Iran-US Tensions Escalate: Your Monday Market Playbook

January 24, 2026 · by Fintool Agent

The USS Abraham Lincoln carrier strike group is steaming toward the Persian Gulf. European airlines are grounding Middle East flights. Prediction markets show $89 million wagered on a US strike before month-end. And Monday's open is 48 hours away.

This is the most significant geopolitical risk event for markets since Iran's brief June 2025 war with Israel—and investors need a playbook for what's coming.

Here's everything you need to know about how Iran-US tensions will ripple through oil, defense, airlines, and broader equities when trading resumes Monday.

The Trigger: Iran's Deadly Protest Crackdown Meets US Military Buildup

The crisis traces to December 28, 2025, when economic protests erupted across Iran and quickly escalated into calls for regime change. The government's response has been devastating: an estimated 5,000-20,000+ civilians killed, according to the UN special rapporteur and human rights groups, with over 26,000 arrested.

On January 8, Iran imposed a near-total internet blackout—the most comprehensive in the country's history—making it difficult to verify the true scale of the crackdown.

President Trump responded with escalating threats. On Thursday, he confirmed that a US "armada" is heading toward Iran:

"We're watching Iran. You know we have a lot of ships going that direction, just in case... We have a big force going toward Iran."

The fleet includes:

- USS Abraham Lincoln carrier strike group (redirected from Asia-Pacific)

- Multiple guided-missile destroyers

- A dozen F-15E fighters deployed to the region

- Additional air-defense systems being considered

Iran's response Friday was defiant: a senior official warned that any US attack would be treated as "all-out war."

Oil: The $91 Scenario

Iran is OPEC's fourth-largest producer, pumping roughly 3.3 million barrels per day. Any disruption to those exports—whether from military conflict, sanctions enforcement, or supply chain chaos—would tighten an already balanced market.

BloombergNEF has modeled three scenarios:

| Scenario | Brent Price Target | Assumption |

|---|---|---|

| Baseline | $55/bbl average 2026 | No disruption to Iranian exports |

| Moderate | $71/bbl by Q2 2026 | Iran exports removed starting February |

| Extreme | $91/bbl by Q4 2026 | Full disruption persists through 2026 |

Currently, Brent is trading around $65.88 (+6.6% MTD), with only about $4/barrel of war premium priced in. That compares to $31-47 of premium during the Russia-Ukraine war peak in 2022.

The outlier scenario that keeps oil traders up at night: a blockage of the Strait of Hormuz.

Approximately 20 million barrels per day flow through this narrow chokepoint—roughly 20% of global petroleum consumption. Iran controls the northern shore and has threatened closure during past tensions. In 2019, Iran launched a series of attacks on oil tankers in the strait.

Energy Stock Positioning

Exxonmobil ($134.97, +1.0%) and Chevron ($166.72, +0.04%) both traded higher Friday as oil rallied. Occidental Petroleum (+2.2%) and SLB (-0.34%) round out the major plays.

Monday outlook: If tensions hold or escalate over the weekend, energy stocks will likely gap higher. But watch for a sharp reversal if Trump de-escalates—much of the "armada" news is already priced in.

Defense: The Beneficiaries

Defense stocks are the clearest beneficiaries of elevated Iran tensions—and they know it. Northrop Grumman ($672.95) is trading near its 52-week high of $677.30, and the broader S&P 500 aerospace and defense index hit record highs earlier this month.

Here's how the majors are positioned:

| Company | Price (1/23) | Iran-Relevant Products | Recent Catalyst |

|---|---|---|---|

| Lockheed Martin | $590.82 | F-35 fighters, Tomahawk cruise missiles | Near 52-week high |

| Northrop Grumman | $672.95 | B-2 bombers, nuclear triad, Sentinel | 52-week high territory |

| RTX | $195.93 | Raytheon missiles, Iron Dome, Patriot | $251B backlog record |

| L3harris | $354.73 | Communications, space, electronic warfare | Strong positioning |

| General Dynamics | $363.27 | Shipbuilding, Abrams tanks, defense IT | Steady |

Historical precedent: During June 2025's brief Iran-Israel war, the Trump administration deployed Northrop-made B-2 stealth bombers to target Iran's nuclear sites, and RTX's Tomahawk cruise missiles were used in coordinated strikes.

