Earnings summaries and quarterly performance for CORPAY.

Executive leadership at CORPAY.

Board of directors at CORPAY.

Annabelle Bexiga

Director

Archie Jones, Jr.

Director

Gerald Throop

Director

Hala Moddelmog

Director

Jeffrey Sloan

Director

Joseph Farrelly

Director

Rahul Gupta

Director

Richard Macchia

Director

Steven Stull

Director

Thomas Hagerty

Director

Research analysts who have asked questions during CORPAY earnings calls.

Andrew Jeffrey

William Blair & Company

4 questions for CPAY

Darrin Peller

Wolfe Research, LLC

4 questions for CPAY

Mihir Bhatia

Bank of America

4 questions for CPAY

Nate Svensson

Deutsche Bank

4 questions for CPAY

Ramsey El-Assal

Barclays

4 questions for CPAY

Sanjay Sakhrani

Keefe, Bruyette & Woods (KBW)

4 questions for CPAY

Tien-tsin Huang

JPMorgan Chase & Co.

4 questions for CPAY

Trevor Williams

Jefferies LLC

4 questions for CPAY

David Koning

Robert W. Baird & Co.

2 questions for CPAY

John Davis

Raymond James Financial

2 questions for CPAY

Ken Suchoski

Autonomous Research

2 questions for CPAY

Madison Suhr

Raymond James

2 questions for CPAY

Michael Infante

Morgan Stanley

2 questions for CPAY

Rayna Kumar

Oppenheimer & Co. Inc.

2 questions for CPAY

Dave Koning

Baird

1 question for CPAY

Recent press releases and 8-K filings for CPAY.

