Earnings summaries and quarterly performance for 8X8 INC /DE/.

Executive leadership at 8X8 INC /DE/.

Board of directors at 8X8 INC /DE/.

Research analysts who have asked questions during 8X8 INC /DE/ earnings calls.

Peter Levine

Evercore ISI

5 questions for EGHT

Josh Nichols

B. Riley Financial

4 questions for EGHT

Meta Marshall

Morgan Stanley

3 questions for EGHT

Michael Funk

Bank of America

3 questions for EGHT

Siti Panigrahi

Mizuho Securities

3 questions for EGHT

Catharine Trebnick

Rosenblatt Securities

2 questions for EGHT

Ryan Koontz

Needham & Company, LLC

2 questions for EGHT

Ryan MacWilliams

Barclays

2 questions for EGHT

Sitikantha Panigrahi

Mizuho

2 questions for EGHT

Andrew King

Rosenblatt Securities

1 question for EGHT

James Faucette

Morgan Stanley

1 question for EGHT

Michael Berg

Wells Fargo & Company

1 question for EGHT

Michael Turrin

Wells Fargo

1 question for EGHT

Ronit Shah

Wells Fargo

1 question for EGHT

William Power

Baird

1 question for EGHT

Recent press releases and 8-K filings for EGHT.

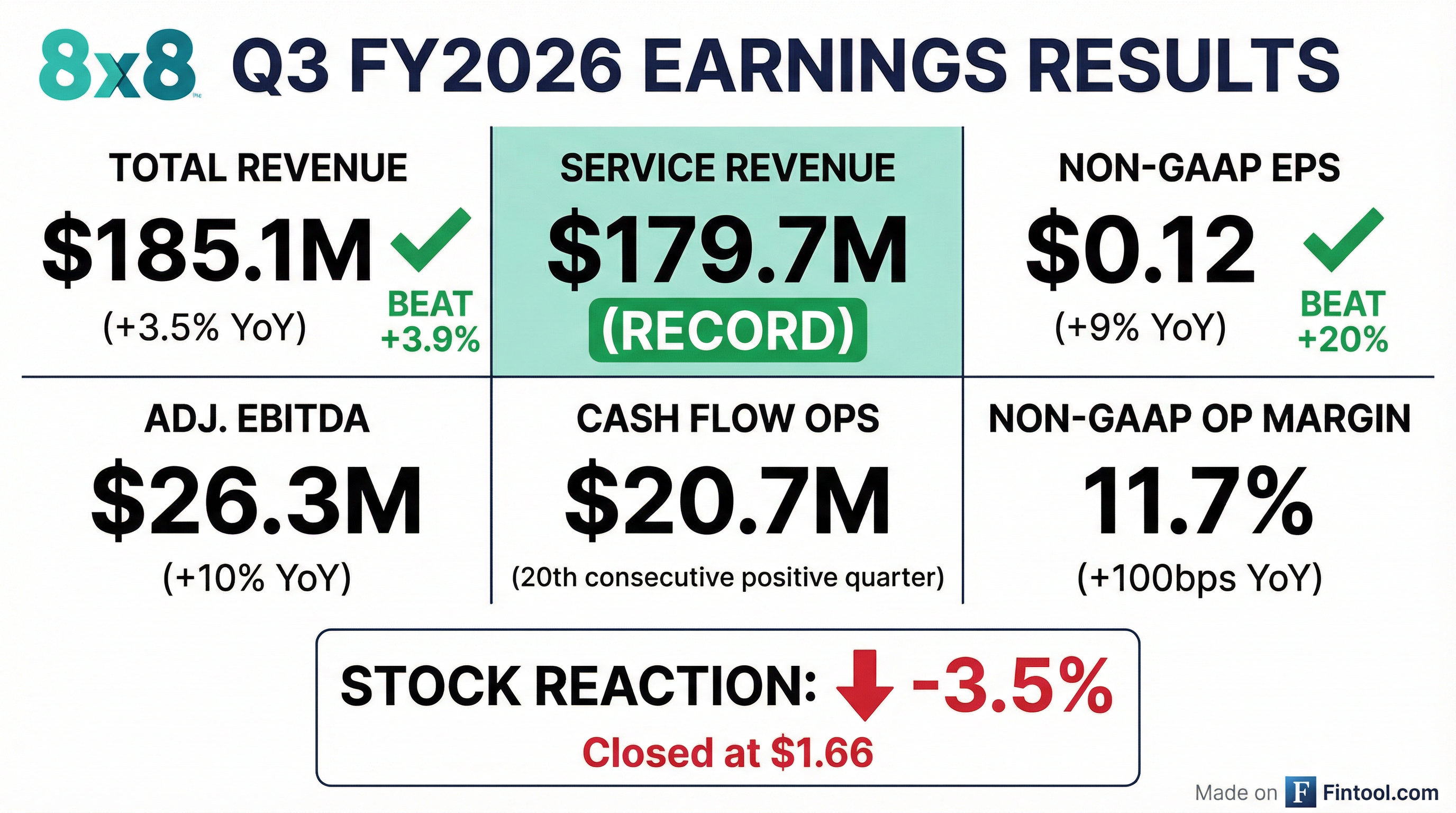

- 8x8 Inc. reported strong Q3 2026 results, exceeding guidance with total revenue of $185 million and service revenue of $179.7 million, growing 3.4% and 3.6% year-over-year respectively. The company achieved its 20th consecutive quarter of positive operating cash flow.

- The company completed the upgrade of all Fuze customers to the 8x8 platform by December 31, 2025, a significant operational milestone. This transition is expected to create a near-term revenue headwind in early fiscal 2027 but is viewed as a strategic benefit.

- Growth was driven by a nearly 60% year-over-year increase in usage-based offerings, which now account for over 20% of service revenue. Adoption of AI-based solutions is accelerating, with Voice AI interactions increasing more than 200%.

- For Q4 2026, 8x8 Inc. raised its guidance, anticipating service revenue between $173.5 million and $178.5 million and total revenue between $178.5 million and $183.5 million. Full-year fiscal 2026 guidance was also updated, with expected service revenue between $708.6 million and $713.6 million and total revenue between $729 million and $734 million.

- 8x8 Inc. reported strong Q3 2026 financial results, with total revenue of $185 million and service revenue of $179.7 million, both exceeding the high end of guidance by approximately $3 million. The company achieved $21.7 million in operating income (11.7% operating margin) and $0.12 fully diluted EPS, surpassing guidance ranges.