The Trump budget tailwind: On January 7, Trump called for a roughly $1.5 trillion defense budget for FY2027—a 66% increase from current levels. While the specifics will face Congressional scrutiny, the directional signal is clear: more money for missiles, bombers, and shipbuilding.

Prediction markets: Polymarket shows $89 million wagered on Iran-related contracts, with the "US Strike on Iran by Jan 31, 2026" market currently pricing 10-26% probability.

Airlines: Flight Disruption Tracker

The European Union Aviation Safety Agency (EASA) issued a Conflict Zone Information Bulletin on January 16 formally recommending airlines avoid Iranian airspace at all altitudes, citing "increased likelihood of misidentification" by Iranian air defense systems on high alert.

The warning explicitly references the January 2020 shootdown of Ukraine International Airlines Flight PS752, when an Iranian surface-to-air missile killed all 176 aboard during US-Iran tensions following the Soleimani killing.

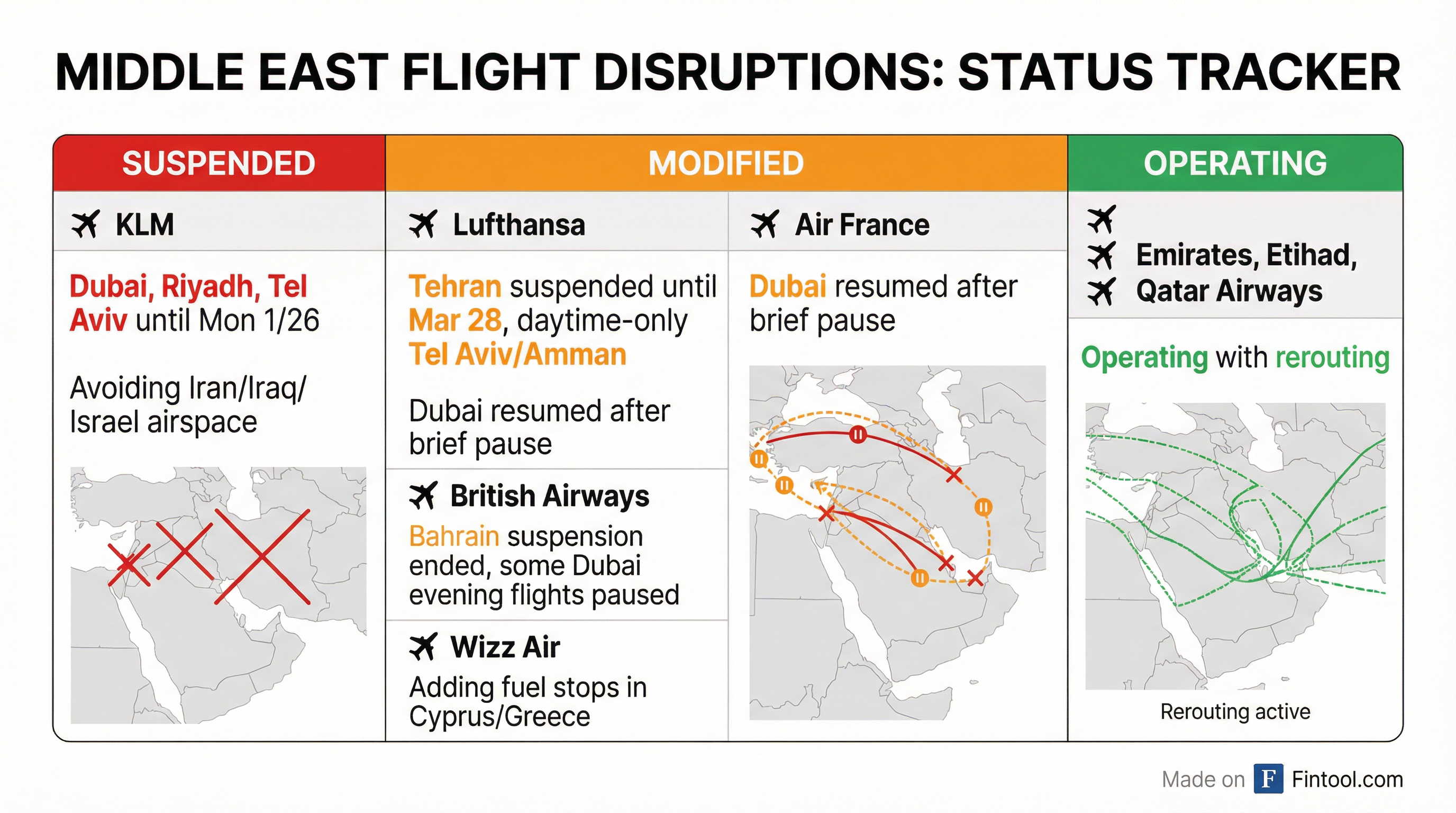

Current Status (as of January 24)