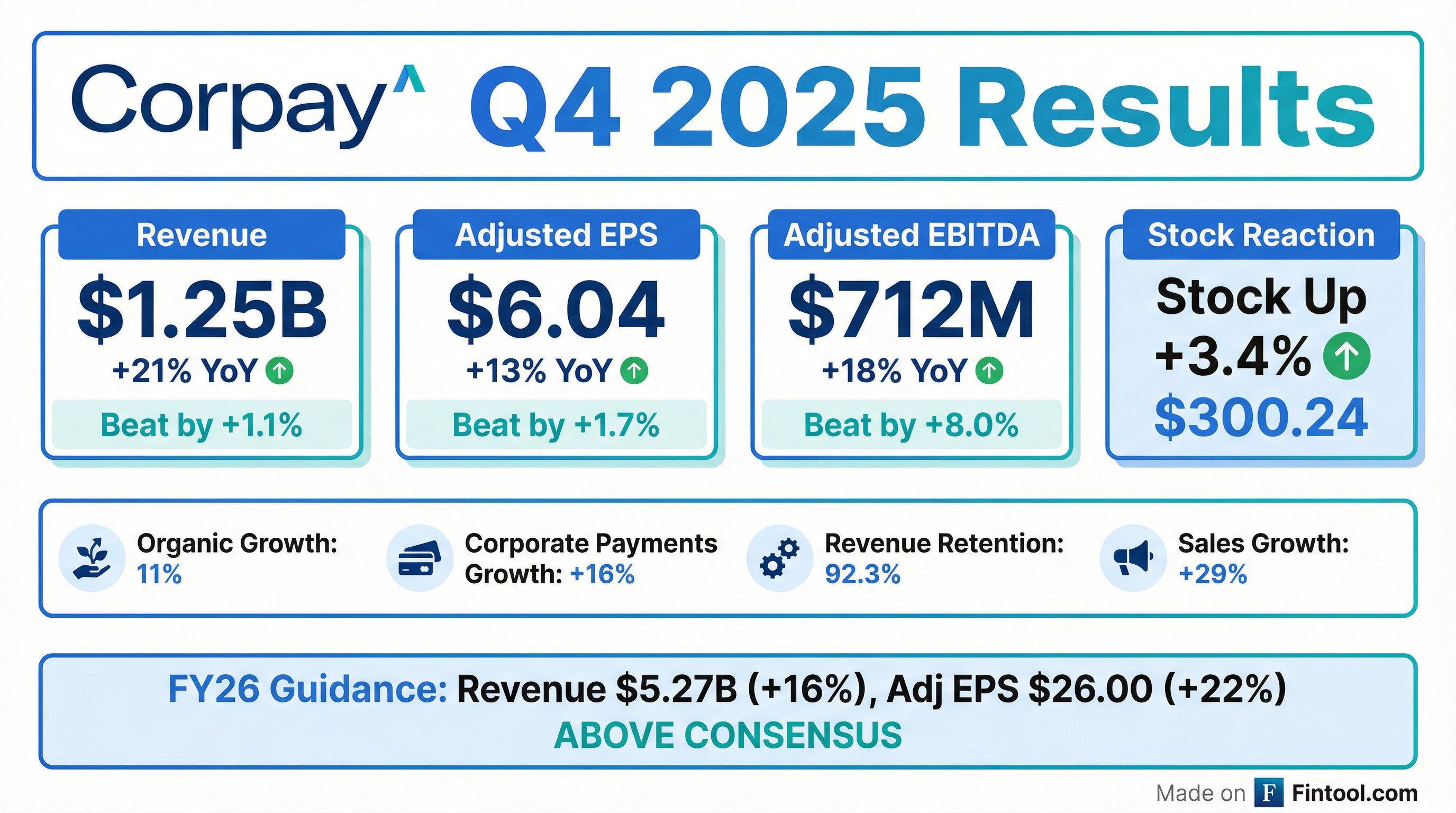

- Corpay reported strong Q4 2025 results with revenue of $1.248 billion, up 21%, and cash EPS of $6.04, up 13% year-over-year. Full year 2025 revenue reached $4.528 billion, an increase of 14%, with cash EPS of $21.38, up 12%.

- The company provided robust full year 2026 guidance, projecting revenue of $5.265 billion, an increase of 16%, and cash EPS of $26, up 22%. This guidance assumes 10% organic revenue growth.

- Key drivers for the 2026 outlook include strong business fundamentals, contributions from recent acquisitions like Alpha and Avid (expected to add approximately $1 to cash EPS) , and a favorable macro environment.

- Corpay is actively repositioning its portfolio towards corporate payments, with the planned divestiture of PayByPhone (expected to generate $100 million in annual revenue) and ongoing efforts to improve sales, expand payables, enhance cross-border capabilities, and implement AI.

- Corpay reported strong Q4 2025 revenue of $1.248 billion, up 21% (11% organic growth), and cash EPS of $6.04, up 13%. For the full year 2025, revenue reached $4.528 billion and cash EPS was $21.38, with 10% organic revenue growth.

- The company issued an optimistic 2026 guidance, forecasting full year revenue of $5.265 billion (up 16%) and cash EPS of $26.00 (up 22%), anticipating 10% organic revenue growth. Q1 2026 is projected to have $1.21 billion in revenue and $5.45 in adjusted EPS.

- Strategic actions in 2025 included the acquisitions of Alpha and an investment in Avid, which are expected to contribute approximately $1 of cash EPS to the 2026 outlook. Corpay also announced the divestiture of PayByPhone and is pursuing two additional vehicle payment divestitures, with proceeds potentially exceeding $1 billion intended for share buybacks.

- Corpay's 2026 priorities include further portfolio simplification towards corporate payments, improving USA sales, expanding payables, enhancing cross-border capabilities, and implementing AI. The company repurchased 1.7 million shares for $500 million in Q4 2025 and has $1.5 billion authorized for future buybacks.

- CPAY reported Q4 2025 revenue of $1.248 billion, an increase of 21% (GAAP) with 11% organic growth, and cash EPS of $6.04, up 13%. For the full year 2025, revenue reached $4.528 billion, up 14%, and cash EPS was $21.38, up 12%, with 10% organic revenue growth.

- The company provided full-year 2026 guidance with revenue at $5.265 billion (midpoint), representing a 16% increase, and cash EPS at $26 (midpoint), up 22%. This guidance assumes 10% organic revenue growth for the year.

- CPAY completed the acquisition of Alpha and invested in Avid, which together are expected to contribute approximately $1 of cash EPS to the 2026 outlook. Additionally, Mastercard invested $300 million in CPAY's cross-border business at a $13 billion valuation.

- The company signed an agreement to sell PayByPhone, a non-core asset, with proceeds expected to be used for share buybacks. CPAY repurchased 1.7 million shares for $500 million in Q4 2025, contributing to $1.5 billion in authorized share repurchases.

- For Q4 2025, Corpay reported revenues of $1.25 billion, an increase of 21% year-over-year, and adjusted EPS of $6.04, up 13% year-over-year, both exceeding guidance. The company also achieved 11% organic revenue growth for the quarter.

- For the full year 2025, Corpay achieved record results with revenues of $4.53 billion, up 14%, and adjusted EPS of $21.38, up 12% year-over-year. Full-year organic revenue growth was 10%.

- In 2025, Corpay was active in capital allocation, closing two acquisitions and two strategic investments totaling approximately $3.5 billion, and repurchasing 2.6 million shares for $782 million.

