Earnings summaries and quarterly performance for Champion Homes.

Executive leadership at Champion Homes.

Tim Larson

President and Chief Executive Officer

Joseph Kimmell

Executive Vice President, Operations

Laurel Krueger

Senior Vice President, General Counsel and Secretary

Laurie Hough

Executive Vice President, Chief Financial Officer and Treasurer

Timothy Burkhardt

Vice President and Controller

Wade Lyall

Executive Vice President, Sales and Business Development

Board of directors at Champion Homes.

Research analysts who have asked questions during Champion Homes earnings calls.

Daniel Moore

CJS Securities, Inc.

7 questions for SKY

Greg Palm

Craig-Hallum Capital Group LLC

6 questions for SKY

Jesse Lederman

Zelman & Associates

6 questions for SKY

Philip Ng

Jefferies

6 questions for SKY

Mike Dahl

RBC Capital Markets

5 questions for SKY

Matthew Bouley

Barclays PLC

4 questions for SKY

Matthew Bouley

Barclays

2 questions for SKY

Elizabeth Langan

Barclays

1 question for SKY

Fiona Shang

Jefferies

1 question for SKY

Jay McCanless

Wedbush Securities

1 question for SKY

Michael Dahl

RBC Capital Markets

1 question for SKY

Recent press releases and 8-K filings for SKY.

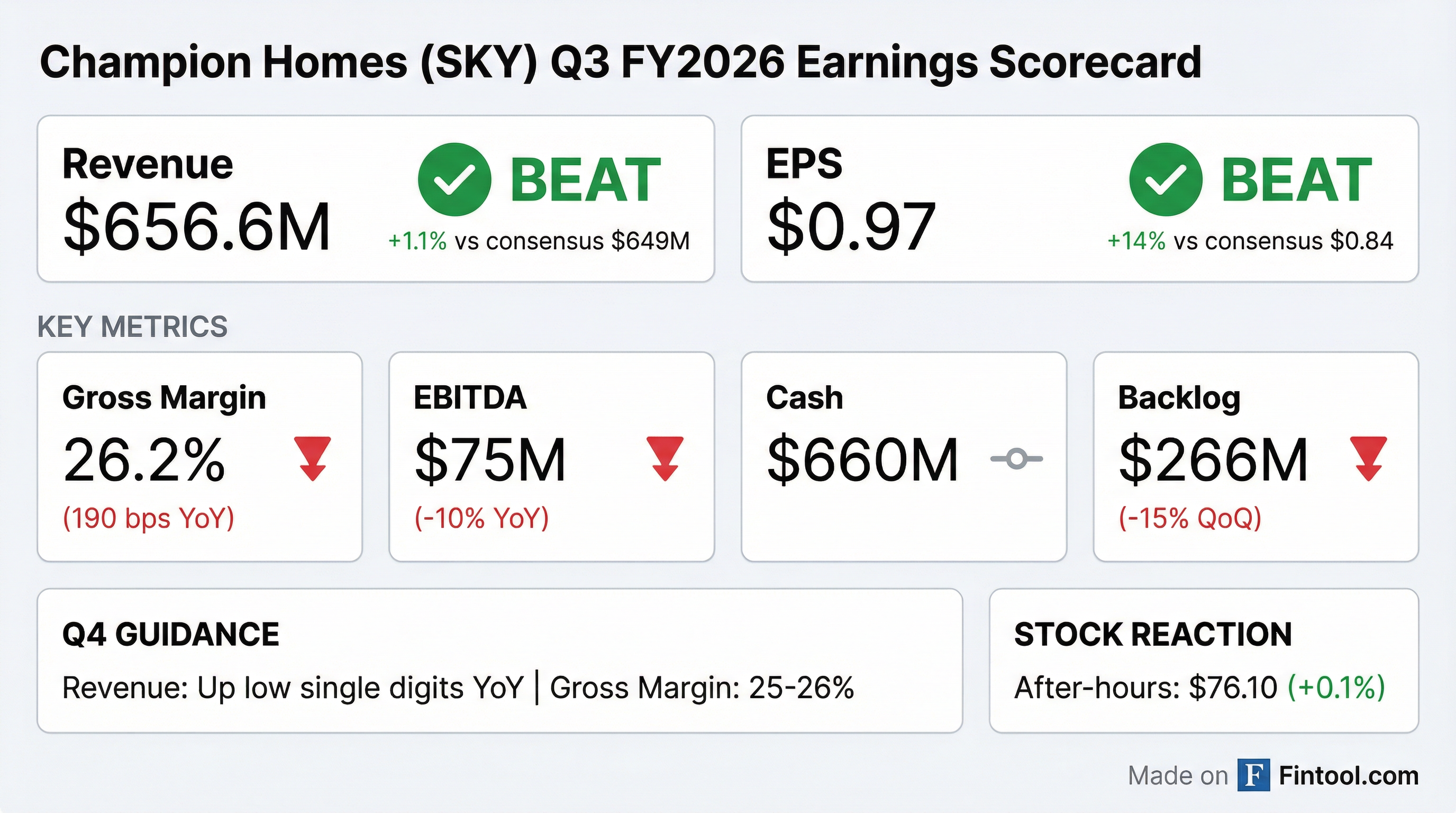

- Champion Homes reported Q3 2026 net sales of $657 million, a 2% increase year-over-year, but net income decreased 12% to $54 million, or $0.97 per diluted share.

