Earnings summaries and quarterly performance for AXON ENTERPRISE.

Executive leadership at AXON ENTERPRISE.

Board of directors at AXON ENTERPRISE.

Adriane Brown

Director

Caitlin Kalinowski

Director

Erika Ayers Badan

Director

Graham Smith

Director

Hadi Partovi

Director

Jeri Williams

Director

Julie Cullivan

Director

Matthew McBrady

Director

Michael Garnreiter

Chair of the Board

Todd Morgenfeld

Director

Research analysts who have asked questions during AXON ENTERPRISE earnings calls.

Jeremy Hamblin

Craig-Hallum Capital Group LLC

9 questions for AXON

Andrew Sherman

Cowen

8 questions for AXON

Jordan Lyonnais

Bank of America

8 questions for AXON

Jonathan Ho

William Blair & Company

7 questions for AXON

Joshua Reilly

Needham & Company

7 questions for AXON

Trevor Walsh

Citizens JMP

7 questions for AXON

George Notter

Jefferies

6 questions for AXON

Joseph Cardoso

JPMorgan Chase & Co.

6 questions for AXON

Keith Housum

Northcoast Research

6 questions for AXON

Meta Marshall

Morgan Stanley

5 questions for AXON

William Power

Baird

5 questions for AXON

Michael Ng

Goldman Sachs

4 questions for AXON

Andrew Spinola

UBS

3 questions for AXON

Mike Latimore

Northland Capital Markets

3 questions for AXON

Mike Ng

Goldman Sachs

3 questions for AXON

Alyssa Shreves

Barclays

2 questions for AXON

David Paige

RBC Capital Markets

2 questions for AXON

James Fish

Piper Sandler Companies

2 questions for AXON

Jamie Reynolds

Morgan Stanley

2 questions for AXON

Jim Fish

Piper Sandler

2 questions for AXON

Tim Long

Barclays

2 questions for AXON

Will Power

Robert W. Baird & Co.

2 questions for AXON

Joe Cardoso

JPMorgan Chase & Co.

1 question for AXON

Josh Reilly

Needham

1 question for AXON

Josh Riley

Needham & Company

1 question for AXON

Trevor J. Walsh

Citizens

1 question for AXON

Yani Samolus

Baird

1 question for AXON

Yanni Samoilis

Robert W. Baird & Co.

1 question for AXON

Recent press releases and 8-K filings for AXON.

- Axon delivered $7.4 billion in full-year bookings for 2025, up more than 40% YoY, with Q4 bookings up over 50%, driven by record large-scale deals and $1 billion in new product bookings including AI offerings.

