Earnings summaries and quarterly performance for WERNER ENTERPRISES.

Executive leadership at WERNER ENTERPRISES.

Derek Leathers

Chief Executive Officer

Christopher Wikoff

Executive Vice President, Treasurer & Chief Financial Officer

Craig Callahan

Executive Vice President & Chief Commercial Officer

Daragh Mahon

Executive Vice President & Chief Information Officer

Eric Downing

Executive Vice President & Chief Operating Officer

James Johnson

Executive Vice President & Chief Accounting Officer

Jim Schelble

Executive Vice President & Chief Administrative Officer

Marty Nordlund

Executive Vice President of Strategic Partnerships

Nathan Meisgeier

President & Chief Legal Officer

Board of directors at WERNER ENTERPRISES.

Research analysts who have asked questions during WERNER ENTERPRISES earnings calls.

Scott Group

Wolfe Research

6 questions for WERN

Brian Ossenbeck

JPMorgan Chase & Co.

5 questions for WERN

Ravi Shanker

Morgan Stanley

5 questions for WERN

Christian Wetherbee

Wells Fargo

4 questions for WERN

Jason Seidl

TD Cowen

4 questions for WERN

Ken Hoexter

BofA Securities

4 questions for WERN

Richa Harnain

Deutsche Bank

4 questions for WERN

Eric Morgan

Barclays

3 questions for WERN

Tom Wadewitz

UBS Group

3 questions for WERN

Andrew Cox

Stifel

2 questions for WERN

Daniel Imbro

Stephens Inc.

2 questions for WERN

Jordan Alliger

Goldman Sachs

2 questions for WERN

Reed Seay

Stephens Inc.

2 questions for WERN

Andrew Baxter Cox

Stifel, Nicolaus & Company, Incorporated

1 question for WERN

Ariel Rosa

Citigroup

1 question for WERN

Bascome Majors

Susquehanna Financial Group

1 question for WERN

Jeffrey Kauffman

Vertical Research Partners

1 question for WERN

Joe Enderlin

Stephens

1 question for WERN

Recent press releases and 8-K filings for WERN.

- Werner Enterprises observes positive indicators for a market turn, including elevated spot rates and high rejection rates, driven by supply tightening due to regulatory enforcement. Demand is stable, with inventory levels returning to pre-COVID levels.

- The recently completed FirstFleet acquisition is immediately accretive and is projected to generate $18 million in synergies over 18 months, contributing a 300 basis point improvement to operating income on $600 million of revenue.

- With the dedicated segment now comprising approximately 70% of the portfolio, Werner anticipates 300-500 basis points of OR improvement in this segment during the current cycle, targeting double-digit margins by year-end.

- The company expects a Q2 inflection point for its one-way restructuring, which focuses on specialized niches and an asset-light Powerlink solution. This follows a Q1 impact from Storm Fern, which temporarily parked over 50% of the fleet.

- Capital allocation for 2026 prioritizes debt paydown after the FirstFleet acquisition, alongside continued openness to M&A and internal investments.

- Werner Enterprises observes positive market indicators including elevated spot rates and high rejection rates, attributing the tightening supply to regulatory enforcement and driver school closures, which are expected to limit supply growth.

- The company's recent FirstFleet acquisition is a strategic move into pure-play dedicated services, anticipated to be immediately accretive and generate $18 million in synergies over 18 months, boosting operating income by 300 basis points.

- With the dedicated segment growing to approximately 70% of its portfolio after the acquisition and One-Way restructuring, Werner expects 300 to 500 basis points of operating ratio improvement in Dedicated and a Q2 inflection point for the One-Way restructuring to show results.

- Debt paydown is a priority following the FirstFleet acquisition, with the company maintaining leverage in the low twos, while also considering M&A and internal investments.

- Werner Enterprises sees strong indicators of a market turn, with elevated spot rates and rejection rates persisting three weeks post-Storm Fern, alongside ongoing supply enforcement and inventory levels returning to pre-COVID levels.

- The recent FirstFleet acquisition is immediately accretive and strategically increases the dedicated segment to approximately 70% of the portfolio. The company expects $18 million in identified synergies, leading to a 300 basis point improvement in operating income on $600 million of revenue.

- Management anticipates significant margin improvement in the dedicated business, projecting 300-500 basis points of operating ratio improvement in this cycle, with a goal to reach double-digit margins by year-end.

- The ongoing one-way restructuring, which focuses on asset-light solutions and specialized niches, is expected to show a Q2 inflection point in its results.

- Following the acquisition, debt paydown is identified as a likely capital allocation priority for the year, with leverage currently in the low twos.

- Werner Enterprises expresses optimism for demand in the coming months, citing low inventory levels, tax incentives, and a positive ISM, despite the network currently being overbooked.

- Government enforcement actions targeting CDLs, driver schools, and electronic logging are significantly constraining over-the-road trucking capacity, with estimates suggesting an impact on 25% or more of the approximately 1 million trucks in this segment, which the company views as crucial for safety and creating a level playing field.

