Earnings summaries and quarterly performance for CANADIAN NATIONAL RAILWAY.

Research analysts who have asked questions during CANADIAN NATIONAL RAILWAY earnings calls.

Cherilyn Radbourne

TD Cowen

6 questions for CNI

David Vernon

Sanford C. Bernstein & Co., LLC

6 questions for CNI

Fadi Chamoun

BMO Capital Markets

6 questions for CNI

Jonathan Chappell

Evercore ISI

6 questions for CNI

Ken Hoexter

BofA Securities

6 questions for CNI

Konark Gupta

Scotiabank

6 questions for CNI

Ravi Shanker

Morgan Stanley

6 questions for CNI

Scott Group

Wolfe Research

6 questions for CNI

Stephanie Moore

Jefferies

6 questions for CNI

Steven Hansen

Raymond James

6 questions for CNI

Walter Spracklin

RBC Capital Markets

6 questions for CNI

Benoit Poirier

Desjardins Capital Markets

5 questions for CNI

Brian Ossenbeck

JPMorgan Chase & Co.

5 questions for CNI

Christian Wetherbee

Wells Fargo

4 questions for CNI

Ariel Rosa

Citigroup

3 questions for CNI

Brandon Oglenski

Barclays

3 questions for CNI

Daniel Imbro

Stephens Inc.

3 questions for CNI

Thomas Wadewitz

UBS

3 questions for CNI

Bascome Majors

Susquehanna Financial Group

2 questions for CNI

Chris Wetherbee

Wells Fargo & Company

2 questions for CNI

Kevin Chiang

CIBC Capital Markets

2 questions for CNI

Benjamin Nolan

Stifel

1 question for CNI

David Zazula

Barclays

1 question for CNI

Tom Wadewitz

UBS Group

1 question for CNI

Recent press releases and 8-K filings for CNI.

