Earnings summaries and quarterly performance for ARCBEST CORP /DE/.

Executive leadership at ARCBEST CORP /DE/.

Judy McReynolds

Chief Executive Officer

Christopher Adkins

Chief Strategy Officer

Dennis Anderson

Chief Innovation Officer

Edward Sorg

Chief Commercial Officer

Erin Gattis

Chief Human Resources Officer

Matthew Beasley

Chief Financial Officer

Matthew Godfrey

President, ABF Freight

Michael Johns

Chief Legal Officer and Corporate Secretary

Seth Runser

President

Steven Leonard

Chief Operating Officer, Asset-Light Logistics

Board of directors at ARCBEST CORP /DE/.

Chris Sultemeier

Director

Craig Philip

Director

Eduardo Conrado

Lead Independent Director

Fredrik Eliasson

Director

Janice Stipp

Director

Kathleen McElligott

Director

Michael Hogan

Director

Salvatore Abbate

Director

Thom Albrecht

Director

Research analysts who have asked questions during ARCBEST CORP /DE/ earnings calls.

Jordan Alliger

Goldman Sachs

6 questions for ARCB

Ken Hoexter

BofA Securities

6 questions for ARCB

Stephanie Moore

Jefferies

6 questions for ARCB

Brian Ossenbeck

JPMorgan Chase & Co.

5 questions for ARCB

Jason Seidl

TD Cowen

5 questions for ARCB

Christian Wetherbee

Wells Fargo

4 questions for ARCB

Daniel Imbro

Stephens Inc.

4 questions for ARCB

J. Bruce Chan

Stifel

4 questions for ARCB

Ravi Shanker

Morgan Stanley

4 questions for ARCB

Scott Group

Wolfe Research

4 questions for ARCB

Thomas Wadewitz

UBS

3 questions for ARCB

Ariel Rosa

Citigroup

2 questions for ARCB

Ari Rosa

Citigroup Inc.

2 questions for ARCB

Bruce Chan

Stifel Financial Corp.

2 questions for ARCB

Chris Wetherbee

Wells Fargo & Company

2 questions for ARCB

Cole Couzens

Wolfe Research

2 questions for ARCB

Reed Seay

Stephens Inc.

2 questions for ARCB

Tom Wadewitz

UBS Group

2 questions for ARCB

Elliot Alper

TD Cowen

1 question for ARCB

Jeffrey Kauffman

Vertical Research Partners

1 question for ARCB

Larry Solow

CJS Securities

1 question for ARCB

Tom Wadowitz

UBS

1 question for ARCB

Recent press releases and 8-K filings for ARCB.

