Earnings summaries and quarterly performance for DARLING INGREDIENTS.

Executive leadership at DARLING INGREDIENTS.

Randall Stuewe

Chief Executive Officer

Brandon Lairmore

Executive Vice President – Darling U.S. Rendering Operations

Carlos Paz

Executive Vice President – Global Risk Management, Ingredients

Jan van der Velden

Executive Vice President – International Rendering and Specialties

Jeroen Colpaert

Executive Vice President – Rousselot

John Sterling

Executive Vice President – General Counsel and Secretary

Nick Kemphaus

Executive Vice President – General Counsel and Secretary (effective January 4, 2026)

Patrick McNutt

Executive Vice President – Chief Administrative Officer

Robert Day

Chief Financial Officer

Sandra Dudley

Executive Vice President – Renewables and Chief Strategy Officer

Board of directors at DARLING INGREDIENTS.

Research analysts who have asked questions during DARLING INGREDIENTS earnings calls.

Heather Jones

Heather Jones Research

8 questions for DAR

Manav Gupta

UBS Group

8 questions for DAR

Matthew Blair

Tudor, Pickering, Holt & Co.

8 questions for DAR

Andrew Strelzik

BMO Capital Markets

6 questions for DAR

Betty Zhang

Scotiabank

6 questions for DAR

Jason Gabelman

TD Cowen

6 questions for DAR

Pooran Sharma

Stephens Inc.

6 questions for DAR

Thomas Palmer

Citigroup Inc.

6 questions for DAR

Derrick Whitfield

Texas Capital

5 questions for DAR

Dushyant Ailani

Jefferies

5 questions for DAR

Ben Kallo

Robert W. Baird & Co.

4 questions for DAR

Ryan M. Todd

Piper Sandler & Co.

4 questions for DAR

Dushyant Ajit Ailani

Jefferies LLC

3 questions for DAR

Ryan Todd

Simmons Energy

3 questions for DAR

Ben Mayhew

BMO

2 questions for DAR

Connor Fitzpatrick

Bank of America

2 questions for DAR

Conor Fitzpatrick

Bank of America Merrill Lynch

2 questions for DAR

Jason Daniel Gabelman

TD Securities

2 questions for DAR

Benjamin Kallo

Robert W. Baird & Co.

1 question for DAR

Brian Sharma

Stephens Inc.

1 question for DAR

Davis Sunderland

Baird

1 question for DAR

Derrick Lee Whitfield

Texas Capital Securities

1 question for DAR

John Royall

JPMorgan Chase & Co.

1 question for DAR

Paul Cheng

Scotiabank

1 question for DAR

Recent press releases and 8-K filings for DAR.

- Darling Ingredients reported combined adjusted EBITDA of $336.1 million for Q4 2025 and $922 million for core ingredients EBITDA for the full year 2025, with total net sales of $1.7 billion in Q4 2025.

- The company announced the strategic acquisition of three rendering facilities from the Potencei Group in Brazil for approximately $120 million, expected to close later in Q1 2026.

- Darling significantly improved its financial position, with total debt net of cash at $3.8 billion and a bank covenant preliminary leverage ratio of 2.9 times at year-end 2025, down from 3.9 times at year-end 2024.

- For Q1 2026, the company anticipates core business EBITDA (excluding DGD) to be between $240 million and $250 million, and maintains an optimistic outlook for 2026, expecting improved performance throughout the year.

- Darling Ingredients reported strong Q4 2025 financial results, with combined adjusted EBITDA of $336.1 million and core ingredients EBITDA of $278.2 million, demonstrating significant improvement year-over-year and sequentially.

- The company meaningfully improved its debt leverage, reaching 2.9 times at year-end 2025, down from 3.9 times at year-end 2024, with total debt net of cash at $3.8 billion as of January 3, 2026.

- Diamond Green Diesel (DGD) delivered its strongest quarter of the year with $57.9 million of EBITDA in Q4 2025, contributing to a full-year 2025 DGD EBITDA of $103.7 million. The company expresses optimism for 2026 due to an improving policy backdrop.

- For Q1 2026, Darling Ingredients estimates core ingredients adjusted EBITDA to be in the range of $240 million to $250 million, and DGD is expected to produce about 260 million gallons.

- Strategic actions include an advancing joint venture with PB Leiner and Tessenderlo, the acquisition of three assets in Brazil for approximately $120 million, and potential asset sales aimed at sharpening the company's portfolio.

- Darling Ingredients reported strong Q4 2025 financial results, with combined adjusted EBITDA of $336.1 million and total net sales of $1.7 billion. For the full year 2025, core ingredients EBITDA reached $922 million.

- The company significantly improved its debt leverage to 2.9 times at year-end 2025, down from 3.9 times in 2024, and ended the year with approximately $1.3 billion available on its revolving credit facility.

