Earnings summaries and quarterly performance for AGNC Investment.

Executive leadership at AGNC Investment.

Peter Federico

President and Chief Executive Officer

Bernice Bell

Executive Vice President and Chief Financial Officer

Christopher Kuehl

Executive Vice President and Chief Investment Officer

Gary Kain

Executive Chair

Kenneth Pollack

Executive Vice President, General Counsel, Chief Compliance Officer, and Secretary

Sean Reid

Executive Vice President, Strategy and Corporate Development

Board of directors at AGNC Investment.

Research analysts who have asked questions during AGNC Investment earnings calls.

Bose George

Keefe, Bruyette & Woods

6 questions for AGNC

Crispin Love

Piper Sandler

6 questions for AGNC

Douglas Harter

UBS

6 questions for AGNC

Eric Hagen

BTIG

6 questions for AGNC

Harsh Hemnani

Green Street

6 questions for AGNC

Jason Stewart

Janney Montgomery Scott LLC

6 questions for AGNC

Trevor Cranston

Citizens JMP

6 questions for AGNC

Richard Shane

JPMorgan Chase & Co.

2 questions for AGNC

Rick Shane

JPMorgan Chase & Co.

2 questions for AGNC

Jason Weaver

Unaffiliated Analyst

1 question for AGNC

Matthew Erdner

JonesTrading Institutional Services

1 question for AGNC

Recent press releases and 8-K filings for AGNC.