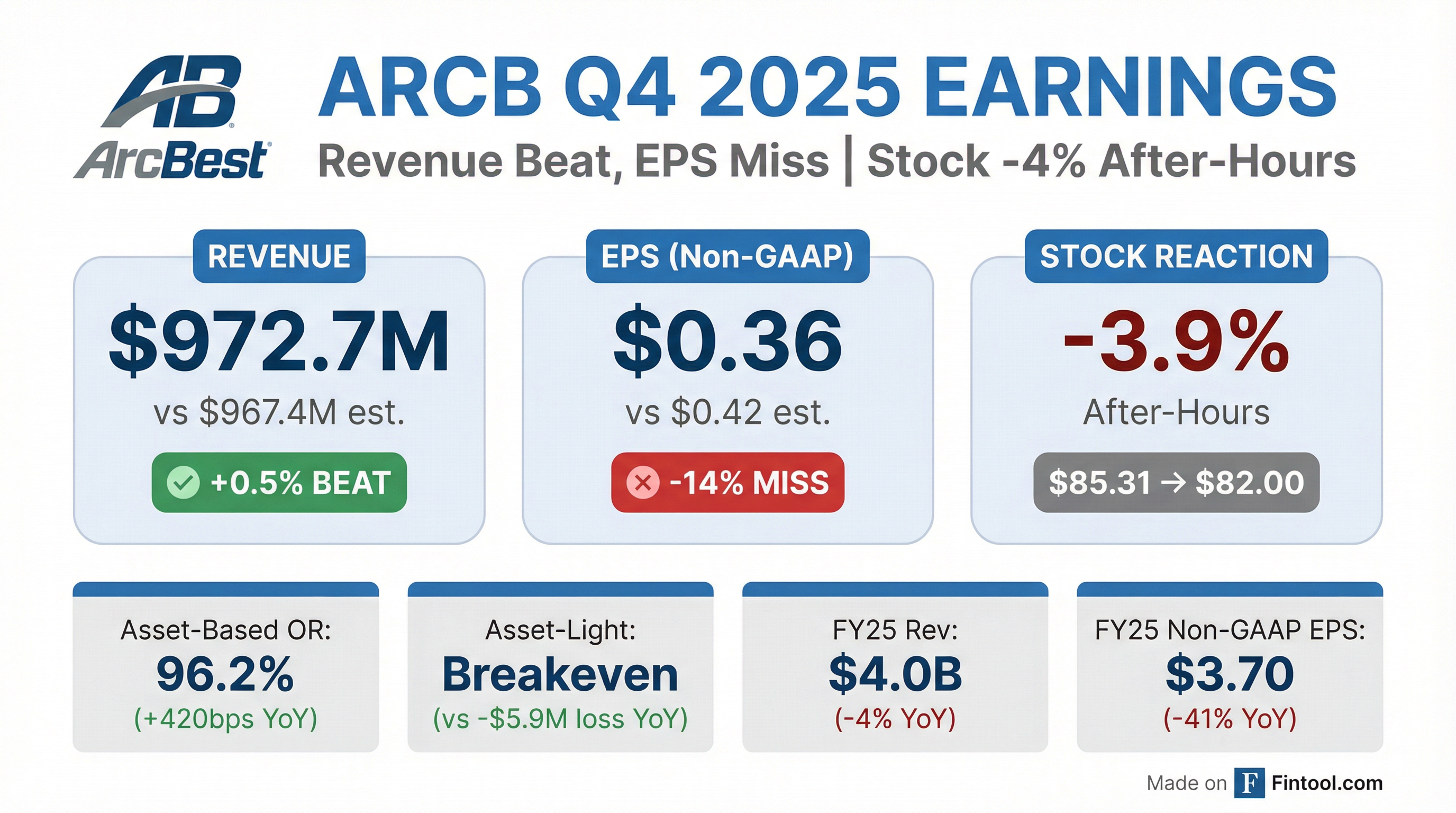

- ArcBest reported Q4 2025 consolidated revenue of $973 million, a 3% increase, however, Non-GAAP Earnings per Diluted Share decreased by 73% to $0.36 and Non-GAAP Operating Income fell by 67% to $13.7 million.

- The company outlined 2028 financial targets, aiming for Non-GAAP Diluted EPS of $12-$15, an Asset-Based Non-GAAP Operating Ratio of 87%-90%, and Annual Operating Cash Flow of $400M-$500M.

- Operational highlights include core LTL shipments per day reaching 2200 in Q4 2025 and the Managed Solutions pipeline growing to $1 billion as of Q4 2025, alongside $24 million in cost savings from continuous improvement training in 2025.

- ArcBest authorized a new $125 million share repurchase program, contributing to nearly $500 million returned to shareholders since 2019.

- ArcBest reported Q4 2025 consolidated revenue of $973 million, a 3% decrease year-over-year, with non-GAAP operating income of $14 million and adjusted non-GAAP EPS of $0.36. Despite a challenging freight market, the company achieved 2% year-over-year growth in Asset-Based LTL shipments and double-digit growth in Managed Solutions shipments per day, with Truckload revenue per shipment increasing 11%.

- The company realized significant cost savings from efficiency and innovation initiatives, including $24 million in annual cost savings from its continuous improvement program and $15 million in total savings in 2025 from City Route Optimization. AI-powered process improvements in truckload also contributed $2.5 million in operating income benefit in 2025.

- ArcBest anticipates 2026 net capital expenditures to be between $150 million and $170 million, a decrease from $198 million in 2025, and returned over $86 million to shareholders in 2025 through share repurchases and dividends.

- New leadership appointments include Mac Pinkerton as Chief Operating Officer of the Asset-Light business and Anne Bordelon and Bobby George as independent directors.

- ArcBest reported Q4 2025 consolidated revenue of $973 million, a 3% year-over-year decrease, and adjusted non-GAAP earnings per share of $0.36, down from $1.33 in Q4 2024.

- The Asset-Light segment achieved break-even non-GAAP operating results in Q4 2025, an improvement of $6 million year-over-year, and delivered over $1 million in non-GAAP operating profit for the full year, marking a turnaround from a $17 million loss in 2024.

- Despite a prolonged freight recession and not anticipating significant market recovery in 2026, the company reaffirmed its 2028 financial targets, including EPS of $12-$15. For Q1 2026, ArcBest expects its Asset-Based operating ratio to increase by approximately 100-200 basis points sequentially.

- In 2025, ArcBest returned over $86 million to shareholders through share repurchases and dividends, and anticipates 2026 net capital expenditures between $150 million and $170 million.

- ArcBest reported Q4 2025 consolidated revenue of $973 million, a 3% year-over-year decrease, with non-GAAP operating income of $14 million and adjusted non-GAAP EPS of $0.36.

- The Asset-Based segment experienced a 2% year-over-year increase in LTL shipments, while the Asset-Light segment achieved break-even non-GAAP operating results, an improvement of $6 million compared to the previous year.

- The company made significant progress on efficiency and innovation in 2025, with initiatives like continuous improvement training yielding $24 million in annual cost savings and City Route Optimization totaling $15 million in savings.

