Earnings summaries and quarterly performance for DARLING INGREDIENTS.

Executive leadership at DARLING INGREDIENTS.

Randall Stuewe

Chief Executive Officer

Brandon Lairmore

Executive Vice President – Darling U.S. Rendering Operations

Carlos Paz

Executive Vice President – Global Risk Management, Ingredients

Jan van der Velden

Executive Vice President – International Rendering and Specialties

Jeroen Colpaert

Executive Vice President – Rousselot

John Sterling

Executive Vice President – General Counsel and Secretary

Nick Kemphaus

Executive Vice President – General Counsel and Secretary (effective January 4, 2026)

Patrick McNutt

Executive Vice President – Chief Administrative Officer

Robert Day

Chief Financial Officer

Sandra Dudley

Executive Vice President – Renewables and Chief Strategy Officer

Board of directors at DARLING INGREDIENTS.

Research analysts who have asked questions during DARLING INGREDIENTS earnings calls.

Heather Jones

Heather Jones Research

6 questions for DAR

Manav Gupta

UBS Group

6 questions for DAR

Matthew Blair

Tudor, Pickering, Holt & Co.

6 questions for DAR

Andrew Strelzik

BMO Capital Markets

4 questions for DAR

Betty Zhang

Scotiabank

4 questions for DAR

Dushyant Ailani

Jefferies

4 questions for DAR

Jason Gabelman

TD Cowen

4 questions for DAR

Pooran Sharma

Stephens Inc.

4 questions for DAR

Thomas Palmer

Citigroup Inc.

4 questions for DAR

Derrick Whitfield

Texas Capital

3 questions for DAR

Ryan Todd

Simmons Energy

3 questions for DAR

Ben Kallo

Robert W. Baird & Co.

2 questions for DAR

Ben Mayhew

BMO

2 questions for DAR

Conor Fitzpatrick

Bank of America Merrill Lynch

2 questions for DAR

Dushyant Ajit Ailani

Jefferies LLC

2 questions for DAR

Jason Daniel Gabelman

TD Securities

2 questions for DAR

Ryan M. Todd

Piper Sandler & Co.

2 questions for DAR

Benjamin Kallo

Robert W. Baird & Co.

1 question for DAR

Brian Sharma

Stephens Inc.

1 question for DAR

Davis Sunderland

Baird

1 question for DAR

Derrick Lee Whitfield

Texas Capital Securities

1 question for DAR

John Royall

JPMorgan Chase & Co.

1 question for DAR

Paul Cheng

Scotiabank

1 question for DAR

Recent press releases and 8-K filings for DAR.

