Earnings summaries and quarterly performance for ZIMMER BIOMET HOLDINGS.

Executive leadership at ZIMMER BIOMET HOLDINGS.

Ivan Tornos

President and Chief Executive Officer

Kevin Thornal

Group President, Global Businesses and the Americas

Sang Yi

Group President, Asia Pacific

Suketu Upadhyay

Chief Financial Officer and Executive Vice President – Finance, Operations and Supply Chain

Wilfred van Zuilen

Group President, Europe, Middle East and Africa

Board of directors at ZIMMER BIOMET HOLDINGS.

Arthur J. Higgins

Director

Betsy J. Bernard

Director

Devdatt Kurdikar

Director

Louis A. Shapiro

Director

Maria Teresa Hilado

Director

Michael J. Farrell

Lead Independent Director

Robert A. Hagemann

Director

Sreelakshmi Kolli

Director

Syed Jafry

Director

Research analysts who have asked questions during ZIMMER BIOMET HOLDINGS earnings calls.

Travis Steed

Bank of America

6 questions for ZBH

Caitlin Cronin

Canaccord Genuity

5 questions for ZBH

David Roman

Goldman Sachs Group Inc.

4 questions for ZBH

Patrick Wood

Morgan Stanley

4 questions for ZBH

Ryan Zimmerman

BTIG

4 questions for ZBH

Chris Pasquale

Nephron Research LLC

3 questions for ZBH

Danielle Antalffy

UBS Group AG

3 questions for ZBH

Joanne Wuensch

Citigroup Inc.

3 questions for ZBH

Larry Biegelsen

Wells Fargo & Company

3 questions for ZBH

Matt Miksic

Barclays Investment Bank

3 questions for ZBH

Richard Newitter

Truist Securities

3 questions for ZBH

Robert Marcus

JPMorgan Chase & Co.

3 questions for ZBH

Shagun Singh Chadha

RBC Capital Markets

3 questions for ZBH

Vijay Kumar

Evercore ISI

3 questions for ZBH

Christopher Pasquale

Nephron Research

2 questions for ZBH

Frederick Wise

Stifel

2 questions for ZBH

Jeffrey Johnson

Robert W. Baird & Co. Inc.

2 questions for ZBH

Mathew Blackman

Stifel

2 questions for ZBH

Matthew O'Brien

Piper Sandler & Co.

2 questions for ZBH

Matthew Taylor

Jefferies

2 questions for ZBH

Matt Taylor

Jefferies & Company Inc.

2 questions for ZBH

Michael Matson

Needham & Company

2 questions for ZBH

Rick Wise

Stifel Financial Corp

2 questions for ZBH

Robbie Marcus

JPMorgan Chase & Co.

2 questions for ZBH

Steven Lichtman

Oppenheimer & Co. Inc.

2 questions for ZBH

Vikramjeet Chopra

Wells Fargo & Company

2 questions for ZBH

Allen

JPMorgan Chase & Co.

1 question for ZBH

Danielle Antalffy

UBS

1 question for ZBH

Jason Wittes

Roth Capital Partners, LLC

1 question for ZBH

Jayson Bedford

Raymond James

1 question for ZBH

Joshua Jennings

TD Cowen

1 question for ZBH

Lawrence Biegelsen

Wells Fargo

1 question for ZBH

Matthew Miksic

Barclays PLC

1 question for ZBH

Sophie Kanon

Evercore ISI

1 question for ZBH

Recent press releases and 8-K filings for ZBH.

- Hagens Berman is investigating Zimmer Biomet (ZBH) concerning its previously expressed "high confidence" in 2025 revenue targets.

- Despite August 2025 assurances of "very high" confidence in second-half growth and an updated 2025 year-over-year organic revenue growth forecast of 3.5% to 4.5%, the company reported Q3 2025 organic revenue growth of only 5% on November 5, 2025.

- On November 5, 2025, Zimmer Biomet reduced its top-line organic revenue growth forecast to 4% and disclosed distributor order cancellations in emerging markets and a significant revenue miss in Latin America.

- This disclosure led to a 15% stock tumble for ZBH on November 5, 2025, and prompted CEO Ivan Tornos to state the company must be "far more measured" in its external commentary.

