Earnings summaries and quarterly performance for BILL Holdings.

Executive leadership at BILL Holdings.

René Lacerte

Chief Executive Officer

John Rettig

President and Chief Operating Officer

Ken Moss

Chief Technology Officer

Mary Kay Bowman

Executive Vice President, General Manager of Payments and Financial Services

Mike Cieri

Executive Vice President, General Manager of Software Solutions

Rohini Jain

Chief Financial Officer

Board of directors at BILL Holdings.

Aida Alvarez

Director

Alison Wagonfeld

Director

Allie Kline

Lead Independent Director

Allison Mnookin

Director

Beth Johnson

Director

Brian Jacobs

Director

Dan Wernikoff

Director

David Hornik

Director

Keri Gohman

Director

Lee Kirkpatrick

Director

Natalie Derse

Director

Peter Feld

Director

Steven Cakebread

Director

Tina Chan Reich

Director

Research analysts who have asked questions during BILL Holdings earnings calls.

Tien-tsin Huang

JPMorgan Chase & Co.

7 questions for BILL

Andrew Schmidt

Citigroup Inc.

6 questions for BILL

Darrin Peller

Wolfe Research, LLC

6 questions for BILL

Christopher Quintero

Morgan Stanley

5 questions for BILL

Ken Suchoski

Autonomous Research

5 questions for BILL

Scott Berg

Needham & Company, LLC

5 questions for BILL

Bryan Keane

Deutsche Bank

3 questions for BILL

Alexander Markgraff

KeyBanc Capital Markets

2 questions for BILL

Bradley Sills

Bank of America

2 questions for BILL

Nate Svensson

Deutsche Bank

2 questions for BILL

Samad Samana

Jefferies

2 questions for BILL

Andrew Harte

BTIG, LLC

1 question for BILL

Hoi-Fung Wong

Oppenheimer & Co. Inc.

1 question for BILL

Ian Black

Needham & Company

1 question for BILL

James Friedman

Susquehanna Financial Group, LLLP

1 question for BILL

Keith Weiss

Morgan Stanley

1 question for BILL

Taylor McGinnis

UBS

1 question for BILL

Trevor Dodds

Jefferies Financial Group Inc.

1 question for BILL

William Nance

The Goldman Sachs Group, Inc.

1 question for BILL

Recent press releases and 8-K filings for BILL.

