Earnings summaries and quarterly performance for GeneDx Holdings.

Executive leadership at GeneDx Holdings.

Board of directors at GeneDx Holdings.

Research analysts who have asked questions during GeneDx Holdings earnings calls.

Mark Massaro

BTIG, LLC

9 questions for WGS

Tycho Peterson

Jefferies

7 questions for WGS

David Westenberg

Piper Sandler

6 questions for WGS

Subbu Nambi

Guggenheim Securities

6 questions for WGS

Brandon Couillard

Wells Fargo & Company

5 questions for WGS

Daniel Brennan

TD Cowen

5 questions for WGS

William Bonello

Craig-Hallum Capital Group

5 questions for WGS

Bill Bonello

Craig-Hallum Capital Group LLC

4 questions for WGS

Dan Brennan

UBS

4 questions for WGS

Keith Hinton

Freedom Capital Markets

3 questions for WGS

Kyle Mikson

Canaccord Genuity

3 questions for WGS

Brandon Couillard

Wells Fargo

2 questions for WGS

Matthew Stanton

Jefferies

2 questions for WGS

Matthew Sykes

Goldman Sachs Group Inc.

2 questions for WGS

Matt Sykes

Goldman Sachs Group, Inc.

1 question for WGS

Recent press releases and 8-K filings for WGS.

- GeneDx reported $427 million in revenue for 2025, achieving more than 30% growth in volume and revenue, and over 70% gross margins, while operating profitably.

- For 2026, the company projects revenue between $540 million and $555 million, indicating 33-35% growth in revenue and volume, with adjusted gross margins of at least 70%, maintaining profitability.

- The company is expanding into new markets, including the general pediatrician setting (with anticipated increased adoption in Q4 2026), the prenatal setting, and adult conditions (starting with epilepsy and autism in 2026), in addition to international expansion and a developing biopharma and data business.

- GeneDx leverages its GeneDx Infinity data asset, described as the largest and most diverse rare disease data asset, which contributes to its 80% market share in pediatrics and rare disease and provides a diagnosis that is two times more accurate than the next database.

- GeneDx reported preliminary unaudited Full Year 2025 revenue of $427 million, with exome and genome revenue growing 54% (58% excluding a 2024 one-time benefit) and volume increasing 30.5%.

- The company provided Full Year 2026 revenue guidance of $540 to $555 million, projecting 33% to 35% growth in exome and genome revenue and volume.

- GeneDx achieved a positive adjusted net income and an adjusted gross margin of 71% for FY 2025, with guidance of at least 70% for FY 2026.

- GeneDx is expanding its market footprint into new segments, including pediatricians, NICU, prenatal care, and adult specialists, supported by $172 million in cash on hand as of Q4 2025.

- GeneDx reported strong 2025 financial results, including $427 million in revenue, over 30% growth in volume and revenue, and more than 70% gross margins, while maintaining profitability.

- For 2026, the company issued guidance projecting $540-$555 million in revenue, 33-35% growth in revenue and volume, and at least 70% adjusted gross margins, emphasizing continued profitability.

- Key growth strategies involve expanding into new markets such as the general pediatrician setting (with expected increased adoption in Q4 2026), prenatal diagnostics, and adult conditions, supported by investments in its sales force and AI.

- The company's competitive advantage is underpinned by its GeneDx Infinity data asset, which saw a 30% increase in tests in 2025, and strategic initiatives like international expansion and pioneering genomic newborn screening.