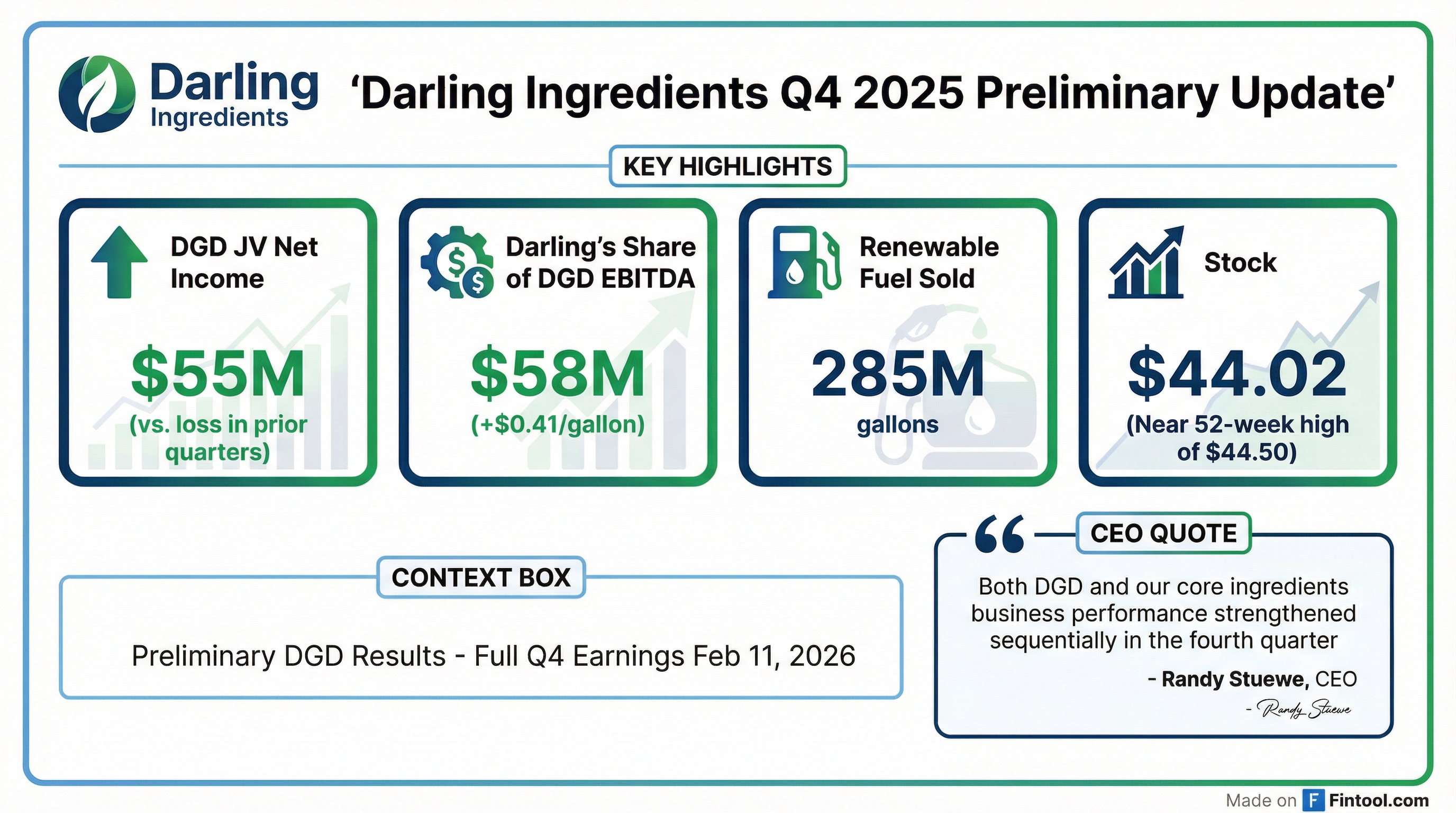

- Darling Ingredients Inc. announced that its 50/50 joint venture, Diamond Green Diesel (DGD), reported a net income of $55 million for the three months ended December 31, 2025.

- For the full fiscal year ended December 31, 2025, DGD incurred a net loss of ($68) million.

- Darling Ingredients' share of DGD Adjusted EBITDA was $58 million or $0.41 per gallon for Q4 2025, and $104 million or $0.21 per gallon for the full fiscal year 2025.

- The company anticipates ending the year with solid improvement over its prior outlook, noting that both DGD and the core ingredients business performance strengthened sequentially in the fourth quarter.

- Darling Ingredients will release its full fourth quarter and fiscal year 2025 financial results on February 11, 2026, and will host a conference call on February 12, 2026.

- Darling Ingredients' Diamond Green Diesel (DGD) joint venture reported a net income of $55 million for the fourth quarter of 2025, with 285.3 million gallons of renewable fuels sold/shipped.

- For the full fiscal year 2025, DGD reported a net loss of ($68) million and sold/shipped 1.003 billion gallons of renewable fuels.

- Darling Ingredients' share of DGD Adjusted EBITDA was $58 million ($0.41 per gallon) for Q4 2025 and $104 million ($0.21 per gallon) for FY 2025.

- Darling Ingredients will release its full fourth quarter and fiscal year 2025 financial results on Wednesday, February 11, 2026, after market close, and host a conference call on February 12, 2026.

- Darling Ingredients Inc. is establishing a new joint venture by combining its collagen and gelatin divisions with Tessenderlo Group's PB Leiner business, with Darling holding an 85% stake.

- The new entity is expected to generate approximately $1.5 billion in annual revenue and will operate 22 global facilities.

- This merger requires no initial financial contribution from either company and is anticipated to close in 2026, subject to regulatory approvals.

- Following the announcement, Darling Ingredients' shares experienced a 1.94% drop in after-hours trading.

- Darling Ingredients Inc. (DAR) and Tessenderlo Group have signed a definitive agreement to form a new company by combining their collagen and gelatin segments.

- Darling Ingredients will hold an 85% majority ownership stake in the new company, with Tessenderlo Group holding 15%.

- The new entity is expected to generate approximately $1.5 billion in initial annual revenue and possess a total gelatin and collagen capacity of about 200,000 metric tons.

