Earnings summaries and quarterly performance for Xometry.

Executive leadership at Xometry.

Board of directors at Xometry.

Research analysts who have asked questions during Xometry earnings calls.

Brian Drab

William Blair & Company

6 questions for XMTR

Greg Palm

Craig-Hallum Capital Group LLC

6 questions for XMTR

Ronald Josey

Citigroup Inc.

6 questions for XMTR

Cory Carpenter

JPMorgan Chase & Co.

5 questions for XMTR

Eric Sheridan

Goldman Sachs

5 questions for XMTR

Matthew Swanson

RBC Capital Markets

5 questions for XMTR

Andrew Boone

JMP Securities

3 questions for XMTR

Josh Chen

UBS

2 questions for XMTR

Joshua Chan

UBS Group AG

1 question for XMTR

Matt Swanson

RBC Capital Markets, LLC

1 question for XMTR

Nicholas Jones

Citizens JMP

1 question for XMTR

Troy Jensen

Cantor Fitzgerald

1 question for XMTR

Recent press releases and 8-K filings for XMTR.

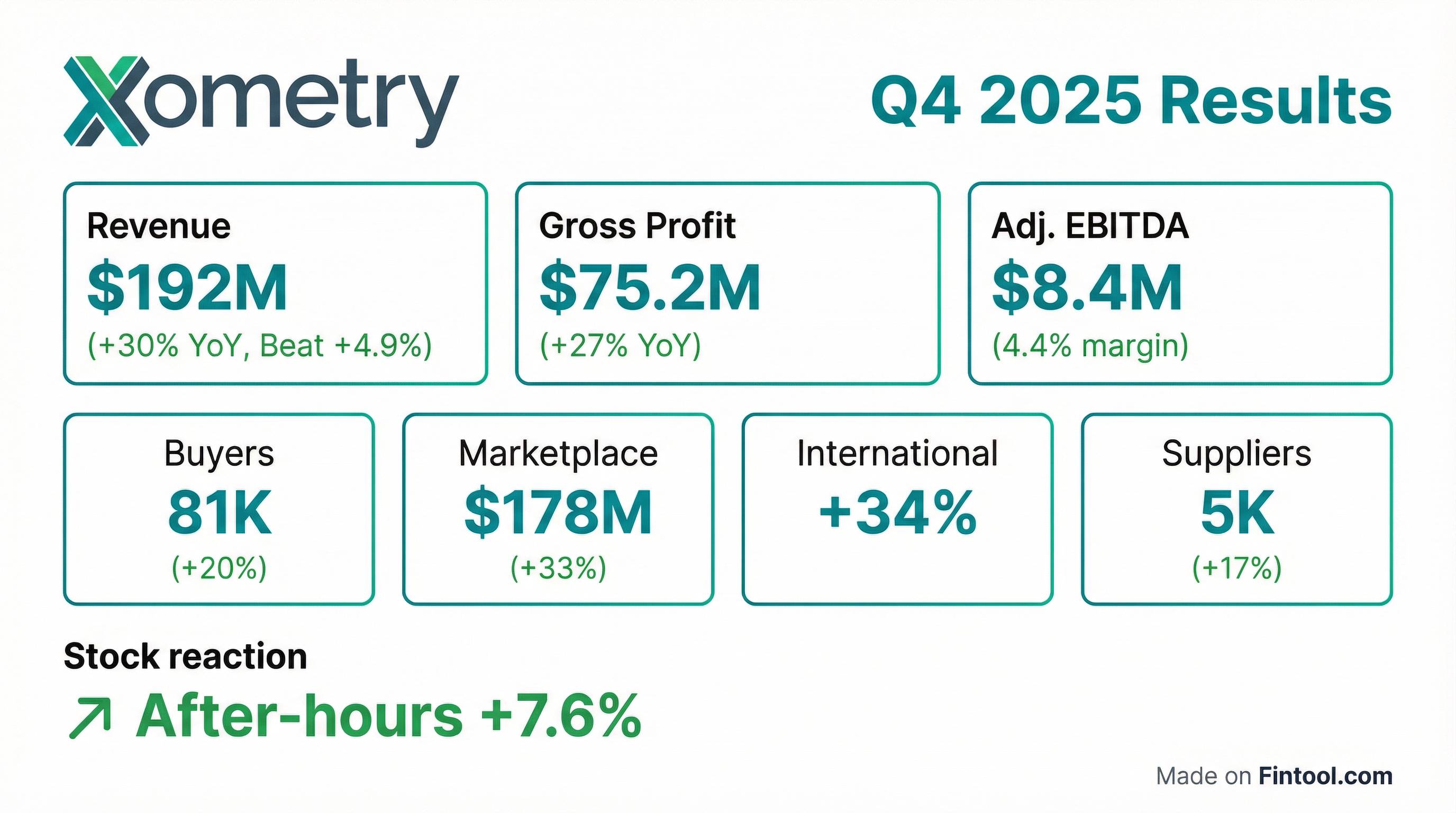

- Xometry reported record Q4 and full year 2025 financial results, with Q4 revenue increasing 30% year-over-year to over $192 million and full year adjusted EBITDA reaching $18.5 million. The marketplace gross margin expanded 80 basis points year-over-year to 35.3% in Q4 2025, with expectations for it to be higher in 2026 than in 2025.

- The company provided strong guidance for Q1 and full year 2026, expecting Q1 revenue between $187 million and $189 million (24%-25% growth year-over-year) and full year revenue growth of at least 21%.

- A leadership transition was announced, with CEO Randy Altschuler moving to Executive Chair and President Sanjeev Singh Sahni becoming CEO, effective July 1st, 2026.

- Operational highlights include 81,821 active buyers (up 20% year-over-year) and four accounts with at least $10 million in spend in 2025, reflecting strong enterprise growth and the success of its AI-native marketplace.

- Xometry reported record Q4 and full year 2025 financial results, with Q4 revenue increasing 30% year-over-year to $192 million and full year adjusted EBITDA reaching $18.5 million.

- CEO Randy Altschuler will transition to Executive Chair on July 1, 2026, with current President Sanjiv Singh Sahni becoming the new CEO.

