Earnings summaries and quarterly performance for Coursera.

Executive leadership at Coursera.

Board of directors at Coursera.

Research analysts who have asked questions during Coursera earnings calls.

Josh Baer

Morgan Stanley

8 questions for COUR

Ryan MacDonald

Needham & Company

6 questions for COUR

Rishi Jaluria

RBC Capital Markets

5 questions for COUR

Bryan Smilek

JPMorgan Chase & Co.

4 questions for COUR

Nafeesa Gupta

Bank of America

4 questions for COUR

Stephen Sheldon

William Blair

4 questions for COUR

Jeffrey Silber

BMO Capital Markets

3 questions for COUR

Stephen Sheldon

William Blair & Company

3 questions for COUR

Claire Gerdes

UBS

2 questions for COUR

Devin Au

KeyBanc Capital Markets Inc.

2 questions for COUR

Matt Shea

Needham

2 questions for COUR

Ryan Griffin

BMO Capital Markets

2 questions for COUR

Taylor McGinnis

UBS

2 questions for COUR

Brian Peterson

Raymond James Financial

1 question for COUR

Jessica

Raymond James & Associates

1 question for COUR

Jessica Reif

Bank of America

1 question for COUR

Sarang Vora

Telsey Advisory Group

1 question for COUR

Yi Fu Lee

Cantor Fitzgerald

1 question for COUR

Recent press releases and 8-K filings for COUR.