- The transaction is anticipated to close in 2026, pending regulatory approvals.

- Darling Ingredients Inc. and Tessenderlo Group have signed a definitive agreement to form a new company by combining their collagen and gelatin segments, branded as Rousselot and PB Leiner, respectively.

- The new company will be majority-owned by Darling Ingredients with an 85% stake, while Tessenderlo Group will hold the remaining 15%, with no cash or initial investment required from either party.

- This new entity is expected to have an initial annual revenue of approximately $1.5 billion and a total gelatin and collagen capacity of about 200,000 metric tons across 22 facilities.

- The transaction is anticipated to close in 2026, subject to regulatory approvals.

- Darling Ingredients sold an additional $60 million in production tax credits generated through its Diamond Green Diesel joint venture, increasing the total production tax credit sales for 2025 to approximately $185 million.

- The proceeds from the $60 million sale are anticipated by the end of 2025, contingent upon the satisfaction of specific funding conditions.

- The Diamond Green Diesel joint venture, a significant asset for Darling, has the capacity to produce over 1.2 billion gallons annually of renewable diesel and sustainable aviation fuel.

- This strategic sale is intended to strengthen Darling's financial position, as the company maintains adequate liquidity but also carries a significant debt load.

- Darling Ingredients reported Q3 2025 combined adjusted EBITDA of $245 million and total net sales of $1.6 billion, with the core ingredients business delivering its strongest performance in a year and a half.

- The global ingredients business (feed and food segments) performed strongly, with feed segment EBITDA improving to $174 million and food segment EBITDA rising to $72 million in Q3 2025.

- The renewables business (Diamond Green Diesel - DGD) posted a negative $3 million EBITDA for Q3 2025, impacted by a $38 million lower of cost or market expense, higher feedstock costs, lower RINs and LCFS pricing, and a scheduled turnaround at DGD-3. DGD-1 remains idled.

- The company ended Q3 2025 with net debt of $4.01 billion and a bank covenant preliminary ratio of 3.65 times, with $1.17 billion available on its revolving credit facility. Management expects total debt to decrease by year-end due to cash generation and anticipated payments from $300 million in production tax credits generated in 2025.

- Despite short-term uncertainty in the renewables market due to policy delays, management is optimistic about DGD's improvement in Q4 2025 and the outlook for 2026, anticipating a shift that will enhance DGD's earnings potential.

- Darling Ingredients reported Q3 2025 combined adjusted EBITDA of $245 million and total net sales of $1.6 billion.

- The core ingredients business delivered strong performance with $248 million in EBITDA, fueled by robust global demand and exceptional execution.

- The renewables business (DGD) posted a negative $3 million EBITDA, significantly impacted by a $38 million lower of cost or market (LCM) expense, LIFO, and continued delays in the Renewable Volume Obligation (RVO) ruling.

- The company's total debt net of cash was $4.01 billion as of September 27, 2025, with a bank covenant preliminary ratio of 3.65x.

- Darling Ingredients expects to generate around $300 million in production tax credits (PTCs) in 2025, anticipating payment for approximately $200 million by year-end 2025.

- Darling Ingredients Inc. has completed the refinancing of its long-term debt to extend maturities.

- Darling Global Finance B.V., a wholly-owned subsidiary, closed an offering of €750 million aggregate principal amount of unsecured senior notes due 2032, which bear interest at 4.5% per annum.

- The company also entered into a Third Amended and Restated Credit Agreement, providing a $2 billion revolving loan facility and a $900.0 million farm credit term loan A facility.

- Proceeds from the new notes and credit facilities were used to redeem €515.0 million of 3.625% Senior Notes due 2026 and refinance existing senior secured credit facilities.

- On June 18, 2025, Darling Global Finance B.V., a wholly owned subsidiary of Darling Ingredients Inc., priced an offering of €750 million aggregate principal amount of 4.5% senior notes due 2032 at 100% of par, with settlement expected on or about June 24, 2025.

- The notes are guaranteed by Darling Ingredients and its restricted subsidiaries (excluding foreign subsidiaries, receivables entities and certain other subsidiaries).

- Proceeds will be used to redeem €515 million of 3.625% senior notes due 2026, repay portions of existing senior secured credit facilities, and cover refinancing fees and expenses.

- CEO Randall C. Stuewe noted the transaction maintains the company’s blended cost of debt and extends the term of its Euro notes by seven years.

Quarterly earnings call transcripts for DARLING INGREDIENTS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more