- ArcBest reaffirmed its 2028 financial targets of $12-$15 EPS, despite not expecting significant market improvement in 2026, and anticipates its Q1 operating ratio to increase by approximately 100-200 basis points sequentially.

- Mac Pinkerton was appointed Chief Operating Officer of the Asset-Light business, and Anne Bordelon and Bobby George were welcomed as independent directors to the board.

- ArcBest reported a fourth-quarter net loss of $8.1 million and adjusted EPS of $0.36, which was 97 cents lower than the prior-year quarter and missed consensus.

- Full-year adjusted net income decreased 51.2% to $84.8 million, with 2025 revenue around $4.01 billion.

- Fourth-quarter revenue was roughly $973 million, slightly beating expectations, but included a noncash impairment/one-time charge of about $22.8 million.

- The ABF Freight unit's operating income plunged to $24.387 million from $52.335 million a year earlier, and its adjusted operating ratio worsened to 96.2%.

- The Asset-Light segment returned to break-even on a non-GAAP basis for the quarter, and management guided to a smaller sequential LTL operating ratio degradation of 100-200 bps from Q4 to Q1.

- ArcBest reported fourth quarter 2025 revenue of $972.7 million and a net loss from continuing operations of $8.1 million, or $0.36 per diluted share.

- For the full year 2025, revenue totaled $4.0 billion, with net income from continuing operations of $60.1 million, or $2.62 per diluted share.

- The company returned more than $86 million to shareholders through share repurchases and dividends in 2025.

- In the Asset-Based segment, tonnage per day increased 2.6 percent and shipments per day increased 2.4 percent in Q4 2025 compared to the prior-year period.

- The Asset-Light segment achieved breakeven non-GAAP operating income in Q4 2025.

- ArcBest reported Q4 2025 revenue of $972.7 million and a net loss from continuing operations of $8.1 million, or $0.36 per diluted share, compared to Q4 2024 revenue of $1.0 billion and net income of $29.0 million, or $1.24 per diluted share.

- For the full year 2025, revenue totaled $4.0 billion and net income from continuing operations was $60.1 million, or $2.62 per diluted share, down from $4.2 billion in revenue and $173.4 million in net income, or $7.28 per diluted share, in 2024.

- On a non-GAAP basis, Q4 2025 net income was $8.2 million, or $0.36 per diluted share, and full year 2025 net income was $84.8 million, or $3.70 per diluted share.

- The company returned more than $86 million to shareholders in 2025 through share repurchases and dividends.

- Despite a challenging freight environment, ArcBest achieved record Asset-Light productivity for full-year 2025 and reported increased Asset-Based shipments and tonnage.

- ArcBest Corporation (ARCB) provided an update on its fourth quarter 2025 financial results and business trends for October and November 2025.

- For the Asset-Based segment, November 2025 saw a 1% increase in billed revenue per day and a 3% increase in tonnage per day year-over-year, despite one less workday compared to November 2024. The non-GAAP operating ratio is anticipated to deteriorate by about 400 basis points sequentially from Q3 to Q4 2025, driven by freight market softness and fewer workdays.

- The Asset-Light segment experienced a 1% year-over-year decline in daily revenue but a 5% increase in daily shipments in November 2025. The company expects a non-GAAP operating loss in the range of $1 million to $3 million for the fourth quarter of 2025.

- ArcBest Corporation entered into a Fifth Amended and Restated Credit Agreement on November 25, 2025, for its revolving credit facility.

- The facility has a five-year term, maturing on November 25, 2030, with an initial maximum credit amount of $250 million.

- The letter of credit sub-facility sublimit was increased to $50 million, and the agreement includes an "Accordion Feature" for up to $125 million in additional commitments.

- Borrowings will bear interest at either the Alternate Base Rate (spread of 0.125% to 1.00%) or the Adjusted Term SOFR Screen Rate (spread of 1.125% to 2.00%), with the applicable spread dependent on the company's Adjusted Leverage Ratio.

- ArcBest has set 2028 financial targets including non-GAAP diluted EPS of $12-$15, an Asset-Based Non-GAAP Operating Ratio of 87%-90%, and $40M-$70M in Asset-Light Non-GAAP Operating Income.

- For the trailing twelve months (TTM) ended Q3 2025, the company reported non-GAAP diluted EPS of $4.72 , consolidated non-GAAP operating income of $153.5 million , and non-GAAP Asset-Light operating income of $(4.4) million.

- The Asset-Based Non-GAAP Operating Ratio for the TTM ended Q3 2025 was 93.3% , and its non-GAAP Return on Capital Employed was 12%.

- ArcBest authorized a new $125 million share repurchase program and has returned nearly $500 million to shareholders since 2019.

- Strategic initiatives are yielding results, with the City Route Optimization tools realizing $15 million in annual savings for 2025 , and continuous improvement training projected to generate $20 million in cost savings for 2026. The company also expanded its network by approximately 800 net doors since 2021, reaching 9,635 total doors in 2025.

Quarterly earnings call transcripts for ARCBEST CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more