Earnings summaries and quarterly performance for EASTGROUP PROPERTIES.

Executive leadership at EASTGROUP PROPERTIES.

Marshall Loeb

Chief Executive Officer and President

Brent Wood

Executive Vice President, Chief Financial Officer and Treasurer

John Coleman

Executive Vice President

Reid Dunbar

Executive Vice President

Ryan Collins

Executive Vice President

Staci Tyler

Executive Vice President, Chief Accounting Officer and Chief Administrative Officer

Board of directors at EASTGROUP PROPERTIES.

Research analysts who have asked questions during EASTGROUP PROPERTIES earnings calls.

Blaine Heck

Wells Fargo Securities

9 questions for EGP

Craig Mailman

Citigroup

9 questions for EGP

Brendan Lynch

Barclays

8 questions for EGP

Omotayo Okusanya

Deutsche Bank AG

8 questions for EGP

Ronald Kamdem

Morgan Stanley

8 questions for EGP

Samir Khanal

Bank of America

8 questions for EGP

Alexander Goldfarb

Piper Sandler

7 questions for EGP

Michael Carroll

RBC Capital Markets

7 questions for EGP

Michael Griffin

Citigroup Inc.

7 questions for EGP

Nicholas Thillman

Robert W. Baird & Co.

7 questions for EGP

John Kim

BMO Capital Markets

6 questions for EGP

Todd Thomas

KeyBanc Capital Markets

6 questions for EGP

Jessica Zheng

Green Street Advisors, LLC

5 questions for EGP

Richard Anderson

Wedbush Securities

5 questions for EGP

Vikram Malhotra

Mizuho Financial Group, Inc.

5 questions for EGP

Michael Mueller

JPMorgan Chase & Co.

4 questions for EGP

Vince Tibone

Green Street

4 questions for EGP

Eric Borden

BMO Capital Markets

3 questions for EGP

Andrew Berger

Bank of America

2 questions for EGP

Connor Mitchell

Piper Sandler & Co.

2 questions for EGP

Jon Petersen

Jefferies

2 questions for EGP

Ki Bin Kim

Truist Securities

2 questions for EGP

Mike Miller

JPMorgan

2 questions for EGP

Mike Mueller

JPMorgan Chase & Co.

2 questions for EGP

Nick Tillman

Baird

2 questions for EGP

Rich Anderson

Cantor Fitzgerald

2 questions for EGP

A.J. Peak

KeyBanc Capital Markets

1 question for EGP

Nikita Bely

J.P. Morgan

1 question for EGP

Steve Sakwa

Evercore ISI

1 question for EGP

Recent press releases and 8-K filings for EGP.

- EastGroup Properties reported strong leasing trends in the first quarter of 2026 to date, with rental rate increases on new and renewal leases averaging 41.9% on a straight-line basis and 27.9% on a cash basis.

- In February 2026, Moody's Ratings upgraded EastGroup's issuer rating to Baa1, outlook stable from Baa2, outlook positive.

- The company raised approximately $70,000,000 in gross proceeds by selling 365,620 shares of common stock and closed on the acquisition of Legend Point for approximately $38,200,000.

- EastGroup also completed the disposition of a property in Fresno for approximately $37,000,000, resulting in a gain of approximately $25,000,000, and began construction on a new development project in Tampa totaling approximately 156,000 square feet.

