Earnings summaries and quarterly performance for Duke Energy.

Executive leadership at Duke Energy.

Harry K. Sideris

President and Chief Executive Officer

Alex Glenn

Executive Vice President and Chief Legal Officer

Brian D. Savoy

Executive Vice President and Chief Financial Officer

Cameron McDonald

Senior Vice President and Chief Human Resources Officer

Kodwo Ghartey-Tagoe

Executive Vice President and Chief Executive Officer, Duke Energy Carolinas; Head of Natural Gas Business Unit

Louis Renjel

Executive Vice President and Chief Executive Officer, Duke Energy Florida and Midwest; Chief Corporate Affairs Officer

Board of directors at Duke Energy.

Annette K. Clayton

Director

Caroline Dorsa

Director

Derrick Burks

Director

E. Marie McKee

Director

Idalene F. Kesner

Director

Jeffrey Guldner

Director

John T. Herron

Director

Michael J. Pacilio

Director

Nicholas C. Fanandakis

Director

Robert M. Davis

Director

Theodore F. Craver, Jr.

Independent Chair of the Board

Thomas E. Skains

Director

W. Roy Dunbar

Director

William E. Webster, Jr.

Director

Research analysts who have asked questions during Duke Energy earnings calls.

Carly Davenport

Goldman Sachs

7 questions for DUK

Nicholas Campanella

Barclays

7 questions for DUK

Julien Dumoulin-Smith

Jefferies

6 questions for DUK

Anthony Crowdell

Mizuho Financial Group

5 questions for DUK

David Paz

Wolfe Research, LLC

4 questions for DUK

David Arcaro

Morgan Stanley

3 questions for DUK

Durgesh Chopra

Evercore ISI

3 questions for DUK

Jeremy Tonet

JPMorgan Chase & Co.

3 questions for DUK

Shahriar Pourreza

Guggenheim Partners

3 questions for DUK

Alex

Citigroup

2 questions for DUK

Alexander Weintraub

Wells Fargo

2 questions for DUK

Diana Niles

JPMorgan Chase & Co.

2 questions for DUK

James Ward

Jefferies

2 questions for DUK

Andrew Weisel

Scotiabank

1 question for DUK

Stephen D’Ambrisi

Ladenburg Thalmann

1 question for DUK

Steve D'Ambrisi

RBC Capital Markets

1 question for DUK

Steve Fleishman

Wolfe Research, LLC

1 question for DUK

Recent press releases and 8-K filings for DUK.

- Duke Energy’s nuclear fleet achieved a 96.9% capacity factor in 2025, marking a new systemwide reliability record.

- Strong performance generated approximately $600 million in federal nuclear production tax credits, passed directly to customers to reduce costs.

- The fleet comprises 11 nuclear units across six sites, making nuclear the largest generation source for Duke Energy in the Carolinas.

- In 2025, the nuclear plants provided power to over 8 million homes with consistent, around-the-clock output.

- Duke Energy plans to extend operational lifespans, conduct power uprates, and develop advanced reactors to further enhance reliability and capacity.

- The U.S. Nuclear Regulatory Commission issued a threshold determination on February 17, 2026, confirming no direct or indirect transfer of NRC licenses, clearing the way for the first closing under the Investment Agreement.

- Under the August 4, 2025 Investment Agreement with Peninsula Power Holdings L.P., an affiliate of Brookfield Super-Core Infrastructure Partners, Florida Progress will issue membership interests totaling up to $6 billion.

- The first closing is scheduled for March 3, 2026, upon which the investor will pay $2.8 billion and acquire 9.2% of outstanding Florida Progress interests.

- Subsequent investments of $200 million (by Dec 31, 2026), $500 million (by Jun 30, 2027), $1.5 billion (by Dec 31, 2027) and $1 billion (by Jun 30, 2028) will follow.

