Earnings summaries and quarterly performance for PACCAR.

Executive leadership at PACCAR.

R. Preston Feight

Chief Executive Officer

Brice Poplawski

Senior Vice President and Chief Financial Officer

C. Michael Dozier

Executive Vice President

Darrin Siver

Executive Vice President

John Rich

Senior Vice President and Chief Technology Officer

Kevin Baney

Executive Vice President

Laura Bloch

Senior Vice President

Mark Pigott

Executive Chairman

Board of directors at PACCAR.

Alison Carnwath

Director

Barbara Hulit

Director

Brice Hill

Director

Cynthia Niekamp

Director

Ganesh Ramaswamy

Director

John Pigott

Director

Kirk Hachigian

Director

Luiz Pretti

Director

Mark Schulz

Lead Independent Director

Pierre Breber

Director

Research analysts who have asked questions during PACCAR earnings calls.

Angel Castillo Malpica

Morgan Stanley

9 questions for PCAR

Jamie Cook

Truist Securities

9 questions for PCAR

Jeffrey Kauffman

Vertical Research Partners

9 questions for PCAR

Kyle Menges

Citigroup

9 questions for PCAR

Michael Feniger

Bank of America

9 questions for PCAR

Tami Zakaria

JPMorgan Chase & Co.

9 questions for PCAR

David Raso

Evercore ISI

7 questions for PCAR

Jerry Revich

Goldman Sachs Group Inc.

7 questions for PCAR

Scott Group

Wolfe Research

7 questions for PCAR

Stephen Volkmann

Jefferies

7 questions for PCAR

Steven Fisher

UBS

7 questions for PCAR

Chad Dillard

AllianceBernstein

6 questions for PCAR

Rob Wertheimer

Melius Research LLC

4 questions for PCAR

Robert Wertheimer

Melius Research

3 questions for PCAR

Timothy Thein

Raymond James

3 questions for PCAR

Avi Jaroslawicz

UBS Group

2 questions for PCAR

Charles Albert Dillard

Bernstein

2 questions for PCAR

Nick Housden

RBC Capital Markets

2 questions for PCAR

Tim Thein

Raymond James Financial

2 questions for PCAR

Walter Piecyk

LightShed Partners

2 questions for PCAR

Max Liss

Kepler Cheuvreux

1 question for PCAR

Recent press releases and 8-K filings for PCAR.

