Earnings summaries and quarterly performance for BANK BRADESCO.

Research analysts who have asked questions during BANK BRADESCO earnings calls.

Carlos Gomez-Lopez

HSBC

7 questions for BBD

Mario Pierry

Bank of America

7 questions for BBD

Pedro Leduc

Itau BBA

7 questions for BBD

Tito Labarta

Goldman Sachs

7 questions for BBD

Renato Meloni

Autonomous Research

6 questions for BBD

Yuri Fernandes

JPMorgan Chase & Co.

6 questions for BBD

Daniel Vaz

Banco Safra

5 questions for BBD

Eduardo Rosman

BTG Pactual

5 questions for BBD

Eduardo Nishio

Genial Investimentos

4 questions for BBD

Thiago Bovolenta Batista

UBS

4 questions for BBD

Bernardo Guttmann

XP Inc.

3 questions for BBD

Gustavo Schroden

Citigroup

3 questions for BBD

Henrique Navarro

Banco Santander, S.A.

3 questions for BBD

Jorge Kuri

Morgan Stanley

3 questions for BBD

Andrew Gerrity

Morgan Stanley

2 questions for BBD

Brian Flores

Citigroup Inc.

2 questions for BBD

Daniel Vas

Safra

2 questions for BBD

Eduardo Michivo

Genial Investimentos

2 questions for BBD

Enrique Navarro

Santander

2 questions for BBD

Gustavo Schroeder

Citigroup

2 questions for BBD

Matheus Guimarães

XP Inc.

2 questions for BBD

Thiago Batista

UBS BB

2 questions for BBD

Daer Labarta

Goldman Sachs

1 question for BBD

Yuri Fernandez

JPMorgan

1 question for BBD

Recent press releases and 8-K filings for BBD.

- Banco Bradesco S.A. will hold an Extraordinary General Meeting on March 31, 2026, to approve the partial spin-off of Bradseg Participações S.A., with the spun-off net assets absorbed by Bradesco.

- This transaction is the first step to consolidate all healthcare businesses of the Bradesco Organization under Odontoprev S.A., aiming for a simplified corporate structure, greater administrative efficiency, and expanded health and dental solutions.

- The spun-off portion, valued at R$ 16,136,310,439.65 as of December 31, 2025, includes all shares of Bradesco Gestão de Saúde S.A. and Bradseg's 53.61% equity interest in Odontoprev S.A..

- While Bradseg's share capital will be reduced by R$ 17,085,933,361.06, Bradesco's share capital will not change, and no new shares will be issued as a result of this spin-off.

- Banco Bradesco S.A. is undertaking a corporate reorganization to consolidate its healthcare businesses within Odontoprev S.A..

- Upon implementation, Odontoprev will assume the role of consolidator for the Bradesco Organization's healthcare ecosystem, taking control of all healthcare businesses, and its corporate name will be changed to "Bradsaúde S.A.".

- The transaction involves a partial spin-off of Bradseg, the merger of Bradesco Gestão de Saúde S.A. (BGS) shares by Odontoprev, and an asset contribution of Odontoprev's dental plans to Mediservice.

- Following the transaction, Bradesco's interest in Odontoprev's share capital will become 91.35% of the total and voting capital, with an exchange ratio of 0.17998067486 Odontoprev share for each BGS share.

- Banco Bradesco reported a net income of R$24.7 billion in 2025, marking a 26.1% growth compared to 2024, with total revenues reaching R$137.7 billion, up 13.2%. The Return on Average Shareholders' Equity (ROAE) improved to 14.8%.

- The company proposes to increase its capital stock by R$6,670,000,000.00, from R$87,100,000,000.00 to R$93,770,000,000.00, through the capitalization of profit reserves without issuing new shares.

- For the fiscal year 2025, R$14,499,272,511.68 was allocated as interest on shareholders' equity, with the mandatory dividend being fully paid.

- A proposal was made to amend the Bylaws to allow for profit sharing for management, aiming to align performance with shareholder remuneration.

- Bradesco's indirectly controlled entity, Atlântica Hospitais e Participações S.A., expanded its partnership with Rede D’Or São Luiz S.A. by including Hospital Glória D’Or and Maternidade São Luiz Star in the "Atlântica D’Or" hospital network, retaining a 49.99% stake.

- BANK BRADESCO reported net income attributable to shareholders of the parent of R$23,672,706 thousand for the year ended December 31, 2025, an increase from R$17,252,900 thousand in 2024.

- The company's net interest income grew to R$73,269,592 thousand and fee and commission income reached R$31,073,646 thousand for the year ended December 31, 2025.

- Total assets increased to R$2,330,327,216 thousand as of December 31, 2025, up from R$2,069,484,362 thousand on December 31, 2024.

