Earnings summaries and quarterly performance for ENTERPRISE PRODUCTS PARTNERS.

Research analysts who have asked questions during ENTERPRISE PRODUCTS PARTNERS earnings calls.

Jean Ann Salisbury

Bank of America

7 questions for EPD

John Mackay

Goldman Sachs Group, Inc.

7 questions for EPD

Manav Gupta

UBS Group

7 questions for EPD

Spiro Dounis

Citigroup Inc.

7 questions for EPD

Theresa Chen

Barclays PLC

7 questions for EPD

Brandon Bingham

Scotiabank

6 questions for EPD

Keith Stanley

Wolfe Research, LLC

6 questions for EPD

Michael Blum

Wells Fargo & Company

6 questions for EPD

Jeremy Tonet

JPMorgan Chase & Co.

5 questions for EPD

Jason Gabelman

TD Cowen

4 questions for EPD

Andrew John O'Donnell

Tudor, Pickering, Holt & Co.

2 questions for EPD

Neal Dingmann

Truist Securities

2 questions for EPD

A.J. O'Donnell

Tudor, Pickering, Holt & Company

1 question for EPD

A.J. O'Donnell

Tudor, Pickering, Holt & Co.

1 question for EPD

Julian Demoulin Smith

Jefferies Financial Group Inc.

1 question for EPD

Julien Dumoulin-Smith

Jefferies

1 question for EPD

Michael Bloom

Wells Fargo

1 question for EPD

Recent press releases and 8-K filings for EPD.