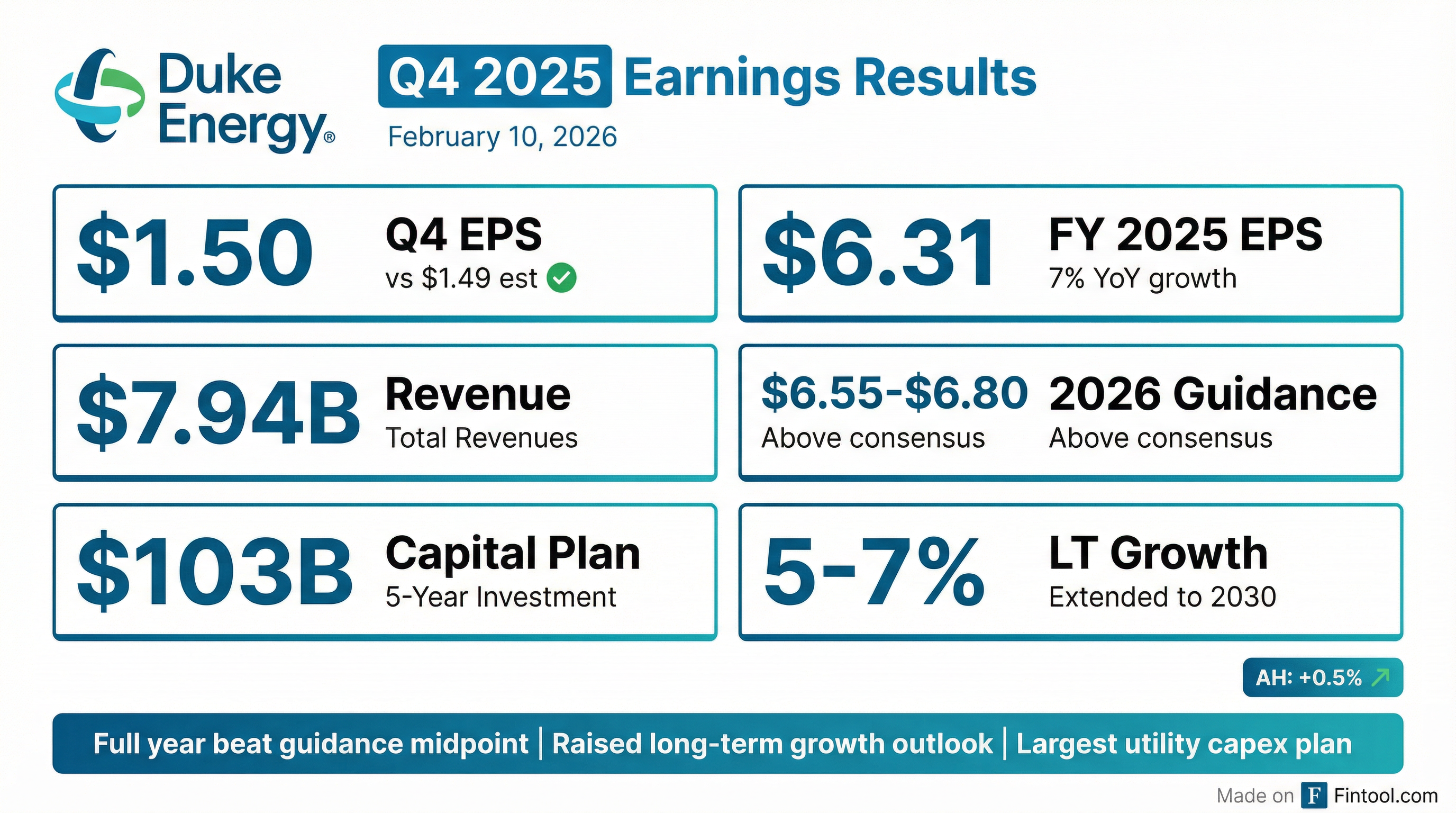

- Adjusted EPS of $6.31, above guidance midpoint and reflecting 9.6% earnings base growth in 2025.

- 2026 adjusted EPS guidance of $6.55 – $6.80 (midpoint $6.68), driven by customer growth and regulatory riders.

- 5-year capex plan raised ~18% to $103 billion, funding ~14 GW of new generation by 2031 and accelerated storage deployments.

- Achieved 14.8% FFO/Debt in 2025, raised long-term target to 15%, and targeting a 60–70% dividend payout ratio.

- Reported full-year 2025 EPS of $6.31, up 7% year-over-year, above the guidance midpoint; introduced 2026 EPS guidance of $6.55–$6.80 and extended a 5–7% long-term EPS growth target through 2030.

- Increased its five-year capital plan by $16 billion to $103 billion, expected to drive 9.6% earnings-based growth through 2030, representing the largest fully regulated investment program in the industry.

- Secured approximately 4.5 GW of data center load under Electric Service Agreements, with projects under construction and load ramp-up expected to drive an earnings inflection in 2028.

- Achieved 14.8% FFO to debt in 2025, forecasting 14.5% for 2026 and targeting 15% long term; plans $10 billion of equity issuances from 2027–2030 to fund growth.

