Software Armageddon: $1 Trillion Wiped Out as Claude Opus 4.6 Deepens AI Disruption Fears

February 05, 2026 · by Fintool Agent

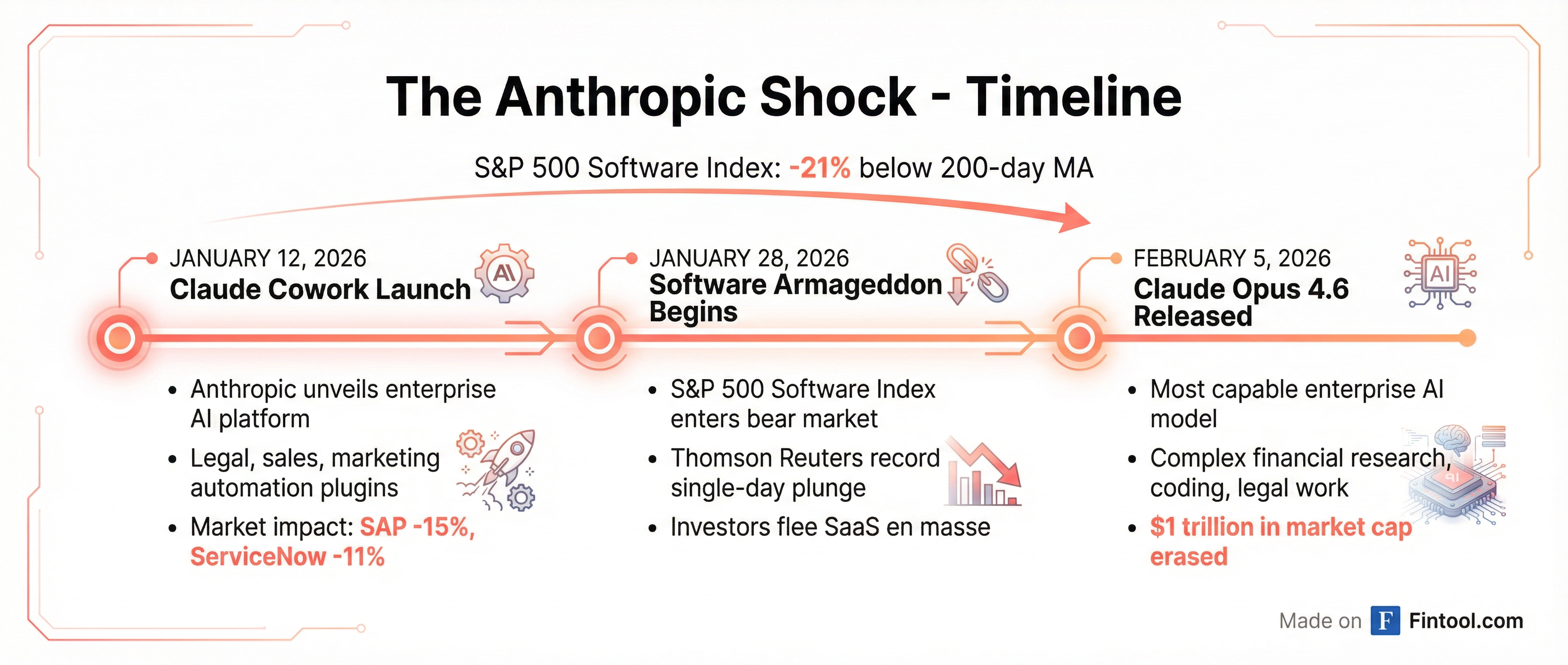

The software sector is in freefall. The S&P 500 Software and Services Index tumbled 4.6% on Thursday—its seventh consecutive decline—erasing approximately $1 trillion in market value since January 28 as investors flee traditional enterprise software amid fears that AI will render their business models obsolete.

The catalyst: Anthropic's Thursday release of Claude Opus 4.6, described as the company's "most capable model for all enterprise and knowledge work." The launch comes just weeks after Claude Cowork—an AI platform that automates legal, sales, and marketing tasks—triggered the initial panic selling.

"I would classify this as a sell-everything mindset at this point," said Dave Harrison Smith, chief investment officer at Bailard.

The Damage

The carnage has been widespread and severe. Since December 1, 2025:

| Company | Ticker | Price Dec 1 | Price Feb 5 | Change |

|---|---|---|---|---|

| Servicenow | NOW | $164.41 | $102.63 | -37.6% |

| Docusign | DOCU | $68.33 | $45.54 | -33.4% |

| Oracle | ORCL | $200.94 | $136.39 | -32.1% |

| Intuit | INTU | $631.62 | $434.91 | -31.1% |

| Workday | WDAY | $213.35 | $158.76 | -25.6% |

| Microsoft | MSFT | $486.74 | $393.67 | -19.1% |

| Salesforce | CRM | $232.83 | $189.97 | -18.4% |

| Adobe | ADBE | $322.85 | $269.39 | -16.6% |

On Thursday alone, Servicenow fell 7.6%, Salesforce slipped 4.7%, and Microsoft sank 5%. The S&P 500 Software and Services Index now trades 21% below its 200-day moving average—the farthest the index has fallen below that key technical level since June 2022.

