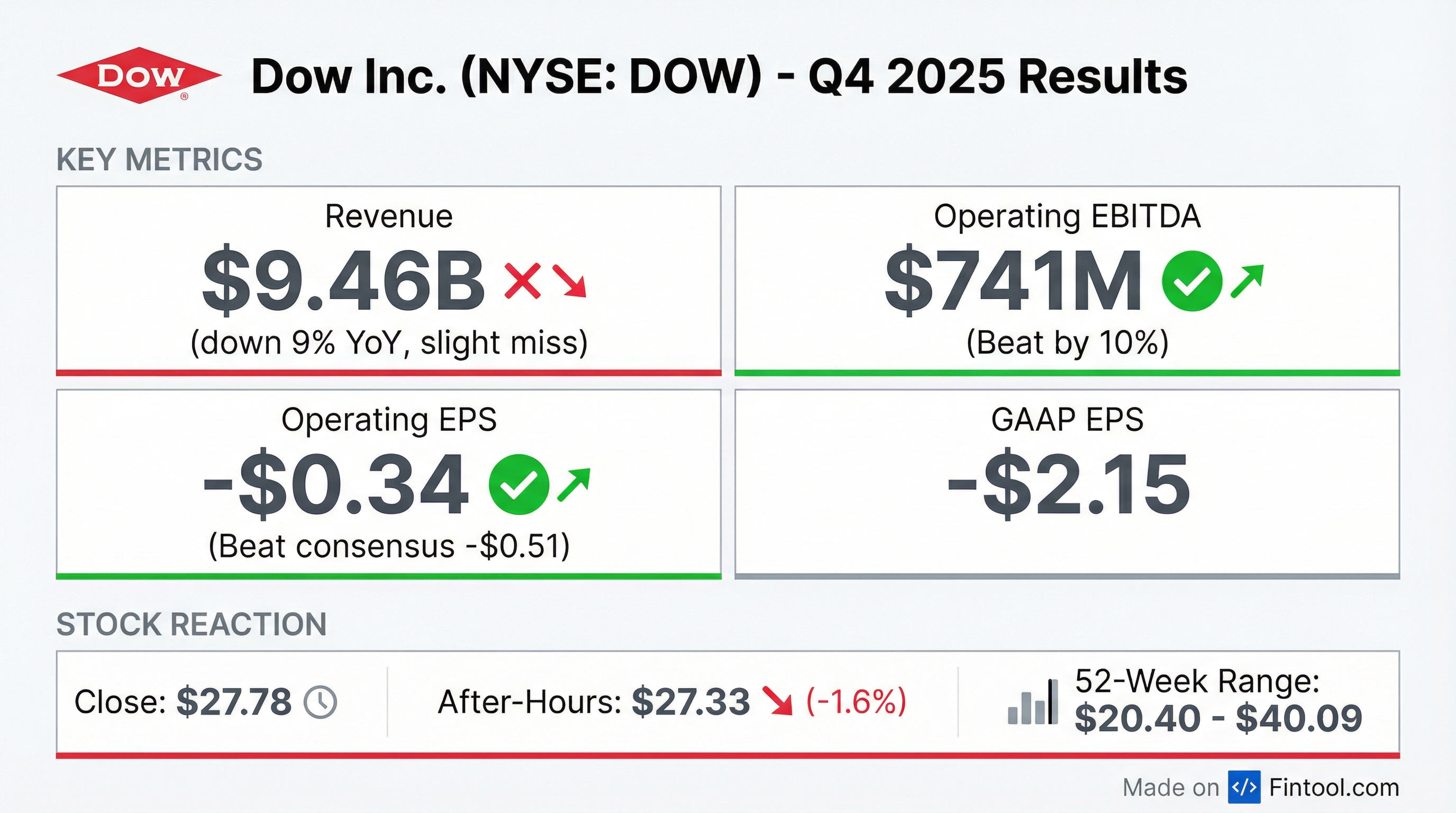

Earnings summaries and quarterly performance for DOW.

Executive leadership at DOW.

Jim Fitterling

Chief Executive Officer

A. N. Sreeram

Chief Technology Officer

Amy E. Wilson

General Counsel and Corporate Secretary

Brendy Lange

President, Performance Materials & Coatings

Debra Bauler

Chief Information & Digital Officer

Jeffrey L. Tate

Chief Financial Officer

John M. Sampson

Senior Vice President, Operations, Manufacturing & Engineering

Karen S. Carter

Chief Operating Officer

Keith Cleason

President, Packaging & Specialty Plastics

Marco ten Bruggencate

President, Industrial Intermediates & Infrastructure

Board of directors at DOW.