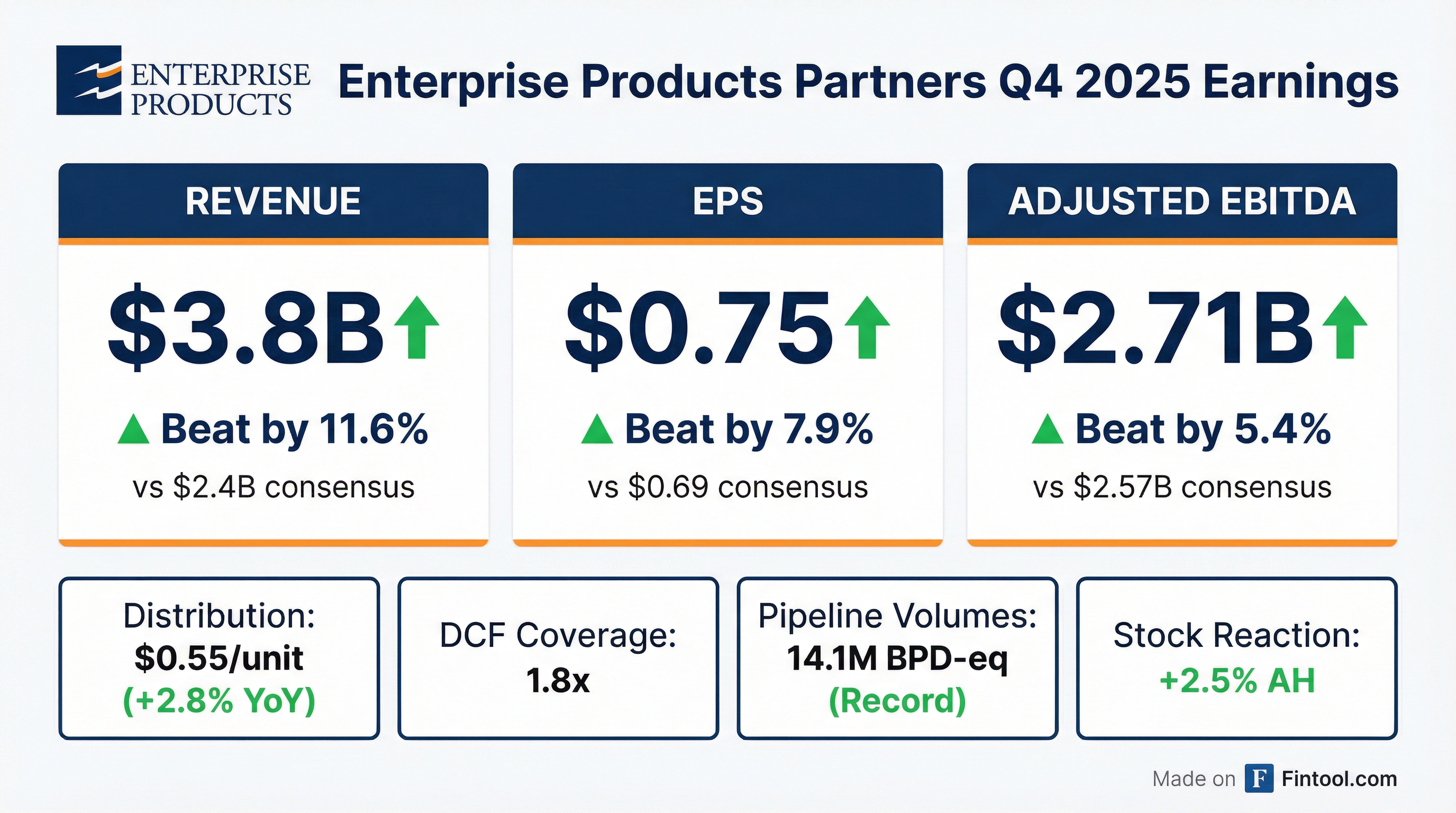

- Enterprise Products Partners reported record Q4 2025 EBITDA of $2.7 billion, surpassing the previous record set in Q4 2024, and a record $8.7 billion in adjusted cash flow from operations for the full year 2025. Net income attributable to common unit holders for Q4 2025 was $1.6 billion, or $0.75 per common unit.

- The company declared a Q4 2025 distribution of $0.55 per common unit, representing a 2.8% increase over Q4 2024, and repurchased approximately $300 million of common units in 2025.

- For 2026, growth capital expenditures are expected to be in the range of $2.5 billion-$2.9 billion, netting to $1.9 billion-$2.3 billion after asset sales, with sustaining capital expenditures projected at $580 million.

- Management anticipates modest adjusted EBITDA and cash flow growth in 2026, followed by double-digit growth in 2027 compared to 2026. The consolidated leverage ratio stood at 3.3 times at December 31, 2025, with a target range of 2.75-3.25 times expected by the end of 2026.

- Several new assets were brought online in 2025, including Frac 14, Mentone West, Orion, the Neches River Terminal ethane export train, and the Bahia NGL pipeline. Enterprise expects to be exporting near 1.5 million barrels a day of NGLs by next year.

- Enterprise Products Partners (EPD) achieved a record adjusted EBITDA of $2.7 billion in Q4 2025 and a record $8.7 billion in adjusted cash flow from operations for the full year 2025, with full-year adjusted EBITDA just under $10 billion.

- EPD declared a Q4 2025 distribution of $0.55 per common unit, marking a 2.8% increase over Q4 2024, and repurchased $300 million in common units during 2025, utilizing 29% of its $5 billion buyback program.

- The company projects modest adjusted EBITDA and cash flow growth in 2026, followed by an anticipated double-digit growth (around 10%) in 2027, as recently completed assets reach full utilization.

- For 2026, growth capital expenditures are projected between $2.5 billion and $2.9 billion (net $1.9 billion-$2.3 billion after asset sales), with discretionary free cash flow expected around $1 billion, of which 50%-60% is earmarked for buybacks.

- EPD's consolidated leverage ratio stood at 3.3 times as of December 31, 2025, with the company expecting to return to its target range of 2.75-3.25 times by the end of 2026.

- Enterprise Products Partners (EPD) reported a total Gross Operating Margin (GOM) of $2,737 million for Q4 2025, an increase from $2,628 million in Q4 2024.

- The company announced distributions of $0.55/unit for Q4 2025, representing a 2.8% increase over Q4 2024, marking 27 consecutive years of distribution growth.

- EPD repurchased $50 million (1.6 million common units) in Q4 2025 and $300 million (9.5 million common units) for the full year 2025.

- As of December 31, 2025, the company's Leverage Ratio was 3.3x, and it maintained $5.2 billion in liquidity.

- Projected growth capital expenditures are in the range of $2.5 billion to $2.9 billion for 2026 and $2.0 billion to $2.5 billion for 2027.

- Enterprise Products Partners reported a record $2.7 billion in EBITDA for Q4 2025, exceeding the previous Q4 2024 record, and a record $8.7 billion in adjusted cash flow from operations for the full year 2025.

- The company declared a Q4 2025 distribution of $0.55 per common unit, a 2.8% increase over Q4 2024, and repurchased $300 million of common units in 2025.

- Organic growth capital investments totaled $4.4 billion in 2025, with projected growth capital expenditures for 2026 ranging from $2.5 billion to $2.9 billion (netting to $1.9 billion-$2.3 billion after asset sales) and $2 billion-$2.5 billion for 2027.