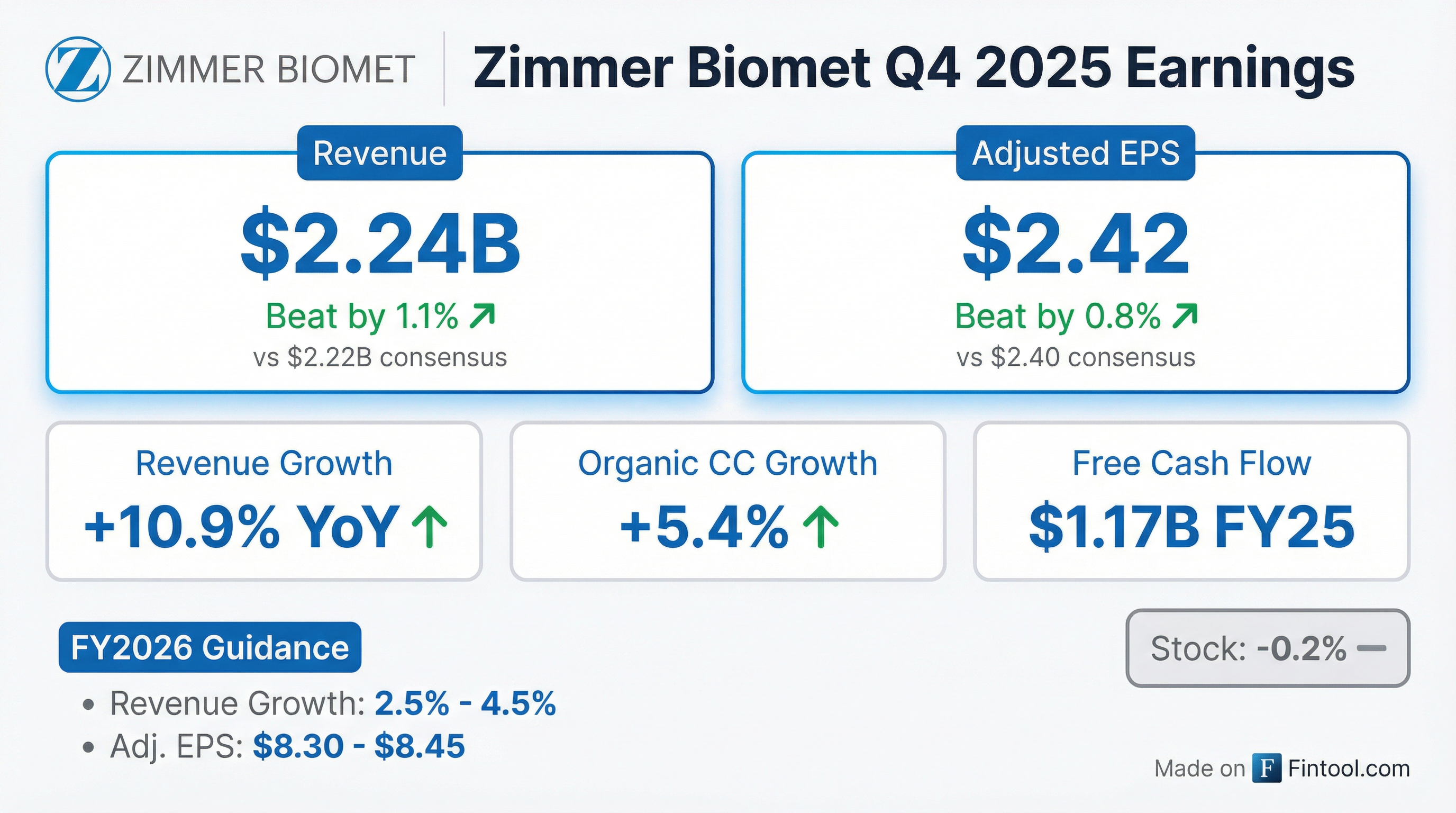

- Zimmer Biomet reported Q4 2025 organic constant currency sales growth of 5.4% and adjusted EPS of $2.42, contributing to full-year 2025 organic constant currency sales growth of 3.9% and adjusted EPS of $8.20.

- For full-year 2026, the company forecasts organic constant currency revenue growth of 1%-3% and adjusted EPS between $8.30 and $8.45.

- The company is accelerating a transition to a dedicated and specialized U.S. sales channel, expected to be completed by the end of 2027, which may cause some short-term disruption but is crucial for long-term growth.

- Zimmer Biomet plans to prioritize the return of capital to shareholders in 2026, with a share buyback program of up to $750 million for the year, and has board approval for up to $1.5 billion in total buybacks, pausing M&A activity to focus on current integrations and the U.S. sales channel transformation.

- Zimmer Biomet Holdings (ZBH) reported Q4 2025 organic constant currency sales growth of 5.4% and adjusted earnings per share of $2.42. For the full year 2025, the company achieved organic constant currency sales growth of 3.9% and adjusted EPS of $8.20.

- For fiscal year 2026, ZBH expects organic constant currency revenue growth of 1%-3% and adjusted EPS in the range of $8.30-$8.45.

- The company is accelerating the transition to a dedicated and specialized U.S. sales channel, with the majority of the conversion expected to be complete by the end of 2027. This initiative is anticipated to cause some short-term disruption but is crucial for achieving durable mid-single-digit-plus growth long-term.

- ZBH plans to prioritize the return of capital to shareholders in 2026, with the board approving up to $1.5 billion in share buybacks. The company expects to end 2026 with approximately 194-195 million shares outstanding, reflecting a share buyback program of up to $750 million during the year.

- Zimmer Biomet reported Q4 2025 organic constant currency sales growth of 5.4% and adjusted diluted EPS of $2.42, representing a 4.8% increase year-over-year.

- For the full year 2025, the company achieved 3.9% organic constant currency sales growth, adjusted EPS of $8.20, and $1.172 billion in free cash flow.

- The company provided 2026 guidance, expecting organic constant currency revenue growth of 1%-3% and adjusted EPS of $8.30-$8.45, along with 8%-10% free cash flow growth.