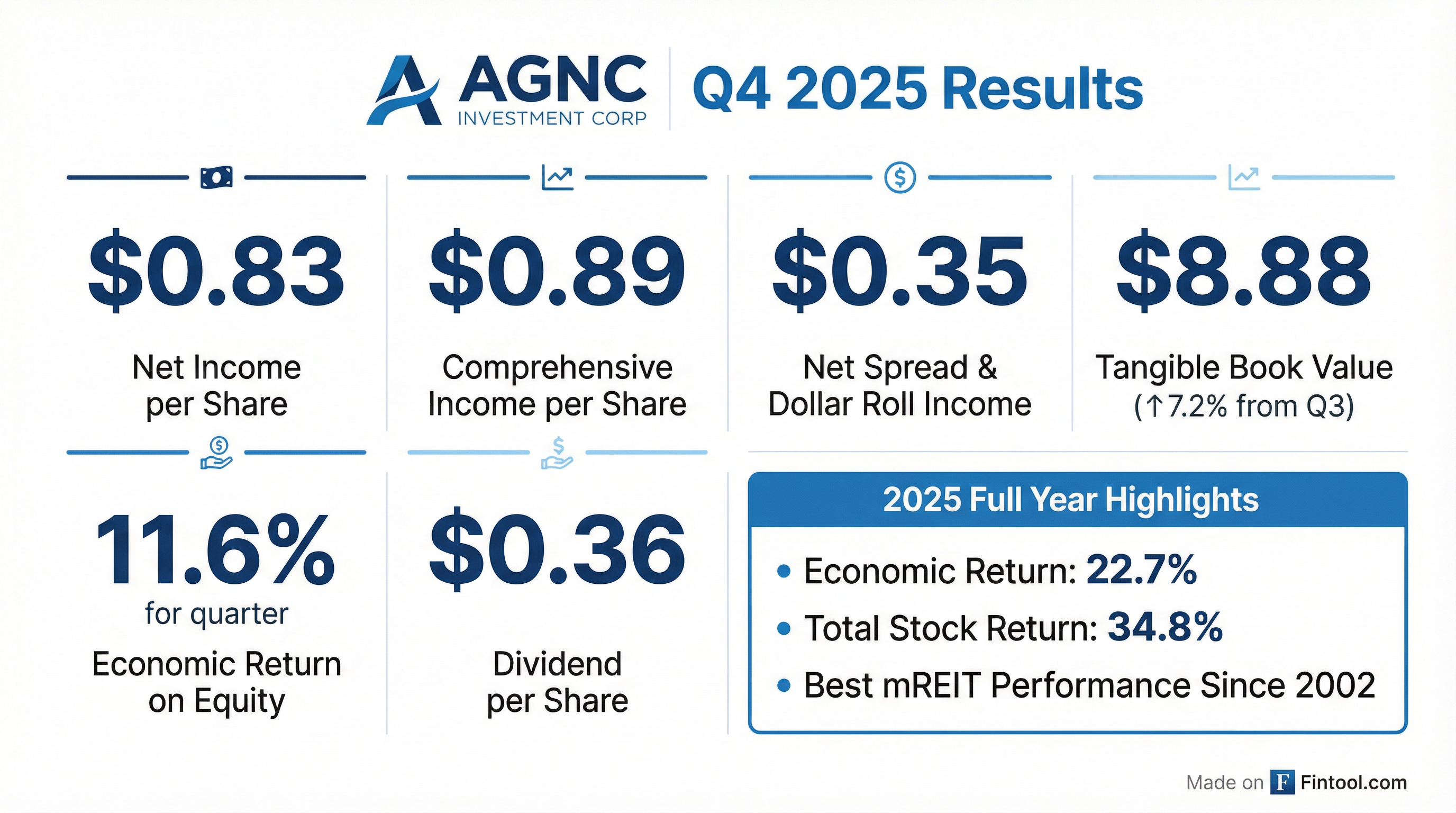

- For Q4 2025, AGNC reported Comprehensive Income Per Share of $0.89 and Net Spread and Dollar Roll Income Per Share of $0.35. The company also declared dividends of $0.36 per share and achieved an Economic Return of 11.6%.

- As of December 31, 2025, AGNC's Tangible Net Book Value Per Share was $8.88 , with Total Common Equity Capital at $10.4 billion. Total Assets stood at $115.077 billion.

- For the full year 2025, AGNC delivered a Comprehensive Income Per Share of $1.74 , an Economic Return of 22.7% , and a Total Stock Return of 34.8%.

- The company's leverage as of December 31, 2025, was 7.2x , with an average asset yield of 4.91% and an average total cost of funds of 3.10% for Q4 2025.

- AGNC Investment Corp. reported an 11.6% economic return in Q4 2025, contributing to an impressive full-year economic return of 22.7% and a total stock return of 34.8% for 2025 with dividends reinvested.

- For Q4 2025, the company reported comprehensive income of $0.89 per common share and net spread and dollar roll income of $0.35 per common share.

- The company's tangible net book value per common share increased by $0.60 in Q4 2025, and was up about 4% for January (or 3% net of monthly dividend accrual).

- Leverage decreased to 7.2x tangible equity at the end of Q4 2025 from 7.6x in Q3 2025, and the company issued $356 million of common equity in Q4 2025, totaling approximately $2 billion for the year.

- Management maintains a favorable outlook for Agency MBS in 2026, expecting returns in the 13%-15% range at current spread levels, and has shifted its hedge mix to 70% swap-based hedges to benefit from anticipated lower funding costs and rate cuts.

- AGNC Investment Corp. achieved an 11.6% economic return on tangible common equity for Q4 2025, contributing to an impressive 22.7% full-year economic return and a 34.8% total stock return in 2025 with dividends reinvested.

- The company's tangible net book value per common share increased by $0.60 in Q4 2025, and as of late January 2026, it was up 4% for the month.

- AGNC ended Q4 2025 with a leverage of 7.2x tangible equity, a decrease from 7.6x in the prior quarter, and maintained a strong liquidity position of $7.6 billion.

- The asset portfolio grew to $95 billion at quarter-end, and the company issued $356 million in common equity during Q4, contributing to approximately $2 billion in accretive common equity issuances for the full year 2025.

- Management holds a positive outlook for the Agency MBS market in 2026, driven by favorable macro themes, potential government actions to enhance housing affordability, and a balanced supply and demand environment.

- AGNC achieved an 11.6% economic return in the fourth quarter of 2025, contributing to an impressive 22.7% full-year economic return. The company's total stock return for 2025, with dividends reinvested, was 34.8%.

- For Q4 2025, AGNC reported comprehensive income of $0.89 per common share and declared dividends of $0.36 per common share.

- The company ended Q4 2025 with leverage of 7.2x tangible equity and a strong liquidity position of $7.6 billion in cash and unencumbered Agency MBS.

- AGNC issued $356 million of common equity through its at-the-market offering program in Q4 2025, bringing total accretive common equity issuances for the year to approximately $2 billion.

- The asset portfolio totaled $95 billion at quarter-end, with the hedge portfolio's composition shifting to 70% swap-based hedges. The company anticipates returns on equity (ROEs) in the 13%-15% range at current spread levels and expects generally low yield volatility in 2026.

- For the fourth quarter of 2025, AGNC Investment Corp. reported $0.89 comprehensive income per common share and $0.83 net income per common share.

