Earnings summaries and quarterly performance for BOSTON SCIENTIFIC.

Executive leadership at BOSTON SCIENTIFIC.

Michael Mahoney

President and Chief Executive Officer

Arthur Butcher

Executive Vice President and Group President, MedSurg and Asia Pacific

Daniel Brennan

Executive Vice President and Chief Financial Officer

Jeffrey Mirviss

Executive Vice President and President, Peripheral Interventions

John Sorenson

Executive Vice President, Global Operations

Joseph Fitzgerald

Executive Vice President and Group President, Cardiology

Miriam O'Sullivan

Senior Vice President, Chief Human Resources Officer

Vance Brown

Senior Vice President, General Counsel and Corporate Secretary

Board of directors at BOSTON SCIENTIFIC.

Research analysts who have asked questions during BOSTON SCIENTIFIC earnings calls.

Danielle Antalffy

UBS Group AG

8 questions for BSX

David Roman

Goldman Sachs Group Inc.

8 questions for BSX

Travis Steed

Bank of America

8 questions for BSX

Patrick Wood

Morgan Stanley

7 questions for BSX

Robert Marcus

JPMorgan Chase & Co.

6 questions for BSX

Frederick Wise

Stifel

5 questions for BSX

Joanne Wuensch

Citigroup Inc.

5 questions for BSX

Joshua Jennings

TD Cowen

5 questions for BSX

Larry Biegelsen

Wells Fargo & Company

5 questions for BSX

Michael Polark

Wolfe Research

5 questions for BSX

Vijay Kumar

Evercore ISI

5 questions for BSX

Chris Pasquale

Nephron Research LLC

4 questions for BSX

Lawrence Biegelsen

Wells Fargo

3 questions for BSX

Rick Wise

Stifel Financial Corp

3 questions for BSX

Joanne Lynch

Citigroup Inc.

2 questions for BSX

Matthew Miksic

Barclays PLC

2 questions for BSX

Pito Chickering

Deutsche Bank

2 questions for BSX

Robbie Marcus

JPMorgan Chase & Co.

2 questions for BSX

Anthony Petrone

Mizuho Group

1 question for BSX

Christopher Pasquale

Nephron Research

1 question for BSX

Danielle Antalffy

UBS

1 question for BSX

Joanne Winch

Citibank

1 question for BSX

Marie Thibault

BTIG

1 question for BSX

Matthew O'Brien

Piper Sandler & Co.

1 question for BSX

Matthew Taylor

Jefferies

1 question for BSX

Matt O'Brien

Piper Sandler Companies

1 question for BSX

Matt Taylor

Jefferies & Company Inc.

1 question for BSX

Michael Pollock

Wolfe Research, LLC

1 question for BSX

Mike Polark

Wolfe Research, LLC

1 question for BSX

Peter Chickering

Deutsche Bank AG

1 question for BSX

Recent press releases and 8-K filings for BSX.

- Boston Scientific entered into a $6.0 billion Term Loan Credit Agreement dated February 26, 2026 to finance, in part, its acquisition of Penumbra, Inc.

- The company also established a $3.0 billion Credit Agreement for revolving and multicurrency loans to fund working capital and general corporate needs

- Additionally, Boston Scientific put in place a $2.0 billion 364-day Credit Agreement providing short-term revolving and multicurrency commitments

- Boston Scientific’s Board increased from ten to twelve members and appointed Cathy Smith and Christophe Weber as directors, effective February 18, 2026.

- Smith brings extensive expertise in finance and corporate strategy from roles at Starbucks, Nordstrom and Walmart; Weber contributes global pharmaceutical leadership as Takeda’s retiring CEO (June 2026).

- Under the non-employee director compensation program, each new director will receive a prorated $24,663 cash retainer and an equity award valued at $42,420, vesting at the end of their term.

- In a separate action, the Board approved raising its stock repurchase authorization by $4.0 billion, bringing the total repurchase capacity to $5.0 billion, all fully available as of February 18, 2026.