- The company provided first-half 2026 guidance for one-way truckload revenue per mile of flat to up 3%, while expecting mid-single-digit increases for new contract renewals and anticipating stronger performance in the second half of the year.

- Werner is proactively restructuring its One Way portfolio to enhance profitability and focus on less commoditized niches, and the dedicated services segment shows a very positive outlook with a robust pipeline.

- Werner is in the latter stages of a significant technology journey, including investments in AI, which has contributed to OpEx reductions in logistics. The CEO noted that the market's reaction to recent AI news was an "overreaction," as Werner and other sophisticated companies are also heavily investing in this area.

- Werner Enterprises anticipates an optimistic demand outlook for the coming months, citing factors like low inventory levels and potential rate cuts, while the supply side is expected to tighten significantly due to Department of Transportation enforcement actions, potentially impacting 25% or more of the over-the-road market.

- The company guided for flat to 3% one-way truckload revenue per mile growth for the first half of 2026, but expects mid-single-digit increases in contract rate renewals for one-way, driven by a strategic restructure towards more profitable, specialized areas.

- Werner sees a robust pipeline and positive outlook for its dedicated segment, aiming for low to mid-single-digit rate increases over several years, and is in the "latter innings" of a significant tech journey, including investments in AI.

- Werner Enterprises sees an optimistic market outlook for the trucking industry in the coming months, driven by inventory levels at or below long-term run rates, tax incentives, positive ISM, and potential rate cuts.

- For the first half of 2026, the company guided one-way truckload revenue per mile to be flat to up 3% and dedicated revenue per truck per week to be down 1% to up 2%. The dedicated guide is primarily attributed to the mix effect of the FirstFleet acquisition.

- The company is strategically focusing on its dedicated segment, which now accounts for over two-thirds of its fleet, as it is considered a more stable, defensible, and long-term performing business compared to one-way trucking.

- Werner maintains its long-term mid-cycle margin guidance for its Truckload Transportation Services (TTS) segment at 12%-17% and targets 4-6% for its Logistics segment.

- The company has made significant investments in technology and AI, with its Logistics segment largely converted to a new TMS system and AI capabilities being implemented to enhance efficiency and competitive positioning.

- Werner Enterprises recently acquired FirstFleet, a pure-play dedicated company with 2,400 trucks and 10,000 trailers, to strengthen its dedicated presence and leverage cross-selling opportunities with long-standing customer relationships.

- The company is strategically focused on dedicated freight, citing its resilience and historical outperformance over one-way freight in 8 out of 10 years, driven by the increasing demand for time-sensitive supply chains.

- Management anticipates significant supply constraints in the trucking industry, stemming from increased enforcement, bankruptcies of regional and middle-tier players, and OEM production challenges, which could result in a 5% or greater impact on one-way OTR capacity.

- Werner is implementing its EDGE TMS for comprehensive freight visibility and utilizing AI in areas like optimizing freight selection, brokerage, and predictive maintenance, expecting these technologies to drive significant cost savings.

- The company has achieved over $150 million in structural cost savings over the last three years and expects an additional $18 million in cost synergies from the FirstFleet acquisition over the next 18 months, projecting mid-single-digit rate increases and margin expansion in 2026.

- Werner recently acquired FirstFleet, a pure-play dedicated company, to strengthen its resilient dedicated segment, anticipating $18 million in cost synergies over the next 18 months and significant cross-selling opportunities.

- The trucking market is experiencing a supply-driven inflection due to increased enforcement, bankruptcies, and driver training school issues, with Werner estimating the 5% capacity impact to be a low estimate, potentially affecting up to a third of the over-the-road for-hire capacity.

- The company expects the industry to achieve mid-single-digit rate increases this year, supported by moderating inflation and improving demand, aiming to expand margins in 2026 after several years of unsustainably low industry-wide margins. Werner has already realized over $150 million in structural cost savings over the past three years.

- Werner is in the later stages of its EDGE TMS rollout for comprehensive freight visibility and is increasingly utilizing AI for optimizing operations, including freight selection, brokerage, and predictive maintenance, which is expected to drive future efficiencies and cost savings.

- Werner Enterprises recently acquired FirstFleet, a pure-play dedicated company with 2,400 trucks and 10,000 trailers, to strengthen its dedicated presence and leverage cross-selling opportunities.

- The company is strategically focused on its dedicated segment due to its resilience and outperformance, aligning with shippers' increasing need for structured, time-sensitive supply chains.

- Management anticipates significant supply constraints in the trucking market, potentially impacting 5% or more of one-way OTR capacity due to enforcement, bankruptcies, and OEM limitations.

- Werner is investing in technology, including the EDGE TMS rollout and AI applications for operational optimization, freight selection, and predictive maintenance.

- The company has achieved over $150 million in structural cost savings over the past three years and expects $18 million in cost synergies from the FirstFleet acquisition, projecting mid-single-digit rate increases in the industry for 2026 to expand margins.