- This marks the third consecutive quarter of year-on-year service revenue growth , driven significantly by usage-based offerings which grew nearly 60% year-over-year and now account for 21% of service revenue. Voice AI interactions also increased over 200%.

- A major operational milestone was reached with the completion of the Fuze customer base upgrade to the 8x8 platform by December 31, 2025. This transition, while causing a near-term revenue headwind due to churn, is expected to improve efficiency and customer satisfaction.

- The company updated its full-year fiscal 2026 guidance, with service revenue now anticipated between $708.6 million and $713.6 million and total revenue between $729 million and $734 million, reflecting Q3 overperformance.

- 8x8 Inc. reported strong Q3 2026 results, with total revenue of $185 million and service revenue of $179.7 million, representing 3.6% year-over-year growth. The company exceeded its guidance for service revenue, total revenue, operating profit, and cash flow, achieving an 11.7% operating margin and $0.12 fully diluted EPS.

- Growth was significantly driven by usage-based offerings, which increased nearly 60% year-over-year and now constitute over 20% of service revenue. Additionally, Voice AI interactions grew more than 200% and Intelligent Customer Assistant contracts increased 70% year-over-year.

- The company successfully completed the upgrade of all Fuze customers to its 8x8 platform by December 31, 2025, a strategic milestone that, while creating a near-term revenue headwind, is expected to improve efficiency and customer satisfaction.

- Following the strong Q3 performance, 8x8 raised its full-year fiscal 2026 guidance, with service revenue now anticipated between $708.6 million and $713.6 million and total revenue between $729 million and $734 million.

- 8x8, Inc. reported record service revenue of $179.7 million and total revenue of $185.1 million for the third quarter of fiscal year 2026, demonstrating year-over-year growth.

- The company achieved its 20th consecutive quarter of positive cash flow from operations, totaling $20.7 million in Q3 FY2026, and reported non-GAAP operating profit of $21.7 million.

- Management raised its financial outlook for the full fiscal year 2026, projecting total revenue between $729.0 million and $734.0 million and non-GAAP diluted net income per share between $0.36 and $0.37.

