Earnings summaries and quarterly performance for ADVANCED MICRO DEVICES.

Executive leadership at ADVANCED MICRO DEVICES.

Lisa Su

Chair, President and Chief Executive Officer

Ava Hahn

Senior Vice President, General Counsel and Corporate Secretary

Darren Grasby

Executive Vice President, Chief Sales Officer

Forrest Norrod

Executive Vice President and General Manager, Data Center Solutions Business Unit

Jack Huynh

Senior Vice President and General Manager, Computing and Graphics Business Group

Jean Hu

Executive Vice President, Chief Financial Officer and Treasurer

Mark Papermaster

Executive Vice President and Chief Technology Officer

Philip Guido

Executive Vice President, Chief Commercial Officer

Board of directors at ADVANCED MICRO DEVICES.

Research analysts who have asked questions during ADVANCED MICRO DEVICES earnings calls.

Aaron Rakers

Wells Fargo

9 questions for AMD

Joshua Buchalter

TD Cowen

9 questions for AMD

Timothy Arcuri

UBS

9 questions for AMD

Vivek Arya

Bank of America Corporation

9 questions for AMD

Ross Seymore

Deutsche Bank

8 questions for AMD

Stacy Rasgon

Bernstein Research

7 questions for AMD

Thomas O’Malley

Barclays Capital

6 questions for AMD

Ben Reitzes

Melius Research LLC

4 questions for AMD

Joe Moore

Morgan Stanley

4 questions for AMD

Joseph Moore

Morgan Stanley

4 questions for AMD

C J Muse

Tanner Fitzgerald

3 questions for AMD

CJ Muse

Cantor Fitzgerald

3 questions for AMD

Harlan Sur

JPMorgan Chase & Co.

3 questions for AMD

Antoine Chkaiban

New Street Research

2 questions for AMD

Jim Schneider

Goldman Sachs

2 questions for AMD

Tom O'Malley

Barclays

2 questions for AMD

Toshiya Hari

Goldman Sachs Group, Inc.

2 questions for AMD

Benjamin Reitzes

Melius Research

1 question for AMD

Blayne Curtis

Jefferies Financial Group

1 question for AMD

Christopher Muse

Cantor Fitzgerald

1 question for AMD

Harsh Kumar

Piper Sandler & Co.

1 question for AMD

Recent press releases and 8-K filings for AMD.