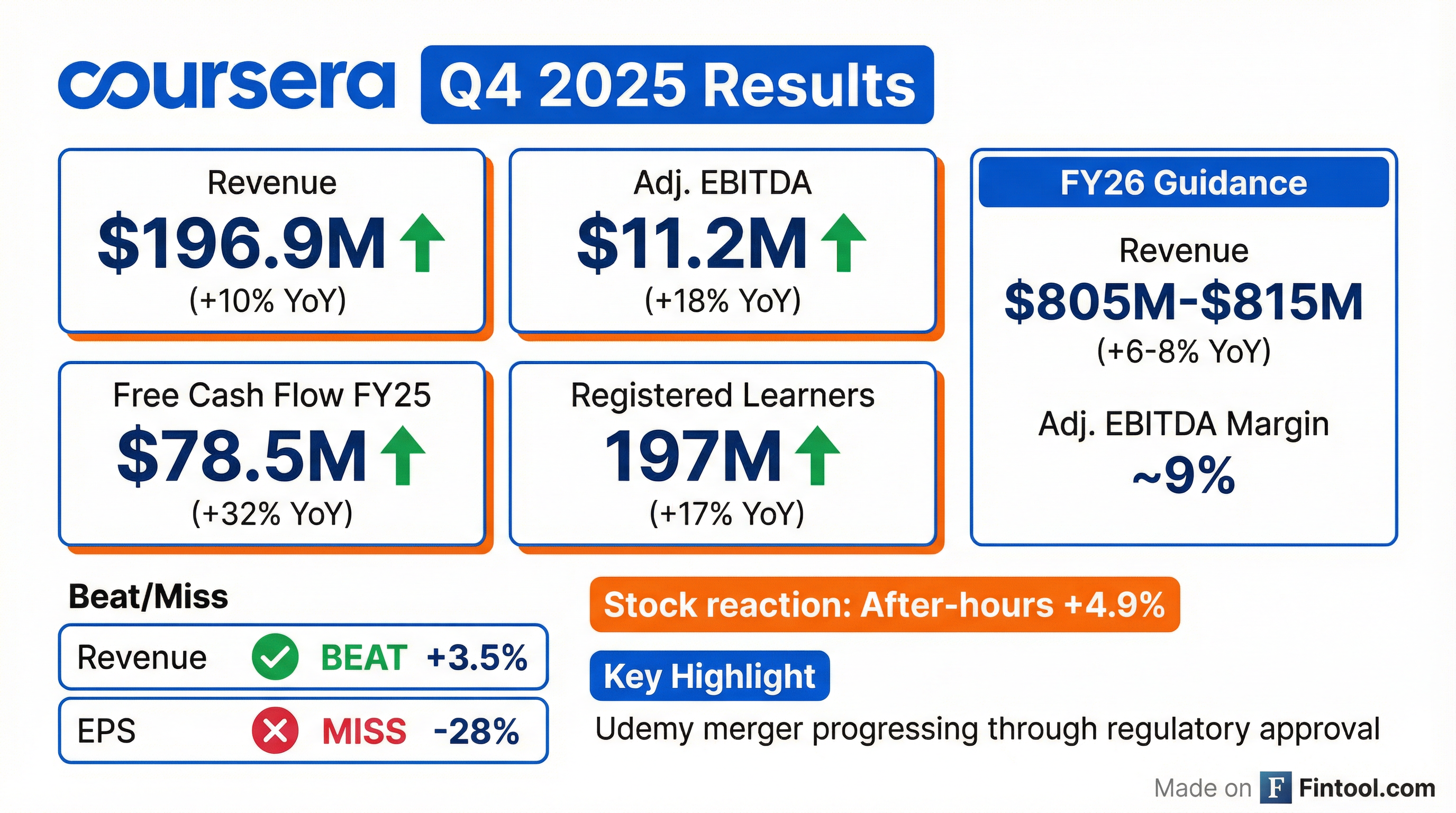

- Coursera delivered strong financial results for Q4 2025, with revenue of $197 million (up 10% year-over-year), and full year 2025 revenue of $757 million (up 9% year-over-year). The company also achieved record free cash flow of $78 million in 2025, a 32% increase, and expanded its annual Adjusted EBITDA margin to 8.4%.

- In December 2025, Coursera announced an agreement to combine with Udemy, a transaction expected to generate $115 million in annual run rate cost synergies within 24 months of closing. The merger is currently undergoing regulatory and shareholder approval processes, with an anticipated closing in the second half of 2026.

- A Platform Fee was introduced, effective January 1, 2026, for eligible new sales across Consumer subscriptions/courses and Enterprise offerings. This fee is intended to fund ongoing investment in AI-native platform capabilities and is expected to provide a structural benefit to gross margin over time, with no change to customer pricing.

- For Q1 2026, Coursera expects standalone revenue between $193 million and $197 million and Adjusted EBITDA between $11 million and $15 million. The full year 2026 standalone guidance projects revenue of $805 million to $815 million (6%-8% growth) and Adjusted EBITDA of $70 million to $76 million, targeting an Adjusted EBITDA margin of approximately 9% at the midpoint.

- Coursera delivered strong Q4 2025 results, with $197 million in revenue (up 10% year-over-year) and $11 million in Adjusted EBITDA. For the full year 2025, revenue grew 9% to $757 million, achieving record free cash flow of $78 million and an 8.4% Adjusted EBITDA margin.

- The company issued Q1 2026 revenue guidance of $193 million-$197 million and Adjusted EBITDA guidance of $11 million-$15 million. For the full year 2026, Coursera expects revenue of $805 million-$815 million (6%-8% growth) and Adjusted EBITDA of $70 million-$76 million, targeting an approximate 9% Adjusted EBITDA margin.

- Coursera's agreement to combine with Udemy is progressing through regulatory and shareholder approvals, with closing anticipated in the second half of 2026. The merger is expected to generate $115 million in annual run rate cost synergies within 24 months of closing.

- A new 15% Platform Fee, effective January 1, 2026, was introduced for eligible new sales in consumer and enterprise segments to fund AI-native platform investments. This fee is projected to gradually improve gross margins, with initial benefits for consumer margins in H2 2026 and enterprise margins in 2027.

- Coursera reported Q4 2025 revenue of $197 million, an increase of 10% year-over-year, contributing to full-year 2025 revenue of $757 million, up 9% year-over-year.

- For full-year 2025, the company generated record free cash flow of $78 million (up 32% from the prior year) and expanded its annual Adjusted EBITDA margin by 240 basis points year-over-year to 8.4%.

- Coursera provided Q1 2026 revenue guidance of $193 million-$197 million and full-year 2026 revenue guidance of $805 million-$815 million, representing 6%-8% growth from the prior year, with an anticipated Adjusted EBITDA margin of approximately 9% at the midpoint.

- The proposed merger with Udemy is progressing through regulatory and shareholder approvals, and is expected to generate $115 million in annual run rate cost synergies within 24 months of closing. Additionally, a new Platform Fee took effect in early 2026, intended to support ongoing platform investment and contribute to gross margin expansion.

- Coursera delivered fourth quarter 2025 revenue of $197 million, an increase of 10% year over year, contributing to full year 2025 revenue of $757 million, up 9% from the prior year.

- The company generated full year 2025 net cash provided by operating activities of $109 million and a record Free Cash Flow of $78 million.

- In December 2025, Coursera announced a definitive merger agreement to combine with Udemy in an all-stock transaction, which has been unanimously approved by both companies' Boards of Directors.

- For full year 2026, Coursera provides revenue guidance in the range of $805 to $815 million and Adjusted EBITDA guidance between $70 to $76 million.