- The Diamond Green Diesel (DGD) segment delivered its strongest quarter of the year in Q4 2025 with $57.9 million in EBITDA, contributing $103.7 million in EBITDA for the full year 2025 from approximately 1 billion gallons sold.

- Darling Ingredients is acquiring three rendering facilities in Brazil for approximately $120 million, expected to close in Q1 2026, and is advancing its joint venture for global collagen and gelatin demand.

- The company recorded $58 million in restructuring and impairment charges in Q4 2025 and is evaluating potential asset sales, while expressing an optimistic outlook for 2026 driven by positive global demand trends and a favorable renewable fuels policy backdrop.

- Darling Ingredients (DAR) reported a significant increase in Q4 2025 Total Net Sales by 20.6% to $1,709.8 million and Combined Adjusted EBITDA by 16.1% to $336.1 million, but Net Income decreased by 44.2% to $56.9 million and Diluted EPS fell by 44.4% to $0.35 compared to Q4 2024.

- For the full year 2025, Total Net Sales grew by 7.4% to $6,135.9 million, however, Net Income and Diluted EPS both declined by 77.5% to $62.8 million and $0.39 respectively, primarily impacted by $58 million in restructuring and asset impairment charges related to portfolio realignment in Q4 2025.

- The company's balance sheet showed improvement with the preliminary leverage ratio decreasing to 2.90X as of January 3, 2026, from 3.93X at December 28, 2024, alongside net debt of $3,849 million.

- Darling Ingredients Inc. reported net income of $56.9 million and total net sales of $1.7 billion for the fourth quarter of 2025, with Combined Adjusted EBITDA reaching $336.1 million.

- For fiscal year 2025, the company reported net income of $62.8 million, total net sales of $6.1 billion, and Combined Adjusted EBITDA of $1.03 billion.

- The company strategically realigned its portfolio of businesses in Q4 2025, resulting in restructuring and asset impairment charges of $58.0 million.

- Darling Ingredients monetized $255 million of $285 million in Production Tax Credit sales during fiscal year 2025, enhancing cash generation, and its bank leverage ratio declined to 2.90X as of January 3, 2026.

- For the first quarter of 2026, the company estimates core ingredients business adjusted EBITDA to be approximately $240-$250 million.

- Darling Ingredients Inc. reported net income of $56.9 million and total net sales of $1.7 billion for the fourth quarter of 2025, compared to $101.9 million and $1.4 billion, respectively, for the fourth quarter of 2024.

- For fiscal year 2025, the company achieved total net sales of $6.1 billion and Combined Adjusted EBITDA of $1.03 billion, compared to $5.7 billion and $1.08 billion, respectively, for fiscal year 2024.

- The company monetized $255 million of Production Tax Credit sales and reduced its bank leverage ratio to 2.90X as of January 3, 2026, demonstrating a commitment to deleveraging.

- Darling Ingredients estimates its core ingredients business adjusted EBITDA for Q1 2026 to be approximately $240-$250 million.