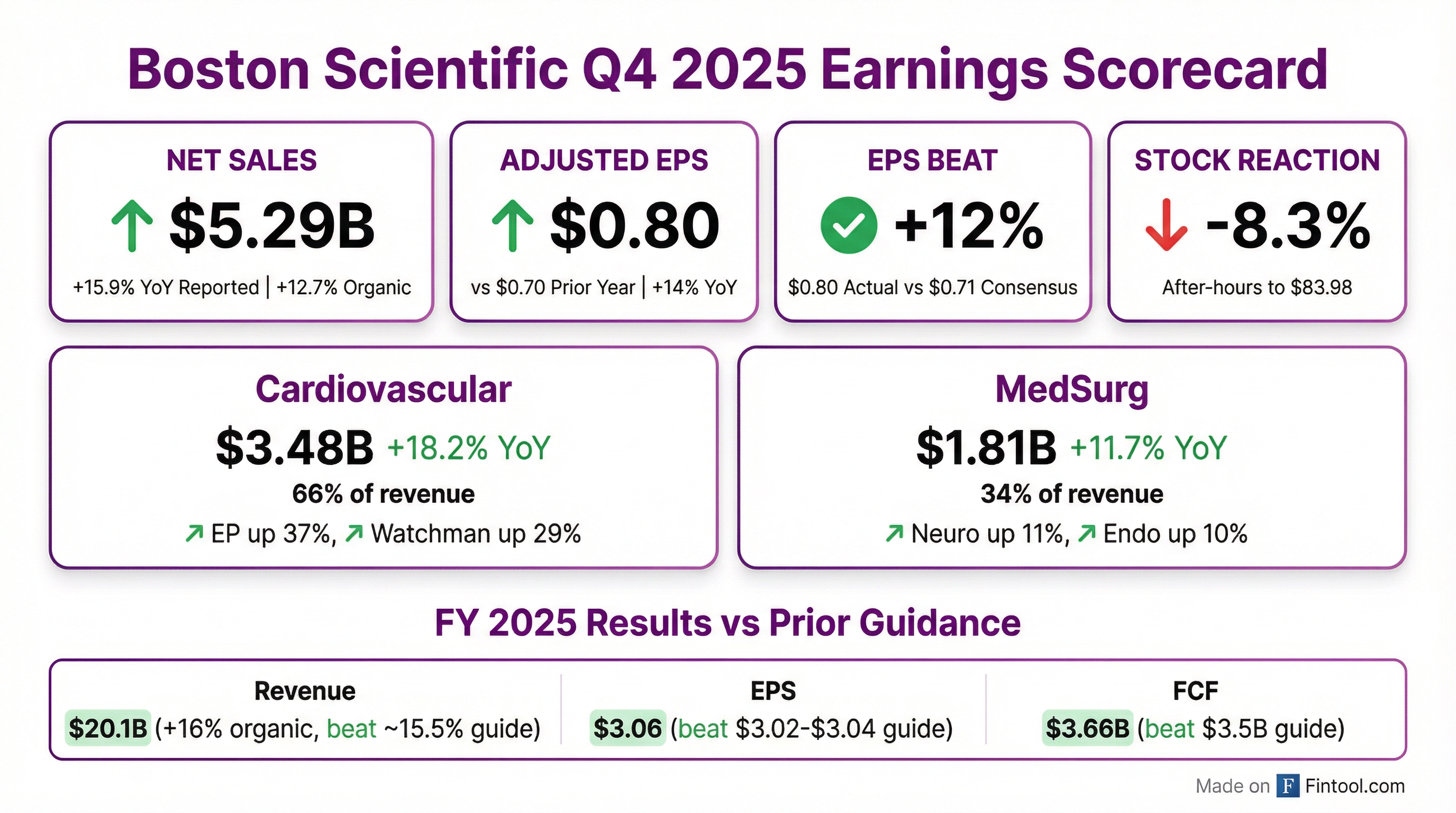

- Q4 2025 consolidated revenue of $5.286 billion, up 15.9% reported (14.3% operational) and 12.7% organic; Q4 adjusted EPS of $0.80, up 15%, exceeding the high end of guidance.

- Full-year 2025 revenue of $20.074 billion, up 19.9% reported (19.2% operational) and 15.8% organic; full-year adjusted EPS of $3.06, up 22%, surpassing guidance.

- Q4 adjusted gross margin of 70.7% and operating margin of 27.3%; full-year adjusted operating margin expanded 100 bps to 28.0%.

- 2026 guidance: full-year organic revenue growth of 10%-11%, adjusted EPS of $3.43–$3.49, and adjusted operating margin expansion of 50–75 bps; Q1 2026 organic growth of 8.5%–10% with adjusted EPS of $0.78–$0.80.

- Q4 2025 consolidated revenue of $5.286 bn (+15.9% y/y; 12.7% organic) and adjusted EPS of $0.80 (+15%).

- Full year 2025 revenue of $20.074 bn (+19.9% y/y; 15.8% organic) and adjusted EPS of $3.06 (+22%).

- Q4 adjusted gross margin 70.7%, operating margin 27.3%; FY adjusted gross margin 70.6% (+30 bps) and operating margin 28.0% (+100 bps).

- 2026 guidance: Q1 organic revenue growth 8.5–10% with EPS $0.78–$0.80; full-year organic growth 10–11% with EPS $3.43–$3.49.