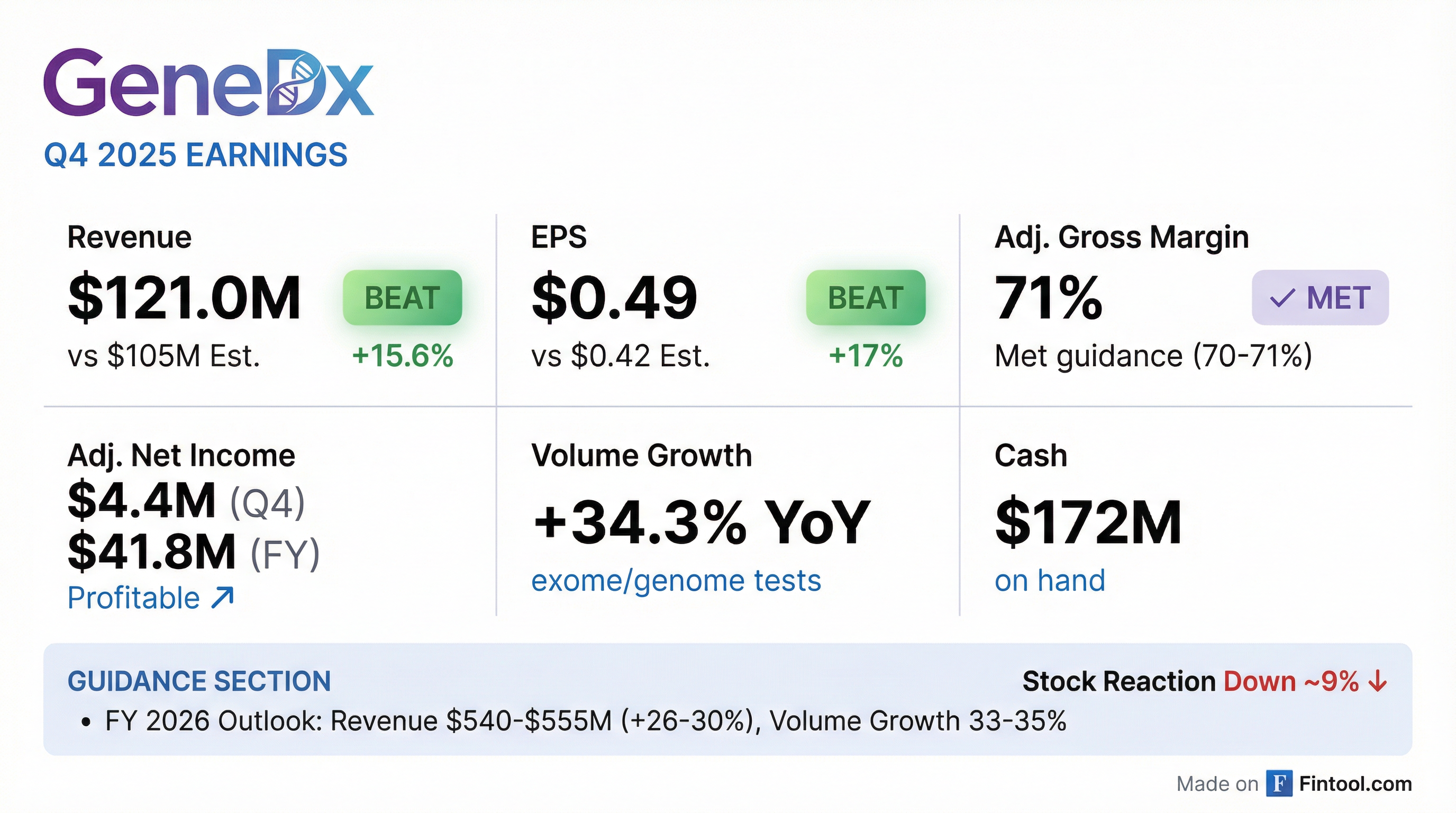

- GeneDx Holdings Corp. announced preliminary full year 2025 revenues of $427 million, representing a 41% year-over-year increase, and Q4 2025 revenues of $121 million, up 27% year-over-year.

- The company reported strong growth in its core business, with full year 2025 exome and genome revenue increasing by 54% (58% excluding a one-time 2024 benefit) and volume growth of 30.5%. The adjusted gross margin for both full year and Q4 2025 was 71%.

- For full year 2026, GeneDx expects revenues between $540 and $555 million, with exome and genome growth of 33% to 35% and an adjusted gross margin of at least 70%.

- Strategic highlights for 2025 included the launch of GeneDx Infinity, expansion into general pediatrics and prenatal diagnostics, and receiving FDA Breakthrough Device designation for its ExomeDx™ and GenomeDx™ products. The company also held $172 million in cash as of December 31, 2025.

- GeneDx reported preliminary full year 2025 revenues of approximately $427 million, with exome and genome revenue increasing by 54% year-over-year, and an adjusted gross margin of 71%.

- For the fourth quarter of 2025, preliminary revenues were approximately $121 million, with exome and genome volume growing by 34.3% year-over-year.

- The company provided full year 2026 guidance, expecting revenues between $540 and $555 million, with 33-35% growth in exome and genome revenue and volume, an adjusted gross margin of at least 70%, and positive adjusted net income.

- Key strategic developments in 2025 included the launch of GeneDx Infinity™, expansion into general pediatrics and prenatal diagnostics, and receiving FDA Breakthrough Device designation for its ExomeDx™ and GenomeDx™ tests.

- GeneDx maintains a dominant market position in rare disease genomics, with 80% market share among geneticists, driven by the accuracy, speed, and cost-effectiveness of its testing.

