Earnings summaries and quarterly performance for Chubb.

Executive leadership at Chubb.

Board of directors at Chubb.

David H. Sidwell

Director

Frances F. Townsend

Director

Fred Hu

Director

Michael G. Atieh

Director

Michael L. Corbat

Director

Michael P. Connors

Lead Independent Director

Nancy K. Buese

Director

Nelson J. Chai

Director

Olivier Steimer

Director

Robert J. Hugin

Director

Robert W. Scully

Director

Sheila P. Burke

Director

Theodore E. Shasta

Director

Research analysts who have asked questions during Chubb earnings calls.

Brian Meredith

UBS

7 questions for CB

David Motemaden

Evercore ISI

7 questions for CB

C. Gregory Peters

Raymond James

6 questions for CB

Alex Scott

Barclays PLC

5 questions for CB

Meyer Shields

Keefe, Bruyette & Woods

5 questions for CB

Andrew Kligerman

TD Cowen

4 questions for CB

Michael Zaremski

BMO Capital Markets

4 questions for CB

Jian Huang

Morgan Stanley

3 questions for CB

Ryan Tunis

Cantor Fitzgerald

3 questions for CB

Bob Huang

Morgan Stanley

2 questions for CB

Elyse Greenspan

Wells Fargo

2 questions for CB

Matthew Heimermann

Citi

2 questions for CB

Tracy Benguigui

Wolfe Research

2 questions for CB

Vikram Gandhi

HSBC

2 questions for CB

Yaron Kinar

Oppenheimer & Co. Inc.

2 questions for CB

Charles Peters

Raymond James

1 question for CB

Mike Zaremski

BMO Capital Markets

1 question for CB

Robert Cox

The Goldman Sachs Group, Inc.

1 question for CB

Recent press releases and 8-K filings for CB.

- Total premium revenue reached $56.4 B LTM 9/30/25, up 59% vs. 2020; P&C underwriting income surged to $5.9 B (389% growth) and core operating income to $9.4 B (185% growth)

- Core operating ROE improved to 13.2% and ROTE to 20.1%, approaching medium-term targets of 14%+ ROE and 20%+ ROTE

- Capital returns: share buybacks rose from $1.5 B in 2019 to $3.0 B LTM 9/30/25; dividends increased 24% to $0.97 per share

- Digital transformation aims for ~20% headcount reduction, ~1.5 pts of combined ratio savings, and automation of 85% of underwriting and claims processes within 3–4 years

