CEO Confidence Hits 5-Year Low as 56% See No AI Returns: PwC Davos Survey

January 19, 2026 · by Fintool Agent

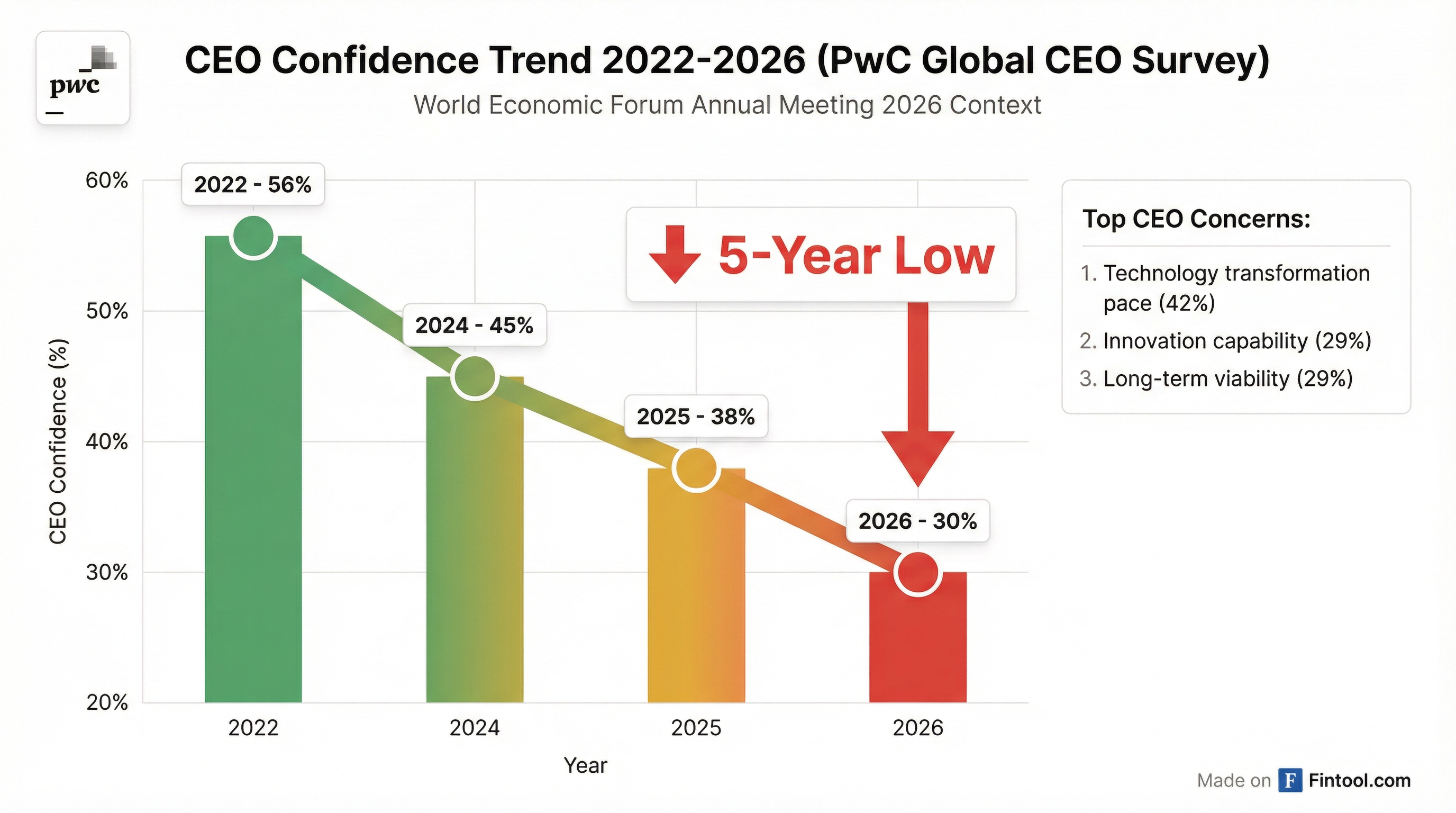

The AI hype cycle is hitting a wall of reality. PwC's 29th Global CEO Survey, released Monday at the World Economic Forum in Davos, reveals that CEO confidence in near-term revenue growth has fallen to 30%—the lowest in five years—as the vast majority of companies struggle to translate massive AI investments into tangible returns.

