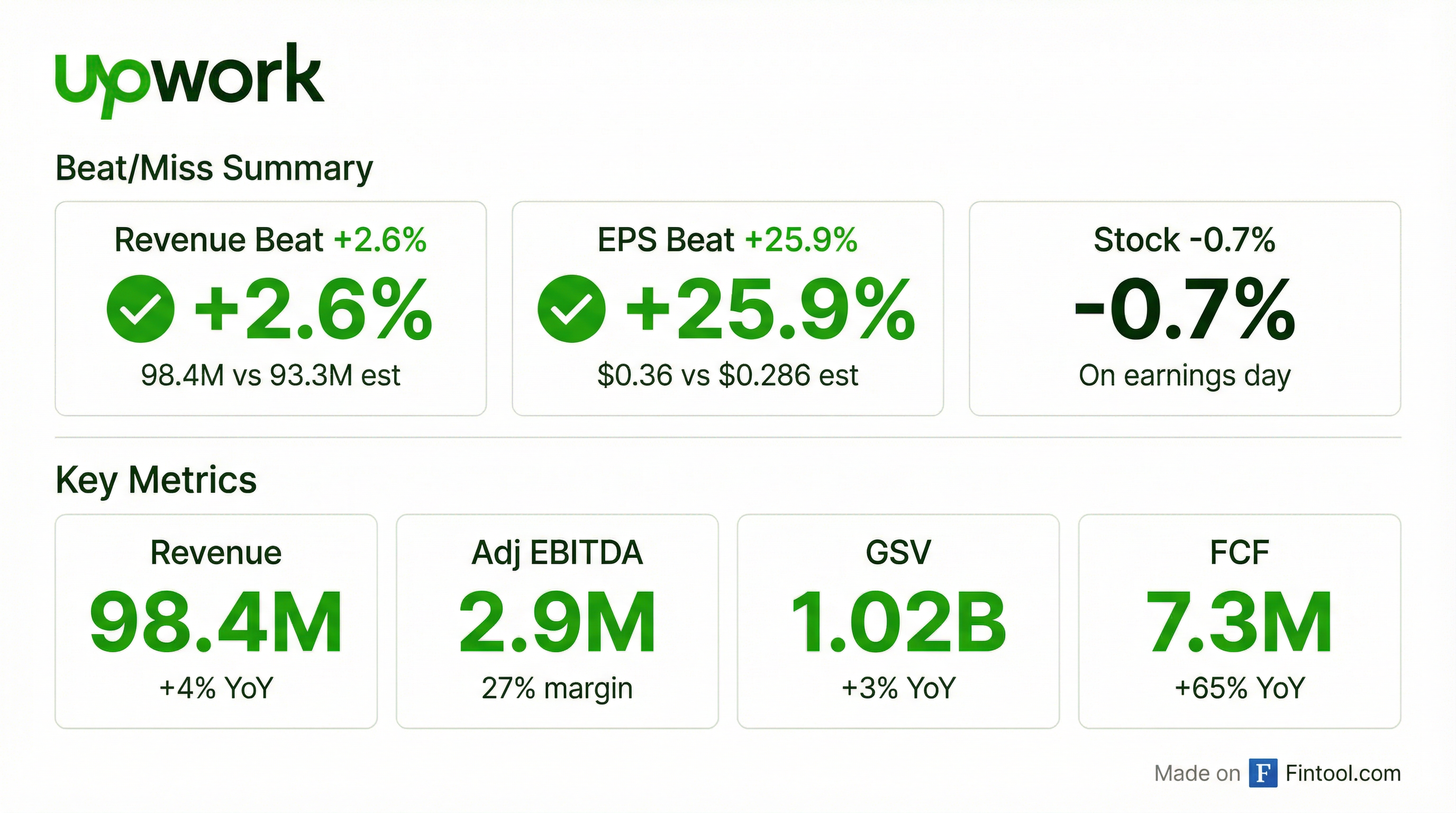

Earnings summaries and quarterly performance for UPWORK.

Executive leadership at UPWORK.

Hayden Brown

President and Chief Executive Officer

David Bottoms

GM, Marketplace

Erica Gessert

Chief Financial Officer

Sunita Solao

Chief People Officer

Andrew Rabinovich

Chief Technology Officer

Anthony Kappus

Chief Operating Officer

Jacob McQuown

Chief Legal Officer

Board of directors at UPWORK.

Research analysts who have asked questions during UPWORK earnings calls.

