Earnings summaries and quarterly performance for Air Products & Chemicals.

Research analysts who have asked questions during Air Products & Chemicals earnings calls.

Christopher Parkinson

Wolfe Research

8 questions for APD

Jeffrey Zekauskas

JPMorgan Chase & Co.

8 questions for APD

John Ezekiel Roberts

Mizuho Securities

8 questions for APD

Kevin McCarthy

Vertical Research Partners

8 questions for APD

Patrick Cunningham

Citigroup

8 questions for APD

Duffy Fischer

Goldman Sachs

7 questions for APD

John McNulty

BMO Capital Markets

6 questions for APD

Laurence Alexander

Jefferies

6 questions for APD

Joshua Spector

UBS

5 questions for APD

Matthew Deyoe

Bank of America

5 questions for APD

David Begleiter

Deutsche Bank

4 questions for APD

Vincent Andrews

Morgan Stanley

4 questions for APD

James Hooper

AB Bernstein

3 questions for APD

Josh Spector

UBS Group

3 questions for APD

Michael Harrison

Seaport Research Partners

3 questions for APD

Michael Leithead

Barclays

3 questions for APD

Michael Sison

Wells Fargo

3 questions for APD

Steve Byrne

Bank of America

3 questions for APD

Arun Viswanathan

RBC Capital Markets

2 questions for APD

Daniel Rizzo

Jefferies

2 questions for APD

Emily Fusco

Deutsche Bank

2 questions for APD

Avi Ganesan

Wells Fargo & Company

1 question for APD

David Huang

Deutsche Bank

1 question for APD

Laurent Favre

BNP Paribas

1 question for APD

Mike Sasson

Wells Fargo

1 question for APD

Patrick Fischer

Goldman Sachs

1 question for APD

Sebastian Bray

Berenberg

1 question for APD

Steven Haynes

Morgan Stanley

1 question for APD

Recent press releases and 8-K filings for APD.