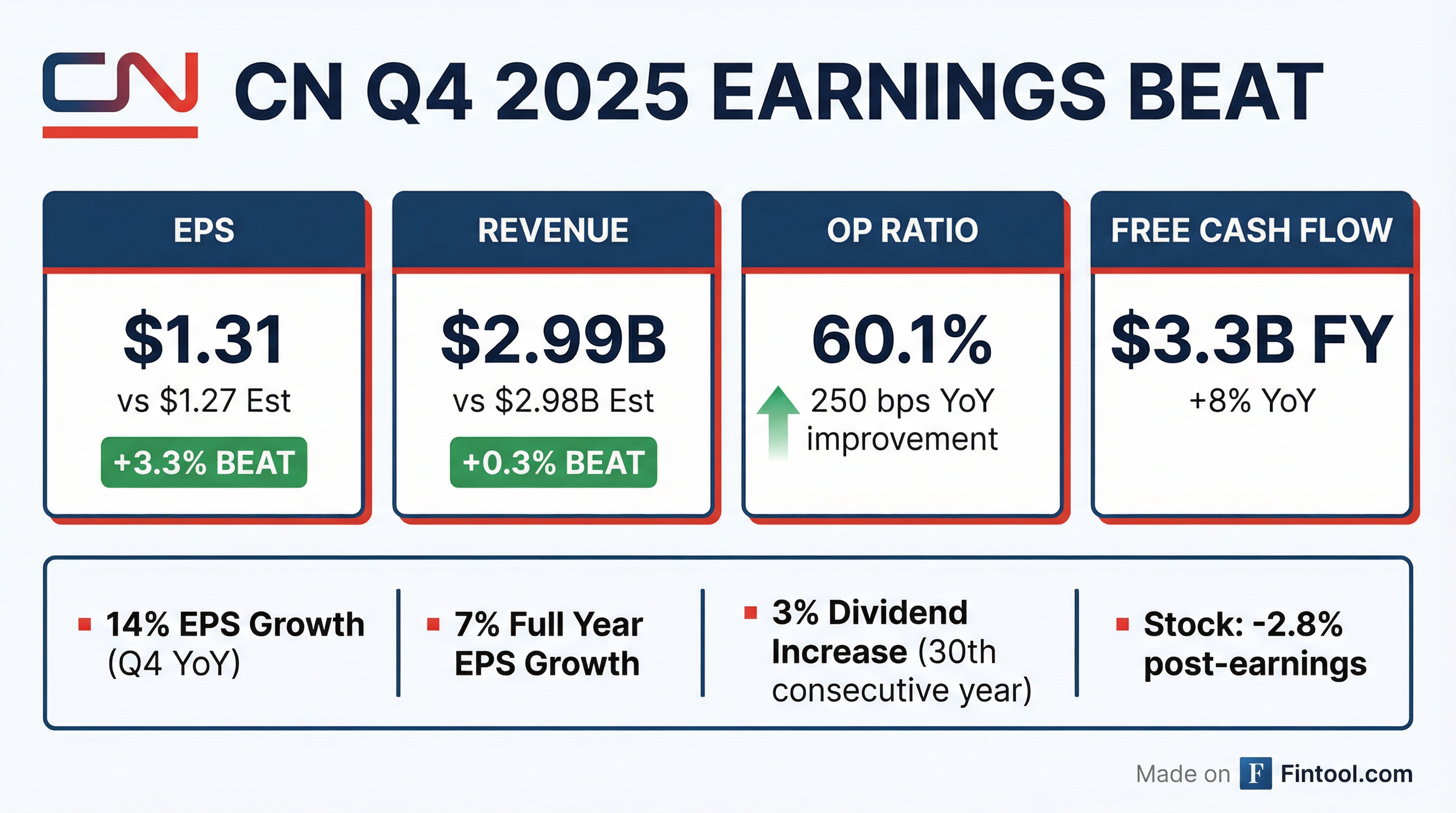

- Canadian National Railway (CNI) reported strong 2025 performance, with 14% EPS growth in Q4 and 7% EPS growth for the full year, driven by solid cost management despite only 1% volume growth.

- For 2026, the company anticipates a murky macroeconomic environment with flattish revenue ton miles (RTMs) and EPS expected to slightly exceed volume growth, while facing significant headwinds from tariffs, an increased effective tax rate, and FX.

- CNI has completed a multi-year investment cycle, resulting in sufficient network capacity and a reduced capital expenditure target for 2026, which is expected to generate increased free cash flow for shareholders.

- The company's business is diversified, with strong performance in agriculture (grain) and energy sectors, but forest products and metals/minerals remain challenged due to significant tariffs.

- Canadian National Railway reported 14% EPS growth in Q4 2025 and 7% for the full year 2025, with an operating ratio improvement of 120 basis points for the year. For 2026, the company expects revenue ton miles (RTMs) to be flattish and EPS to slightly exceed volume growth, facing headwinds from mix due to tariffs, a reduced capital envelope, a higher effective tax rate, and potential FX impacts.

- To offset headwinds, CN is focusing on operational efficiencies, including labor productivity improvements of 6% in 2025 and 7% year-to-date 2026, and cost savings from consolidating accounting and treasury ($75 million, two-thirds favorable for 2026) and reducing contractors in engineering by $100 million.

- The company is bullish on achieving an operating ratio starting with a "five" and at least low double-digit EPS growth in a supportive economy. CN views a potential east-west merger as not good for the industry but believes it would be the least impacted due to its north-south network, and plans to aggressively seek remedies and concessions.

- Management considers the current stock price to be "quite cheap" and has temporarily increased leverage from 2.5 times to 2.7 times to take advantage of this, with a goal to return to 2.5 times in 2027.

- Canadian National Railway (CNI) achieved 7% EPS growth in 2025 on 1% volume growth, with a 120 basis point improvement in operating ratio (OR). For 2026, CNI expects flattish revenue ton miles (RTMs) and EPS to slightly exceed volume growth amidst a weak macroeconomic environment.

- Significant headwinds for 2026 include mix issues from tariffs on forest products and metals/minerals, reduced capital credits (CAD 100 million), a higher effective tax rate of 25%-26%, and a potential $0.10 FX headwind for the year.

- The company is focused on cost management and productivity initiatives, such as consolidating accounting and treasury for an estimated $75 million in synergies (two-thirds favorable for 2026) and reducing engineering unit costs by $100 million.

- Management is bullish on achieving a sub-60 operating ratio and low double-digit EPS growth in a supportive economy, and while viewing the proposed east-west merger as detrimental to the industry, believes CNI would be the least impacted.

- Canadian National Railway (CNI) reported strong 2025 results, including a 14% EPS growth in Q4 and 7% for the full year, alongside an 8% free cash growth and 120 basis point operating ratio improvement for the year.

- The company anticipates a challenging 2026 with muted macroeconomic growth and uncertainty from USMCA renewal, expecting Q1 to be the most difficult quarter with volumes slightly up, and a more back-end loaded year as energy and coal volumes strengthen.

- CNI's high-margin business was significantly impacted by tariffs in 2025, costing approximately $350 million, and the company assumes current tariff levels in its 2026 plan due to ongoing renegotiations.

- CNI has reset its capital program after completing investments to address network pinch points and improve its locomotive fleet, now possessing significant network capacity and focusing on cost reduction and productivity improvements, including exploring AI, to drive future earnings leverage.

- CNI expressed a negative view on the proposed UP-Norfolk Southern merger, citing concerns about reduced competition, though it expects a smaller impact on its own operations due to its high originating and terminating volumes.

- Canadian National Railway (CNI) reported a strong 2025, achieving 14% EPS growth and 250 basis point operating ratio improvement in Q4, and 7% EPS growth with 8% free cash growth for the full year.