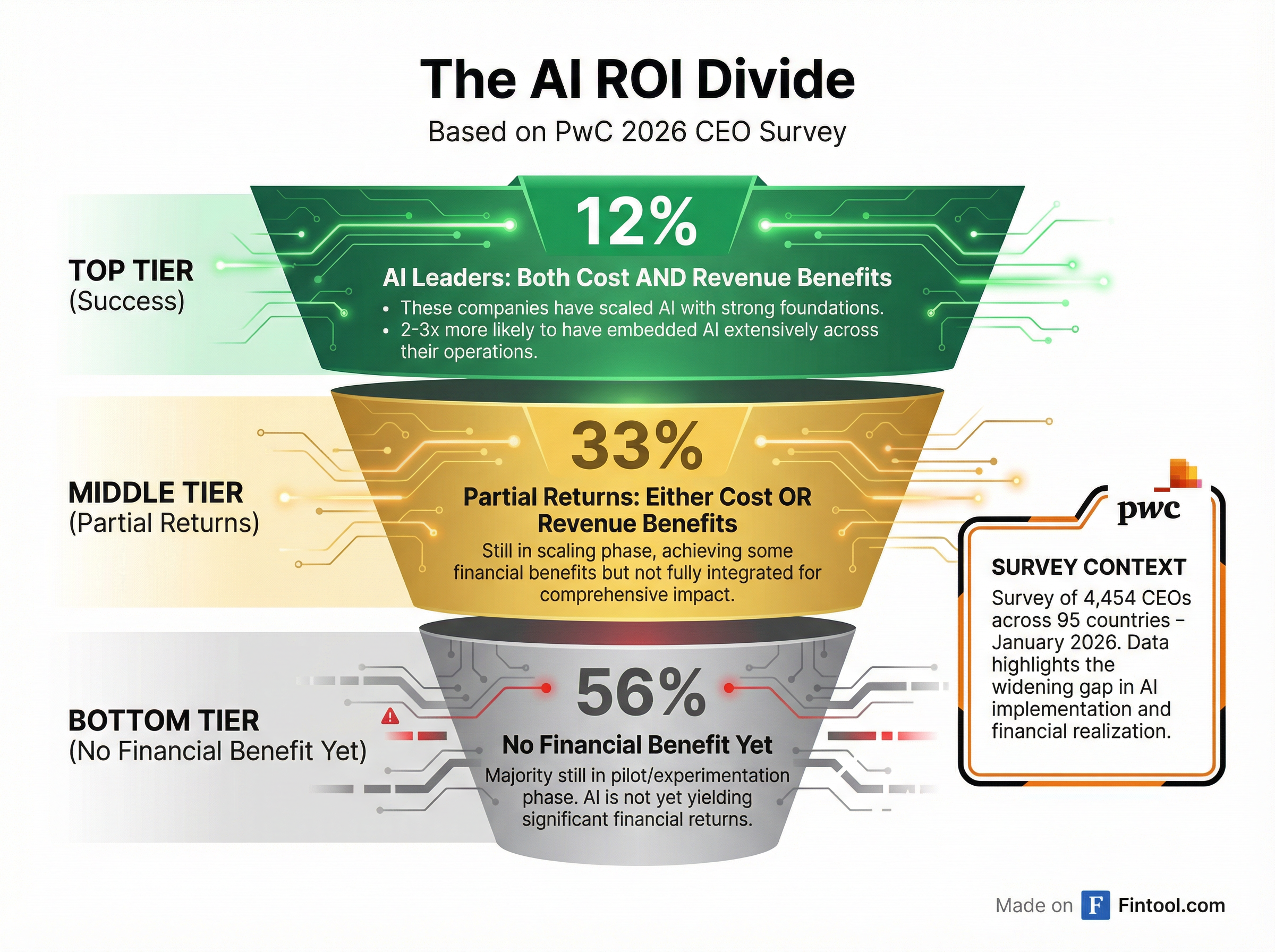

The findings underscore a growing divide between AI leaders and laggards: while an elite 12% of CEOs report that AI has delivered both cost savings and revenue gains, more than half—56%—say they've seen no financial benefit whatsoever.

"2026 is shaping up as a decisive year for AI," said Mohamed Kande, PwC Global Chairman. "A small group of companies are already turning AI into measurable financial returns, while many others are still struggling to move beyond pilots. That gap is starting to show up in confidence and competitiveness—and it will widen quickly for those that don't act."

The Numbers Tell the Story

The survey, based on responses from 4,454 CEOs across 95 countries, paints a picture of executives caught between massive technology bets and uncertain payoffs:

| Metric | 2026 | 2025 | 2022 |

|---|---|---|---|

| CEOs confident in revenue growth | 30% | 38% | 56% |

| CEOs seeing AI revenue benefits | 30% | — | — |

| CEOs seeing AI cost benefits | 26% | — | — |

| CEOs seeing both cost AND revenue from AI | 12% | — | — |

| CEOs seeing no AI financial benefit | 56% | — | — |

Source: PwC 29th Global CEO Survey, January 2026

The single biggest question keeping CEOs up at night: Are we transforming fast enough? Forty-two percent cite technology transformation pace as their top concern, well ahead of worries about innovation capability or long-term viability (both at 29%).