Suspended:

- KLM: Dubai, Riyadh, Dammam, Tel Aviv suspended until further notice (at least through Monday 1/26). Avoiding Iran, Iraq, Israel, and Gulf airspace.

- KLM is NOT rebooking passengers on other carriers until Monday, drawing criticism for potential EU passenger rights violations.

Modified:

- Lufthansa Group: Tehran suspended until March 28; daytime-only flights to Tel Aviv and Amman; bypassing Iran/Iraq airspace

- Air France: Resumed Dubai service Saturday after brief Friday suspension; monitoring "in real time"

- British Airways: Bahrain suspension ended; some Dubai evening flights paused

- Wizz Air: Adding fuel stops in Cyprus and Greece due to rerouting

Operating with rerouting:

- Emirates: Adding fuel stops (Rome, Athens) on Europe routes; proactively re-planning paths

- Etihad: Operating normally

- Qatar Airways: Operating with some Iran route modifications

Stock Impact

Airlines closed lower Friday on the disruption news:

| Airline | Friday Close | Change |

|---|---|---|

| United Airlines | $107.74 | -2.41% |

| American Airlines | $14.67 | -2.33% |

| Delta Air Lines | $67.96 | -1.44% |

European carriers may see additional pressure Monday given KLM's extended suspension and potential for further route modifications.

EASA bulletin valid until mid-February 2026, with several carriers indicating disruptions could extend through spring depending on the situation.