- For 2026, CNI anticipates a challenging macroeconomic environment, with Q1 expected to be the most difficult, and projects the year to be back-end loaded with strengthening volumes in international intermodal, energy, and coal in the latter half, while committing to generate free cash flow growth.

- The company is intensely focused on productivity improvements and cost reduction, aiming for a lower cost base in 2026, and is leveraging its network capacity and natural resource base for unique growth opportunities in sectors like energy, mining, and agriculture.

- CNI has reset its capital program after significant investments, prioritizing internal capacity and fleet needs, followed by consistent dividend growth. Tariffs negatively impacted 2025 by approximately $350 million, primarily affecting high-margin forest products, steel, and aluminum, leading to an unfavorable traffic mix.

- Canadian National (CNI) reported a strong 2025, with 14% EPS growth in Q4 and 7% EPS growth for the full year, alongside 8% free cash growth and a 120 basis point operating ratio improvement for the year.

- The company anticipates a challenging 2026 due to muted macroeconomic growth and uncertainty surrounding USMCA renewal and trade flows, with Q1 expected to be the most difficult and the year being back-end loaded.

- Key growth areas include strong performance in grain and potash, with expected strengthening in energy and coal volumes. However, tariffs on steel, aluminum, and forest products negatively impacted high-margin business by approximately $350 million in 2025 and continue to be a headwind.

- CNI is focused on productivity improvements and lowering its cost base, leveraging its completed investment cycle to achieve significant operating leverage without substantial incremental capital for future growth. The company plans consistent dividend growth and returning excess cash to shareholders.

- CNI holds a negative view on the proposed UP-Norfolk Southern merger, citing concerns about reduced competition, though it expects a smaller impact on its own operations due to its unique network characteristics.

- For the full year ended December 31, 2025, Canadian National Railway Co reported total revenues of $17,304 million, net income of $4,720 million, and diluted earnings per share of $7.57.

- In the fourth quarter of 2025, revenues increased by 2% to $4,464 million, net income rose 9% to $1,248 million, and diluted earnings per share grew 12% to $2.03 compared to the same period in 2024. The operating ratio improved by 1.4 points to 61.2% in Q4 2025.

- The company repurchased $2,047 million in common shares and paid $3.55 per share in dividends during 2025.

- A new Normal Course Issuer Bid (NCIB) was approved on January 30, 2026, allowing for the repurchase of up to 24.0 million common shares between February 4, 2026, and February 3, 2027.

- CNI reported strong Q4 2025 EPS growth of 14% and 7% for the full year, with a Q4 operating ratio of 60.1% (a 250 basis point improvement year-over-year) and $3.3 billion in cash flow, up 8%.

- For 2026, CNI anticipates flattish volumes compared to 2025, with EPS growth slightly exceeding volume growth and continued free cash flow growth.

- The company plans to reduce capital spending to $2.8 billion in 2026, a $500 million reduction from the previous year.

- CNI's board approved a 3% dividend increase, marking 30 consecutive years of growth, and authorized a new share buyback program for up to 24 million common shares, temporarily increasing debt leverage to approximately 2.7 times to fund repurchases.

- CNI reported 14% EPS growth for Q4 2025 and 7% for the full year 2025, reaching $7.63 adjusted diluted EPS, aligning with guidance.

- The company achieved significant operational efficiency improvements, with a Q4 operating ratio of 60.1% (a 250 basis point improvement year-over-year) and a full-year adjusted operating ratio of 61.7% (a 120 basis point improvement from 2024).

- CNI generated over $3.3 billion in free cash flow in 2025, an 8% increase, and announced a 3% dividend increase, marking 30 consecutive years of growth.

- For 2026, CNI anticipates flattish volumes compared to 2025, with EPS growth slightly exceeding volume growth, and has set capital expenditures at $2.8 billion, a $500 million reduction from 2025.

- A new share buyback program was authorized for up to 24 million common shares, with debt leverage expected to temporarily increase to approximately 2.7 times to support these repurchases.

- Canadian National Railway Company (CNI) reported strong Q4 and full-year 2025 results, with 14% EPS growth in Q4 and 7% for the full year, reaching CAD 7.63 adjusted diluted EPS. The operating ratio improved to 60.1% in Q4 and 61.7% for the full year.

- The company generated over CAD 3.3 billion in free cash flow for 2025, an 8% increase year-over-year.

- For 2026, CNI anticipates flattish volumes compared to 2025, with EPS growth slightly exceeding volume growth. Capital expenditures are projected to be CAD 2.8 billion, a CAD 500 million reduction from 2025.

- CNI's board approved a 3% dividend increase, marking the 30th consecutive year of growth, and authorized a new share buyback program for up to 24 million common shares. The company expects a temporary increase in debt leverage to approximately 2.7x to facilitate these repurchases.

Fintool News

In-depth analysis and coverage of CANADIAN NATIONAL RAILWAY.

Quarterly earnings call transcripts for CANADIAN NATIONAL RAILWAY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more