Earnings summaries and quarterly performance for Johnson Controls International.

Executive leadership at Johnson Controls International.

Joakim Weidemanis

Chief Executive Officer

Anu Rathninde

Vice President and President, APAC

John Donofrio

Executive Vice President and General Counsel

Julie Brandt

Vice President and President, Global Commercial & Field Operations

Lei Schlitz

Vice President and President, Global Products & Solutions

Marc Vandiepenbeeck

Executive Vice President and Chief Financial Officer

Richard Lek

Vice President and President, EMEA

Todd Grabowski

Vice President and President, Americas

Board of directors at Johnson Controls International.

Ayesha Khanna

Director

Gretchen Haggerty

Director

Jean Blackwell

Director

John Young

Director

Jürgen Tinggren

Lead Independent Director

Mark Vergnano

Chairman of the Board

Patrick Decker

Director

Pierre Cohade

Director

Roy Dunbar

Director

Swamy Kotagiri

Director

Tim Archer

Director

Research analysts who have asked questions during Johnson Controls International earnings calls.

Andrew Obin

Bank of America

7 questions for JCI

Christopher Snyder

Morgan Stanley

7 questions for JCI

Julian Mitchell

Barclays Investment Bank

7 questions for JCI

Nigel Coe

Wolfe Research, LLC

7 questions for JCI

Scott Davis

Melius Research

7 questions for JCI

Amit Mehrotra

UBS

6 questions for JCI

Joe Ritchie

Goldman Sachs

4 questions for JCI

Steve Tusa

JPMorgan Chase & Co.

4 questions for JCI

Andrew Kaplowitz

Citigroup

3 questions for JCI

C. Stephen Tusa

JPMorgan Chase & Co.

3 questions for JCI

Deane Dray

RBC Capital Markets

3 questions for JCI

Jeffrey Sprague

Vertical Research Partners

3 questions for JCI

Joe O'Dea

Wells Fargo

3 questions for JCI

Joseph Ritchie

Goldman Sachs

3 questions for JCI

Nicole DeBlase

BofA Securities

3 questions for JCI

Noah Kaye

Oppenheimer & Co. Inc.

3 questions for JCI

Andy Kaplowitz

Citigroup Inc.

2 questions for JCI

Jeff Sprague

Vertical Research

2 questions for JCI

Joseph O'Dea

Wells Fargo & Company

2 questions for JCI

Joseph O'Dea

Wells Fargo

1 question for JCI

Nicole DeBlase

Deutsche Bank

1 question for JCI

Sahil Manocha

RBC Capital Markets

1 question for JCI

Stephen Volkmann

Jefferies

1 question for JCI

Recent press releases and 8-K filings for JCI.

