Earnings summaries and quarterly performance for Harmony Biosciences Holdings.

Executive leadership at Harmony Biosciences Holdings.

Board of directors at Harmony Biosciences Holdings.

Research analysts who have asked questions during Harmony Biosciences Holdings earnings calls.

David Amsellem

Piper Sandler Companies

6 questions for HRMY

Ami Fadia

Needham & Company, LLC

4 questions for HRMY

Ashwani Verma

UBS Group AG

4 questions for HRMY

Graig Suvannavejh

Mizuho Securities

4 questions for HRMY

Patrick Trucchio

H.C. Wainwright & Co.

4 questions for HRMY

Charles Duncan

Cantor Fitzgerald & Co.

3 questions for HRMY

Corinne Johnson

Goldman Sachs

3 questions for HRMY

David Hoang

Citigroup

3 questions for HRMY

Jason Gerberry

Bank of America Merrill Lynch

3 questions for HRMY

Jay Olson

Oppenheimer & Co. Inc.

3 questions for HRMY

Pete Stavropoulos

Cantor Fitzgerald

3 questions for HRMY

Bhavin Patel

Bank of America

2 questions for HRMY

Danielle Brill

Truist Securities

2 questions for HRMY

David Huang

Deutsche Bank

2 questions for HRMY

Poorna Kannan

Needham & Company

2 questions for HRMY

Ryan

B. Riley

2 questions for HRMY

Soyun Shin

UBS

2 questions for HRMY

Alec

Truist Securities

1 question for HRMY

Alex

Citigroup

1 question for HRMY

Corinne Jenkins

Goldman Sachs

1 question for HRMY

François Brisebois

Oppenheimer & Co. Inc.

1 question for HRMY

John Gregory Dean

Oppenheimer & Co. Inc.

1 question for HRMY

Luis Santos

H.C. Wainwright & Co.

1 question for HRMY

Pavan Patel

Bank of America

1 question for HRMY

Recent press releases and 8-K filings for HRMY.