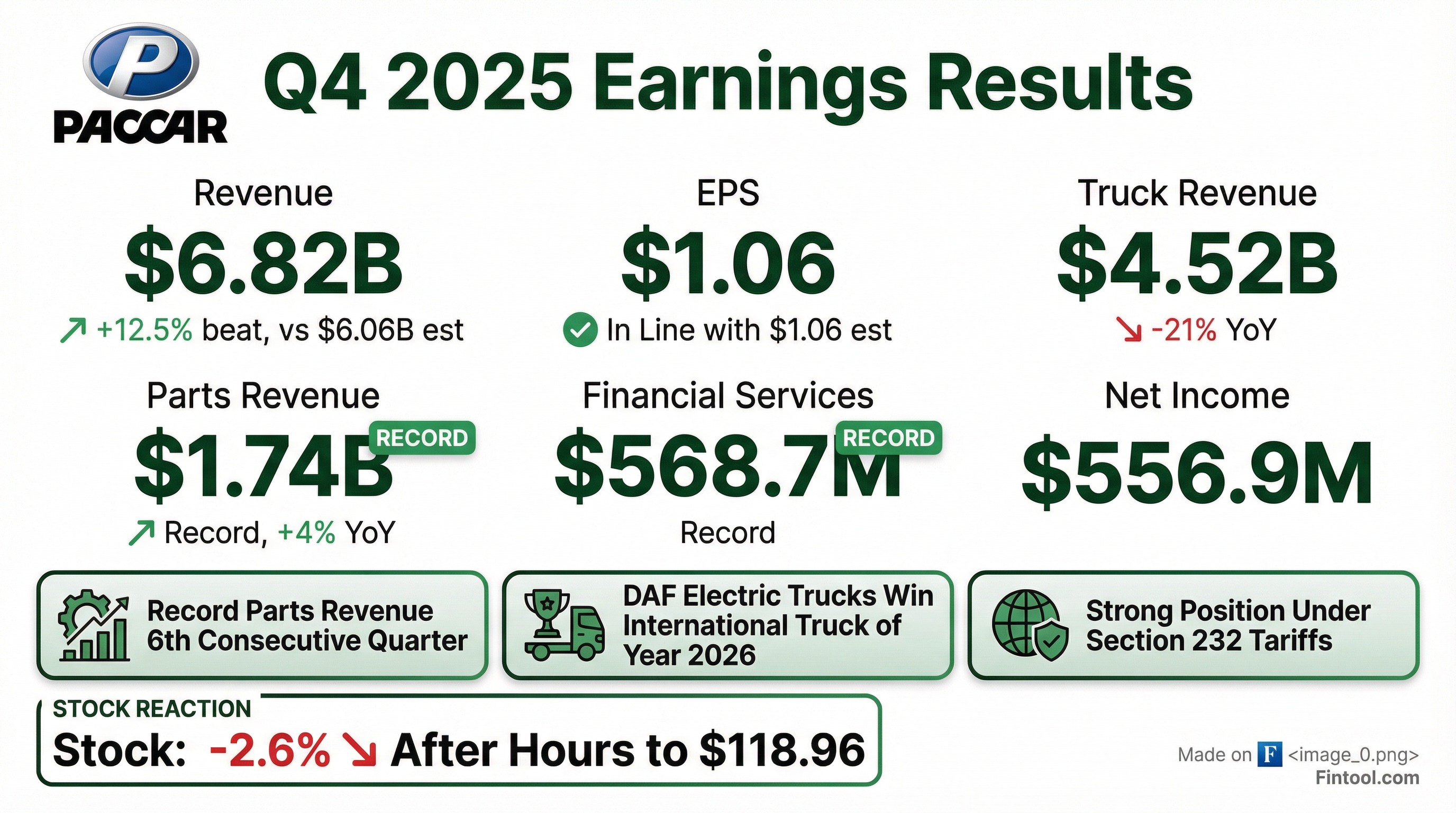

- PACCAR's Q4 revenues were $6.8 B with net income of $557 M; full-year 2025 revenues reached $28.4 B and adjusted net income was $2.64 B, delivering a 9.3% return on revenue.

- For 2026, PACCAR forecasts North American Class 8 retail sales of 230,000–270,000 units, European above-16 t registrations of 280,000–320,000, and South American above-16 t demand of 100,000–110,000 units.

- PACCAR Parts set record Q4 revenues of $1.7 B (pre-tax profit $415 M) and annual revenues of $6.9 B; PACCAR Financial Services posted Q4 revenues of $569 M (pre-tax income $115 M) and annual pre-tax income of $485 M.

- PACCAR delivered 32,900 trucks in Q4 2025 and expects Q1 2026 deliveries at a comparable level, with truck gross margins rising to 12.5%–13% from 12% in Q4.

- PACCAR declared $2.72 per share in 2025 dividends (84th consecutive year) and plans $725–775 M in capital investments and $450–500 M in R&D for 2026.

- Q4 revenue $6.8 B and net income $557 M; FY2025 revenue $28.4 B and adjusted net income $2.64 B (9.3% after-tax return on revenue)

- Dividends of $2.72 per share declared for 2025 (yield ~3%), marking 84 consecutive years of payouts

- PACCAR Parts Q4 revenue $1.7 B (+4%) with pre-tax profit $415 M; FY revenue $6.9 B (+3%) and pre-tax profit $1.67 B

- PACCAR Financial Services Q4 revenue $569 M and pre-tax income $115 M (+10%); FY revenue $2.2 B and pre-tax income $485 M (+11%)

- 2026 market outlook: North American Class 8 sales 230,000–270,000 units; European above-16 t registrations 280,000–320,000; South American above-16 t 100,000–110,000

- Q4 revenue was $6.8 B and net income $557 M; full-year 2025 revenues of $28.4 B and adjusted net income of $2.64 B, with adjusted after-tax return on revenue of 9.3%

- Declared dividends of $2.72 per share in 2025, including a $1.40 year-end payment, marking the 84th consecutive year of dividends and yielding ~3%

- Q4 truck deliveries totaled 32,900 units, with Q1 2026 deliveries expected at comparable levels; truck gross margins projected to rise from 12% in Q4 to 12.5–13% in Q1

- PACCAR Parts posted Q4 revenues of $1.7 B (+4%; pre-tax profit $415 M) and record FY revenues of $6.9 B (+3%; pre-tax $1.67 B), while PACCAR Financial recorded Q4 revenues of $569 M and pre-tax income of $115 M (FY rev $2.2 B; pre-tax $485 M)

- Full-year 2025 revenue of $28.4 B and net income of $2.38 B, lowered by a $264.5 M after-tax litigation charge.

- PACCAR Parts revenue rose 3% to $6.87 B, and Financial Services posted record revenue of $2.2 B with pretax income of $485.4 M; finance assets grew to $22.8 B (+1.8%).