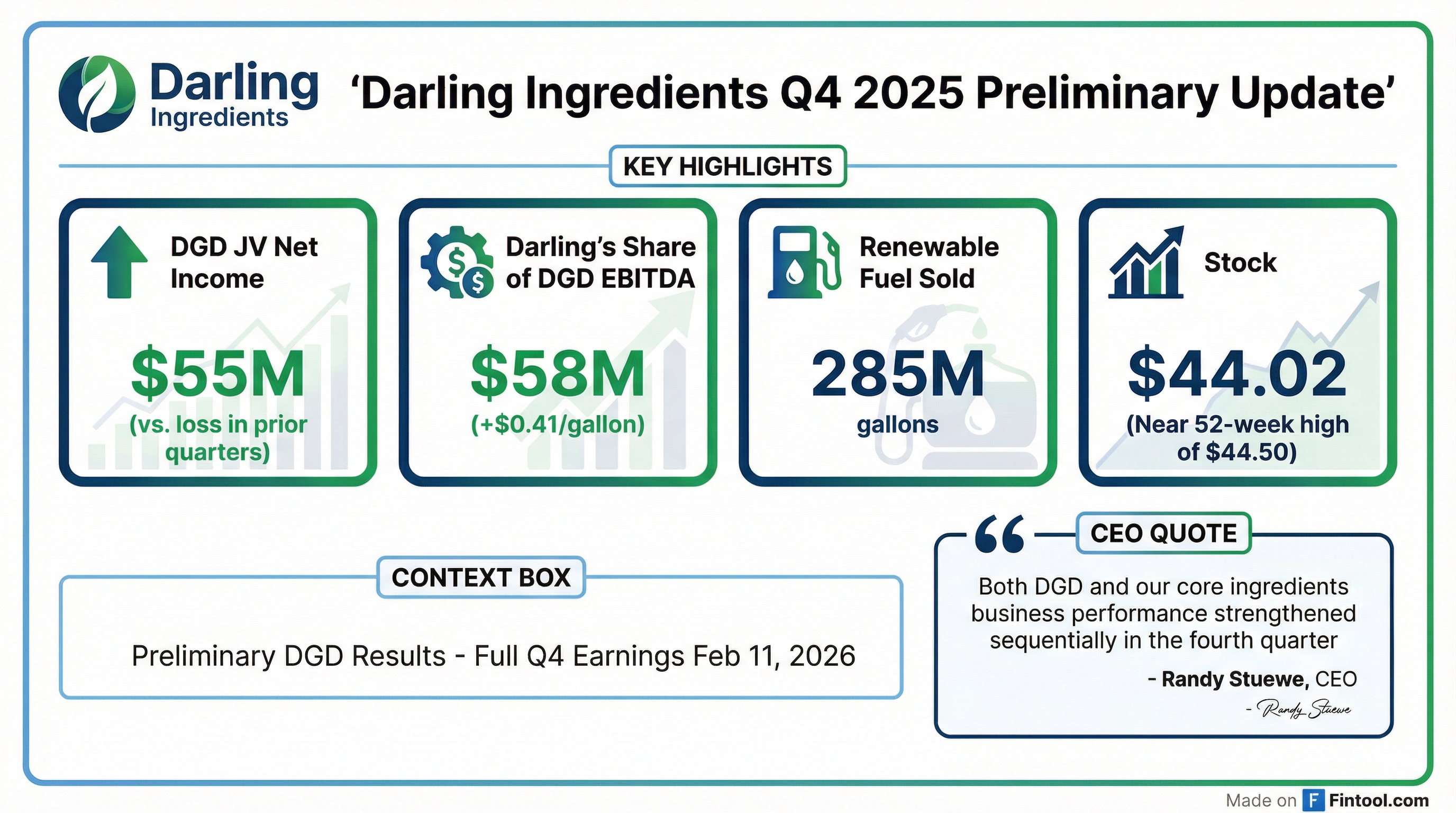

- Darling Ingredients Inc. announced that its 50/50 joint venture, Diamond Green Diesel (DGD), reported a net income of $55 million for the three months ended December 31, 2025.

- For the full fiscal year ended December 31, 2025, DGD incurred a net loss of ($68) million.

- Darling Ingredients' share of DGD Adjusted EBITDA was $58 million or $0.41 per gallon for Q4 2025, and $104 million or $0.21 per gallon for the full fiscal year 2025.

- The company anticipates ending the year with solid improvement over its prior outlook, noting that both DGD and the core ingredients business performance strengthened sequentially in the fourth quarter.

- Darling Ingredients will release its full fourth quarter and fiscal year 2025 financial results on February 11, 2026, and will host a conference call on February 12, 2026.

- Darling Ingredients' Diamond Green Diesel (DGD) joint venture reported a net income of $55 million for the fourth quarter of 2025, with 285.3 million gallons of renewable fuels sold/shipped.

- For the full fiscal year 2025, DGD reported a net loss of ($68) million and sold/shipped 1.003 billion gallons of renewable fuels.

- Darling Ingredients' share of DGD Adjusted EBITDA was $58 million ($0.41 per gallon) for Q4 2025 and $104 million ($0.21 per gallon) for FY 2025.

- Darling Ingredients will release its full fourth quarter and fiscal year 2025 financial results on Wednesday, February 11, 2026, after market close, and host a conference call on February 12, 2026.

- Darling Ingredients Inc. is establishing a new joint venture by combining its collagen and gelatin divisions with Tessenderlo Group's PB Leiner business, with Darling holding an 85% stake.

- The new entity is expected to generate approximately $1.5 billion in annual revenue and will operate 22 global facilities.

- This merger requires no initial financial contribution from either company and is anticipated to close in 2026, subject to regulatory approvals.

- Following the announcement, Darling Ingredients' shares experienced a 1.94% drop in after-hours trading.

- Darling Ingredients Inc. (DAR) and Tessenderlo Group have signed a definitive agreement to form a new company by combining their collagen and gelatin segments.

- Darling Ingredients will hold an 85% majority ownership stake in the new company, with Tessenderlo Group holding 15%.

- The new entity is expected to generate approximately $1.5 billion in initial annual revenue and possess a total gelatin and collagen capacity of about 200,000 metric tons.

- The transaction is anticipated to close in 2026, pending regulatory approvals.

Quarterly earnings call transcripts for DARLING INGREDIENTS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more