Maria Ripps

Morgan Stanley

5 questions for UPWK

Marvin Fong

BTIG, LLC

5 questions for UPWK

Brad Erickson

RBC Capital Markets

4 questions for UPWK

Rohit Kulkarni

ROTH Capital Partners, LLC

4 questions for UPWK

Andrew Boone

JMP Securities

3 questions for UPWK

Eric Sheridan

Goldman Sachs

3 questions for UPWK

John Byun

Jefferies Financial Group Inc.

3 questions for UPWK

Bernie McTernan

Needham

2 questions for UPWK

Josh Chan

UBS

2 questions for UPWK

Joshua Chan

UBS Group AG

2 questions for UPWK

Matt Condon

Citizens Financial Group, Inc.

2 questions for UPWK

Ron Josey

Citi

2 questions for UPWK

Sang-Jin Byun

Jefferies

2 questions for UPWK

Stefanos Crist

Needham & Company, LLC

2 questions for UPWK

Bernard McTernan

Needham & Company

1 question for UPWK

Jake Hallac

JMP Securities

1 question for UPWK

Jared Osteen

ROTH Capital Partners

1 question for UPWK

Matthew Condon

Not Specified in Transcript

1 question for UPWK

Ronald Josey

Citigroup Inc.

1 question for UPWK

Recent press releases and 8-K filings for UPWK.

- Upwork reiterated its full-year 2026 guidance, projecting 4%-6% GSV growth, 6%-8% revenue growth, and a 29% adjusted EBITDA margin, despite a challenging macro environment in late 2025 and early 2026.

- Key growth drivers include the AI category, which achieved a $300 million run rate and 50% annual growth in 2025, and the AI companion Uma, contributing a $100 million GSV lift in 2025.

- The Business Plus premium plan, representing 2.5% of GSV at the end of 2025, is anticipated to at least double its GSV contribution in 2026.

- The new Enterprise offering, Lifted, enhanced by 2025 acquisitions, aims to manage all contingent work types for large clients, potentially saving them 10%-30% on staffing programs, with significant acceleration expected in the latter half of 2026.

- The board approved an incremental $300 million stock buyback, reflecting confidence in the company's growth strategy and commitment to its long-term 35% EBITDA margin target.

- Upwork noted a choppy macro environment with deceleration in late 2025 and early 2026, particularly affecting small jobs, and observed that 2025 job openings were the lowest non-recessionary year since 2003.

- The AI category on the platform is a significant growth driver, currently at a $300 million run rate and growing approximately 50% per year, with Upwork's AI companion Uma contributing a $100 million GSV lift in 2025.

- Upwork acquired Bubty and Ascen in 2025 to launch Lifted, an enhanced enterprise offering designed to manage all types of contingent work and potentially save clients 10%-30% on staffing programs, with significant acceleration expected in the back half of 2026.

- The company reiterated its FY 2026 guidance for 4%-6% GSV growth, 6%-8% revenue growth, and 29% adjusted EBITDA margin, and its board approved an incremental $300 million stock buyback.

- The macro environment remains choppy and decelerating in early 2026, particularly impacting small jobs under $300, consistent with broader market trends.

- Upwork reiterated its full-year 2026 guidance for 4%-6% GSV growth, 6%-8% revenue growth, and 29% adjusted EBITDA margin.

- Key growth catalysts for 2026 include the AI category, which is at a $300 million run rate and growing 50% per year, and the Business Plus premium plan, which was 2.5% of GSV at the end of 2025 and is expected to at least double in GSV in 2026.

- The new Enterprise "Lifted" offering, enabled by 2025 acquisitions of Bubty and Ascen, aims to address the $650 billion staffing market by managing all types of contingent work, with the platform launching in the back half of 2026.

- The company's board approved an incremental $300 million stock buyback, reflecting confidence in the growth strategy and current valuations.

- Upwork Inc. (UPWK) announced on February 18, 2026, that its board of directors approved a new $300 million share repurchase program.

- This new authorization follows the company's 2025 deployment of $136 million to repurchase more than 9 million shares.

- The company cited 2025 as a pivotal year with a return to GSV growth and record financial results, enabling them to return value to shareholders and invest in key growth areas.

- The repurchase authorization has no expiration date and allows for discretionary repurchases through various methods.

- Upwork achieved record full year 2025 financial performance with $788 million in revenue and $226 million in adjusted EBITDA, representing a 29% adjusted EBITDA margin. For Q4 2025, adjusted EBITDA was $53 million with a 27% margin.

- The company provided full year 2026 guidance, projecting revenue between $835 million-$850 million (growth of 6%-8%) and adjusted EBITDA between $240 million-$250 million (approximately 29% margin). Q1 2026 revenue is expected to be $192 million-$197 million.