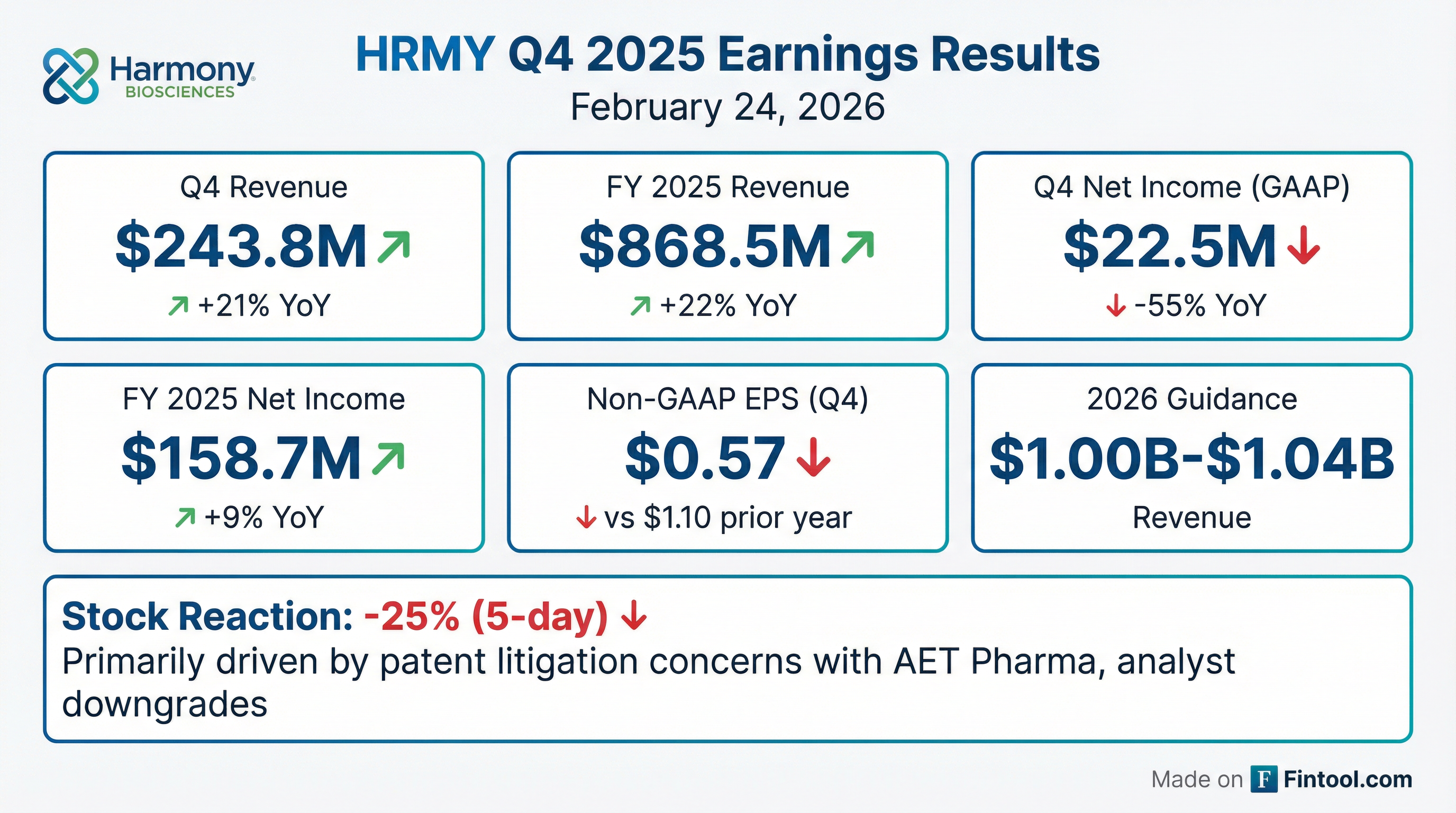

- Harmony Biosciences reported Q4 2025 net product revenue of $243.8 million and full-year 2025 net product revenue of $868.5 million for WAKIX, marking six consecutive years of revenue growth.

- The company issued WAKIX net revenue guidance of $1 billion-$1.04 billion for full-year 2026, projecting blockbuster status.

- Harmony Biosciences ended Q4 2025 with $882.5 million in cash equivalents and investments, having generated $348.2 million in cash from operations in 2025.

- Significant pipeline progress includes an NDA submission for Pitolisant GR on track for Q2 2026 and five ongoing Phase 3 registrational trials for distinct CNS indications, with top-line data for EPX-100 expected in H1 2027.

- The company has settled with 6 of 7 ANDA filers, positioning generic entry for WAKIX no sooner than March 2030 if pediatric exclusivity is obtained.

- Harmony Biosciences reported Q4 2025 net product revenue of $243.8 million and full-year 2025 WAKIX net product revenue of $868.5 million, reflecting strong growth and profitability.

- The company provided 2026 WAKIX net revenue guidance of $1 billion to $1.04 billion, anticipating blockbuster status for the first time.

- Harmony Biosciences received FDA approval for WAKIX for the treatment of cataplexy in pediatric patients six years of age and older on February 13th.

- The company has settled with six of seven generic filers, with generic entry for WAKIX expected no sooner than March 2030 if pediatric exclusivity is granted, or September 2029 without it.

- Advancements in the pitolisant franchise include Pitolisant GR NDA submission on track for Q2 2026 with a target PDUFA in Q1 2027, and a new pitolisant formulation with patent protection until 2042 for broader CNS indications.

- Harmony Biosciences Holdings reported net product revenue of $243.8 million for Q4 2025, an increase of 21% compared to Q4 2024, and $868.5 million for the full year 2025, up 22% from FY 2024.

- The company ended Q4 2025 with $882.5 million in cash, cash equivalents, and investments, marking a 53% increase from Q4 2024.

- Harmony Biosciences provided 2026 net revenue guidance of $1.00 billion to $1.04 billion.

- Key pipeline updates include the anticipated NDA filing for Pitolisant GR in Narcolepsy in Q2 2026 with a target PDUFA date in Q1 2027, and the initiation of Phase 3 registrational trials for Pitolisant HD in Q4 2025, with topline data expected in 2027.

- Harmony Biosciences reported strong financial results for Q4 2025, with net product revenue of $243.8 million, contributing to full-year 2025 net product revenue of $868.5 million for WAKIX. The company ended the quarter with $882.5 million in cash equivalents and investments.

- The company issued 2026 guidance for WAKIX net revenue of $1 billion-$1.04 billion, anticipating blockbuster status for the first time. This growth is supported by an expansion of field-based teams by almost 20%.

- WAKIX received FDA approval for cataplexy in pediatric patients 6 years of age and older. Harmony Biosciences is also advancing its next-generation pitolisant franchise, with Pitolisant GR on track for NDA submission in Q2 2026 and Pitolisant HD expecting top-line data in 2027.

- Harmony Biosciences has settled with 6 of 7 ANDA filers, securing generic entry for WAKIX no sooner than March 2030 if pediatric exclusivity is granted, while continuing to vigorously defend its intellectual property.

- Harmony Biosciences reported net product revenue of $243.8 million for Q4 2025 and $868.5 million for the full year 2025, reflecting 21% and 22% year-over-year growth, respectively.

