Earnings summaries and quarterly performance for Andersons.

Executive leadership at Andersons.

William Krueger

President and Chief Executive Officer

Anne Rex

Senior Vice President, Strategy, Planning and Development

Brian Valentine

Executive Vice President and Chief Financial Officer

Brian Walz

Senior Vice President and Treasurer

Mark Simmons

Executive Vice President, Renewables

Michael Hoelter

Vice President, Corporate Controller and Investor Relations

Sarah Zibbel

Executive Vice President, Chief Human Resources Officer

Weston Heide

Executive Vice President, Agribusiness

Board of directors at Andersons.

Catherine Kilbane

Director

Gary Douglas

Director

Gerard Anderson

Lead Independent Director

John Stout Jr.

Director

Pamela Hershberger

Director

Patrick Bowe

Executive Chairman of the Board

Robert King Jr.

Director

Ross Manire

Director

Steven Campbell

Director

Steven Oakland

Director

Research analysts who have asked questions during Andersons earnings calls.

Pooran Sharma

Stephens Inc.

6 questions for ANDE

Benjamin Klieve

Lake Street Capital Markets

3 questions for ANDE

Benjamin Mayhew

BMO Capital Markets

3 questions for ANDE

Ben Klieve

Lake Street Capital Markets

3 questions for ANDE

Ben Mayhew

BMO

2 questions for ANDE

Ben Mahy

BMO Capital Markets

1 question for ANDE

Craig Irwin

ROTH Capital Partners

1 question for ANDE

Recent press releases and 8-K filings for ANDE.

- Phospholutions achieved substantial commercial growth, with its RhizoSorb® technology surpassing 1 million acres treated in commercial crop production last growing season.

- The company demonstrated strong on-farm performance, including a 1.6% average corn yield increase at a 50% reduction in phosphorus, supported by over 700 trials.

- Phospholutions expanded its operational capabilities by securing three phosphate manufacturing partners and increased its global reach with shipments to Canada and Brazil.

- The leadership team was strengthened with key appointments, including Justin Archibee as Chief Financial Officer, and its intellectual property portfolio grew with two new U.S. patents in early 2026, bringing the total to 11 independent patent families across 100 countries.