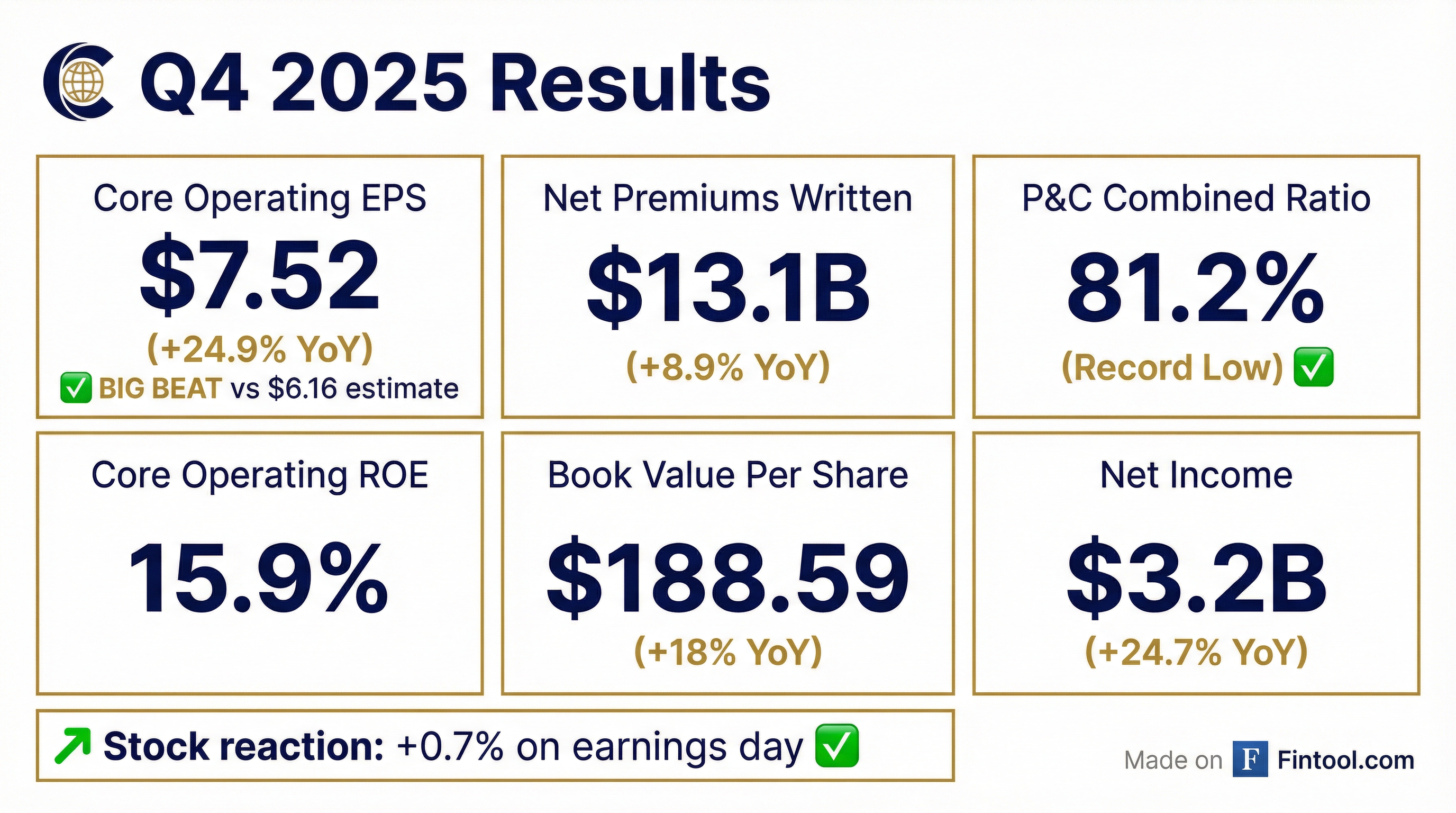

- Core operating income for Q4 was $3 billion or $752 per share, up 22% and 25% year-over-year respectively; full-year 2025 core operating income set a record at $9.9 billion or $24.79 per share, up 9% and 11% respectively.

- P&C underwriting income in Q4 was $2.2 billion, up 40%, with a combined ratio of 81.2%; full-year P&C underwriting income was $6.5 billion with a combined ratio of 85.7%.

- Net premiums grew 9% in Q4 (P&C +7.7%, Life +17%) and 6.5% for the year (P&C +5.5%, Life +15%).

- Adjusted net investment income in Q4 was $1.8 billion (+7.3%), with invested assets of $169 billion at a 5.1% yield; full-year investment income was $6.9 billion (+9%), and Q1 2026 guidance is $1.81–1.84 billion.

- Returned $4.9 billion of capital in 2025 (share repurchases of $3.4 billion at $282.57 average price and $1.5 billion in dividends); core operating tax rate for 2026 is guided at 19.5%–20%.

- Chubb delivered record Q4 core operating income of nearly $3 billion (up ~22%) or $7.52 per share (up 25%), and full-year core operating income of just under $10 billion ($24.79/share, +11%).

- Q4 net premiums grew 9% (P&C +7.7%, life +17%), with a Q4 combined ratio of 81.2% and a full-year combined ratio of 85.7%; full-year net premiums increased 6.5% (P&C +5.5%, life +15%).

- Record Q4 adjusted net investment income was $1.8 billion (+7.3%), with full-year investment income of $6.9 billion (+9%) on a $169 billion invested asset base (vs. $151 billion a year ago).

- Returned $4.9 billion of capital in FY 2025 ($3.4 billion repurchases at $282.57/share; $1.5 billion dividends); expects Q1 2026 adjusted net investment income of $1.81–$1.84 billion and annual effective tax rate of 19.5–20%.

- Q4 core operating ROE was 15.9%, core operating ROTE 23.5%, full-year operating cash flow $13.9 billion, and book value per share (ex-AOCI) grew 11% (tangible book +15.5%).