- In Q4 2025, revenue was $6.82 B (–13.8% YoY) and EPS was $1.06, above the $6.12 B consensus.

- U.S. Class 8 truck deliveries declined 15% to 63,300 units in 2025 (Peterbilt 31,764; Kenworth 31,536).

- PACCAR reported Q4 2025 revenue of $6.82 billion and net income of $556.9 million ($1.06 per diluted share)

- Full-year 2025 revenue was $28.44 billion, with net income of $2.38 billion ($4.51 per diluted share) and adjusted net income of $2.64 billion ($5.01 per diluted share)

- PACCAR Parts and PACCAR Financial Services delivered record revenues and strong profits in 2025, supporting diversified earnings growth

- Cash dividends of $2.72 per share were declared for 2025, including a $1.40 year-end payout on January 7, 2026

- PACCAR posted Q3 revenue of $6.7 billion and net income of $590 million, with PACCAR Parts record revenues of $1.72 billion (up 4%) and pre-tax income of $410 million, and PACCAR Financial Services pre-tax income of $126 million.

- Third-quarter gross margins were 12.5%, pressured by steel and aluminum tariffs; Q4 margins are expected around 12% as tariffs peak in October, with new Section 232 duties effective November 1 set to reduce costs and improve competitive position.

- PACCAR forecasts the 2025 U.S./Canada Class 8 market at 238,000–245,000 trucks and 2026 at 230,000–270,000; Europe above-16 ton at 275,000–295,000 (2025) and 270,000–300,000 (2026); South America above-16 ton at 95,000–105,000 (2025 & 2026).

- Capital spending for 2025 is guided to $750–775 million (capex) and $450–465 million (R&D), with 2026 investments of $725–775 million and $450–500 million, supporting next-generation powertrains, ADAS, connected services, and expanded production capacity.

- PACCAR reported Q3 revenues of $6.7 billion and net income of $590 million; PACCAR Parts delivered record quarterly revenues of $1.72 billion with $410 million pretax income, and PACCAR Financial Services posted $126 million pretax income

- 2025 U.S. & Canadian Class 8 market expected at 230,000–245,000 units (2026: 230,000–270,000); European above-16 ton market at 275,000–295,000 units (2026: 270,000–300,000); South America at 95,000–105,000 units for both years

- Q3 gross margin of 12.5% impacted by steel and aluminum tariffs; Q4 margins guided to around 12% with Section 232 tariff relief effective Nov 1 improving costs and competitive position

- 2025 capital expenditures forecast at $750–775 million and R&D at $450–465 million; 2026 capex of $725–775 million and R&D of $450–500 million to support new products and factory expansions

- PACCAR delivered $6.67 billion in consolidated net sales and revenues and net income of $590.0 million (US$1.12 per diluted share) in Q3 2025, down from $8.24 billion and $972.1 million in Q3 2024.

- For the first nine months of 2025, PACCAR earned net income of $1.82 billion (US$3.45 per diluted share), including a $264.5 million after-tax litigation charge, and achieved adjusted net income of $2.08 billion (US$3.95 per diluted share); net sales and revenues were $21.62 billion.

- PACCAR Parts set a quarterly record with $1.72 billion in revenues and $410.0 million pretax profit in Q3 2025, and generated $5.14 billion in nine-month revenues with $1.25 billion pretax income.

- The company forecasts 2025 U.S. and Canada Class 8 truck retail sales of 230,000–245,000 units and expects volumes to increase to 230,000–270,000 vehicles in 2026.

- Q1 2025 Performance: PACCAR reported consolidated revenues of $7.44 billion with GAAP net income of $505.1 million (after a $264.5 million after-tax litigation charge) and adjusted net income of $769.6 million.

- Record Parts Division: Achieved record Parts revenue of approximately $1.7 billion and parts pretax income of about $427 million, reflecting strong operational performance.

- Strategic Investments: Invested $171.9 million in capital projects and incurred $115.4 million in R&D expenses, underlining a commitment to next-generation products.

- Q2 Guidance: Expecting gross margins in the 13%-14% range amid ongoing tariff uncertainties and focused cost management.

- Leadership Changes: Announced the retirement of Harrie Schippers after a 39-year career, with Kevin Baney taking charge of PACCAR Financial Services and Brice promoted to CFO.

- Harrie C. A. M. Schippers, the President and CFO, will retire effective June 2, 2025 after 39 years of service.

- Brice J. Poplawski is promoted to Senior Vice President and CFO effective June 2, 2025, and Kevin D. Baney assumes additional responsibilities for PACCAR Financial Services and Investor Relations.

Quarterly earnings call transcripts for PACCAR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more