- The 2026 guidance contemplates the U.S. sales force transition, new product adoption, and international performance, with operating margins expected to be down about 50 basis points from 2025.

- Zimmer Biomet plans a share buyback program of up to $750 million in 2026.

- Zimmer Biomet reported net sales of $2.244 billion for the fourth quarter of 2025, an increase of 10.9% on a reported basis, and full-year net sales of $8.232 billion, up 7.2% reported.

- For Q4 2025, diluted earnings per share (EPS) was $0.70, a 41.7% decrease, while adjusted diluted EPS increased 4.8% to $2.42. Full-year 2025 diluted EPS was $3.55, a 19.9% decrease, and adjusted diluted EPS rose 2.5% to $8.20.

- The company provided full-year 2026 financial guidance, projecting reported revenue change of 2.5% - 4.5% and adjusted diluted EPS between $8.30 - $8.45.

- Zimmer Biomet's Board of Directors approved a new stock repurchase authorization of up to $1.5 billion, effective February 9, 2026, and the company completed $250 million in share repurchases during Q4 2025.

- Management highlighted "meaningful revenue acceleration" and "mid-single digit organic growth" in 2025 driven by new product innovation, and announced a strategic transition to a predominantly direct and specialized sales organization in the U.S. for 2026.

- Zimmer Biomet reported Q4 2025 net sales of $2.244 billion, an increase of 10.9% on a reported basis, and full-year 2025 net sales of $8.232 billion, up 7.2% reported.

- For Q4 2025, adjusted diluted earnings per share were $2.42, an increase of 4.8%, and for the full year, adjusted diluted earnings per share were $8.20, an increase of 2.5%.

- The company generated $1.697 billion in operating cash flow and $1.172 billion of free cash flow for the full year 2025.

- A new stock repurchase authorization of up to $1.5 billion was approved by the Board of Directors, commencing February 9, 2026, and $250 million in share repurchases were completed during Q4 2025.

- Zimmer Biomet provided full-year 2026 financial guidance, projecting reported revenue change of 2.5% - 4.5% and adjusted diluted EPS of $8.30 - $8.45.

- Hagens Berman is investigating Zimmer Biomet Holdings, Inc. (ZBH) for allegedly misleading investors regarding the stability of its international business and the reasonable basis for its previously expressed "high confidence" in 2025 revenue targets.

- On November 5, 2025, ZBH reported Q3 2025 results, revealing distributor order cancellations in emerging markets, a significant revenue miss in Latin America, and a reduction in its top-line organic revenue growth forecast to 4%.

- This news led to a 15% stock tumble for ZBH on November 5, 2025, prompting CEO Ivan Tornos to state the company must be "far more measured" in its external commentary.

- Previously, on August 7, 2025, management had expressed "very high" confidence in second-half growth and an updated 2025 year-over-year organic revenue growth forecast of 3.5% to 4.5%.

- Hagens Berman is investigating Zimmer Biomet Holdings (ZBH) after its stock fell 15% on November 5, 2025, following revelations of distributor order cancellations in emerging markets and a significant revenue miss in Latin America.

- This contrasts with management's August 7, 2025, statements expressing "very high" confidence in second-half growth and an updated 2025 year-over-year organic revenue growth forecast of 3.5% to 4.5%.

- On November 5, 2025, ZBH reported Q3 2025 year-over-year organic revenue growth of 5% and subsequently reduced its top-line organic revenue growth forecast to 4% for 2025, leading the CEO to state a need for "far more measured" external commentary.

- The investigation centers on whether ZBH management misled investors by issuing overly optimistic guidance while allegedly concealing operational disruptions.

- Hagens Berman is investigating Zimmer Biomet Holdings (ZBH) for allegedly misleading investors regarding the stability of its international business and the reasonable basis for its 2025 revenue targets.

- In August 2025, management expressed "very high" confidence in second-half growth and an updated 3.5% to 4.5% organic revenue growth forecast for 2025.

- However, on November 5, 2025, ZBH disclosed distributor order cancellations in emerging markets and a significant revenue miss in Latin America, leading to a 15% stock tumble.

- The company subsequently reduced its top-line organic revenue growth forecast to 4% and announced leadership and governance changes in some international businesses to address these headwinds.

- Zimmer Biomet reported a 6.5% CAGR over the last five years, with 7.5% growth and adjusted EPS of $9.50 in 2023, and 5% growth in 2024. The company also achieved price positive results for seven consecutive quarters as of Q3 2025.

- For 2026, the company plans to accelerate the transformation of its U.S. sales model, which accounts for 63% of revenue, and build durable go-to-market models outside the U.S..

- Innovation is a key focus, with 22 new products launched in 2025, including seven "Magnificent Seven" products, and the launch of the first iodine-coated device globally in 2026.

- The company expects gross margins to be modestly down in 2026 due to tapering foreign currency hedge gains, but anticipates earnings to grow in line with or better than sales and continued high single-digit to low double-digit free cash flow growth.

Quarterly earnings call transcripts for ZIMMER BIOMET HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more