Earnings summaries and quarterly performance for Lloyds Banking Group.

Research analysts who have asked questions during Lloyds Banking Group earnings calls.

Aman Rakkar

Barclays PLC

3 questions for LYG

Amit Goel

Mediobanca S.p.A.

3 questions for LYG

Benjamin Caven-Roberts

The Goldman Sachs Group, Inc.

3 questions for LYG

Benjamin Toms

RBC Capital Markets

3 questions for LYG

Christopher Cant

Autonomous Research

3 questions for LYG

Guy Stebbings

BNP Paribas

3 questions for LYG

Edward Hugo Firth

Stifel

2 questions for LYG

Jason Napier

UBS Group AG

2 questions for LYG

Jonathan Richard Pierce

Numis

2 questions for LYG

Andrew Coombs

Citigroup

1 question for LYG

Edward Firth

Keefe, Bruyette & Woods (KBW)

1 question for LYG

Jonathan Pierce

Jefferies

1 question for LYG

Robin Down

HSBC

1 question for LYG

Sheel Shah

J.P. Morgan

1 question for LYG

Recent press releases and 8-K filings for LYG.

- Lloyds Banking Group plc is issuing $1,250,000,000 aggregate principal amount of 4.241% Senior Callable Fixed to Fixed Rate Notes due 2030, $1,000,000,000 aggregate principal amount of 5.668% Senior Callable Fixed to Fixed Rate Notes due 2047, and $500,000,000 aggregate principal amount of Senior Callable Floating Rate Notes due 2030.

- The underwriting agreement for these notes was dated February 3, 2026, and the company filed a 6-K report on February 4, 2026, in connection with this issuance.

- The underwriters for the offering include BMO Capital Markets Corp., J.P. Morgan Securities LLC, Lloyds Securities Inc., Morgan Stanley & Co. LLC, Santander US Capital Markets LLC, and TD Securities (USA) LLC.

- Lloyds Banking Group plc has commenced a share buyback programme on January 30, 2026.

- The programme is authorized to repurchase up to £1.75 billion of ordinary shares.

- The buyback will run until December 31, 2026, with the company intending to cancel the purchased shares to reduce ordinary share capital.

- Goldman Sachs International has been engaged to conduct the share buyback programme independently on the Company's behalf.