- The company's key competitive differentiator is its Infinity data asset, built from over 2.5 million rare disease patient tests and 7 million phenotypic data points, which enhances diagnostic yield and is difficult for competitors to replicate.

- GeneDx is targeting significant growth opportunities in the NICU market, where it has reduced turnaround times to 48 hours, and the general pediatrician market, aiming to address the large population of undiagnosed rare disease patients.

- The acquisition of Fabric Genomics supports GeneDx's international expansion strategy by enabling it to offer interpretation as a service, allowing global partners to utilize its data asset for local sequencing efforts.

- GeneDx maintains an 80% market share in rare disease diagnosis, leveraging improved technology for faster and more cost-effective testing, with exome results now available in approximately two weeks.

- The company's key competitive differentiator is its Infinity data asset, which includes over 2.5 million rare disease tests and nearly one million exomes/genomes, enabling superior accuracy in variant interpretation.

- GeneDx is focused on expanding into the NICU and general pediatrician markets, identifying these as significant underutilized opportunities to end the diagnostic odyssey for children.

- GeneDx is a leader in newborn screening, supporting landmark studies and influencing legislation, such as Florida's Sunshine Genetics Act, to promote early diagnosis of genetic diseases.

- The Fabric Genomics acquisition supports GeneDx's international strategy by enabling interpretation as a service, allowing global partners to utilize GeneDx's data asset and expertise for local sequencing.

- GeneDx, a leader in rare disease diagnostics, reported 33% volume growth in whole exome/genome testing in Q3, driven by pediatric neurologists and geneticists.

- The company expects a significant market expansion, doubling its total addressable market to $2.5 billion, following the American Academy of Pediatrics' June guideline update allowing general pediatricians to order whole exome/genome tests.

- GeneDx is investing in educating 60,000 general pediatricians and developing a simplified ordering process, anticipating a ramp-up in volumes from this new segment over 18-24 months.

- Financially, GeneDx achieved an average reimbursement rate of approximately $3,800 per test in Q3 and projects gross margins of 70-71%, an increase of 600 basis points, while committing to remain EBITDA positive on an adjusted basis in 2026.

- GeneDx is expanding its market opportunity, with the American Academy of Pediatrics' updated guidelines in June allowing whole exome/genome testing for children with global developmental delay (GDD) and intellectual disability (IDD), effectively doubling the total addressable market to $2.5 billion. The company is investing in education and a dedicated sales team to target 25,000 general pediatricians, expecting volumes to ramp in 18-24 months.

- GeneDx maintains market leadership among pediatric specialists and geneticists, holding an 80% market share among genetics experts. The majority of current growth is driven by pediatric neurologists.

- The company reported an average reimbursement rate of approximately $3,800 per test in Q3, with 55% of all tests being paid. GeneDx aims for a theoretical maximum 80% payment rate over time through continued RCM improvements and reducing denials.

- GeneDx anticipates gross margins of 70-71%, an increase of approximately 600 basis points, attributed to RCM improvements and COGS reductions achieved through automation and economies of scale.

- The company is committed to maintaining adjusted EBITDA profitability in 2026 while strategically investing in future growth vectors, including the general pediatrician market and the NICU initiative.

- GeneDx has identified a $2.5 billion total addressable market (TAM), which has doubled following a June guideline update by the American Academy of Pediatrics that allows general pediatricians to order whole exome/genome tests for children with global developmental delay and intellectual disability. The company is investing in educating these pediatricians and building a dedicated sales team, anticipating 18-24 months for volumes to ramp from this new segment.

- The company reported 33% growth in whole exome and whole genome volumes in the third quarter. While geneticists still account for the majority of overall volume, growth is primarily driven by pediatric neurologists.

- GeneDx expects gross margins to reach 70-71%, an increase of 600 basis points, attributing this improvement to cost reductions from automation and scale in the wet lab, with further opportunities in automating post-sequencing analysis using AI and language models.

- The average reimbursement rate in Q3 was approximately $3,800 per test, with the company targeting an 80% payment rate (up from 55%) and a theoretical maximum of $7,000 per test when paid. Medicaid coverage is expanding, with California recently adding whole genome coverage, bringing the total to 36 states.

- GeneDx is committed to remaining EBITDA positive on an adjusted basis while strategically investing in new growth areas, including the NICU market, where only 5% of babies currently receive genetic testing despite potential annual savings of $150,000 per baby.

Quarterly earnings call transcripts for GeneDx Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more