- The marketplace segment demonstrated strong performance, with Q4 revenue up 33% year-over-year to $178 million and marketplace gross margin expanding 80 basis points year-over-year to 35.3%.

- Enterprise growth was robust, ending 2025 with four accounts spending at least $10 million and over 140 accounts with last twelve-month spend of at least $500,000.

- The company anticipates robust growth to continue in 2026, having raised its guidance for Q1 and the full year, and expects to deliver at least 20% incremental adjusted EBITDA margins on its path to $1 billion in revenue.

- Xometry reported strong financial results for Q4 2025, with revenue increasing 30% year-over-year to over $192 million and adjusted EBITDA reaching $8.4 million; this contributed to a profitable full year 2025 with $18.5 million in adjusted EBITDA, a significant turnaround from a $9.7 million loss in 2024.

- The company's marketplace revenue grew 33% year-over-year in Q4 2025, and marketplace gross margin expanded 80 basis points to 35.3%, supported by robust enterprise growth, including over 40% year-over-year revenue increase from accounts spending at least $500,000.

- Xometry provided positive guidance for Q1 2026, expecting revenue between $187 million and $189 million (24%-25% growth) and adjusted EBITDA of $6.5 million to $7.5 million, with full year 2026 revenue growth projected at least 21%.

- Sanjiv Singh Sahni is scheduled to assume the CEO role on July 1st.

- Xometry reported record revenue of $192 million in Q4 2025, a 30% increase year-over-year, contributing to a full-year 2025 revenue of $687 million. This was driven by 33% Marketplace revenue growth in Q4.

- The company achieved a record gross profit of $75.2 million in Q4 2025, up 27% year-over-year, with Marketplace gross profit growing 36%. Adjusted EBITDA for Q4 2025 was $8.4 million, an improvement of $7.3 million year-over-year, and reached $18.5 million for the full year 2025.

- Operational growth included Active Buyers increasing 20% year-over-year to over 81,000 in Q4 2025, and Active Suppliers growing 17% year-over-year to approximately 5,000 in FY 2025. International revenue also saw 34% growth year-over-year in Q4 2025.