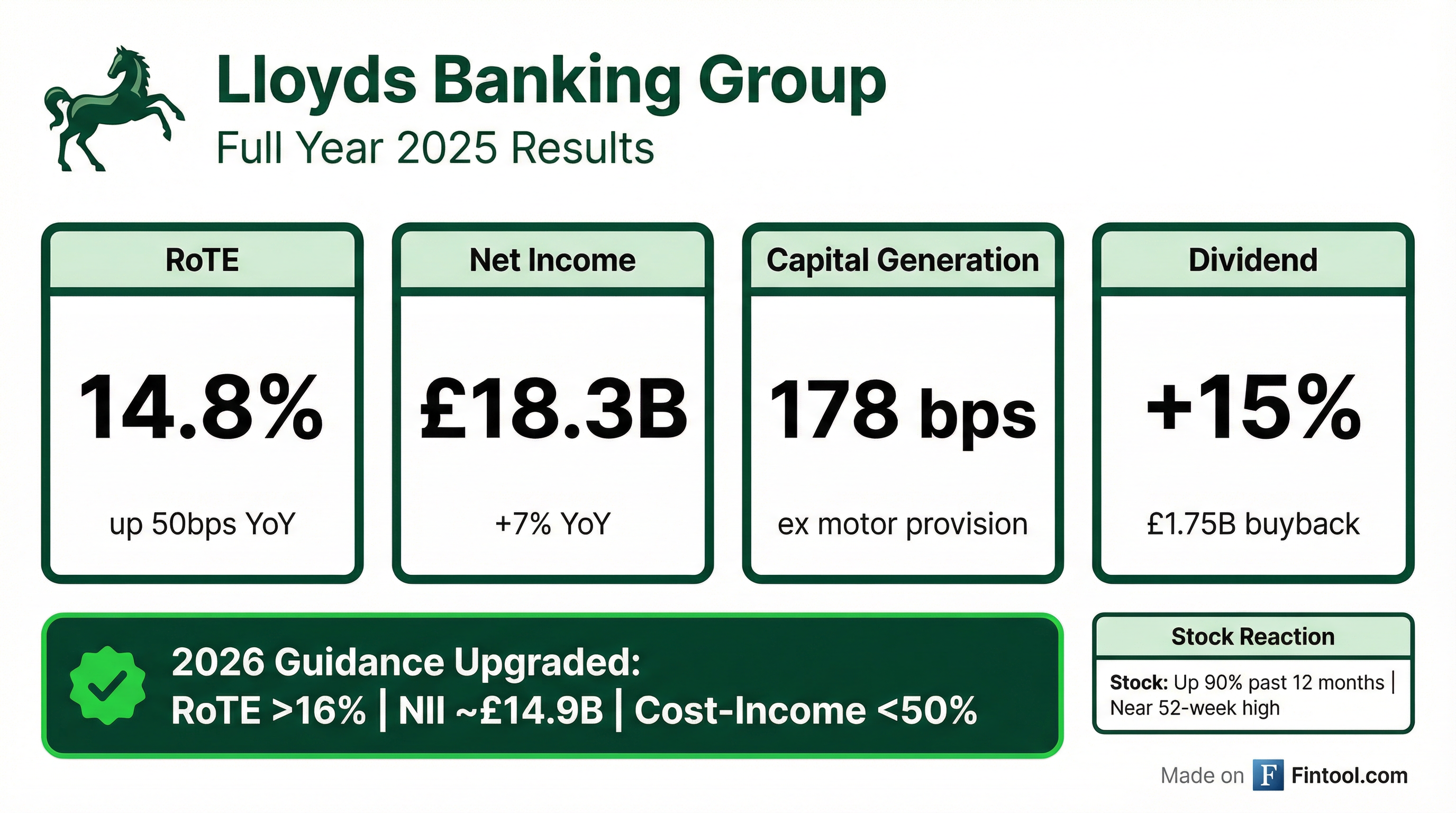

- Lloyds Banking Group plc reported a statutory profit before tax of £6,661 million for 2025, marking a 12% increase from 2024, with basic earnings per share rising to 7.0 pence.

- Total income grew by 8% to £19,422 million in 2025, primarily driven by an 8% increase in net interest income to £13,230 million.

- The Common Equity Tier 1 (CET1) capital ratio stood at 14.0% at 31 December 2025, a slight decrease from 14.2% in 2024, while risk-weighted assets increased to £235.5 billion.

- The Board recommended a total ordinary dividend of 3.65 pence per share for 2025, a 15% increase year-on-year, and announced an intention to implement an ordinary share buyback of up to £1.75 billion by the end of 2026.

- A remediation charge of £968 million was recognized in 2025, including £800 million for motor finance commission arrangements, bringing the total provision for motor finance to £1,950 million. The impairment charge also increased to £795 million in 2025.

- Lloyds Banking Group plc reported a statutory profit before tax of £6.7 billion for 2025, a 12% increase from 2024, with earnings per share of 7.0 pence.

- The Group achieved underlying net interest income of £13.6 billion (up 6%) and underlying other income of £6.1 billion (up 9%) in 2025, contributing to a return on tangible equity of 12.9%.

- Total shareholder distributions for 2025 are approximately £3.9 billion, comprising an increased final ordinary dividend of 2.43 pence per share and an ordinary share buyback of up to £1.75 billion.

- For 2026, the Group expects underlying net interest income of approximately £14.9 billion and a return on tangible equity greater than 16%.

- Lloyds Banking Group delivered a strong financial performance in 2025, achieving a return on tangible equity of 14.8% (excluding motor provision) and 9% growth in Other Operating Income (OOI).

- The Group announced a 15% increase in the ordinary dividend, totaling GBP 3.65 pence per share, and a share buyback of up to GBP 1.75 billion, leading to a total capital return of up to GBP 3.9 billion for 2025.

- Management upgraded its 2026 guidance, targeting a return on tangible equity of greater than 16%, Net Interest Income (NII) of around GBP 14.9 billion, and a cost-income ratio below 50%.

- The company expects capital generation to exceed 200 basis points in 2026 and projects a day one Risk-Weighted Assets (RWA) reduction of GBP 6 billion-GBP 8 billion from Basel 3.1 implementation in 2027.