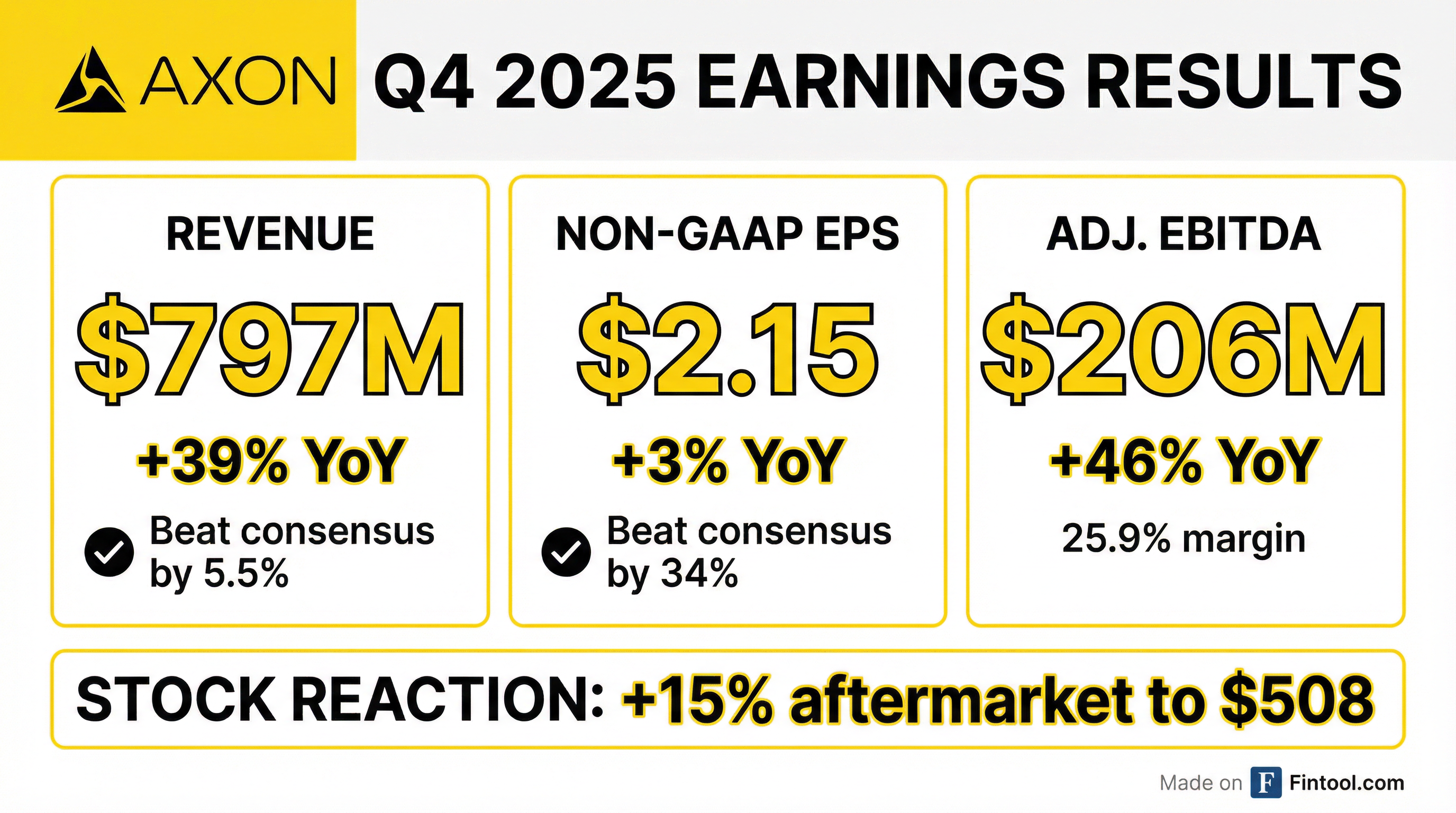

- Q4 2025 revenue rose 39% YoY to $797 million, with software & services up 40% to $343 million, connected devices up 38% to $454 million, net revenue retention at 125%, and ARR exceeding $1.3 billion.

- Adjusted EBITDA grew 46% YoY to $206 million in Q4, representing a 25.9% margin; operating cash flow was $217 million, and free cash flow conversion is expected to return toward 60% in 2026.

- For 2026, Axon guides to 27–30% revenue growth and an adjusted EBITDA margin of 25.5%, supported by a strong bookings backlog, scaled manufacturing, and continued investment in AI-driven products.

- Axon delivered $797 million in Q4 revenue, up 39% year-over-year, driven by software & services revenue of $343 million (+40% YoY) and connected devices revenue of $454 million (+38% YoY); net revenue retention expanded to 125% and ARR grew 35% to over $1.3 billion.

- Full-year 2025 bookings surpassed $7 billion, up over 40% from the prior year, with Q4 bookings up more than 50%; new product bookings (Air, AI, Fusus) totaled over $1 billion, including approximately $750 million from the AI Era Plan.

- Adjusted EBITDA for Q4 was $206 million (+46% YoY) with a 25.9% margin; operating cash flow was $217 million, and free cash flow conversion is expected to normalize toward a 60% target in 2026.

- For 2026, Axon guides to 27–30% revenue growth and a 25.5% adjusted EBITDA margin; long-term targets include reaching ~$6 billion in revenue and a 28% adjusted EBITDA margin by 2028 while maintaining a Rule of 40 above 55%.

- Q4 2025 revenue totaled $797 million (Connected Devices: $454 M; Software & Services: $343 M), reflecting 33% YoY growth.

- FY 2025 revenue was $2.8 billion (+33% YoY), with adjusted gross margin of 62.6% and adjusted EBITDA margin of 25.5%.

- Non-GAAP net income reached $564 million (EPS $6.85).

- Annual recurring revenue hit $1.3 billion, with 125% net revenue retention and $14.4 billion in future contracted bookings.

- FY 2026 guidance calls for 27–30% revenue growth, ~25.5% adjusted EBITDA margin, and $185–215 million in CapEx.

- Record bookings: 2025 full-year bookings exceeded $7 billion, up over 40% year-over-year, with Q4 bookings accelerating more than 50%.

- Strong Q4 revenue growth: Q4 revenue of $797 million, up 39%; software & services at $343 million (+40%); connected devices at $454 million (+38%); net revenue retention 125%; ARR above $1.3 billion.

- 2026 guidance: Forecasting revenue growth of 27%–30% and maintaining an adjusted EBITDA margin of 25.5%.