Daniel W. Yohannes

Director

Debra L. Dial

Director

Gaurdie E. Banister Jr.

Director

Jacqueline C. Hinman

Director

Jeff M. Fettig

Director

Jerri DeVard

Director

Jill S. Wyant

Director

Luis Alberto Moreno

Director

Rebecca B. Liebert

Director

Richard K. Davis

Independent Lead Director

Samuel R. Allen

Director

Wesley G. Bush

Director

Research analysts who have asked questions during DOW earnings calls.

Hassan Ahmed

Alembic Global Advisors

8 questions for DOW

Kevin McCarthy

Vertical Research Partners

8 questions for DOW

Vincent Andrews

Morgan Stanley

8 questions for DOW

Matthew Blair

Tudor, Pickering, Holt & Co.

7 questions for DOW

David Begleiter

Deutsche Bank

6 questions for DOW

Duffy Fischer

Goldman Sachs

6 questions for DOW

Frank Mitsch

Fermium Research

6 questions for DOW

Michael Sison

Wells Fargo

5 questions for DOW

Patrick Cunningham

Citigroup

5 questions for DOW

Chris Parkinson

Wolfe Research, LLC

4 questions for DOW

Jeffrey Zekauskas

JPMorgan Chase & Co.

4 questions for DOW

Matthew Deyoe

Bank of America

4 questions for DOW

Christopher Parkinson

Wolfe Research

3 questions for DOW

John Ezekiel Roberts

Mizuho Securities

3 questions for DOW

Josh Spector

UBS Group

3 questions for DOW

Aleksey Yefremov

KeyBanc Capital Markets

2 questions for DOW

Jeff Stokvis

Morgan Stanley

2 questions for DOW

Jeff Zekauskas

JPMorgan

2 questions for DOW

Joshua Spector

UBS

2 questions for DOW

Michael Leithead

Barclays

2 questions for DOW

Mike Sison

Wells Fargo

2 questions for DOW

Steve Byrne

Bank of America

2 questions for DOW

Arun Viswanathan

RBC Capital Markets

1 question for DOW

Bhavesh Lodaya

BMO Capital Markets

1 question for DOW

Christopher Perrella

UBS Group AG

1 question for DOW

Laurence Alexander

Jefferies

1 question for DOW

Patrick Fischer

Goldman Sachs

1 question for DOW

Richard Garchitorena

Wells Fargo

1 question for DOW

Recent press releases and 8-K filings for DOW.

- Dow to cut 4,500 jobs (about 13% of workforce) in “Transform to Outperform” plan targeting $2 billion core profitability lift; expects $1.1 billion–$1.5 billion in one-time charges (2026–27)

- CEO Jim Fitterling said Dow delivered over $400 million in cost savings from a $1 billion program and has achieved more than half of its $6.5 billion near-term cash and cost support actions in 2025

- Dow warned Q1 net sales will be $9.4 billion, below LSEG consensus of $10.33 billion, signaling a profit warning amid weak demand

- In Q4, net sales in the packaging and specialty plastics segment fell 10.7% year-over-year to $4.74 billion, driven by lower polymer prices

- Operated with discipline in Q4 2025, delivering $741 million in operating EBITDA amid lower seasonal demand and margin compression.

- Achieved over half of $6.5 billion in near-term cash support items in 2025, including accelerated savings from a $1 billion cost-out program.

- Launched Transform to Outperform, targeting $2 billion in EBITDA uplift (two-thirds from productivity, one-third from growth) with $1.1–1.5 billion of one-time costs and ~4,500 role reductions.

- Deferred the Path to Zero Fort Saskatchewan project startup by two years to late 2029, projecting 8–10% returns and retaining existing cash and tax incentives.

- Strengthened financial flexibility with over $3.8 billion in cash, approximately $14 billion of liquidity, $3 billion of asset sale proceeds, $2.4 billion in bond issuances, and a 50% dividend cut.

- Dow delivered Q4 2025 operating EBITDA of $741 MM, achieved $165 MM in in-period cost savings and reduced CapEx to $568 MM (down $199 MM YoY).

- Full-year 2025 net sales reached $40.0 B with operating EBITDA of $3.3 B, and the company returned capital to shareholders.

- Executed measures generating over $6.5 B of near-term cash support (more than half delivered) and expects its Transform to Outperform program to yield over $2 B of near-term Op. EBITDA uplift.

- 1Q 2026 guidance calls for net sales of ~$9.4 B, with a $150 MM tailwind from higher polyethylene margins offset by a $125 MM planned maintenance headwind, and an operational tax rate of (40)% to (80)%.

- Operating EBITDA of $741 million in Q4 2025, reflecting seasonal demand decline and margin compression versus prior quarter.