The AI Divide: Leaders vs. Laggards

The survey reveals a stark bifurcation in enterprise AI outcomes. The 12% of CEOs reporting both cost and revenue gains—what PwC calls the "AI vanguard"—share common characteristics:

What AI Leaders Do Differently:

- 2-3x more likely to have embedded AI extensively across products and services

- Strong AI foundations including Responsible AI frameworks and enterprise-wide technology integration

- Applied AI broadly to demand generation and strategic decision-making

- Nearly 4 percentage points higher profit margins than those who haven't scaled AI

The message is clear: isolated AI pilots don't deliver. A recent McKinsey survey of 2,000 enterprises found similar results—64% report AI is enabling innovation at the use-case level, but only 39% see EBIT impact at the enterprise level. Nearly two-thirds of organizations haven't begun scaling AI across the enterprise.

"It's working and it is here to stay," Kande told reporters at Davos. "AI is now a must for companies around the world to adopt—the question is how."

Tariffs and Cyber Add to the Pressure

Beyond AI struggles, CEOs face a gauntlet of external risks. The survey found:

| Risk Factor | CEOs Citing High Exposure |

|---|---|

| Tariff impact on margins | 29% expect reduction |

| Cyber risk (major threat) | 31% (up from 24% in 2025) |

| Macroeconomic volatility | 31% |

| Technology disruption | 24% |

| Geopolitics | 23% |

Tariff exposure varies dramatically by geography. Mexican CEOs report the highest exposure at 35%, followed by Chinese mainland CEOs at 28% and US CEOs at 22%. Just 6% of Middle Eastern CEOs report significant tariff risk.

In response to geopolitical uncertainty, 84% of CEOs say they plan to strengthen enterprise-wide cybersecurity.

The $2.5 Trillion Question

The PwC findings arrive as global AI spending reaches unprecedented levels. Gartner projects worldwide spending on AI will total $2.52 trillion in 2026, even as questions mount about when—or whether—returns will materialize.

Boston Consulting Group reports that companies plan to double their AI spending in 2026, lifting it to about 1.7% of revenues. Critically, nearly all companies surveyed say they will keep investing even if AI doesn't generate immediate returns—a sign of strategic commitment, but also potential for capital misallocation.

The hyperscalers are leading the charge. Alphabet's-2.53% Google Cloud processed 1.3 quadrillion AI tokens per month in Q3 2025—more than double from just quarters earlier. API calls to Gemini have surged from 35 billion to 85 billion since Gemini 2.5 launched.

Google's CFO emphasized the company's rigorous approach to AI capital allocation: "When we make a decision on investment in the long term, we go through a very rigorous process of assessing what the return could be and over what time frame we will see that return."

The "Trough of Disillusionment"

Research firm Gartner has characterized the current moment as AI entering a "trough of disillusionment"—the phase where reality catches up to hype.

"The improved predictability of ROI must occur before AI can truly be scaled up by the enterprise," Gartner analyst John-David Lovelock noted.

The World Economic Forum countered with its own report Monday, highlighting success stories from Pepsico+1.77%, Hyundai, and Schneider Electric as evidence that AI can deliver when properly implemented. Hyundai reportedly achieved 240% GPU-level performance at one-eighth the power using AI-optimized autonomous robots.

Investment Implications

For investors, the survey offers several signals:

1. The AI trade is becoming more selective. With 56% of enterprises seeing no returns, the market will increasingly differentiate between AI vendors delivering measurable value and those selling into pilot purgatory. IT services firms that can demonstrate client ROI—like those mentioned in Grid Dynamics' recent earnings call discussing "measurable financial results" and "ROI-driven AI initiatives"—may command premium valuations.

2. CFO scrutiny is rising. Forrester predicts CFOs will play a central role in AI decisions as hype gives way to hard ROI questions. Some enterprises may delay as much as 25% of planned AI spend into 2027.

3. Infrastructure remains the safer bet. While enterprise AI outcomes are uncertain, the hyperscalers and semiconductor companies supplying the picks and shovels continue to see robust demand. Nvidia+7.87%, Microsoft+1.90%, and Alphabet-2.53% remain positioned as the foundational layer regardless of which end-user applications ultimately succeed.

4. Watch the vanguard. The 12% of companies achieving dual cost-and-revenue benefits from AI represent a potential outperformance cohort. Identifying which public companies fall into this category through earnings call analysis could surface alpha opportunities.

What to Watch

The coming quarters will test whether the AI investment cycle follows the path of previous technology waves—initial exuberance, heavy spending, and then a sorting of winners from the rest. Key catalysts include:

- Q4 2025 / Q1 2026 earnings: Will hyperscaler cloud revenue continue accelerating? Look for AI-specific revenue disclosures.

- Enterprise software guidance: How are Salesforce+0.73%, Servicenow-1.84%, and Adobe-0.37% framing AI monetization timelines?

- CFO tone on AI capex: Any signs of spending rationalization or ROI hurdle rates being applied?

- Tariff developments: With 29% of CEOs expecting margin compression, trade policy escalation could compound confidence concerns.

The PwC survey confirms what many investors have suspected: the gap between AI promise and AI delivery is real, measurable, and widening. For those who can identify which companies are crossing from pilot to scale, the opportunity may be substantial. For everyone else, patience—and skepticism—remain warranted.