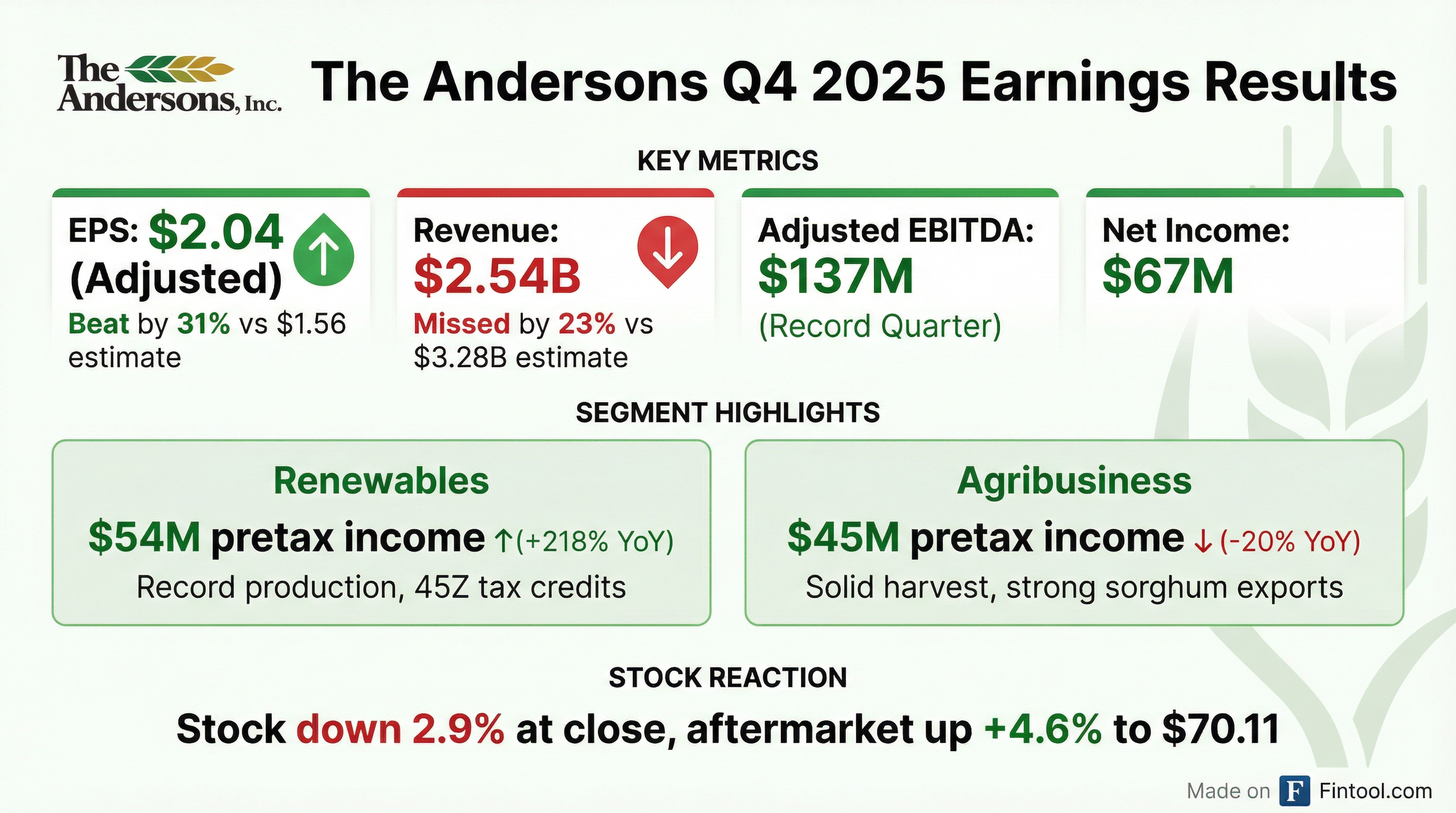

- The Andersons reported Q4 2025 adjusted diluted EPS of $2.04, an increase from $1.36 in Q4 2024, with adjusted net income of $70 million and gross profit of $231 million, an 8% increase year-over-year. For the full year 2025, adjusted EBITDA was $337 million.

- The company completed the acquisition of full ownership of its four ethanol plants in Q3 2025 and announced an additional investment in its Climer, Indiana facility to add 30 million gallons of incremental annual production by 2027. A new renewable feedstock storage and blending facility in Ulysses, Kansas is also planned to begin operations in Q1 2026.

- The Andersons anticipates exiting 2026 with run rate EPS more than $4.30 and has set a long-range target of $7 EPS by the end of 2028. They expect better financial results in agribusiness in 2026 and continued strong demand for ethanol, with 45Z tax credits projected to increase.

- The Andersons reported a record fourth quarter EPS, with adjusted net income of $70 million or $2.04 per diluted share for Q4 2025, a significant increase from $47 million or $1.36 per diluted share in Q4 2024.

- For the full year 2025, gross profit increased 3% to $714 million, and adjusted EBITDA was $337 million. The company's long-term debt to EBITDA at year-end was 1.8 times, remaining below its stated target of 2.5 times.

- The company anticipates better financial results in agribusiness and continued strong demand for ethanol in 2026. It expects to exit 2026 with run rate EPS more than its prior target of $4.30 and has updated its long-range target to $7 EPS as it exits 2028.

- Strategic investments include an additional investment in the Climer, Indiana ethanol facility, expected to add 30 million gallons of incremental annual production in 2027, and the acquisition of full ownership of its four ethanol plants in Q3 2025. 45Z tax credits are expected to increase in 2026, with a full-year expectation of $90 billion-$100 billion.

- **Andersons reported strong Q4 2025 financial results, with adjusted diluted earnings per share increasing to $2.04 from $1.36 in Q4 2024, and net income attributable to Andersons rising to $67 million from $45 million in the prior year quarter. **

- **Both the Agribusiness and Renewables segments contributed positively, with Agribusiness benefiting from a record corn harvest and favorable basis values, and Renewables driven by efficient operations, strong demand, full ownership of ethanol plants, and 45Z tax credits. **

- **The company announced a 30-million-gallon Clymers expansion project and anticipates $90 million to $100 million in 45Z tax credits for 2026. **

- **Andersons maintains a strong balance sheet, with a long-term debt-to-EBITDA ratio of 1.8x, below its target of 2.5x, and projects 2026 capital spending between $200 million and $225 million. **

- The Andersons reported a record Q4 2025 EPS of $1.97 per diluted share and adjusted net income of $70 million or $2.04 per diluted share, a significant increase from $1.36 per diluted share in Q4 2024.