- The Board of Directors approved interest on shareholders' equity totaling R$14,499,273 thousand (gross) for the year ended December 31, 2025, with payments scheduled through July 2026.

- A new share buyback program was authorized on May 07, 2025, allowing the acquisition of up to 106,584,881 shares by November 08, 2026, with 15,000,000 shares remaining in treasury as of December 31, 2025.

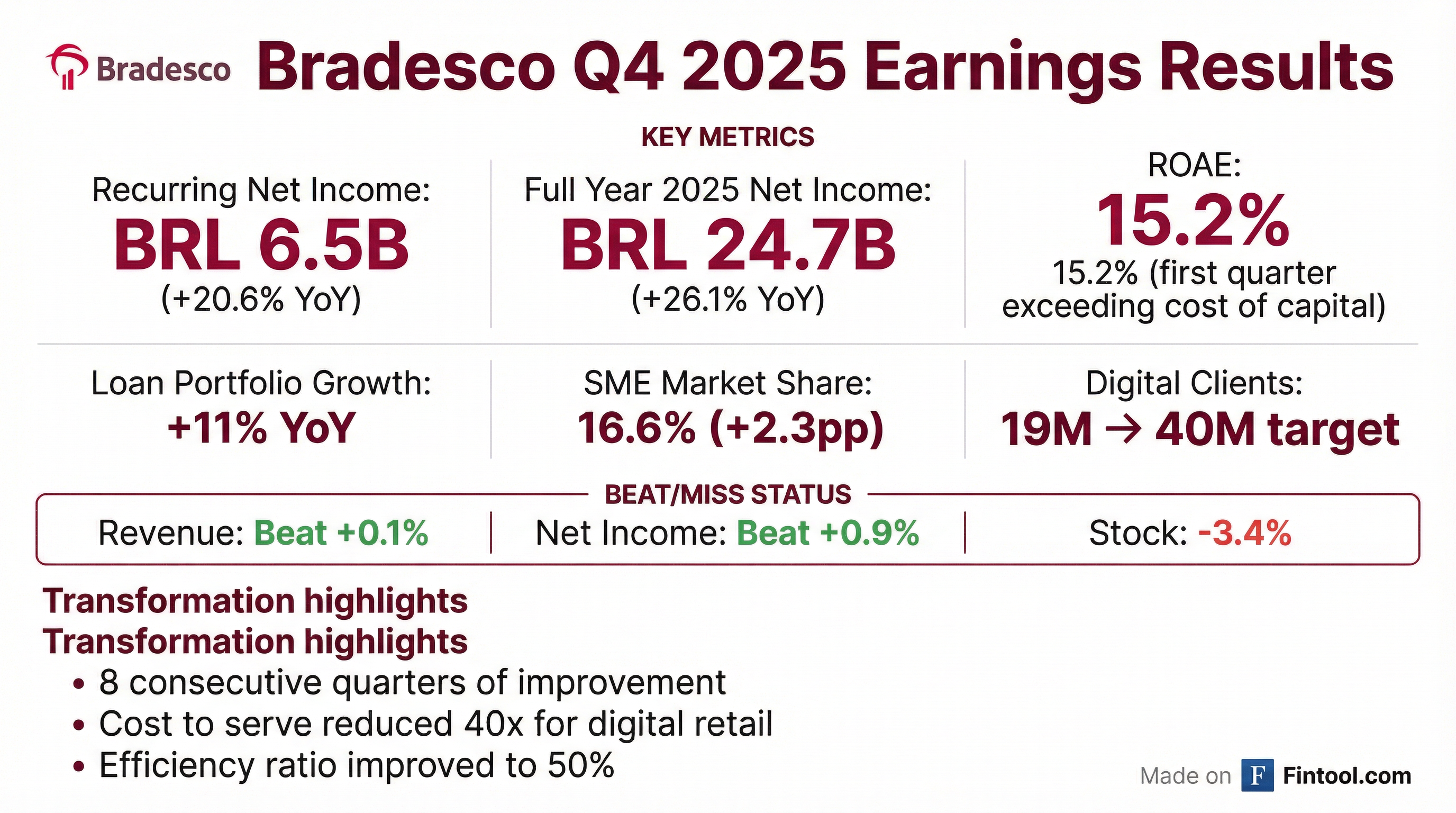

- Bradesco reported a net income of R$6.5 billion in 4Q25, contributing to a R$24.7 billion profit for the full year 2025, marking a 26.1% growth compared to 2024 and achieving a Return on Average Equity (ROAE) of 15.2% in 4Q25.

- Total revenues reached R$36.1 billion in 4Q25, reflecting a 9.8% year-over-year increase, primarily driven by net interest income which grew to R$19.2 billion for the quarter.

- The company surpassed its 2021-2025 socio-environmental allocation goal, reaching R$381.9 billion, and committed to a new cumulative target of R$450 billion by December 2026.