- Lloyds Banking Group reported a strong financial performance for FY 2025, with statutory profit after tax of GBP 4.8 billion and a return on tangible equity of 14.8% (excluding the Q3 motor provision). Net income increased by 7% to GBP 18.3 billion, driven by 6% growth in Net Interest Income (NII) and 9% growth in Other Operating Income (OOI).

- The company announced a 15% increase in the ordinary dividend for 2025, totaling 3.65 pence per share, alongside a share buyback of up to GBP 1.75 billion, bringing the total capital return to GBP 3.9 billion.

- Strategic initiatives have generated GBP 1.4 billion in additional revenues to date and GBP 1.9 billion in gross cost savings. The target for additional revenues from strategic initiatives for 2026 has been upgraded to circa GBP 2 billion.

- For 2026, Lloyds Banking Group upgraded its return on tangible equity target to greater than 16% and expects Net Interest Income (NII) to be around GBP 14.9 billion , with a cost-income ratio below 50%. The group also anticipates capital generation of more than 200 basis points.

- Lloyds Banking Group reported strong full-year 2025 results with statutory profit after tax of GBP 4.8 billion and a return on tangible equity of 14.8% (excluding the Q3 motor provision). Net income grew 7% to GBP 18.3 billion, driven by 6% growth in Net Interest Income (NII) to GBP 13.6 billion and 9% growth in Other Operating Income (OOI).

- The company announced a 15% increase in the ordinary dividend for 2025, taking the total to 3.65 pence per share, and a new share buyback program of up to GBP 1.75 billion, resulting in a total capital return of up to GBP 3.9 billion.

- For 2026, LYG upgraded its guidance, targeting a return on tangible equity greater than 16% and expecting NII of around GBP 14.9 billion, representing a 9% increase from 2025. Capital generation is projected to be more than 200 basis points, and the cost-income ratio is expected to be below 50%.

- Strategic initiatives are accelerating, with 50 Gen AI use cases scaled in 2025, contributing GBP 50 million in P&L benefit, and an expected GBP 100 million benefit in 2026. The strategic initiatives revenue target was upgraded to circa GBP 2 billion.

- Lloyds Banking Group plc announced the completion of its £1.7 billion share buyback programme on December 9, 2025.

- The programme, which was announced on February 21, 2025, resulted in the repurchase of 2,204,109,740 ordinary shares for an aggregate consideration of £1.7 billion by December 8, 2025.

- Lloyds Banking Group comfortably passed the 2025 Bank Capital Stress Test (BCST) conducted by the Bank of England (BoE) on December 2, 2025, and is not required to take any capital actions.

- The Group's stressed CET1 ratio was calculated at 10.9% and its stressed leverage ratio at 4.6%, both significantly exceeding the BoE's minimum requirements of 5.9% and 3.3% respectively.

- The stress test scenario was highly severe, simulating a global aggregate supply shock, deep recessions, rapidly rising interest rates, and significant falls in property prices and GDP, surpassing the severity of the last global financial crisis.

- This strong performance reflects the Group's prudent balance sheet management and robust capital position, with a pro-forma CET1 ratio of 13.5% and a UK leverage ratio of 5.5% as of December 31, 2024.

- Lloyds Banking Group's CFO, William Chalmers, indicated a constructive macroeconomic backdrop for banks, with modest GDP growth of 1.3% this year and 1% next year, and unemployment peaking around 5%.

- The bank anticipates £13.6 billion in Net Interest Income (NII) this year, with material growth expected in 2026 and beyond, driven by a structural hedge yielding £5.4 billion this year and growing by a further £1.5 billion next year.

- Other Operating Income (OOI) grew 9% year-to-date and year-over-year in Q3, with similar growth rates expected for the remainder of this year and into 2026, partly supplemented by the recent acquisition of Lloyds Wealth.

- The company maintains rigorous cost discipline, targeting approximately £9.7 billion in costs this year and expecting flatter, sub-inflation cost growth in 2026, aiming for a sub-50% cost-to-income ratio in 2026.

- Lloyds expects strong capital generation of 145 basis points this year (or 175 basis points excluding motor provision) and over 200 basis points in 2026, supporting a 15% increase in dividends at the half-year and continued share buybacks towards a 13% CET1 ratio target by 2026.

Quarterly earnings call transcripts for Lloyds Banking Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more