- AI and new products traction: AI Era Plan bookings totaled $750 million (~10% of total); new product bookings (Air, AI, Fusus) topped $1 billion; enterprise, federal, and international corrections pipelines gaining momentum.

- Strategic acquisitions: Closed the acquisitions of Prepared in Q4 and Carbyne in February 2026 to enhance 911 and real-time crime center offerings.

- Q4 2025 revenue of $797 million, up 39% year-over-year; Software & Services revenue grew 40% to $343 million.

- Q4 net income of $3 million (0.3% margin), non-GAAP net income of $178 million (22.3% margin) and Adjusted EBITDA of $206 million (25.9% margin).

- Full-year 2025 revenue of $2.8 billion, up 33% year-over-year, with a net income margin of 4.5% and Adjusted EBITDA margin of 25.5%.

- 2026 outlook calls for 27–30% revenue growth and a 25.5% Adjusted EBITDA margin; 2028 targets include $6 billion in revenue and a 28% Adjusted EBITDA margin.

- Q4 2025 revenue of $797 million, up 39% year over year.

- Delivered full-year 2025 revenue of $2.8 billion, a 33% increase versus 2024.

- Recorded net income of $3 million, non-GAAP net income of $178 million, and Adjusted EBITDA of $206 million.

- Established 2026 guidance of 27–30% revenue growth with a 25.5% Adjusted EBITDA margin and set 2028 targets of $6 billion in revenue and a 28% Adjusted EBITDA margin.

- On December 9, 2025, Axon entered into exchange agreements to swap approximately $177.9 million aggregate principal amount of its 0.50% convertible senior notes due 2027 for cash and common stock, based on a assumed VWAP of $550.95, resulting in the issuance of about 468,000 shares upon closing.

- The exchanges are expected to close on or about December 16, 2025, after which roughly $100.1 million aggregate principal amount of the notes will remain outstanding.

- The stock issuance will be made under the Section 4(a)(2) exemption, with participating holders representing institutional accredited investors and qualified institutional buyers; hedged holders may unwind equity positions, potentially affecting Axon's share price.

- Axon reported Q3 revenue of $711 million, up 31% YoY, with software and services revenue of $305 million (+41% YoY), connected devices revenue of $405 million (+24% YoY); net revenue retention was 124%, and ARR reached $1.3 billion.

- Adjusted gross margin was 62.7% (down 50 bps YoY due to tariffs) and Adjusted EBITDA margin was 24.9%; the company plans continued R&D and strategic investments in AI, ALPR products, and newly acquired businesses.

- Management raised Q4 revenue guidance to $750–755 million and full-year revenue to $2.74 billion (implying ~31% growth); Q4 Adjusted EBITDA is projected at $178–182 million, maintaining a 25% full-year margin target.

- Year-to-date bookings are up over 30%, driven by AI Aeroplan software and newer offerings—Axon Air, Dedrone, and Fusus bookings up more than 3× YTD—while corrections bookings more than doubled and the international segment secured a nine-figure cloud deal in Europe.

- Axon acquired Prepared and announced the acquisition of Carbyne to enhance its 911 ecosystem with AI-driven call center and cloud communications capabilities; Carbyne is expected to close in early 2026.

- Q3 revenue of $711 million, up 31% year-over-year; software & services grew 41% to $305 million, with ARR up 41% to $1.3 billion and net revenue retention at 124%.

- Adjusted gross margin was 62.7% (down 50 bps YoY) and adjusted EBITDA margin was 24.9%, reflecting tariffs and increased R&D investments.

- Raised Q4 revenue guidance to $750–755 million, implying full-year revenue of ~$2.74 billion (≈31% growth), and maintained a full-year 25% adjusted EBITDA margin target.

- Acquired Prepared and Carbine to modernize 911 call centers with AI-enabled voice communications; Carbine expected to close early 2026.

- Axon delivered Q3 revenue of $711 million (+31% Y/Y), with software & services revenue at $305 million (+41% Y/Y), net revenue retention of 124%, and ARR of $1.3 billion.

- Adjusted gross margin was 62.7% (-50 bps Y/Y) and adjusted EBITDA margin was 24.9%, with Q4 revenue guidance set at $750–755 million (full-year ~$2.74 billion, ~31% growth) and a full-year 25% EBITDA margin target.

- Axon announced acquisitions of Prepared and Carbine to build its Axon 911 AI voice ecosystem, expected to close in early 2026.

- AI momentum remains strong: AI Aeroplan is the fastest-booked Axon software product and is projected to contribute >10% of U.S. state & local bookings, while Axon Air, Dedrone, and Fusus bookings are up >3× YTD.

Quarterly earnings call transcripts for AXON ENTERPRISE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more