- The Renewables segment's Q4 pre-tax income surged to $54 million, primarily due to the full ownership of four ethanol plants acquired in Q3 2025 and $15 million in 45Z tax incentives for the quarter.

- For 2026, the company expects better financial results in agribusiness and continued strong demand for ethanol, projecting to exit 2026 with run rate EPS more than $4.30 and a long-range target of $7 EPS by the end of 2028.

- Strategic investments include an additional investment in the Clymers, Indiana ethanol facility to add 30 million gallons of incremental annual production by 2027, and the completion of Port of Houston grain elevator upgrades in Q2 2026.

- The Andersons reported record fourth quarter net income attributable to the company of $67 million, or $1.97 per diluted share, and $70 million, or $2.04 per diluted share, on an adjusted basis for the quarter ended December 31, 2025.

- For the full year 2025, net income attributable to the company was $96 million, or $2.79 per diluted share, and $111 million, or $3.23 per diluted share, on an adjusted basis, with adjusted EBITDA reaching $337 million.

- Both the Renewables and Agribusiness segments contributed to the strong performance, with Renewables pretax income at $54 million and Agribusiness pretax income at $46 million for the fourth quarter.

- The company's balance sheet remains strong with a long-term debt to adjusted EBITDA ratio of 1.8 times, well below its stated target of less than 2.5 times.

- Strategic capital investments are progressing, including a new mineral processing facility and a recently announced $60 million investment to increase capacity at the Clymers, Indiana ethanol production facility.

- Cameco reported solid fourth quarter and full-year 2025 financial and operating results, with net earnings of $590 million and adjusted net earnings of $627 million for the year ended December 31, 2025.

- Adjusted EBITDA for 2025 increased by approximately $398 million to $1.9 billion compared to 2024, driven by strong contributions from the uranium and Westinghouse segments.

- The Westinghouse segment's adjusted EBITDA increased by 30% over 2024, and Cameco received US$171.5 million as its share of a cash distribution related to the Dukovany nuclear project.

- The company increased its annual dividend to $0.24 per common share in 2025 and ended the year with a strong balance sheet, including $1.2 billion in cash and cash equivalents.

- Cameco's uranium production volume was 21.0 million pounds (Cameco's share) in 2025, exceeding revised guidance, and the company has about 230 million pounds of uranium committed under long-term contracts.

- The Andersons, Inc. announced a growth plan targeting a run-rate earnings per share of $7.00 exiting 2028, representing a 36% compounded annual growth rate from $2.56 per share for the trailing twelve months ended September 30, 2025.

- The company plans a $60 million capital investment at its Clymers, Indiana, ethanol plant, expected to increase ethanol capacity by 30 million gallons by mid-2027.

- An expansion of the export terminal at the Port of Houston is scheduled for completion in 2026, which will enable the export of soybean meal and enhance the efficient export of western grains.

- The strategic framework also emphasizes strengthening geographic presence through the Skyland Grain acquisition and returning capital to shareholders via a long track record of dividend payments and opportunistic share repurchases.

- The Andersons, Inc. announced a growth plan targeting a run-rate earnings per share of $7.00 exiting 2028, which represents a 36% compounded annual growth rate from $2.56 per share for the trailing twelve months ended September 30, 2025.

- Strategic investments include a $60 million capital investment at the Clymers, Indiana, ethanol plant, expected to increase capacity by 30 million gallons by mid-2027, and the completion of the Port of Houston export terminal expansion in 2026.

- The company's framework emphasizes leveraging its diversified portfolio, strengthening geographic presence through acquisitions like Skyland Grain, and maximizing 45Z tax credits for efficient ethanol plants.

- The Andersons plans to return capital to shareholders through a balanced approach, including continuing its more than 25-year track record of consecutive dividend payments and opportunistic share repurchases.

- The Andersons has set a publicly stated target of $4.30 adjusted EPS exiting 2026 and a run rate EPS target of $7 per share exiting 2028.

- The company completed a $425 million acquisition to gain 100% ownership of its ethanol plants, doubling its financial exposure and opportunity in the ethanol space, and also acquired majority ownership in Skyland Grain in November 2024.

- Over the last three years, The Andersons deployed $1.1 billion in capital, with approximately 45% allocated to capital expenditures, 45% to acquisitions, and 10% returned to shareholders.

- The renewables segment's four ethanol plants operate well over 500 million gallons of capacity, significantly exceeding 100% utilization, and the company is focused on lowering carbon intensity to capitalize on 45Z tax credits.

Quarterly earnings call transcripts for Andersons.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more