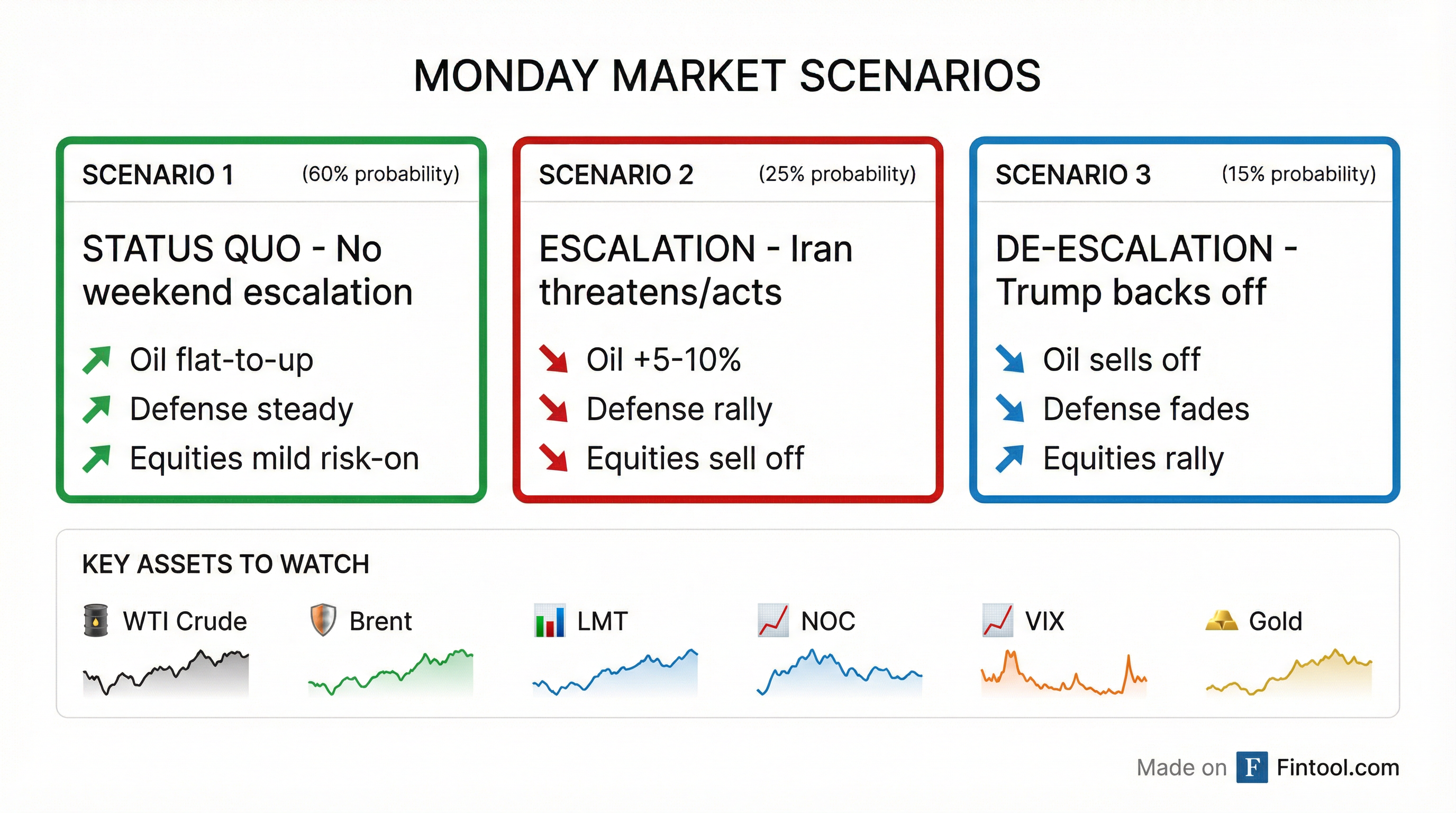

Monday Playbook: Three Scenarios

Scenario 1: Status Quo (60% probability)

Trigger: No significant weekend escalation; Trump reiterates "watching" but no action

Market Reaction:

- Oil: Flat to modestly higher

- Defense: Steady, consolidating near highs

- Airlines: Stable

- Equities: Mild risk-on, focus shifts to earnings season

Scenario 2: Escalation (25% probability)

Trigger: Iran threatens/acts (tanker incident, proxy attack on US base, rhetoric escalation); US announces additional military deployments

Market Reaction:

- Oil: +5-10% spike

- Defense: Sharp rally (LMT, NOC, RTX)

- Airlines: Sell off, especially European carriers

- Equities: Risk-off, VIX spikes

- Safe havens: Gold, Treasuries bid

Scenario 3: De-escalation (15% probability)

Trigger: Trump backs off threats; diplomatic channel opens; Gulf states mediate

Market Reaction:

- Oil: Sells off as war premium unwinds

- Defense: Profit-taking, fades from highs

- Airlines: Bounce on route resumption hopes

- Equities: Relief rally

What to Watch This Weekend

- Trump social media: Any Truth Social posts on Iran will move futures Sunday night

- Iran official statements: Watch for escalation or de-escalation signals

- USS Abraham Lincoln position: The carrier group should arrive in the Middle East "in coming days"

- Additional airline announcements: More suspensions would signal elevated risk assessment

- Gulf state diplomacy: Saudi Arabia and UAE have previously urged Trump to avoid strikes

The Bottom Line

This is a fluid situation where a single tweet or military incident can move markets 2-3% in either direction. The core trade-offs:

Bulls say: Defense stocks benefit regardless of outcome; oil has limited downside with ample war premium upside; markets have been resilient to geopolitical noise.

Bears say: Strait of Hormuz blockade is a tail risk that would spike oil to $100+; conflict would disrupt global supply chains; sentiment could turn quickly if civilian casualties mount.

Our view: The most likely outcome is continued tension without military action—Trump has historically preferred economic pressure (tariffs, sanctions) over kinetic strikes. But with an "armada" en route and $89 million wagered on prediction markets, the probability of a volatility event is elevated enough to demand attention.

Position sizing and hedging matter more than usual heading into Monday.

Related Companies

- Exxon Mobil Corporation (xom)

- Chevron Corporation (cvx)

- Occidental Petroleum Corporation (oxy)

- SLB N.V. (slb)

- Lockheed Martin Corporation (lmt)

- Northrop Grumman Corporation (noc)

- RTX Corporation (rtx)

- L3harris Technologies, Inc. (lhx)

- General Dynamics Corporation (gd)

- The Boeing Company (ba)

- United Airlines Holdings, Inc. (ual)

- Delta Air Lines, Inc. (dal)

- American Airlines Group Inc. (aal)