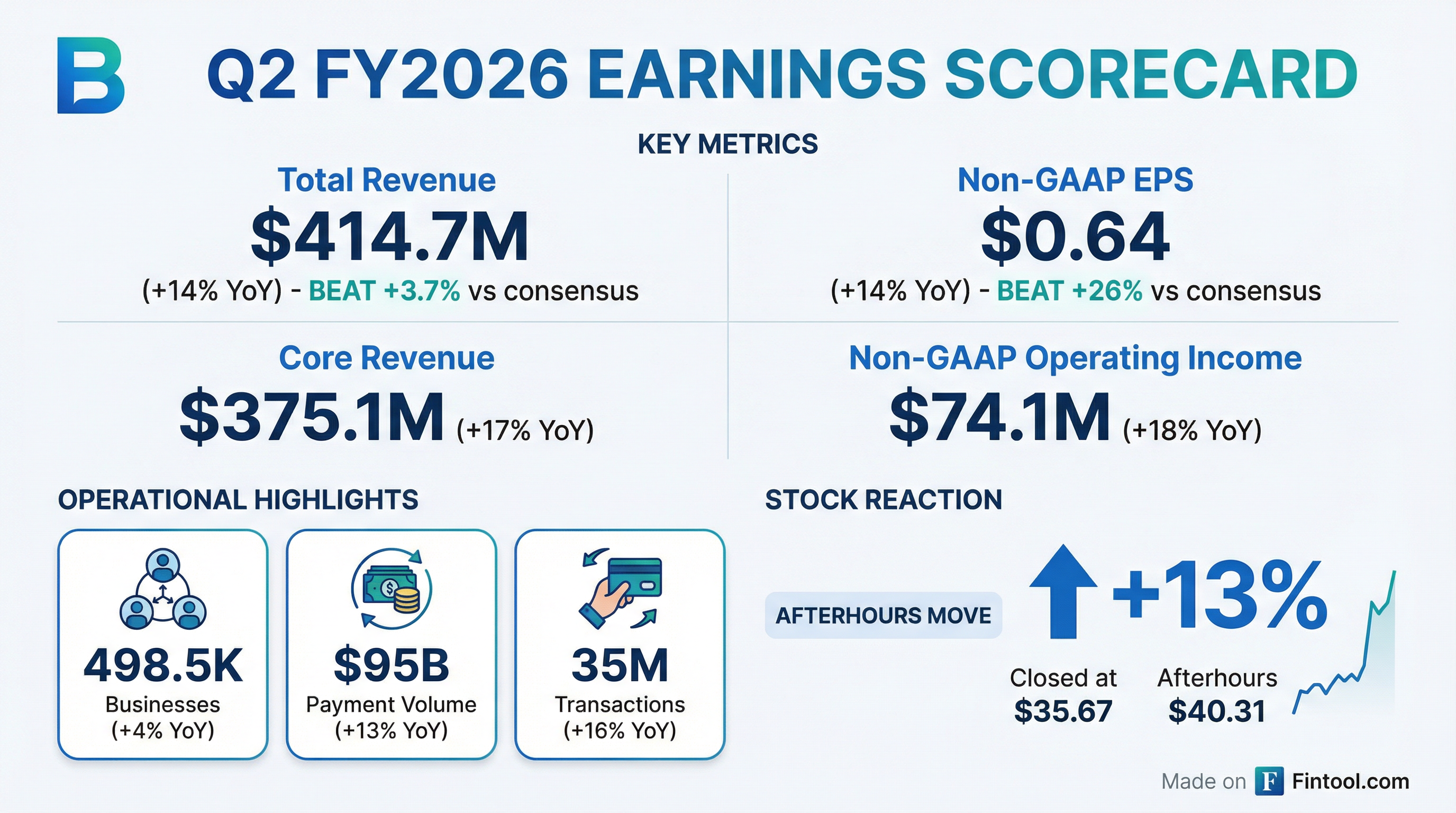

- BILL Holdings reported strong Q2 2026 financial results, with core revenue growing 17% year-over-year to $375 million and a non-GAAP operating margin of 18%.

- The company raised its fiscal year 2026 guidance, now projecting core revenue between $1.490 billion and $1.510 billion (15%-16% growth) and non-GAAP EPS between $2.33 and $2.41.

- Growth was driven by increased multi-product adoption, with businesses using both AP/AR and spend and expense growing 28% year-over-year, and AP card payments volume increasing over 160% year-over-year in Q2.

- Strategic initiatives include leveraging AI with new agentic capabilities, such as the W-9 agent which collected 40,000 W-9s since its Q2 launch, and the BILL Assistant agent which increased the self-serve rate from 13% to over 40%. The company also repurchased $133 million of stock during the quarter.

- BILL Holdings delivered strong Q2 2026 results, with core revenue reaching $375 million, marking a 17% year-over-year growth and surpassing guidance, while achieving an 18% non-GAAP operating margin.

- The company experienced accelerated growth across its integrated platform, including AP card payments volume increasing over 160% year-over-year and spend and expense revenue growing 24% year-over-year to $166 million.

- Strategic initiatives are showing significant progress, with the Embed 2.0 strategy launching new partnerships that unlock potential to reach nearly 1 million businesses, and AI-driven solutions like invoice financing seeing customer growth of nearly 50% year-over-year.

- For Q3 2026, BILL Holdings projects total revenue between $397.5 million and $407.5 million and core revenue between $364.5 million and $374.5 million, reflecting 14%-17% year-over-year growth.

- For Q2 2026, BILL reported total revenue of $414.7 million, comprising $375.1 million in core revenue and $39.5 million in float revenue.

- The company achieved 17% year-over-year core revenue growth.

- Operational highlights for the three months ended December 31, 2025, include $95.1 billion in total payment volume and 34.7 million transactions processed.

- Profitability metrics for Q2 2026 show a Non-GAAP gross margin of 83.9% and Non-GAAP Net Income of $73.4 million.

- The number of businesses using BILL's solutions reached 498,500 as of Q2 2026.

- BILL Holdings reported strong Q2 2026 core revenue of $375 million, a 17% year-over-year increase, and achieved an 18% non-GAAP operating margin.

- Growth was driven by accelerated performance across its integrated platform, with AP/AR core revenue up 11% and Spend & Expense revenue up 24% year-over-year, supported by a 25% increase in card payment volume.

- The company raised its fiscal 2026 core revenue guidance to $1.490 billion-$1.510 billion (15%-16% growth) and non-GAAP EPS to $2.33-$2.41, reflecting a 170 basis point increase in core revenue guidance and over 320 basis points of non-GAAP operating margin expansion (excluding float benefit).

- Strategic focus includes leveraging AI to enhance customer value and operational efficiency, with new agents reducing invoice coding steps by 90% and increasing customer self-serve rates to 40%.