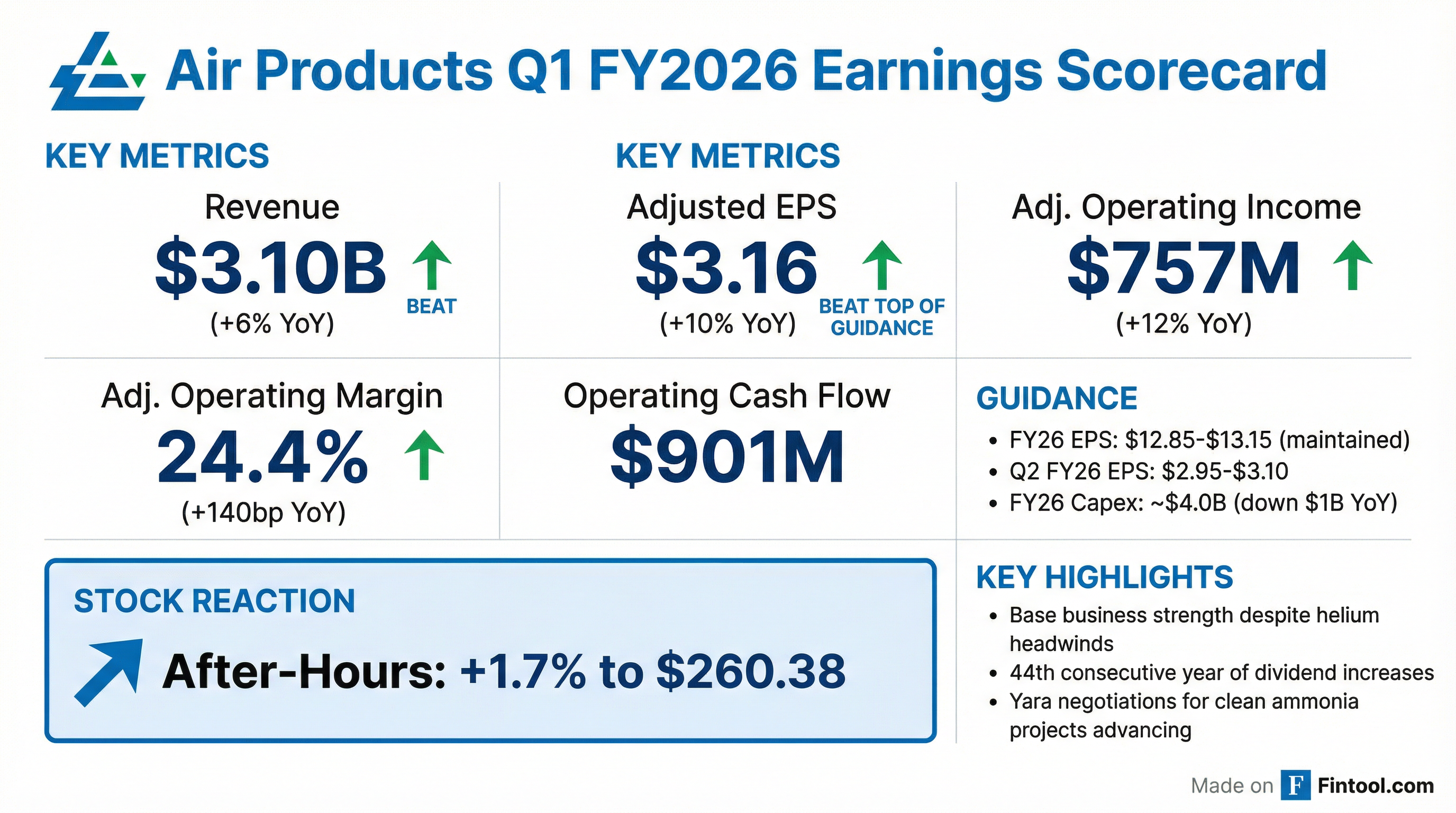

- Sales of $3.1 B (+6%), adjusted operating income of $0.8 B (+12%), and adjusted EPS of $3.16 (+10%); adjusted operating margin rose to 24.4%.

- Reaffirmed FY26 adjusted EPS guidance of $12.85–$13.15 (+7–9%) and Q2 FY26 EPS guidance of $2.95–$3.10 (+10–15%).

- Maintains capital discipline with ~$4 B capex (down ~$1 B vs PY), targeting net cash flow neutral to positive in FY26, and net debt/EBITDA at 2.2×.

- Advancing Yara collaborations on NEOM Green Hydrogen (95%+ complete) and Louisiana Clean Energy Complex, with agreements expected by mid-2026.

- Delivered 12% adjusted operating income growth, with Q1 EPS of $3.16 (+10%), operating margin of 24.4%, and ROIC of 11%; affirmed FY 2026 EPS guidance of $12.85–$13.15 (7–9% midpoint growth).

- Returned ~$400 million in cash to shareholders and raised the quarterly dividend for the 44th consecutive year, underscoring disciplined capital allocation.

- Maintaining fiscal 2026 capital expenditure guidance of ~$4 billion (targeting ~$1 billion reduction) and net debt/EBITDA at 2.2×.

- In advanced negotiations with Yara on low-emission ammonia projects in the U.S. and Saudi Arabia, targeting FID by mid-2026 upon capital cost clarity; NEOM green hydrogen JV deconsolidation expected mid-2027.

- Delivered EPS of $3.16, up 10% YoY, and adjusted operating income up 12%, with an operating margin of 24.4% in Q1 FY2026.

- Affirmed FY 2026 EPS guidance of $12.85–$13.15 (midpoint growth of 7–9%), Q2 EPS outlook of $2.95–$3.10, and maintained CapEx at ~$4 billion, targeting a $1 billion reduction vs. prior plan.

- In advanced negotiations with Yara International on low-emission ammonia projects in Saudi Arabia and Louisiana, focusing on offtake agreements, carbon capture partnerships, and disciplined capital allocation.

- Generated strong cash flow, returned ~$400 million to shareholders with a dividend increase (44th consecutive year), held net debt/EBITDA at 2.2x, and plans to deconsolidate the NEOM green hydrogen JV upon commissioning in mid-2027.