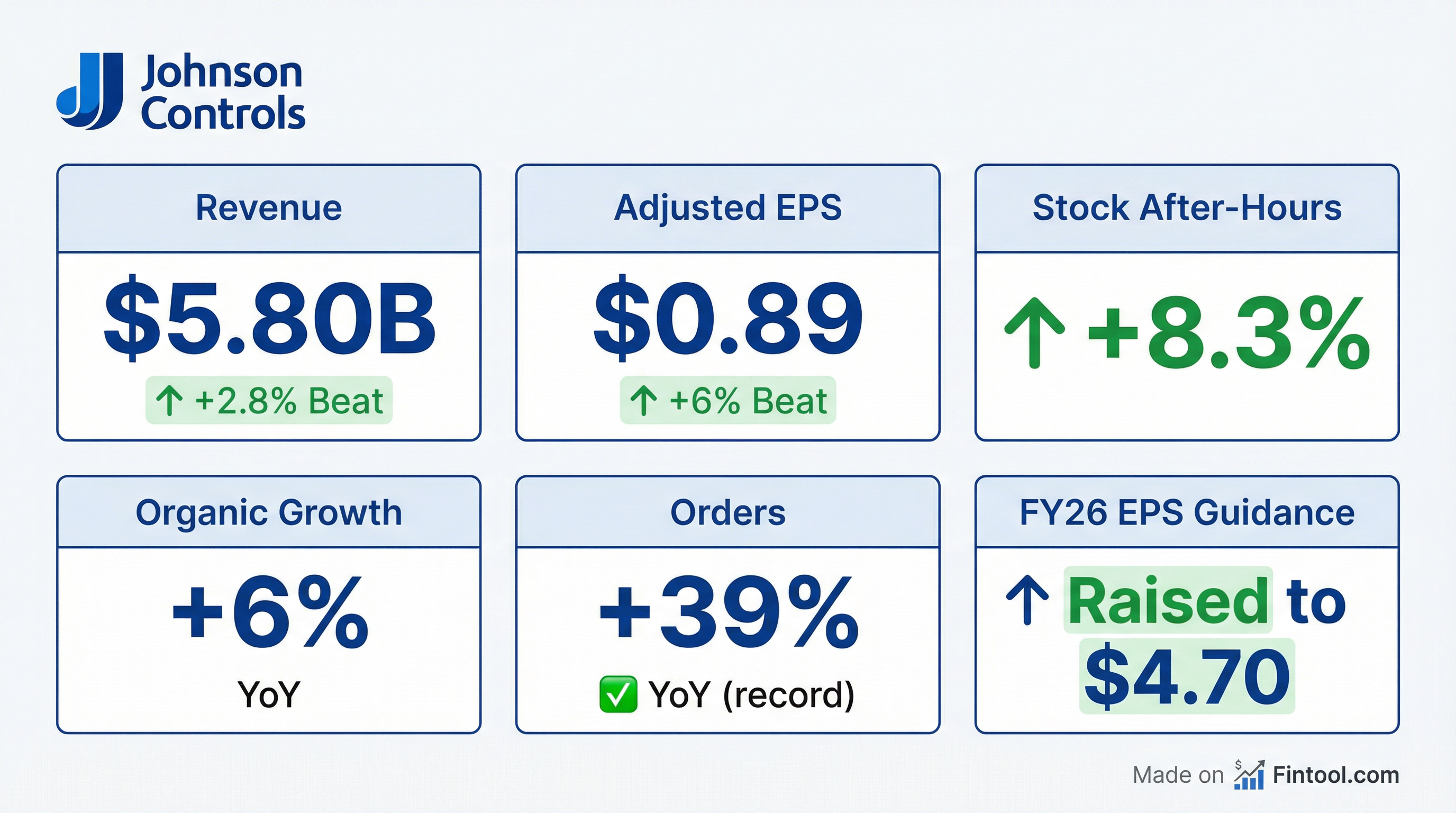

- Organic sales growth of 6% with broad-based strength

- Adjusted EBIT margin expanded 190 bps to 12.4%

- Adjusted EPS rose 39% to $0.89, with orders up ~40% and backlog at $18 billion

- Raised full-year 2026 adjusted EPS guidance by ~25% to $4.70, expecting ~100% free cash flow conversion

- Orders rose nearly 40% year-over-year; record backlog reached $18 billion (up 20%), led by strong data center and life science demand.

- Revenue grew 6% YoY; adjusted EBIT margin expanded 190 bps to 12.4%; adjusted EPS was $0.89 (up ~40%); organic sales +6%.

- Raised full-year guidance: adjusted EPS to ~$4.70 (≈25% growth), maintaining mid-single-digit organic sales growth and 100% free cash flow conversion.

- Launched new data center cooling platforms—YDAM (up to 3.5 MW), YK-HT (widest operating range)—and the Smart Ready Chiller for enhanced insights and service capabilities.

- Organic revenue grew 6%, orders increased nearly 40%, adjusted EBIT margin expanded 190 bps to 12.4%, and adjusted EPS of $0.89; backlog reached $18 billion, up 20%

- Raised full-year adjusted EPS guidance to $4.70 (≈25% growth), with mid-single digit organic sales growth, ~50% operating leverage, and ~100% free cash flow conversion

- Record backlog driven by data center projects and strong life sciences orders; regional orders: Americas +56%, EMEA +8%, APAC +10%

- Launched new data-center cooling solutions: YDAM chiller (3.5 MW, +20% capacity density), YK-HT chiller (broad operating range, saves up to 9 M gallons of water/year), and Smart Ready Chiller service platform

- Appointed Susan Hughes as APAC president to enhance regional execution and business system rollout

- Q1 revenue grew 6%, orders increased nearly 40%, adjusted EBIT margin expanded 190 bps to 12.4%, and adjusted EPS rose nearly 40%

- Record backlog drove raising full-year adjusted EPS guidance to $4.70 (≈25% growth), with expectations for mid-single-digit organic sales growth and ~50% operating leverage

- Net debt declined to 2.2× net debt/EBITDA, free cash flow conversion remains ≈100%, and capital allocation continues to prioritize investment, balance sheet strength, and shareholder returns

- Introduced two high-density data center chillers (YDAM and YK-HT) and the Smart Ready Chiller offering 10× the digital insights to support advanced cooling and proactive service models

- Q1 sales increased 7% to $5.8 billion; GAAP EPS of $0.90 and adjusted EPS of $0.89.