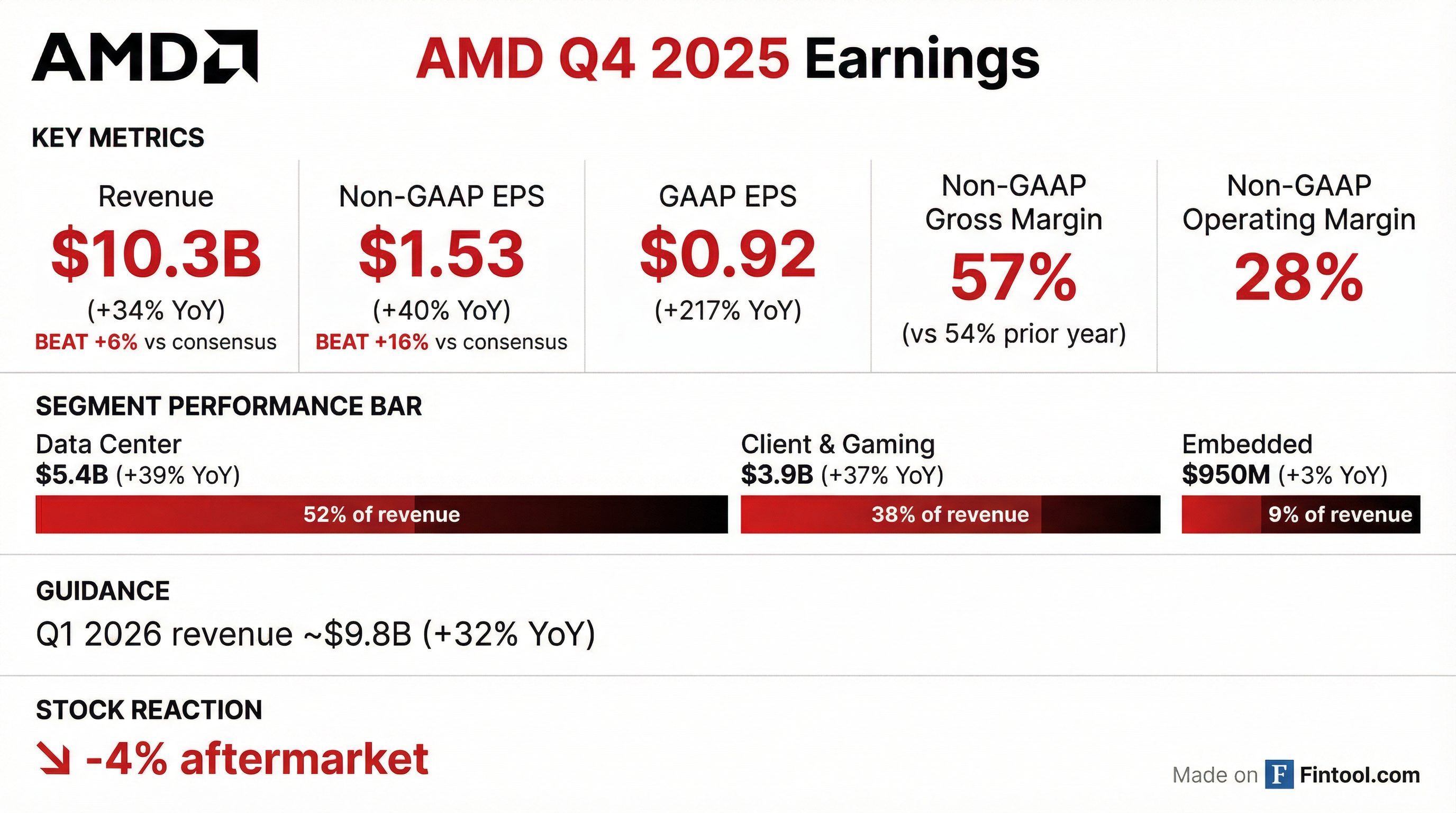

- AMD delivered record Q4 revenue of $10.3 B, up 34% y/y, driven by strength in Data Center and Client & Gaming.

- GAAP gross margin expanded to 54% (+3 ppts y/y); non-GAAP gross margin was 57% (+3 ppts y/y).

- GAAP diluted EPS was $0.92, up 217% y/y; non-GAAP EPS was $1.53, up 40% y/y.

- Data Center revenue reached $5.38 B (+39% y/y); Client & Gaming revenue was $3.94 B (+37% y/y).

- Q1 2026 non-GAAP guidance: revenue ~$9.8 B ± $0.3 B, gross margin ~55%, operating expenses ~$3.05 B.

- AMD posted $10.3 B Q4 revenue (+34% YoY), $34.6 B FY revenue (+34% YoY), $2.5 B Q4 net income (+42% YoY) and $2.1 B free cash flow (nearly 2× YoY).

- Data center segment drove $5.4 B Q4 revenue (+39% YoY) on record EPYC CPU share gains and ramping Instinct MI350 GPU deployments at hyperscalers and enterprises.

- Client & gaming segment delivered $3.9 B Q4 revenue (+37% YoY), including $3.1 B from Ryzen PCs (+34% YoY) and $843 M from gaming (+50% YoY).

- Embedded revenue was $950 M in Q4 (+3% YoY), and AMD closed $17 B in 2025 design wins (+20% YoY), exceeding $50 B total embedded wins since the Xilinx acquisition.

- Q1 2026 guidance: revenue of $9.8 B ± $0.3 B (implying ~32% YoY growth) and non-GAAP gross margin of ~55%.

- AMD Q4 2025 revenue of $10.3 billion, up 34% year-over-year; full year revenue $34.6 billion, +34% YoY.

- Q4 net income $2.5 billion, +42% YoY, and free cash flow $2.1 billion, nearly doubled YoY; gross margin 57%, or ~55% ex-China inventory reserves.

- Segment revenue: Data center $5.4 billion (+39% YoY), client & gaming $3.9 billion (+37% YoY), embedded $950 million (+3% YoY).

- Q1 2026 outlook: revenue $9.8 billion ± $300 million, non-GAAP gross margin ~55%, operating expenses ~$3.05 billion, ~1.65 billion diluted shares.

- Q4 revenue grew 34% YoY to $10.3 billion; net income was $2.5 billion (+42% YoY); free cash flow reached $2.1 billion (+~100% YoY).

- Data Center segment revenue rose 39% YoY to $5.4 billion; Client & Gaming revenue was $3.9 billion (+37% YoY).

- Full-year 2025 revenue totaled $34.6 billion (+34% YoY); Q1 2026 revenue guidance is $9.8 billion ± $0.3 billion, with Data Center expected to grow sequentially.