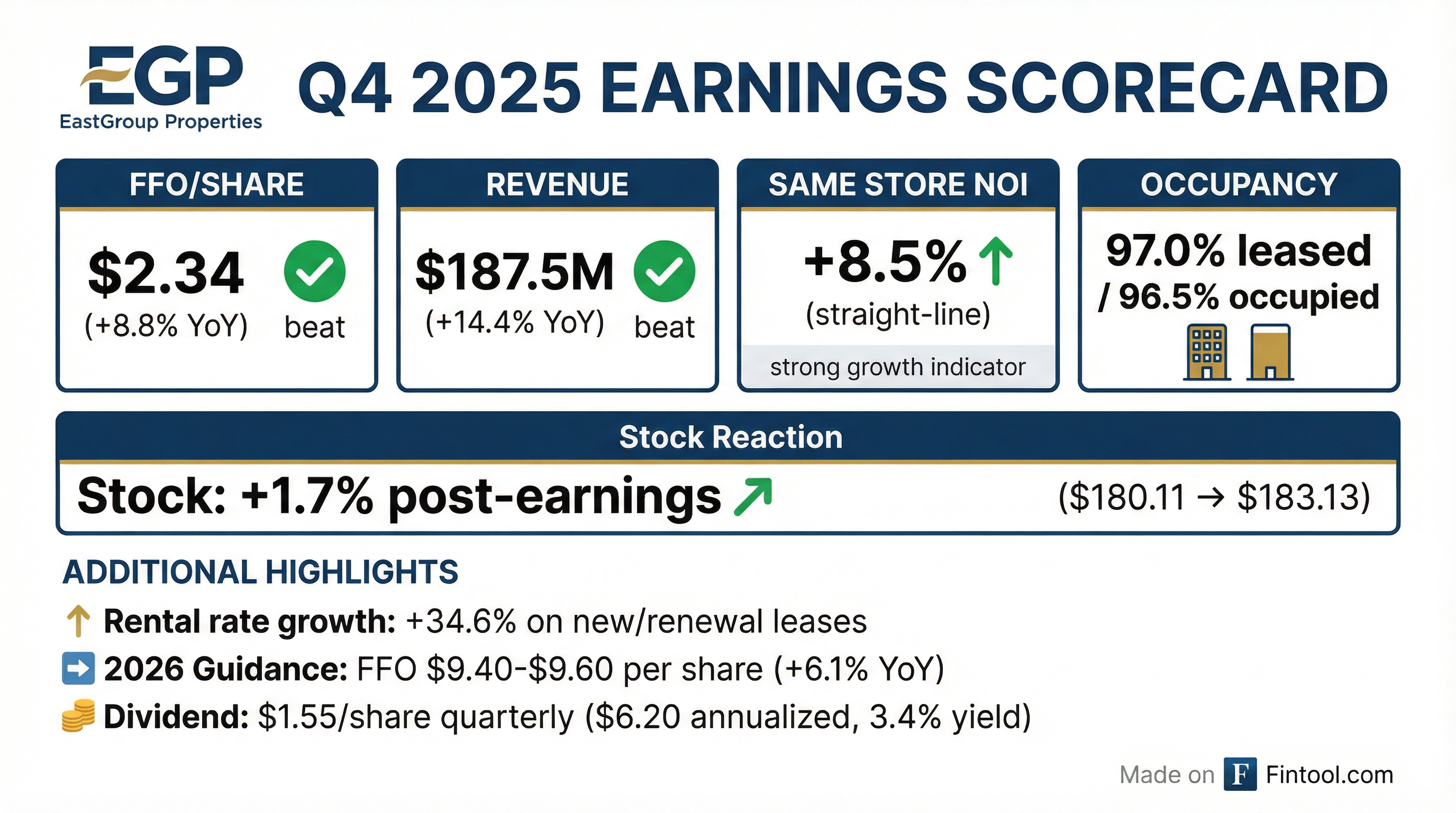

- EastGroup Properties reported strong Q4 2025 FFO per share of $2.34 and FY 2025 FFO per share of $8.98, marking 7.7% growth over the prior year (excluding involuntary conversion gains).

- The company provided 2026 FFO per share guidance of $9.40-$9.60 and plans for $250 million in new development starts and $160 million in operating property acquisitions.

- Operational highlights for Q4 2025 include 97% quarter-end leasing and 96.5% occupancy, with quarterly re-leasing spreads of 35% GAAP and 19% cash.

- Development leasing saw a material improvement in Q4 2025, accounting for 52% of the annual total square footage, and the company maintains a strong balance sheet with a debt to total market capitalization of 14.7% and over $650 million in available credit facility capacity.

- EastGroup Properties is strategically modernizing its portfolio, including an upcoming exit from the Fresno market, and notes that development opportunities currently offer 180-200 basis points better returns than acquisitions.

- EastGroup Properties reported Q4 2025 FFO per share of $2.34 and FY 2025 FFO per share of $8.98, meeting the upper end of their guidance range.

- The company provided 2026 FFO per share guidance of $9.40-$9.60 for the year, with the midpoint representing a 6.1% increase over the prior year, excluding gains on involuntary conversions.

- Occupancy remained strong, with the portfolio 97% leased and 96.5% occupied at year-end 2025, and cash same-store rental income rising 8.4% for Q4 2025 and 6.7% for FY 2025.

- EastGroup plans $250 million in new development starts and $160 million in operating property acquisitions for 2026, supported by a strong balance sheet with over $650 million in available credit facility capacity and a debt to EBITDA ratio of 3 times at year-end 2025.