- Coursera, Inc. entered into a Merger Agreement with Udemy, Inc. on December 17, 2025, under which Chess Merger Sub, Inc., a wholly owned subsidiary of Coursera, will merge with and into Udemy, with Udemy surviving as a wholly owned subsidiary of Coursera.

- Each share of Udemy Common Stock will be converted into the right to receive 0.800 shares of Coursera Common Stock.

- Coursera's Board of Directors unanimously approved the merger, the issuance of Coursera Common Stock, and an amendment to increase authorized shares, recommending stockholder approval.

- Following the merger, the combined company's Board will comprise nine directors, with six from Coursera and three from Udemy. Coursera's Chairman and Chief Executive Officer will maintain their roles.

- The merger is subject to customary closing conditions, including stockholder and regulatory approvals, and has a termination date of December 17, 2026, with potential extensions for regulatory approvals until March 17, 2027, or June 17, 2027.

- Coursera has entered into a definitive agreement to combine with Udemy in an all-stock transaction. Upon closing, existing Coursera shareholders are expected to own approximately 59% and Udemy shareholders approximately 41% of the combined company on a fully diluted basis. The transaction is expected to close by the second half of 2026.

- The combined company is projected to have a pro forma annual revenue exceeding $1.5 billion over the last 12 months, with a gross margin of just over 60% and Adjusted EBITDA of more than $150 million, representing a 10% Adjusted EBITDA margin.

- $115 million of annualized run rate cost synergies have been identified, expected to be fully realized within 24 months of closing. The combined entity will hold nearly $1.2 billion in cash as of the third quarter 2025, and Coursera anticipates executing a sizable share repurchase program following the close.

- Strategically, the combination aims to create a leading technology platform for skills, accelerating AI-native innovation, enhancing global reach, and leveraging complementary strengths in consumer (Coursera's 191 million learners) and enterprise (Udemy's 17,000+ enterprise customers and $525 million of annual recurring revenue) segments.

- Coursera has entered into a definitive agreement to combine with Udemy in an all-stock transaction.

- Upon closing, existing Coursera shareholders are expected to own approximately 59% of the combined company, and Udemy shareholders approximately 41% on a fully diluted basis.

- The combined pro forma annual revenue exceeds $1.5 billion over the last 12 months, with a trailing 12-month gross margin of just over 60% and more than $150 million of adjusted EBITDA, representing a 10% adjusted EBITDA margin.

- The companies expect to realize $115 million of annualized run rate cost synergies within 24 months of closing.

- The transaction is expected to close by the second half of 2026, subject to shareholder and regulatory approvals.

- Coursera has entered into a definitive agreement to combine with Udemy, aiming to create a leading technology platform for skills discovery, development, and mastery.

- The combined pro forma annual revenue exceeds $1.5 billion over the last 12 months, with a gross margin of just over 60% and more than $150 million of Adjusted EBITDA.

- The all-stock transaction will result in existing Coursera shareholders owning approximately 59% and Udemy shareholders approximately 41% of the combined company on a fully diluted basis.

- The companies have identified $115 million of annualized run rate cost synergies, expected to be fully realized within 24 months of closing.

- The transaction is expected to close by the second half of 2026, and the combined entity will eventually operate under the Coursera brand.

- Coursera and Udemy announced a proposed tax-free, stock-for-stock business combination where each Udemy share will be exchanged for 0.800 Coursera shares.

- The transaction is anticipated to close by the second half of 2026 and will result in pro-forma ownership of approximately 59% for Coursera shareholders and 41% for Udemy shareholders.

- The combined company, which will retain the name Coursera, Inc. (NYSE: COUR), expects to generate anticipated annual run-rate cost synergies of $115 million within 24 months of closing.

- Based on reported financial results for October 1, 2024, through September 30, 2025, the combined entity would have had $1,536 million in total revenue and a combined cash balance of $1.2 billion as of Q3 2025.

- Coursera, Inc. (COUR) and Udemy, Inc. (UDMY) have entered into a definitive all-stock merger agreement, with the combined company having an implied equity value of approximately $2.5 billion based on closing prices on December 16, 2025.

- Udemy stockholders will receive 0.800 shares of Coursera common stock for each Udemy share, resulting in existing Coursera stockholders owning approximately 59% and Udemy stockholders approximately 41% of the combined company on a fully diluted basis.

- The combined entity is projected to achieve pro forma annual revenue of more than $1.5 billion and anticipates annual run-rate cost synergies of $115 million within 24 months of closing.

- The transaction is expected to close by the second half of 2026, subject to regulatory and shareholder approvals, and Coursera anticipates executing a sizable share repurchase program following the close.

Quarterly earnings call transcripts for Coursera.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more