- The company has significantly reduced its total debt outstanding by $224 million (41%) since August 2022, including a $5 million voluntary pre-payment in Q3 FY2026.

- 8x8, Inc. reported record service revenue of $179.7 million and total revenue of $185.1 million for the third quarter of fiscal year 2026, reflecting continued year-over-year growth.

- The company achieved its 20th consecutive quarter of positive cash flow from operations, totaling $20.7 million in Q3 FY2026, and reported GAAP net income of $5.1 million and Adjusted EBITDA of $26.3 million.

- Management raised its financial outlook for fiscal year 2026, now projecting total revenue between $729.0 million and $734.0 million and a non-GAAP operating margin between 9.5% and 10.0%.

- 8x8 has made significant progress in debt reduction, having repaid $224 million of debt since August 2022, which represents a 41% reduction in total debt outstanding.

- The company continues to advance its 8x8 Platform for CX with new capabilities, including integrated Workforce Management and AI-driven insights, reflecting increased customer interest in new products and AI capabilities.

- 8x8 experienced strong momentum in platform-wide adoption of intelligent automation and API-driven communications during Q3 of fiscal 2026.

- Demand for AI-driven customer experience tools accelerated, with customer contracts for 8x8 Intelligent Customer Assistant increasing 70% year-over-year and 20% quarter-over-quarter.

- Communications API usage also saw strong growth in Q3 FY26, with messaging interactions up over 269% year-over-year and voice interactions increasing by nearly 3X year-over-year.

- The company secured new customer wins across diverse industries and introduced several CX-driven product innovations in Q3 FY26, including 8x8 Retail Nationwide and Customer 360 enhancements.

- 8x8, Inc. (NASDAQ: EGHT) has acquired Maven Lab, a Singapore-based leader in mobile marketing and enterprise messaging.

- This acquisition is intended to accelerate 8x8's strategy to deliver end-to-end customer engagement and expand its APAC-native messaging, automation, and customer engagement capabilities across the Asia-Pacific region.

- The integration of Maven Lab's Moobidesk platform into the 8x8 Platform for CX is expected to create a more scalable and unified regional platform, enhancing support for various customer interaction channels.

- 8x8 has significantly reduced its debt by approximately 41% since August 2022, from $558 million, and has generated positive cash flow from operations for 19 consecutive quarters. This debt reduction has also lowered interest expense by about $10 million annually.

- The company has achieved year-over-year revenue growth in the last two quarters, with its service business growing almost 6% year over year when excluding the impact of the Fuze acquisition.

- Usage-based revenue now constitutes 19% to 20% of service revenue, an increase from 13% last year, driven by new AI-based products, and is expected to continue growing as a proportion of total revenue.

- 8x8 is nearing completion of the Fuze acquisition integration by the end of the calendar year, which is anticipated to eliminate associated revenue headwinds, and continues to invest approximately 15% of non-GAAP revenue in R&D for product-led growth, including AI-driven offerings.

- The capital allocation strategy primarily focuses on debt paydown to enhance financial flexibility for future investments or M&A, and the company also executed an opportunistic small stock buyback.

- 8x8 has significantly reduced its debt load by approximately 41% since August 2022, when it was $558 million, and has generated positive cash flow from operations for 19 consecutive quarters. This debt reduction is expected to decrease interest expense by about $10 million annually.

- The company has achieved year-over-year revenue growth in the last two quarters, ending an "eight-quarter drought" primarily due to headwinds from the Fuze acquisition, which are expected to conclude by the end of the calendar year.

- Usage-based revenue has grown to almost 20% of service revenue from approximately 13% last year, driven by new AI-based and consumption-based products, and has seen eight or nine quarters of successive growth.

- 8x8 has significantly reduced its debt by approximately 41% since August 2022, from $558 million, and has achieved positive cash flow from operations for 19 consecutive quarters.

- The company has reported year-over-year revenue growth in the last two quarters, following an approximate eight-quarter drought, with Fuze acquisition headwinds expected to conclude by the end of the calendar year.

- Usage-based revenue has grown substantially, now accounting for 19% to 20% of service revenue, an increase from 13% last year, driven by new AI-based products and a focus on multi-product customers.

Quarterly earnings call transcripts for 8X8 INC /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more