WATERS CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more