- For Q1 2026, Xometry expects revenue between $187 million and $189 million, representing 24-25% growth year-over-year, and Adjusted EBITDA between $6.5 million and $7.5 million. The company also projects at least 21% revenue growth for FY 2026.

- Xometry reported record Q4 2025 revenue of $192 million, a 30% increase year-over-year, with marketplace revenue growing 33% to $178 million. Total revenue for the full year 2025 reached $686.6 million.

- Adjusted EBITDA for Q4 2025 was $8.4 million, an improvement of $7.3 million year-over-year, and for the full year 2025, it was $18.5 million, reflecting a $28.2 million improvement year-over-year.

- Key operating metrics showed growth, with Marketplace Active Buyers increasing 20% to 81,821 as of December 31, 2025, and accounts with last twelve-months spend of at least $50,000 increasing 18% to 1,760.

- For Q1 2026, Xometry expects revenue between $187 million and $189 million and Adjusted EBITDA between $6.5 million and $7.5 million. The company projects full year 2026 revenue growth of at least 21%.

- Xometry reported record Q4 2025 revenue of $192 million, a 30% year-over-year increase, and full year 2025 revenue of $686.631 million, up 26% year-over-year.

- Q4 2025 Adjusted EBITDA improved by $7.3 million year-over-year to $8.4 million, with full year 2025 Adjusted EBITDA reaching $18.5 million, an improvement of $28.2 million year-over-year.

- The company's Marketplace Active Buyers increased 20% to 81,821 as of December 31, 2025.

- For Q1 2026, Xometry expects revenue between $187 million and $189 million and Adjusted EBITDA between $6.5 million and $7.5 million.

- XTM Inc. announced changes to its Board of Directors, including the appointment of Keith Nugara as a Board Member and Board Advisor.

- Mr. Nugara brings over 30 years of executive leadership experience in payments, financial services, and enterprise technology, and will support enterprise sales strategy, network expansion, investor relations, and governance.

- The company also announced the departure of Olga Balanovskaya, its former Chief Financial Officer.

- XTM Inc. entered into a short-term convertible promissory note of CAD $406,763 with a related party on December 19, 2025, which was subsequently converted into common shares.

- Xometry introduced eight new materials in December 2025 for Fused Deposition Modeling (FDM) and Stereolithography (SLA) additive manufacturing, critical for advanced applications in the aerospace, defense, medical device, and automotive industries.

- The company launched a "Preferred Subprocess" feature for CNC Machining and new "closer" tolerance options, which can lead to an average 5% price reduction on applicable parts.

- Xometry achieved CMMC Level 2 certification in early 2025, allowing customers to select CMMC requirements during the quoting process to support stringent DoD security requirements.

- Xometry operates an AI-powered marketplace for custom manufacturing, targeting a large, fragmented, and historically offline industry.

- The company achieved adjusted EBITDA profitability and reported 40% year-over-year growth in marketplace gross profit dollars in the last quarter, with a record gross margin of 35.7%.

- Growth is fueled by market share gains despite manufacturing sector contraction, driven by a focused enterprise strategy and rapid international expansion to a $120 million run rate.

- Xometry anticipates at least 20% growth for 2026 and aims to become a $100 billion-plus company, leveraging its data, networks, and product innovation.

- Xometry operates an AI-powered marketplace for custom manufacturing, driving growth through market share gains, enterprise expansion, and product innovation despite macro headwinds.

- The company reported 40% year-over-year growth in marketplace gross profit dollars and achieved a record gross margin of 35.7%. Xometry expects its marketplace to grow 27-28% for the full year 2025 and projects at least 20% growth for 2026.

- Xometry's enterprise strategy, including Teamspace and deep integrations, led to 40% growth in spend from its largest customers in 2024. Its international business has grown from $3 million to a $120 million run rate since 2020, showing faster growth than in the US.

- Product innovations like the Work Center app and instant quoting for injection molding are expanding offerings and increasing spend per buyer. The ThomasNet acquisition provides opportunities for advertising, cross-pollination, and expanding the Xometry ecosystem.

Fintool News

In-depth analysis and coverage of Xometry.

Quarterly earnings call transcripts for Xometry.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more