- Q1 2026 EBITDA guidance of approximately $750 million, driven by expected margin expansion, cost savings, and offset by higher planned turnaround spending.

- Launched Transform to Outperform program targeting ≥ $2 billion of near-term EBITDA uplift (two-thirds from productivity, one-third from growth), with 4,500 roles workforce reduction and one-time costs of $1.1–1.5 billion.

- Deferred Path to Zero Fort Saskatchewan project by two years to a late 2029 start, aiming for 8–10% returns while preserving cash and tax incentives; ~30% of CapEx is already committed.

- Fourth-quarter operating EBITDA of $741 million; identified $6.5 billion in near-term cash support, delivering over half in 2025, including accelerated $1 billion cost-out savings

- Net sales declines across segments: Packaging & Specialty Plastics $4.7 billion (-2% volume), Industrial Intermediates & Infrastructure $2.7 billion (-1% volume), Performance Materials & Coatings $1.9 billion (-2% volume), with mixed EBIT impacts

- Introduced Transform to Outperform program targeting $2 billion near-term EBITDA uplift (two-thirds productivity, one-third growth), 4,500 role reductions, and $1.1–$1.5 billion of one-time costs, with $500 million of value expected in 2026

- Refined Path2Zero project timeline to align capital deployment; adds a first-quartile cost cracker in Alberta, with detailed engineering complete and long-lead items procured, and returns guided at the low end with upside potential

- Net sales of $9.46 billion, down 9% year-over-year; GAAP net loss of $1.5 billion and Operating EBIT of $33 million, down $421 million versus Q4 2024.

- GAAP loss per share of $2.15; operating EPS loss of $0.34, compared to $0.00 in Q4 2024.

- Cash provided by continuing operations of $298 million, down $513 million year-over-year; returned $251 million in dividends.

- Full-year net sales of $39.97 billion, GAAP net loss of $2.44 billion, and Operating EBIT of $422 million for 2025.

- On January 29, 2026, Dow announced Transform to Outperform, targeting at least $2 billion in near-term Operating EBITDA improvement through simplification, cost restructuring and growth initiatives.

- The Board approved severance and related benefit charges for a workforce reduction of approx 4,500 roles, with severance costs of $600–$800 million and implementation costs of $70–$90 million, to be recorded in 2026–2027.

- The plan anticipates $1.1–$1.5 billion in one-time costs (including $500–$700 million in non-severance charges) and sets an Op. EBITDA uplift timeline: $500 million in 2026 vs. $800–$1,000 million cash cost; $1,200 million in 2027 vs. $300–$500 million cost; $300 million in 2028 at no additional cost.

- Net sales of $9.5 billion for 4Q25, down 9% year-over-year and 5% sequentially, driven by price and volume declines across all segments.

- Volume decreased 2% and local price declined 8% year-over-year; sequential volume and price each fell 2% and 3%, respectively.

- GAAP net loss of $1.5 billion; Operating EBIT of $33 million (down $421 million YoY); operating EPS loss of $0.34.

- Cash from operations of $298 million (down $513 million YoY) and shareholder returns via $251 million of dividends in the quarter.

- Full-year 2025 net sales of $40.0 billion, GAAP net loss $2.4 billion, operating EBIT $0.4 billion, operating cash flow $1.1 billion, and dividends of $1.5 billion.

- Dow's Transform to Outperform targets at least $2 billion in near-term operating EBITDA uplift through operational simplification, cost-structure reset and AI-driven productivity gains.

- The plan entails ~$1.1–1.5 billion in one-time costs, including $600–800 million in severance for ~4,500 roles and $500–700 million in other expenses.

- Annual incremental EBITDA targets are $500 million in 2026 (with $800–1,000 million cash costs), $1.2 billion in 2027 (with $300–500 million costs) and $300 million in 2028 (at zero additional cost).

- Dow expects roughly two-thirds of the benefits from productivity improvements and one-third from growth initiatives.

- X-energy and SGL Carbon signed a 10-year supply agreement, including an initial three-year award valued at over $100 million to support X-energy’s first commercial Xe-100 SMR deployment in partnership with Dow at Seadrift, Texas.

- SGL has commenced production of NBG-18 medium-grain isotropic graphite reactor components for the four-unit Xe-100 plant under the U.S. DOE’s Advanced Reactor Demonstration Program.

- The agreement reserves additional capacity to underpin X-energy’s 11 GW commercial pipeline, including future projects such as the 12-unit Cascade facility in Washington State and Amazon collaborations.

Fintool News

In-depth analysis and coverage of DOW.

Quarterly earnings call transcripts for DOW.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more