- Record Q4 and full-year core operating income: Q4 core operating income of nearly $3 billion or $752 per share (up 22% core, 25% EPS); FY core operating income of ~$10 billion or $24.79 per share (up 9% core, 11% EPS)

- P&C underwriting strength: Q4 P&C underwriting income of $2.2 billion (up 40%) with a record low combined ratio of 81.2%; current accident year CR of 80.4% (80.9% excluding agriculture)

- Robust investment performance: Q4 adjusted net investment income of $1.81 billion (up 7.3%); FY NII of $6.9 billion (up 9%); invested assets at $169 billion

- Solid premium growth: Q4 net premiums up 9% (P&C +7.7%, life +17%); FY premiums up 6.5% (P&C +5.5%, life +15%)

- Quarter net income of $3.21 billion (up 24.7%) and core operating income of $2.98 billion (up 21.7%).

- Consolidated Q4 net premiums written of $13.1 billion (up 8.9%) and record P&C combined ratio of 81.2%.

- Full-year 2025 net income of $10.31 billion (up 11.2%), core operating income of $9.95 billion (up 8.9%), and consolidated net premiums written of $54.8 billion (up 6.6%); record P&C combined ratio of 85.7%.

- Annualized return on equity of 17.6% and core operating return on tangible equity of 23.5%.

- Q4 2025 net income of $3.21 billion, up 24.7%, and core operating income of $2.98 billion, up 21.7%

- Q4 consolidated net premiums written of $13.13 billion, up 8.9%; P&C $11.31 billion, up 7.7%; Life $1.83 billion, up 16.9%

- Q4 record P&C combined ratio of 81.2%

- Full-year 2025 record net income of $10.31 billion, up 11.2%, and core operating income of $9.95 billion, up 8.9%

- Full-year consolidated net premiums written of $54.84 billion, up 6.6%; P&C $47.56 billion, up 5.4%; Life $7.28 billion, up 15.1%; record P&C combined ratio of 85.7%

- Q3 2025 core operating income hit $3.0 billion (+29%), driving EPS of $7.49 (+31%); underwriting income was $2.3 billion (+55%) on an 81.8% combined ratio, while adjusted net investment income reached $1.78 billion (+8.3%).

- Total premiums rose 7.5% (consumer +16%, commercial +3.3%), with life insurance premiums up 24.5% and international P&C growth led by Asia (+14%) and Latin America (+10.5%).

- Capital management included $1.6 billion returned to shareholders (dividends $385 million; buybacks $1.2 billion) and issuance of $2.2 billion of debt at 4% average cost and 12-year term.

- Guidance and outlook: core operating ROE was 24.5% in Q3; Q4 adjusted net investment income is expected at $1.775–1.81 billion, full-year core tax rate at 19.5–20%, and medium-term target core operating ROE of 14+%.

- Chubb generated $2.80 billion of net income (up 20.5%), or $6.99 per share, and $3.00 billion of core operating income (up 28.7%), or $7.49 per share for Q3 2025.

- Consolidated net premiums written were $14.9 billion (up 7.5%), including $12.93 billion of P&C (up 5.3%) and $1.93 billion of life insurance (up 24.6%).

- P&C underwriting income reached a record $2.26 billion (up 55.0%) with a combined ratio of 81.8%, and current accident year underwriting income ex-catastrophe was $2.18 billion (up 10.3%) with a combined ratio of 82.5%.

- Book value per share rose 4.7% to $182.22, and tangible book value per share increased 6.6% to $120.13 from June 30, 2025.

- Total capital returned to shareholders was $1.62 billion, including $1.23 billion in share repurchases (average price $277.67) and $385 million in dividends.

- Net income per share of $6.99, up 22.6% year-over-year.

- Core operating EPS of $7.49, up 30.9% year-over-year.

- Consolidated net premiums written of $14.9 billion, up 7.5%.

- Record P&C combined ratio of 81.8%, down from 87.7% a year ago.

- Chubb INA Holdings LLC, unconditionally guaranteed by Chubb Limited, has agreed to sell $1.25 billion of 4.900% Senior Notes due 2035 in a public offering.

- The notes will settle on August 6, 2025 (T+2), mature on August 15, 2035, and pay interest semi-annually on February 15 and August 15, with a long first coupon.

- Initial pricing set the public offering price at 99.951% and underwriting purchase price at 99.501%, plus accrued interest.

- Redemption provisions include a make-whole call prior to May 15, 2035 (Treasury + 15 bps) and a par call on or after that date; no sinking fund or conversion features.

- Joint book-running managers are Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, and Wells Fargo Securities, LLC, among others.

Quarterly earnings call transcripts for Chubb.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more