- As of January 2025, Bradesco adopted new accounting practices established by CMN Resolutions No. 4,966 and No. 4,975, which refine criteria for financial instruments and hedge accounting operations, impacting expected loss provisions.

- Bradesco reported net income of R$6.5 billion in Q4 2025, achieving a Return on Equity (ROAE) of 15.2%, and a full-year 2025 profit of R$24.7 billion, representing 26.1% growth over 2024.

- Total revenues for Q4 2025 were R$36.1 billion, an increase of 9.8% year-over-year, primarily driven by net interest income of R$19.2 billion and robust fee and commission income growth.

- The expanded loan portfolio grew 11.0% year-over-year to R$1.089 trillion by December 2025, while the delinquency ratio (over 90 days NPL) remained stable at 4.1%.

- For 2026, the company expects expanded loan portfolio growth of 8.5% to 10.5% and NII Net of Provisions between R$42 billion and R$48 billion, anticipating continued profitability evolution.

- Banco Bradesco reported Q4 2025 recurring net income of BRL 6.5 billion, an increase of 20.6% year-on-year, contributing to a full-year recurring net income of BRL 24.7 billion, which represents 26.1% growth.

- The bank achieved a Return on Average Equity (ROAE) of 15.2% in Q4 2025, exceeding its cost of capital for the first time this quarter, with management expecting continued ROAE growth in the future.

- Strategic investments in technology grew 22% in 2025 compared to 2024 and are projected to continue, supporting digital transformation efforts that have resulted in 19 million fully digital clients by year-end 2025 and a 40-fold reduction in direct cost to serve for these clients.

- The loan portfolio expanded to almost BRL 1.1 trillion by December 2025, with micro, small, and medium-sized companies (SMEs) growing 21.3%. The bank anticipates 8.5%-10.5% loan book growth for 2026, while expecting its CET1 ratio to remain around 11% throughout the year.

- Bradesco reported recurring net income of BRL 6.5 billion for Q4 2025, marking a 20.6% year-on-year growth, and a full-year 2025 recurring net income of BRL 24.7 billion, up 26.1%.

- The company achieved a Return on Average Equity (ROAE) of 15.2% in Q4 2025, surpassing its cost of capital.

- The loan portfolio reached almost BRL 1.1 trillion in December 2025, with the micro, small, and medium-sized companies (SMEs) segment growing 21.3% and increasing market share from 14.3% to 16.6% by September 2025.

- Investments in technology increased by 22% in 2025 compared to 2024, supporting digital initiatives that grew digital retail clients to 19 million by year-end 2025, with a target of 40 million in 2026.

- Insurance operations exceeded guidance with 16.1% growth and an ROE of 24.3% in Q4 2025, while Common Equity Tier 1 (CET1) is projected to remain around 11% throughout 2026.

- Banco Bradesco reported recurring net income of BRL 6.5 billion for Q4 2025, a 20.6% year-on-year growth, and BRL 24.7 billion for the full year 2025, a 26.1% growth. The Return on Average Equity (ROAE) reached 15.2% in Q4 2025, exceeding the cost of capital for the first time.

- The loan portfolio grew by 11% in December 2025, reaching almost BRL 1.1 billion, with micro, small, and medium-sized companies showing a 21.3% growth. Net Interest Income (NII) increased to BRL 14.9 billion, with client NII up 17.4%.

- The company continues to invest heavily in technology, with technology investments growing 22% in 2025 compared to 2024. Digital retail initiatives have led to 19 million fully digital clients and a 40x reduction in direct cost to serve for the digital platform.

- For 2026, the company expects expanded loan portfolio growth of 9.5% and anticipates operating expenses to increase by 8%, with 3% of this growth attributed to technology investments. The CET1 ratio is projected to remain around 11% throughout 2026.

- Bradesco reported recurring net income of R$6.2 billion in Q3 2025, an 18.8% year-over-year increase and a 2.3% quarter-over-quarter increase, with ROAE reaching 14.7%.

- Total revenue for Q3 2025 was R$35.0 billion, growing 13.1% year-over-year and 3.0% quarter-over-quarter, driven by strong performance in net interest income, fee and commission income, and insurance income.

- The expanded loan portfolio reached R$1,034 billion in September 2025, growing 9.6% year-over-year and 1.6% quarter-over-quarter, while the delinquency ratio remained stable at 4.1%.

- The company maintained robust capital levels with a Tier 1 capital ratio of 13.4% and a common equity ratio of 11.4% in Q3 2025.

- For the first nine months of 2025, expanded loan portfolio growth of 9.6% and income from insurance, pension plans, and capitalization bonds growth of 21.7% both exceeded their respective annual guidance ranges.

Quarterly earnings call transcripts for BANK BRADESCO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more