- The company provided 2026 net revenue guidance for WAKIX between $1.0 billion and $1.04 billion, aiming for blockbuster status.

- GAAP net income for Q4 2025 was $22.5 million, while Non-GAAP adjusted net income was $33.4 million.

- Key business updates include FDA approval for WAKIX's pediatric cataplexy indication on February 13th, Pitolisant GR NDA submission on track for Q2 2026, and settlements with 3 additional generic filers for WAKIX, allowing generic launches no earlier than March 2030 if pediatric exclusivity is granted.

- The pipeline continues to advance with the Orexin-2 Agonist (BP1.15205) Phase 1 trial ongoing (clinical data expected mid-2026) and EPX-100 Phase 3 trials for Dravet and Lennox-Gastaut syndromes enrolling (topline data anticipated 1H 2027).

- Harmony Biosciences reported net product revenue of $868.5 million for the full year 2025, representing 22% year-on-year growth.

- The company reiterated its 2026 WAKIX net revenue guidance of $1.0 billion to $1.04 billion, projecting blockbuster status.

- For the full year 2025, GAAP net income was $158.7 million, or $2.71 per diluted share.

- Key strategic developments include the Pitolisant GR NDA submission on track for Q2 2026 to extend the franchise into the 2040s, and settlements with 3 additional generic filers, allowing generic products to launch no earlier than March 2030 if pediatric exclusivity is granted.

- The FDA approved pitolisant (WAKIX) for the treatment of cataplexy in pediatric patients aged 6 and older with narcolepsy, making it the first-and-only non-scheduled treatment option for pediatric and adult narcolepsy patients with or without cataplexy.

- Harmony Biosciences is pursuing pediatric exclusivity for WAKIX, which, if granted, would add an additional six months of U.S. regulatory exclusivity for the drug franchise.

- A 5-year European post-authorization safety study confirmed pitolisant is generally safe and well tolerated in narcolepsy patients, providing long-term real-world safety data.

- Harmony's financial profile includes a $2.15 billion market capitalization, approximately $825.9 million in revenue, a 33.8% three-year revenue growth rate, and a 22.5% net margin.

- UBS analyst downgraded Harmony to Neutral with a $46 price target, cautioning that the stock may remain range-bound as major catalysts are expected beyond 2027.

- Harmony Biosciences announced that the U.S. Food and Drug Administration (FDA) has approved WAKIX® (pitolisant) for the treatment of cataplexy in pediatric patients 6 years of age and older with narcolepsy.

- This approval makes WAKIX the first-and-only FDA-approved non-scheduled treatment for both pediatric and adult narcolepsy patients with or without cataplexy.

- The company is actively pursuing pediatric exclusivity for WAKIX, which, if granted, would add an additional six months of regulatory exclusivity.

- Harmony Biosciences aims to further grow and expand the value of pitolisant through additional indications and next-generation formulations, with utility patents filed out to 2044.

- Harmony Biosciences projects WAKIX net revenue of $1 billion to $1.04 billion for 2026, aiming for blockbuster status, building on $868 million achieved in 2025.

- The company is progressing its late-stage pipeline with key milestones including the NDA submission for Pitolisant GR in Q2 2026 (anticipated PDUFA in Q1 2027) and Phase 3 trials initiated in Q4 2025 for Pitolisant HD, with top-line data expected in 2027.

- Additional catalysts include top-line data in 2026 for the Pitolisant program in Prader-Willi syndrome and mid-2026 for the RxEN2 receptor agonist Phase 1 clinical PK data.

- Harmony maintains a strong financial profile, reporting over $770 million on the balance sheet at the end of Q3 2025, which supports pipeline development, commercial expansion, and business development initiatives.

- WAKIX is on track to secure pediatric exclusivity, extending its Loss of Exclusivity (LOE) to Q3 2030.

- Harmony Biosciences anticipates WAKIX net revenue to reach $1 billion to $1.04 billion in 2026, achieving blockbuster status, building on $868 million in 2025.

- The company reported a strong financial profile with $770 million on the balance sheet as of Q3 2025, enabling self-funding of its pipeline and commercial expansion.

- Harmony is advancing a robust late-stage pipeline with several upcoming catalysts, including the NDA submission for Pitolisant GR in Q2 2026 (PDUFA Q1 2027), top-line data for Pitolisant HD in 2027 (PDUFA 2028), and top-line data for EPX100 in H1 2027 (PDUFA 2028).

- Pediatric exclusivity for WAKIX is expected to extend its Loss of Exclusivity (LOE) from Q1 2030 to Q3 2030, with the Prader-Willi syndrome study fulfilling the final requirement for this extension.

Quarterly earnings call transcripts for Harmony Biosciences Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more