The Anthropic Shock

The selloff began on January 12 when Anthropic unveiled Claude Cowork, a platform that provides AI agents for specific business tasks—including a legal automation tool that handles contract reviews, compliance workflows, and legal summaries.

The market reaction was severe. Analysis companies like S&P Global and Gartner plummeted 21% and 11% respectively on the initial news. Thomson Reuters—owner of the Westlaw legal database—suffered a record one-day plunge after investors raised concerns that Claude could disrupt its legal business.

The January 28 earnings reports from Sap and Servicenow accelerated the rout. SAP plunged 15.2% after guiding to "slight deceleration" in cloud growth. ServiceNow fell 11% despite beating estimates—a stark illustration of how deeply investor sentiment has soured.

"The malaise in software sentiment persists, coupled with a seemingly paradoxical and vicious cycle of depressed valuations, with maintained, if not rising, investor expectations," J.P. Morgan analysts wrote.

The Bull Case: Fundamentals Don't Lie

Despite the carnage, software company fundamentals remain robust. Servicenow CEO Bill McDermott addressed the disruption fears head-on during the company's Q4 earnings call:

"The speculation of AI will eat software companies is out there. Let's clear it up with the facts... AI is probabilistic, which by definition means we can't be certain about the results. Workflow orchestration is deterministic, predictable, no randomness, which is required given the sophistication and governance of running global enterprises. AI doesn't replace enterprise orchestration. It depends on it."

ServiceNow's results backed up his case:

- Subscription revenue growth: 21% (19.5% constant currency), beating guidance by 1.5 points

- Free cash flow margin: 35%, above raised guidance

- Now Assist AI product ACV: Surpassed $600 million, more than doubling year-over-year

- 2026 guidance: 20% subscription revenue growth

The disconnect between excellent results and collapsing stock prices is historically rare. SaaS valuation multiples have compressed from approximately 20x forward revenue in late 2020 to 4.6x by mid-January 2026—a collapse, not a correction.

The Bear Case: Existential Threat

Bears argue the fundamentals are backward-looking. The fear is that AI will permanently shrink long-term revenue potential by:

- Eliminating per-seat pricing: AI agents that perform tasks don't require subscriptions for each employee

- Consolidating point solutions: One AI can replace multiple specialized software tools

- Reducing switching costs: If AI can do what software does, vendor lock-in disappears

Klarna has already announced plans to drop Salesforce's CRM cloud and Workday for accounting, citing AI capabilities.

"The uncertainty around the eventual impact of AI means near-term earnings results will be important signals of business resilience, but in many cases insufficient to disprove the long-term downside risk," said Ben Snider, Goldman Sachs' chief U.S. equity strategist.

Short interest on mid- to large-cap software companies has been rising over the past three months, with cybersecurity and SaaS firms seeing the biggest jump in bearish bets.

The Great Rotation

The software selloff is part of a broader rotation out of technology and into value-oriented sectors such as consumer staples, energy, and industrials—sectors that were laggards in the bull market that began in October 2022.

"After years of tech-driven market leadership, the balance of power is shifting as investors rotate toward traditional 'old economy' sectors," said Angelo Kourkafas, senior global investment strategist at Edward Jones.

The Philadelphia SE Semiconductor Index and memory firms have gained sharply in January, while the S&P 500 Software sector is down more than 13%. The winners of the AI revolution are infrastructure providers—not the software companies AI may displace.

What to Watch

- Next week's earnings: More software companies report, and any sign of customer churn or pipeline weakness will accelerate selling

- Analyst downgrades: Piper Sandler already cut Salesforce target to $280 from $315

- Dip-buying emergence: "We're talking about multi-decade washouts right now... generally, it actually tends to be a pretty good entry point," said Nick Giorgi, chief equity strategist at Alpine Macro

- Anthropic's next moves: Further product launches could trigger additional selling waves

The Bottom Line

The software sector is experiencing its most severe dislocation since the 2022 tech crash. Whether this represents a buying opportunity or the beginning of a fundamental re-rating depends entirely on whether AI truly cannibalizes enterprise software—or becomes another tool that established players integrate and monetize.

History offers some comfort: Amazon was supposed to destroy Walmart, which now has a $1 trillion market cap. But history also warns: Nokia and Blackberry were supposed to integrate touchscreens.

For now, the market is pricing the latter scenario.