- Advanced Micro Devices reported record Q4 revenue of $10.3 billion, up 34% y/y, with GAAP gross margin of 54%, operating income of $1.8 billion, net income of $1.5 billion and EPS of $0.92; on a non-GAAP basis gross margin was 57%, operating income $2.9 billion, net income $2.5 billion and EPS $1.53.

- Full-year 2025 revenue reached $34.6 billion, up 34% y/y, with GAAP operating income of $3.7 billion and EPS of $2.65; non-GAAP operating income was $7.8 billion and EPS was $4.17.

- Data Center revenue in Q4 was $5.4 billion (+39% y/y) driven by strong EPYC processor and AMD Instinct GPU demand; Client & Gaming revenue was $3.9 billion (+37% y/y) and Embedded revenue was $950 million (+3% y/y).

- CEO Dr. Lisa Su noted broad-based demand for high-performance and AI platforms, highlighting accelerating adoption of EPYC and Ryzen CPUs and rapid scaling of AMD’s data center AI franchise.

- AMD posted Q4 revenue of $10.3 billion (+34% Y/Y), GAAP net income of $1.5 billion (EPS $0.92) and non-GAAP EPS of $1.53.

- Full-year 2025 revenue reached $34.6 billion (+34% Y/Y), with GAAP net income of $4.3 billion (EPS $2.65) and non-GAAP EPS of $4.17.

- Q4 segment revenues: Data Center $5.4 B (+39% Y/Y), Client & Gaming $3.9 B (+37%), Embedded $950 M (+3%); FY 2025 Data Center $16.6 B (+32%) and Client & Gaming $14.6 B (+51%).

- CEO Lisa Su noted strong momentum into 2026 driven by accelerated EPYC & Ryzen CPU adoption and scaling data center AI platforms.

- AMD’s shares climbed in premarket trading ahead of its Q4 report, with Wall Street forecasting $1.32 adjusted EPS on $9.6–9.7 billion in revenue (including $5 billion from data centers).

- Over the past 12 months, AMD’s stock has surged about 114%, outpacing Nvidia’s 58% gain.

- Investor optimism is underpinned by strong AI‐driven demand and new products showcased at CES 2026—such as the Helios rack-scale server—while risks include a global memory shortage and competition amid reports OpenAI is exploring alternative chips.

- Analysts predict a “beat-and-raise” quarter, with segment forecasts of $2.9 billion in client revenue and $855 million in gaming revenue.

- AMD co-led a $50 million strategic funding round for Eliyan alongside Arm, Coherent, Meta, Samsung Catalyst Fund, and Intel Capital.

- Proceeds will accelerate manufacturing and qualification of Eliyan’s next-generation interconnect IP and chiplet products, expand ecosystem partnerships, and support deployment across AI infrastructure, HPC, and edge applications.

- Eliyan’s NuLink PHY offerings include silicon-proven 64G die-to-die links and next-gen SerDes technologies (224G–448G), while its chiplet families target 1.6T to 12.8Tbps bandwidths for large-scale, disaggregated AI systems.

- The financing round underscores broad industry confidence in scalable, energy-efficient AI system architectures and interconnect solutions.

- Acquired 200 acres of the Rockdale Site for $96.0 million, funded by the sale of approximately 1,080 bitcoin.

- Expands Riot’s fully approved data center power portfolio to 1.7 GW across its Texas facilities.

- Signed a 10-year lease with AMD for an initial 25 MW of IT load, generating $311 million in contract revenue, with options to expand to 200 MW and $1.0 billion total value.

- Deployment to occur in two phases from January to May 2026, with $89.8 million in retrofit capex ($3.6 million/MW) and an expected $25 million annual NOI contribution.

- AMD and Tata Consultancy Services (TCS) have partnered to help enterprises scale AI from pilot to production, modernize hybrid cloud and edge infrastructures, and build secure, high-performance digital workplaces.

- They will co-develop industry-specific GenAI frameworks for life sciences (drug discovery), manufacturing (cognitive quality engineering), and BFSI (intelligent risk management), plus tailored accelerators to boost AI training and inference.

- TCS will integrate AMD Ryzen™, EPYC™, and Instinct™ CPUs/GPUs and AI accelerators into client and HPC solutions, and leverage AMD’s SoCs and FPGAs to drive edge innovation and industrial digitalization.

- The collaboration includes joint talent investment to rapidly upskill and certify TCS associates on AMD hardware and software technologies, building expertise for next-generation AI deployments.

Fintool News

In-depth analysis and coverage of ADVANCED MICRO DEVICES.

Quarterly earnings call transcripts for ADVANCED MICRO DEVICES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more