- The company's tangible net book value per common share increased by 7.2% to $8.88 as of December 31, 2025, from $8.28 as of September 30, 2025, contributing to an 11.6% economic return on tangible common equity for the quarter.

- For the full year 2025, AGNC achieved a 22.7% economic return on tangible common equity and declared $1.44 in dividends per common share.

- As of December 31, 2025, the investment portfolio totaled $94.8 billion, with a tangible net book value "at risk" leverage ratio of 7.2x.

- During the fourth quarter of 2025, AGNC issued 34.9 million shares of common equity through At-the-Market (ATM) Offerings for net proceeds of $356 million.

- AGNC Investment Corp. reported $0.89 comprehensive income per common share and $0.83 net income per common share for the fourth quarter ended December 31, 2025.

- The company's tangible net book value per common share increased by 7.2% to $8.88 as of December 31, 2025, up from $8.28 as of September 30, 2025.

- AGNC generated an 11.6% economic return on tangible common equity for the fourth quarter and a 22.7% economic return for the full year 2025.

- The company declared $0.36 in dividends per common share for the fourth quarter of 2025.

- As of December 31, 2025, AGNC's investment portfolio totaled $94.8 billion, with a 7.2x tangible net book value "at risk" leverage.

- AGNC reported comprehensive income per share of $0.78 and net income per diluted common share of $0.72 for Q3 2025, with dividends declared per share of $0.36.

- The company's total investment portfolio grew to $90.8 billion as of September 30, 2025, an increase of $8.5 billion from June 30, 2025, while tangible net book value per share stood at $8.28.

- For Q3 2025, AGNC's average asset yield was 4.95%, with an average cost of funds of 3.17%, leading to a net interest spread of 1.78%.

- During the quarter, AGNC issued $309 million in common equity through ATM offerings and $345 million of 8.75% Series H Fixed-Rate Preferred Equity.

- AGNC achieved a strong economic return of 10.6% in Q3 2025, driven by attractive monthly dividends and book value appreciation, as Agency MBS outperformed U.S. Treasuries in a favorable market environment.

- The company's asset portfolio expanded to $91 billion at quarter-end, with a TBA position of $14 billion, following the deployment of capital raised in Q2 and Q3.

- Monetary policy shifts, including the Federal Reserve's rate cut and signals for further accommodation, along with easing fiscal policy concerns, led to a material decline in interest rate volatility and improved investor sentiment, positively impacting the demand outlook for Agency MBS.

- While core earnings were $0.01 below the dividend, the expected Return on Equity (ROE) for current coupon mortgages is 16-18%, aligning with AGNC's total cost of capital and supporting dividend sustainability. The company also strategically added $7 billion in receiver swaptions for down-rate protection and anticipates an improvement in net spread and dollar roll income from its current $0.35.

- AGNC Investment Corp. reported a 10.6% economic return on tangible common equity for the third quarter of 2025, which included $0.36 in dividends per common share and a $0.47 increase in tangible net book value per common share.

- The company's tangible net book value per common share increased by 6.0% to $8.28 as of September 30, 2025, up from $7.81 as of June 30, 2025.

- For the third quarter of 2025, AGNC achieved $0.78 comprehensive income per common share and $0.35 net spread and dollar roll income per common share.

- As of September 30, 2025, the investment portfolio totaled $90.8 billion, and the tangible net book value "at risk" leverage ratio was 7.6x.

- During the quarter, AGNC issued $345 million of 8.75% Series H Fixed-Rate preferred equity and 31.0 million shares of common equity for net proceeds of $309 million.

- AGNC Investment Corp. reported $0.78 comprehensive income per common share and $0.72 net income per common share for the third quarter ended September 30, 2025.

- The company's tangible net book value per common share increased by 6.0% to $8.28 as of September 30, 2025, up from $7.81 as of June 30, 2025.

- AGNC generated a 10.6% economic return on tangible common equity for the third quarter of 2025, comprised of $0.36 dividends per common share and a $0.47 increase in tangible net book value per common share.

- The investment portfolio totaled $90.8 billion as of September 30, 2025, with a 7.6x tangible net book value "at risk" leverage.

- During the quarter, the company issued 31.0 million shares of common equity for $309 million and $345 million of 8.75% Series H Fixed-Rate preferred equity.

Quarterly earnings call transcripts for AGNC Investment.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more