- Organic orders grew 39%, driving backlog to $18.2 billion, up 20% year-on-year.

- Fiscal 2026 adjusted EPS guidance raised to $4.70 (from $4.55) with mid-single-digit organic sales growth and ~50% operating leverage.

- Johnson Controls delivered $5.797 billion in Q1 FY26 net sales, up 7% year-over-year, with 6% organic growth driven by Americas (6%), EMEA (4%) and APAC (8%).

- Income from continuing operations was $555 million, translating to diluted EPS of $0.90, versus $363 million and $0.55 in Q1 FY25.

- Cash provided by operating activities reached $611 million, free cash flow was $531 million, with free cash flow conversion of 96%; the company paid $245 million in dividends.

- Johnson Controls raised its full-year FY26 adjusted EPS guidance to $4.70 (from $4.55) and maintains assumptions of mid-single digit organic sales growth, ~50% operating leverage and ~100% adjusted free cash flow conversion.

- Q4 FY 2025 organic revenue grew 4%, segment margin expanded 20 bps to 18.8%, adjusted EPS reached $1.26 (+14%), available cash was $400 million, net debt was 2.4×, and full-year free cash flow conversion was 102%.

- FY 2025 sales rose 6%, segment margins widened by 100 bps, adjusted EPS increased 17%, orders grew 7%, and backlog expanded 13% to a record $15 billion.

- Updated long-term growth algorithm targets mid-single-digit organic revenue growth, > 30% operating leverage, double-digit EPS growth, and ~ 100% free cash flow conversion; FY 2026 guidance calls for Q1 organic growth ~ 3%, operating leverage ~ 55%, adjusted EPS ~ $0.83, and full-year adjusted EPS ~ $4.55 (+20%) with ~ 50% operating leverage.

- Early gains from the proprietary business system include > 60% more customer-facing time for HVAC sellers and on-time delivery > 95% in a key chiller plant.

- Organic sales growth of 4% in Q4, driving 6% growth for full-year FY25.

- FY25 Adjusted Segment EBITA margin expanded 100 bps to 17.1%, and Adjusted EPS rose 17% to $3.76.

- Q4 orders grew 6% organically, with backlog up 13% to $14.9 billion, supporting future visibility.

- Strong cash generation: FY25 free cash flow conversion at 102%, with net debt/EBITDA at 2.4x and net debt of $9.5 billion at quarter end.

- FY26 outlook: Adjusted EPS guidance of ~$4.55 and organic revenue growth targeted at ~MSD.

- Fiscal 2025 sales grew 6%, segment margins expanded 100 bps, adjusted EPS increased 17%, free cash flow conversion reached 102%, and backlog ended at $15 B (+13%).

- Q4 2025 organic revenue was up 4%, segment margin reached 18.8% (+20 bps), adjusted EPS was $1.26 (+14%), available cash was $400 M, net debt was 2.4×, and backlog remained at a record $15 B.

- Fiscal 2026 guidance calls for mid-single-digit organic revenue growth, ~50% operating leverage, adjusted EPS of $4.55 (>20% growth), and ~100% free cash flow conversion; Q1 guide: organic sales ~3%, leverage ~55%, EPS $0.83.

- Launched coolant distribution units for data center liquid cooling and invested in Excelsius cold plate technology; awarded Zurich waste‐to‐heat project supplying ~15,000 homes, reinforcing thermal management and decarbonization leadership.

- Rolling out a proprietary business system (Simplify, Accelerate, Scale) to boost productivity; capital allocation priorities remain organic investment, dividends & share buybacks, and selective M&A.

- Johnson Controls reported 6% sales growth, 100 bp segment margin expansion, 17% adjusted EPS increase and 102% free cash flow conversion in fiscal 2025; orders grew 7% and backlog reached a record $15 billion (+13%).

- Regional Q4 performance saw Americas adjusted EBITDA margins improve by 50 bp to 19.9%, EMEA margins expand 30 bp to 15.6%, while APAC margins declined 190 bp to 17.8%; backlog remained at $15 billion.

- Launched a coolant distribution unit for AI-driven data centers and made a strategic investment in Excelsius to advance next-generation cold plate technologies, enhancing its end-to-end thermal management offering.

- Fiscal 2026 guidance includes approximately 3% Q1 organic sales growth, 55% operating leverage and $0.83 Q1 adjusted EPS; full-year targets mid-single-digit organic growth, 50% operating leverage, $4.55 adjusted EPS (+20%) and ~100% free cash flow conversion.

Quarterly earnings call transcripts for Johnson Controls International.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more