- Duke delivered 2025 EPS of $6.31, up 7% year-over-year and above the guidance midpoint; for 2026, the company guided EPS of $6.55–$6.80 and reiterated a 5%–7% long-term EPS growth rate through 2030.

- Increased its five-year capital plan by $16 billion to $103 billion, expected to drive 9.6% earnings-based growth through 2030, representing the largest fully regulated plan in the industry.

- Achieved 14.8% FFO to debt in 2025 after recovering and securitizing $3 billion of storm costs, with 2026 FFO to debt forecast around 14.5%, supporting balance-sheet strength.

- Secured 4.5 GW of data center energy service agreements under construction and holds a 9 GW late-stage pipeline, positioning a load growth inflection in 2028.

- Duke Energy reported 2025 EPS of $6.31, up 7% year-over-year and above its guidance midpoint, and provided 2026 EPS guidance of $6.55–$6.80, extending a 5%–7% long-term EPS growth target through 2030.

- Announced a $103 billion five-year capital plan, an 18% increase versus its prior plan, supporting 9.6% earnings-based growth through 2030 as load growth and grid investments accelerate.

- Delivered 14.8% FFO to debt in 2025, aided by nearly $3 billion of storm cost recovery, forecasts approximately 14.5% FFO to debt in 2026, and plans $10 billion of equity issuance for 2027–2030.

- Advanced its all-of-the-above generation strategy with the installation of a 100 MW battery storage system and groundbreaking on 5 GW of new natural gas capacity, underscoring investment in diversified resources.

- Full-year 2025 adjusted EPS of $6.31, up from $5.90 in 2024.

- Fourth-quarter 2025 adjusted EPS of $1.50, down from $1.66 in Q4 2024.

- 2026 adjusted EPS guidance of $6.55–$6.80, and long-term adjusted EPS growth target of 5–7% through 2030 off the 2025 midpoint of $6.30.

- Q4 segment income: Electric Utilities $1.209 B, Gas Utilities $230 M, Other segment loss $272 M.

- Five-year $103 B capital plan driving 9.6% earnings-base growth through 2030, with construction started on 5 GW of new dispatchable generation.

- Extremely cold temperatures across the East Coast are driving unusually high energy demand, prompting Duke Energy to ask Carolinas customers to voluntarily reduce usage between 4–10 a.m. on Feb. 2 to help prevent outages.

- Customers are advised to lower thermostats, avoid major appliances such as washers and dryers during peak hours, and turn off unnecessary devices; electric vehicle owners should charge midday when demand is lower.

- Duke Energy is maximizing its generation and power purchases and coordinating with large commercial and industrial customers through demand response programs to maintain grid reliability.

- The company’s electric utilities serve 8.6 million customers and its natural gas utilities serve 1.7 million customers, with a combined 55,100 MW of generation capacity across six states.

- Executive VP and Chief Generation Officer Preston Gillespie will retire after 40 years, remaining through March 1, 2027 to guide new-nuclear decisions; Kelvin Henderson will succeed him as Senior VP and Chief Generation Officer effective March 1, 2026.

- Kelvin Henderson, Duke’s current Chief Nuclear Officer and a 35+-year nuclear industry veteran, will join the senior management committee and report to CEO Harry Sideris.

- Steven Capps will be promoted to Senior VP and Chief Nuclear Officer, ensuring continuity in Duke’s nuclear operations.

- Leadership describes the transition as talent-driven to preserve operational continuity amid a $95 billion–$105 billion 2026–2030 CAPEX plan targeting ~8.5% rate-base growth and 30%–50% incremental equity funding.

- Analysts at UBS, Morgan Stanley and J.P. Morgan have trimmed near-term price targets to about $126 on concerns over high leverage and heavy capital spending.

- Duke Energy Florida will remove the storm cost recovery charge from customer bills in February, one month ahead of schedule, after fully recovering approximately $1.1 billion in storm-related costs.

- Residential customers will see a $33 reduction per 1,000 kWh starting in February and an additional $11 decrease in March, totalling $44 per 1,000 kWh versus January.

- Commercial and industrial customers’ bills will be reduced by 9.6% to 15.8% compared to January, depending on individual usage and factors.

- Efficiency improvements at natural gas plants saved customers $340 million in fuel costs, new solar sites saved $750 million, and $65 million in tax credits were passed on to customers.

Fintool News

In-depth analysis and coverage of Duke Energy.

Quarterly earnings call transcripts for Duke Energy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more