- The company's gross margin for Q3 2026 was 26.2%, a 190 basis point decrease compared to the prior year period, primarily due to higher manufacturing material costs and less absorption of fixed costs.

- For Q4 2026, Champion Homes anticipates revenue to be up low single digits versus the prior year and expects gross margin to be in the 25%-26% range, reflecting cautious consumer sentiment and seasonal factors.

- Manufacturing backlogs decreased 15% sequentially to $266 million, with an average lead time of 7 weeks at the end of December.

- Champion Homes maintained a strong cash position with $660 million in cash and cash equivalents as of December 27, 2025, and repurchased $50 million in shares during Q3. The company also expects to receive approximately CAD 189 million from the sale of its 19.7% ownership in ECN Capital.

- Champion Homes reported Q3 2026 net sales of $657 million, a 2% increase year-over-year, with net income decreasing 12% to $54 million, or $0.97 per diluted share.

- For Q4 2026, the company anticipates revenue to be up low single digits year-over-year and gross margin to be in the 25%-26% range.

- Dave McKinstry officially joined as Chief Financial Officer on January 12th, following the retirement of Laurie Hough in December.

- Manufacturing backlogs decreased 15% sequentially to $266 million at the end of December, and the company repurchased $50 million in shares during Q3.

- Champion Homes reported Q3 2026 net sales of $657 million, a 2% increase year-over-year, with net income of $54 million and diluted EPS of $0.97, both down 12% from the prior year.

- The company provided Q4 2026 guidance, expecting revenue to be up low single digits year-over-year and gross margin to be in the 25%-26% range.

- Dave McKinstry officially joined as CFO on January 12, 2026, succeeding Laurie Hough who retired, and Tawn Kelley was elected Chair of the Board in November 2025.

- Champion Homes repurchased $50 million in shares during Q3 2026 and refreshed its $150 million share repurchase authority.

- The sale of Triad's parent company, ECN Capital, is progressing, which will extinguish Champion's 19.7% ownership, delivering approximately CAD 189 million in proceeds.

- Champion Homes reported net sales of $656.6 million, an increase of 1.8%, for the third quarter fiscal 2026. However, net income decreased 11.7% to $54.3 million, and diluted EPS decreased 8.5% to $0.97.

- Adjusted EBITDA for the quarter decreased 10.2% to $74.8 million, with the gross profit margin declining by 190 basis points to 26.2%.

- Operationally, U.S. homes sold decreased 2.6% to 6,270, while the average selling price per U.S. home sold increased 4.6% to $99,300.

- The company repurchased $50.0 million of shares during the quarter, and its Board of Directors approved an increase of $50.0 million to the share repurchase program, refreshing the available amount to $150.0 million.

- Champion Homes reported net sales increased 1.8% to $656.6 million for the third quarter fiscal 2026, while net income decreased 11.7% to $54.3 million and diluted EPS decreased 8.5% to $0.97 compared to the prior-year period.

- The company's U.S. homes sold decreased 2.6% to 6,270, although the average selling price per U.S. home sold increased 4.6% to $99,300.

- Gross profit margin decreased by 190 basis points to 26.2%, primarily due to higher manufacturing materials costs and less absorption of fixed costs.

- Champion Homes repurchased $50.0 million of shares during the quarter, and on January 29, 2026, the board of directors refreshed the share repurchase authorization to provide for $150 million of potential future repurchases.

- Champion Homes reported Q2 2026 net sales of $684 million, an 11% increase year-over-year, with net income attributable to Champion Homes rising to $58 million, or $1.03 per diluted share.

- Gross margin expanded to 27.5%, an increase of 50 basis points from the prior year, driven by lower material input costs and a higher percentage of sales through company-owned retail centers. Manufacturing backlog totaled $313 million, up 4% sequentially.

- The company anticipates third quarter revenue to be flat versus the prior year and expects near-term gross margin to be in the 26% range.

- Champion Homes returned $50 million to shareholders through share repurchases in Q2 and refreshed its $150 million share repurchase authority.

- Champion Homes reported strong financial results for Q2 Fiscal 2026, with net sales increasing 11.0% to $684.4 million and diluted earnings per share (EPS) rising 9.6% to $1.03.

- Net income grew 6.3% to $58.2 million, and Adjusted EBITDA increased 12.3% to $83.4 million.

- The company saw a 3.4% increase in U.S. homes sold to 6,575 and a 6.8% rise in the average selling price per U.S. home sold to $98,700.

- Profitability improved, with gross profit margin expanding by 50 basis points to 27.5% and Adjusted EBITDA margin by 20 basis points to 12.2%.

- Champion Homes repurchased $50.0 million of shares during the quarter, and its Board of Directors refreshed the share repurchase authorization to $150.0 million on October 30, 2025.

Quarterly earnings call transcripts for Champion Homes.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more