- In Q4 2025, net sales rose 15.9% to $5.286 B, with 12.7% organic growth year-over-year.

- Reported EPS was $0.45 (adjusted $0.80) vs. $0.38 (adj. $0.70) in Q4 2024.

- Free cash flow was $1.013 B vs. $1.181 B in Q4 2024.

- Segment performance: Watchman +29.4%, Electrophysiology +37.1%, Cardiovascular +18.2% Y/Y.

- Q1 2026 guidance: net sales growth 10.5%–12.0% (organic 8.5%–10.0%), adj. EPS $0.78–$0.80; FY 2026: net sales +10.5%–11.5%, organic +10.0%–11.0%, adj. EPS $3.43–$3.49.

- Q4 2025 consolidated revenue of $5.286 billion (+15.9% reported, +14.3% operational, +12.7% organic) and adjusted EPS of $0.80 (+15%); adjusted gross margin 70.7% and operating margin 27.3%.

- Full-year 2025 revenue of $20.074 billion (+19.9% reported, +19.2% operational, +15.8% organic) with adjusted EPS of $3.06 (+22%); free cash flow $3.659 billion (38% growth, 80% conversion) and 28.0% operating margin (+100 bps).

- 2026 guidance: organic revenue growth of 10%–11%, adjusted operating margin expansion of 50–75 bps, and adjusted EPS of $3.43–3.49 (+12%–14%); Q1 2026 organic growth of 8.5%–10% with EPS of $0.78–0.80.

- Business highlights: EP grew 35% in Q4 (market ~18%–20%), Watchman grew 29%, with strong Asia Pac (+15%) and MEA (+5%) performances; Urology and Endoscopy growth tempered by product discontinuations.

- Capital deployment: 2026 free cash flow projected at $4.2 billion; closed Nalu Medical acquisition, pending Valencia and Penumbra deals; prioritizing strategic tuck-in M&A and share repurchases.

- Q4 net sales were $5.286 billion, up 15.9% on a reported basis and 12.7% on an organic basis year-over-year.

- Q4 GAAP EPS was $0.45, versus $0.38 a year ago; adjusted EPS was $0.80, up from $0.70.

- FY 2025 net sales reached $20.074 billion, up 19.9% reported and 15.8% organic; full-year GAAP EPS was $1.94, with adjusted EPS of $3.06.

- 2026 guidance calls for net sales growth of 10.5–11.5% reported (organic 10.0–11.0%) and adjusted EPS of $3.43–3.49; Q1 2026 growth is pegged at 10.5–12.0% reported (organic 8.5–10.0%) with adjusted EPS of $0.78–0.80.

- Q4 net sales of $5.286 billion, up 15.9% reported year-over-year; GAAP net income of $672 million (EPS $0.45), adjusted EPS $0.80 per share.

- Full year net sales of $20.074 billion, up 19.9% reported; GAAP net income of $2.898 billion (EPS $1.94), adjusted EPS $3.06 per share.

- Full year 2026 guidance: reported net sales growth expected at 10.5–11.5%, adjusted EPS projected at $3.43–$3.49; Q1 2026 sales growth guidance 10.5–12.0%, adjusted EPS $0.78–$0.80.

- Global cardiovascular devices market was valued at US$74.58 billion in 2025 and is forecast to grow at a 7.70% CAGR to US$157.32 billion by 2035.

- Therapeutic & surgical devices accounted for 77.5% of market revenue in 2025, driven by premium implantable technologies like CRM systems and structural heart implants.

- Boston Scientific’s Farapulse pulsed field ablation system generated over US$1 billion in 2024, highlighting rapid adoption of PFA over thermal ablation.

- Clinical research remains robust with 51 major cardiovascular trials between 2019–2024 enrolling 292,985 patients, signaling sustained R&D investment.

- North America led the market with a 45.68% revenue share in 2025, underscoring regional dominance in device adoption.

- On January 14, 2026, Boston Scientific entered into a merger agreement to acquire Penumbra, Inc., with Penumbra becoming a wholly owned subsidiary at closing.

- Penumbra shareholders may elect to receive 3.8721 Boston Scientific shares per Penumbra share or $374.00 in cash, with elections prorated to target 73.26% cash and 26.74% stock consideration.

- Outstanding Penumbra options and RSUs will be cancelled or assumed and converted into cash and Boston Scientific stock or RSUs under specified terms, including acceleration for certain vested awards.

- The merger is subject to customary closing conditions, including Penumbra stockholder approval, regulatory clearances and the effectiveness of a Form S-4 registration statement.

Fintool News

In-depth analysis and coverage of BOSTON SCIENTIFIC.

Quarterly earnings call transcripts for BOSTON SCIENTIFIC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more