- Growth in AI-related work is significant, with annualized GSV surpassing $300 million in Q4 2025, a 50% increase year-over-year, and clients engaging in AI work spending about three times the average.

- The Business Plus solution for SMBs saw active clients grow 49% sequentially in Q4 2025, with these clients spending almost 2.5 times more than the marketplace average.

- The new enterprise offering, Lifted, secured two new clients and is targeting 25% GSV growth for the enterprise business in 2026, with substantial acceleration anticipated in the second half of the year.

- Upwork reported record full-year 2025 financial performance, with revenue of $788 million and adjusted EBITDA of $226 million, achieving a 29% adjusted EBITDA margin.

- For Q4 2025, GSV grew 3% year-over-year to over $1 billion, and the marketplace take rate increased to 19.0%.

- The company provided full-year 2026 guidance, projecting revenue growth of 6%-8% (between $835 million-$850 million) and an adjusted EBITDA margin of approximately 29% (between $240-$250 million).

- Key growth drivers include AI-related work, which surpassed $300 million in annualized GSV in Q4 2025 (up over 50% year-over-year), and Business Plus GSV, which increased 24% quarter-over-quarter.

- Upwork expects accelerated growth in the second half of 2026 as the Lifted platform integration completes and AI and Business Plus initiatives continue to ramp.

- Upwork achieved record full year 2025 revenue of $788 million, representing 2.4% growth, and adjusted EBITDA of $226 million, with an adjusted EBITDA margin of 29%. For Q4 2025, revenue grew 4% year-over-year, and the adjusted EBITDA margin was 27%.

- The company experienced substantial growth in AI-related work, with GSV from this category exceeding $300 million on an annualized basis in Q4 2025, marking over 50% year-over-year growth. The number of clients engaging in AI work also increased over 50% year-over-year.

- Key growth initiatives showed strong traction: Business Plus (SMB solution) saw active clients grow 49% sequentially in Q4 2025, with these clients spending almost 2.5 times more than the marketplace average. The new Lifted offering for enterprise clients secured two new clients in Q4 and is developing a robust pipeline.

- For full year 2026, Upwork projects revenue between $835 million-$850 million (6%-8% growth) and an Adjusted EBITDA margin of approximately 29% ($240-$250 million). Non-GAAP diluted EPS is expected to be between $1.43 and $1.48.

- In 2025, Upwork generated a record $223 million in free cash flow and utilized $136 million to repurchase over 9 million shares.

- Upwork achieved record revenue of $788 million for fiscal year 2025, with Q4 2025 revenue at $198.4 million, marking a 4% year-over-year increase. Gross Services Volume (GSV) for FY 2025 was $4,028 million, and Q4 2025 GSV grew 3% year-over-year to $1,020.3 million.

- The company reported record annual adjusted EBITDA of $225.6 million in 2025, a 35% increase year-over-year, resulting in a 28.6% margin. Q4 2025 adjusted EBITDA was $52.9 million with a 26.6% margin.

- AI-related work on the platform saw significant growth, with GSV surpassing $300 million on an annualized basis in Q4 2025, an increase of more than 50% from 2024.

- Upwork generated strong free cash flow of $223.1 million for the full year 2025, including $57.3 million in Q4 2025.

- Upwork reported record full-year 2025 revenue of $787.8 million and record adjusted EBITDA of $225.6 million, with fourth-quarter 2025 revenue reaching $198.4 million and GAAP net income of $15.6 million.

- The company provided Q1 2026 revenue guidance of $192 million to $197 million and full-year 2026 revenue guidance of $835 million to $850 million.

- In 2025, Upwork returned $136 million to shareholders through the purchase of 9.3 million shares, with $64 million in remaining authorization as of December 31, 2025.

- GSV from AI-related work surpassed $300 million on an annualized basis in Q4 2025, marking an increase of more than 50% from the prior year.

- Upwork reported record full-year 2025 revenue of $787.8 million and record adjusted EBITDA of $225.6 million, with GAAP net income of $115.4 million.

- For the fourth quarter of 2025, revenue grew 4% year over year to $198.4 million, and adjusted EBITDA increased 5% to $52.9 million.

- The company provided full-year 2026 guidance, expecting revenue between $835 million and $850 million, adjusted EBITDA between $240 million and $250 million, and non-GAAP diluted EPS between $1.43 and $1.48.

- Upwork returned $136 million to shareholders in 2025 through its share repurchase program, purchasing 9.3 million shares.

Quarterly earnings call transcripts for UPWORK.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more