- Q1 EPS of $3.16, up 10% YoY and exceeding guidance; reaffirmed FY26 EPS guidance of $12.85–$13.15 (+7–9% at midpoint) and Q2 EPS guidance of $2.95–$3.10

- Volume flat; price gains on non-helium products offset lower helium; operating income +12% and margin +140 bps YoY

- Returned nearly $400 million to shareholders and increased the quarterly dividend for the 44th consecutive year

- Maintained FY26 CapEx guidance at $4 billion, aiming to reduce spending by $1 billion; heavy CapEx in FY26–27 for Canada and Netherlands clean energy projects

- Advanced negotiations with Yara on low-emission ammonia projects in the US and Saudi Arabia, targeting a distribution agreement in H1 2026; Louisiana project on track for high-return go-forward scope with CO₂ capture partner

- Air Products delivered Q1 FY26 GAAP EPS of $3.04 (up 10%) and adjusted EPS of $3.16 (up 10%) on $3.1 billion in sales (up 6%)

- Maintained FY26 adjusted EPS guidance of $12.85–$13.15 and Q2 guidance of $2.95–$3.10, with full-year capital expenditures expected at ~$4.0 billion

- Increased quarterly dividend to $1.81 per share, marking the 44th consecutive annual increase

- Announced advanced negotiations with Yara International on low-emission ammonia projects and secured $140 million+ NASA liquid hydrogen supply contracts

- GAAP EPS of $3.04, up 10%, and GAAP operating income of $735 million, up 14% year-over-year

- Adjusted EPS of $3.16, up 10%, and adjusted operating income of $757 million, up 12% year-over-year

- Maintains FY 2026 adjusted EPS guidance of $12.85–$13.15, Q2 guidance of $2.95–$3.10, and capital expenditures of ~$4.0 billion

- Raised quarterly dividend to $1.81 per share, marking the 44th consecutive year of increases

- Advanced negotiations with Yara for low-emission ammonia projects and secured $140 million in NASA supply contracts

- Air Products was awarded supply contracts from NASA totaling more than $140 million to provide liquid hydrogen to key space facilities.

- Under the new agreement, the company will deliver 36.5 million pounds of liquid hydrogen to NASA’s Kennedy Space Center, Cape Canaveral Space Force Station, Marshall Space Flight Center and Stennis Space Center.

- Air Products has supported NASA since 1957, spanning Apollo, the Space Shuttle and Orion programs, and in 2025 completed the first fill of the world’s largest hydrogen sphere at Kennedy Space Center.

- The Board of Directors raised the quarterly dividend to $1.81 per share, marking the 44th consecutive year of dividend increases.

- The dividend is payable on May 11, 2026 to shareholders of record at the close of business on April 1, 2026.

- Air Products reported fiscal 2025 sales of $12.0 billion from operations in approximately 50 countries.

- Air Products and Yara International will co-develop low-emission ammonia projects in Louisiana and Saudi Arabia, with the Louisiana project targeting FID by mid-2026 and completion by 2030; total cost $8–9 billion, with a 75%/25% Air Products/Yara capital split.

- Under the U.S. agreement, Air Products will sell the ammonia production and distribution assets to Yara and secure a 25-year offtake contract for hydrogen and nitrogen from its industrial gas facility.

- Air Products retains ownership of the CO₂ capture credits, expects to store up to 10 million tons of CO₂ per year in its pore space, and will emit 5.5 million tons of CO₂ annually eligible for 45Q credits; final sequestration partners to be confirmed pre-FID.

- In Saudi Arabia, Yara will handle marketing and distribution of renewable ammonia from the NEOM joint venture on a commission basis, with agreement planned for H1 2026 and first supply in 2027, leveraging Yara’s 12-vessel and 18-terminal network.

- Air Products and Yara are negotiating a long-term partnership for low-emission ammonia projects in Louisiana, US (FID targeted mid-2026, completion by 2030), and in Saudi Arabia (first supply expected 2027).

- The Louisiana project carries an estimated $8 billion–$9 billion capex, with Air Products funding 75% (industrial gas scope) and Yara funding 25% (ammonia production and shipping assets) under a 25-year hydrogen and nitrogen supply contract.

- CO₂ credits from the project accrue to Air Products under the 45Q tax credit, while CO₂ sequestration will be managed by third-party service providers at fee rates, incurring no additional capex for Air Products.

- Under the NEOM joint venture, Yara will handle transportation and commercialization of renewable ammonia not used by Air Products for green hydrogen in Europe, earning a commission linked to market prices.

Quarterly earnings call transcripts for Air Products & Chemicals.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more