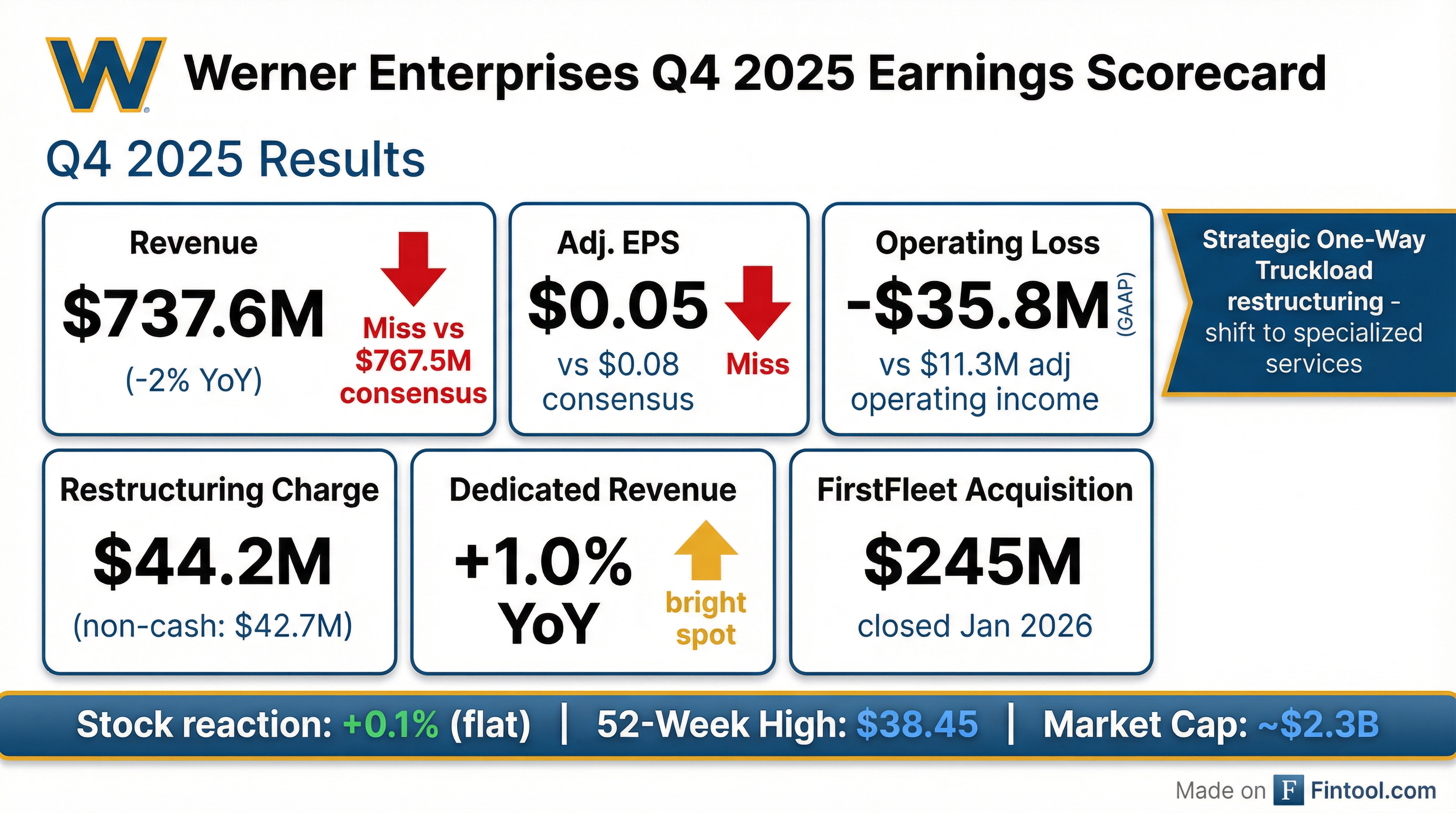

- Werner Enterprises reported Q4 2025 revenues of $738 million, a 2% decrease year-over-year, with adjusted operating income of $11.3 million and adjusted EPS of $0.05.

- The company completed the acquisition of FirstFleet for $282.8 million, which is immediately accretive and is expected to generate $18 million in targeted synergies. This acquisition will increase the dedicated business to over 70% of Truckload Transportation Services (TTS).

- A strategic restructuring of the one-way trucking business was initiated in Q4 2025, resulting in a $44.2 million charge (mostly non-cash), with expected meaningful earnings improvement in TTS in 2026, becoming noticeable from Q2 2026.

- For 2026, Werner provided guidance including an average truck fleet increase of 23%-28%, Net CapEx between $185 million and $225 million, and net interest expense between $40 million and $45 million.

Fintool News

In-depth analysis and coverage of WERNER ENTERPRISES.

Quarterly earnings call transcripts for WERNER ENTERPRISES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more