- EPD anticipates modest adjusted EBITDA and cash flow growth in 2026 (lower end of 3%-5%) and projects double-digit growth (around 10%) in 2027 compared to 2026, driven by new assets ramping up.

- The consolidated leverage ratio stood at 3.3 times as of December 31, 2025, with the company expecting to return to its target range of 2.75-3.25 times by the end of 2026.

- For the full year 2025, Enterprise Products Partners reported net income attributable to common unitholders of $5.8 billion or $2.66 per common unit, and record Adjusted cash flow from operations (CFFO) of $8.7 billion.

- Operational distributable cash flow (DCF) was $7.9 billion for 2025, providing 1.7 times coverage of the $2.175 per common unit distributions declared, which increased by 3.6 percent.

- In 2025, the company repurchased approximately $300 million of its common units and retained $3.2 billion of DCF for reinvestment.

- Total capital investments, net of asset sales, reached $5.6 billion in 2025, including $4.4 billion for growth capital projects. Key projects like the Bahia NGL Pipeline and the first phase of the Neches River NGL marine terminal began operations in 2025.

- At December 31, 2025, total debt principal outstanding was $34.7 billion, and consolidated liquidity stood at approximately $5.2 billion.

- Enterprise Products Partners L.P. reported net income attributable to common unitholders of $1.6 billion ($0.75 per common unit) for Q4 2025 and $5.8 billion ($2.66 per common unit) for the full year 2025.

- The company declared a Q4 2025 distribution of $0.550 per common unit, marking its 27th consecutive year of distribution growth, with operational distributable cash flow providing 1.8 times coverage for the quarter.

- Enterprise repurchased $300 million of common units in 2025, bringing total repurchases under its authorized program to approximately $1.4 billion.

- Total capital investments, net of asset sales, were $5.6 billion in 2025, including $4.4 billion for growth capital projects. Key projects like the Bahia NGL Pipeline and the first phase of the Neches River NGL marine terminal began operations in 2025.

- Enterprise Products Partners L.P. declared a quarterly cash distribution of $0.55 per unit for the fourth quarter of 2025, which represents a 2.8 percent increase over the distribution declared for the fourth quarter of 2024.

- This distribution will be paid on Friday, February 13, 2026, to common unitholders of record as of January 30, 2026.

- The company repurchased approximately $50 million of its common units during the fourth quarter of 2025, bringing total repurchases for 2025 to approximately $300 million.

- Approximately 29 percent of the authorized $5.0 billion buyback program has been utilized.

- Enterprise will announce its fourth quarter 2025 earnings on Tuesday, February 3, 2026, before the New York Stock Exchange opens for trading.

- Enterprise Products Partners L.P. (EPD) has executed an agreement for ExxonMobil to acquire a 40-percent undivided joint interest in Enterprise’s Bahia natural gas liquids pipeline.

- ExxonMobil will contribute approximately $650 million for its proportionate share of Bahia project costs.

- The transaction is subject to regulatory approvals and is expected to close by early 2026.

- Following the closing, Enterprise and ExxonMobil plan to increase Bahia’s capacity to 1 million BPD and construct a 92-mile extension, with completion anticipated in the fourth quarter of 2027.

- Enterprise will serve as the operator of the combined system.

- Enterprise Products Operating LLC (EPO) completed a public offering of $1.65 billion aggregate principal amount of senior notes on November 14, 2025.

- The offering consisted of three tranches: $300 million of 4.30% Senior Notes due June 20, 2028; $600 million of 4.60% Senior Notes due January 15, 2031; and $750 million of 5.20% Senior Notes due January 15, 2036.

- The net proceeds of approximately $1.65 billion will be used for general company purposes, including growth capital investments and acquisitions, and for the repayment of existing debt.

- Specifically, the proceeds will help repay EPO’s $750 million principal amount of 5.05% Senior Notes FFF due January 2026 and $875 million principal amount of 3.70% Senior Notes PP due February 2026.

- Enterprise Products Operating LLC (EPO) priced a public offering of $1.65 billion aggregate principal amount of senior notes.

- The offering comprises three tranches: $300 million due June 20, 2028 (4.30% coupon), $600 million due January 15, 2031 (4.60% coupon), and $750 million due January 15, 2036 (5.20% coupon).

- Net proceeds are intended for general company purposes, including growth capital investments and acquisitions, and the repayment of debt, specifically $750 million of 5.05% Senior Notes FFF and $875 million of 3.70% Senior Notes PP maturing in early 2026.

- Settlement for the offering is expected to occur on November 14, 2025.

Quarterly earnings call transcripts for ENTERPRISE PRODUCTS PARTNERS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more