- Looking ahead to FY 2026, Corpay provided guidance for GAAP Revenues between $5,215 million and $5,315 million (midpoint $5,265 million, representing +16% year-over-year growth) and Adjusted Net Income per Diluted Share between $25.50 and $26.50 (midpoint $26.00, representing +22% year-over-year growth).

- Corpay reported Q4 2025 revenues increased 21% to $1,248.2 million and adjusted net income per diluted share grew 13% to $6.04, with 11% organic revenue growth.

- For the full year 2025, revenues increased 14% to $4.5 billion and adjusted net income per diluted share grew 12% to $21.38, achieving 10% organic revenue growth.

- The company projects 16% revenue growth and 22% adjusted earnings per share growth at the midpoint for fiscal year 2026, with expected full-year organic revenue growth of 10%.

- Corpay repurchased $500 million of shares in Q4 2025 and announced an agreement to sell its PayByPhone mobile parking payments business, signaling a continued rotation to corporate payments.

- Corpay reported strong fourth quarter 2025 revenues of $1,248.2 million, a 21% increase year-over-year, with 11% organic revenue growth and adjusted diluted EPS of $6.04, up 13%.

- For the full year 2025, the company achieved $4.5 billion in revenues, a 14% increase, and adjusted diluted EPS of $21.38, a 12% increase, driven by 10% organic revenue growth.

- Corpay provided a positive outlook for fiscal year 2026, projecting total revenues between $5,215 million and $5,315 million and adjusted diluted EPS between $25.50 and $26.50, with an expected 10% organic revenue growth.

- In 2025, Corpay was active in corporate development, closing its second largest acquisition and two significant strategic investments, and repurchased $782 million of its stock.

- CPAY anticipates favorable macro trends for 2026, with expectations of interest rates coming down in the U.S. and positive FX tailwinds.

- The company projects its Corporate Payments business to achieve 15% organic growth in Q4 despite a 300 basis points headwind from float, and expects this segment to be over $2 billion in 2026.

- Key strategic initiatives include the acquisition of Alpha, which adds a private capital markets business with $3 billion in cash funds, and a Mastercard partnership for $300 million (a 3% stake), expected to provide a 1 to 3 basis points uplift in cross-border business in 2026.

- For 2026, CPAY has a preliminary outlook for roughly 10% top-line growth, driven by high to mid-teens growth in corporate payments and double-digit growth in vehicle payments.

- Management indicates a focus on share buybacks due to the stock being considered "incredibly undervalued," while remaining open to M&A opportunities.

- CPAY anticipates approximately 10% top-line growth for 2026, with Corporate Payments expected to deliver mid-to-high teens growth and Vehicle Payments projected for double-digit growth.

- The Corporate Payments business is projected to exceed $2 billion in 2026 and is expanding into new segments (financial institutions, private capital markets, digital market) through strategic acquisitions like Alpha and partnerships with Mastercard and Circle.

- For 2026, CPAY expects favorable macro trends, including anticipated interest rate reductions in the U.S. and a positive foreign exchange environment.

- The company plans a heavier focus on share buybacks in late 2025 and into 2026, citing the stock's undervaluation, while remaining open to M&A opportunities.

- The North America Fleet business, a $700 million segment, is expected to maintain mid-single digit organic growth in Q4 and throughout 2026.

- Corpay has completed Mastercard's $300 million minority investment in its cross-border business.

- This transaction values Corpay's Cross-Border Business at approximately $13 billion, with Mastercard acquiring a ~2.3% equity stake.

- A new commercial partnership was established to integrate Corpay's cross-border services with Mastercard's financial institution customer base.

- Corpay projects its Corporate Payments 2026 revenue to surpass $2 billion, which is expected to represent over 40% of the company's total revenues next year.

- Corpay is targeting 9%-11% organic growth for 2026 and reported no meaningful change to its 2024 outlook as of December 2, 2025.

- The company recently closed the ~$2.5 billion Alpha Group acquisition to enhance cross-border capabilities and took a one-third stake in AvidXchange with an option to acquire the remainder within 32-33 months.

- Mastercard invested $300 million in Corpay's cross-border business, a deal that recently closed and is expected to drive incremental growth by improving capabilities for regional banks.

- Corpay is exploring the divestiture of non-core international vehicle payments assets, with potential proceeds to be reallocated towards corporate payments or share buybacks, and anticipates ending the year with 2.8 times leverage.

- Generating approximately $1.5 billion in annual free cash flow, Corpay prioritizes accretive M&A but is currently leaning towards share buybacks given its stock's current valuation.

Quarterly earnings call transcripts for CORPAY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more