- During Q2, BILL repurchased $133 million of stock and is strategically focusing on larger customers and aligning pricing, which may lead to a slight decrease in net new customer additions in the short term.

- BILL reported total revenue of $414.7 million for the second fiscal quarter ended December 31, 2025, an increase of 14% year-over-year, with core revenue growing 17% year-over-year to $375.1 million.

- For Q2 FY26, the company reported a GAAP net loss of $2.6 million, or $(0.03) per basic and diluted share, while non-GAAP net income was $73.4 million, or $0.64 per diluted share.

- BILL processed $95 billion in total payment volume and 35 million transactions during the second quarter, representing increases of 13% and 16% year-over-year, respectively.

- The company repurchased approximately 2.5 million shares of common stock for a total cost of approximately $133 million in Q2 FY26.

- For the fiscal third quarter ending March 31, 2026, BILL expects total revenue between $397.5 million and $407.5 million and non-GAAP net income per diluted share between $0.53 and $0.57.

- BILL reported strong second quarter fiscal year 2026 results for the period ended December 31, 2025, with total revenue increasing 14% year-over-year to $414.7 million and core revenue growing 17% year-over-year to $375.1 million.

- The company's non-GAAP operating income rose 18% year-over-year to $74.1 million, and non-GAAP net income reached $73.4 million, or $0.64 per diluted share in Q2 FY26.

- For the third fiscal quarter ending March 31, 2026, BILL expects total revenue between $397.5 million and $407.5 million and non-GAAP net income per diluted share between $0.53 and $0.57.

- During the second quarter, BILL repurchased approximately 2.5 million shares of common stock for a total cost of approximately $133 million.

- Barington Capital Group, a shareholder of BILL Holdings, Inc., has sent a letter to Allie Kline, the Lead Independent Director, urging the company to reduce operating costs.

- Barington also called on the Board to explore all strategic alternatives for BILL, including a potential sale, merger, or other business combination.

- These recommendations are based on BILL's slowing fundamentals, inability to deliver operating profitability, and prolonged share price underperformance.

- Barington believes BILL would be an extremely attractive acquisition candidate for both strategic and financial buyers.

- BILL's CFO, Rohini, highlighted three "inflection drivers" for future growth: leveraging AI for customer experience, scaling Supplier Payment Plus (SPP), and expanding through embed partnerships.

- The company is reallocating resources to focus on the mid-market, expecting short-term fluctuations in Net New Adds (NNA) but anticipating an increase in Average Revenue Per User (ARPU), as mid-market customers spend three times more.

- BILL is implementing a new pricing strategy and expects continued take rate expansion, with the emerging transaction portfolio growing at 40% in Q1 FY25 and SPP anticipated to significantly impact take rate in the next year.

- The company is confident in achieving the Rule of 40 through revenue growth and cost structure optimization, including a recent workforce reduction.

- BILL's CFO, Rohini Jain, outlined key strategic priorities for durable growth and profitability, including leveraging AI for customer experience, scaling Supplier Payment Plus (SPP), and expanding through embed partnerships.

- The company is actively balancing growth and profitability, aiming for the Rule of 40 through revenue growth and cost structure optimization, which included a recent workforce reduction.

- BILL is reallocating resources to focus on the mid-market, expecting this shift to increase Average Revenue Per User (ARPU) and TPV per customer, despite potential short-term fluctuations in Net New Adds (NNA). Mid-market customers spend three times more than other customers.

- A new pricing strategy, including modular pricing, is being implemented to better align value with price, and the emerging transaction portfolio, growing at 40% in Q1, is expected to drive take rate expansion, with SPP contributing significantly next year.

- The embed opportunity, with partners like NetSuite, Acumatica, and Paychex, is seen as a significant growth driver, utilizing a revenue share model to expand reach across different customer segments.

- CFO Rohini Jain's strategic priorities include driving durable growth through AI-driven customer experiences, Supplier Payment Plus (SPP) for TPV monetization, and embed partnerships (e.g., NetSuite, Acumatica, Paychex), alongside cost base optimization to enhance profitability and shareholder value.

- BILL is reallocating resources to focus on the mid-market, expecting Average Revenue Per User (ARPU) to increase as these customers spend three times more, though this may cause short-term fluctuations in Net New Adds (NNA).

- The company is implementing a new pricing strategy, including short-term tactical adjustments and a long-term framework, to better align value delivered with price charged.

- BILL anticipates continued take rate expansion, with the emerging transaction portfolio growing at 40% in Q1 and becoming a meaningful contributor, while Supplier Payment Plus (SPP) is expected to be a significant driver next year.

Quarterly earnings call transcripts for BILL Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more