- The company noted significant development leasing activity in Q4 2025, accounting for 52% of the annual total square footage, and anticipates increased decision-making and deal velocity due to declining supply and improving demand.

- For the full year 2025, EastGroup Properties reported net income attributable to common stockholders of $257,402 thousand and basic earnings per share of $4.88.

- Funds From Operations (FFO) per diluted share increased by 7.5% to $8.98 for the full year 2025.

- Same Property Net Operating Income (PNOI), excluding income from lease terminations, grew by 7.0% on a straight-line basis and 6.7% on a cash basis for the full year 2025, with occupancy at 97.4% as of December 31, 2025.

- The company maintained a Debt-to-EBITDAre ratio of 3.2 and an Adjusted Debt-to-Pro Forma EBITDAre ratio of 2.5 for the full year 2025, while distributing $5.90 in dividends.

- EastGroup (EGP) reported strong FFO results for Q4 2025 at $2.34 per share and full-year 2025 at $8.98 per share, representing 7.7% growth over the prior year, and issued 2026 FFO guidance of $9.40-$9.60 per share.

- The company experienced a material improvement in development leasing in Q4 2025, which accounted for 52% of the annual total square footage, and concluded the year with its operating portfolio 97% leased and 96.5% occupied.

- For 2026, EastGroup plans $250 million in new development starts and $160 million in operating property acquisitions, with funding expected from $300 million in new debt issuance and available credit facilities.

- EastGroup maintains a strong balance sheet, ending 2025 with a debt to total market capitalization of 14.7% and an annualized debt to EBITDA ratio of 3 times, providing ample capacity for future growth.

- EastGroup Properties reported Net Income Attributable to Common Stockholders of $1.27 Per Diluted Share for the fourth quarter of 2025 and $4.87 Per Diluted Share for the full year 2025.

- Funds from Operations (FFO), excluding gain on involuntary conversion and business interruption claims, increased 8.8% to $2.34 Per Diluted Share for Q4 2025 and 7.7% to $8.95 Per Diluted Share for the full year 2025.

- The company provided an outlook for 2026, estimating FFO per share attributable to common stockholders to be in the range of $9.40 to $9.60 and EPS in the range of $4.93 to $5.13.

- Operational highlights include rental rates on new and renewal leases increasing an average of 34.6% on a straight-line basis for Q4 2025 and 40.1% for the full year 2025, and a 10.7% increase in the quarterly dividend to $1.55 Per Share.

- Effective January 1, 2026, Reid Dunbar was promoted to President and Staci Tyler to Chief Financial Officer, among other executive leadership changes.

- For the fourth quarter of 2025, Net Income Attributable to Common Stockholders was $1.27 per diluted share, and for the full year 2025, it was $4.87 per diluted share.

- Funds from Operations (FFO), Excluding Gain on Involuntary Conversion and Business Interruption Claims, increased 8.8% to $2.34 per diluted share for Q4 2025 and 7.7% to $8.95 per diluted share for FY 2025.

- As of December 31, 2025, the operating portfolio was 97.0% leased and 96.5% occupied, with rental rates on new and renewal leases increasing an average of 34.6% on a straight-line basis for Q4 2025.

- EastGroup increased its quarterly dividend by $0.15 per share (10.7%) to $1.55 per share.

- The company's 2026 outlook estimates EPS in the range of $4.93 to $5.13 and FFO per share in the range of $9.40 to $9.60.

- As of November 30, 2025, EastGroup's portfolio was 97.0% leased and 96.2% occupied. During the fourth quarter of 2025 to date, new and renewal leases for 1,057,000 square feet were signed, achieving rental rate increases averaging 31.1% on a straight-line basis and 17.1% on a cash basis.

- In November 2025, the company closed on $250,000,000 in senior unsecured term loans with a weighted average effectively fixed interest rate of 4.13%.

- EastGroup began construction on a 113,000 square foot, 100% pre-leased development project in Orlando with projected costs of $16,000,000. The company also acquired 128 acres of development land in Dallas and San Antonio for approximately $34,000,000 during October and November 2025, expected to accommodate over 1.4 million square feet of future development.

- EastGroup Properties Inc. (EGP) filed a prospectus supplement on December 5, 2025, for an at-the-market common stock offering of up to $1,000,000,000.

- The offering will be conducted through a new sales agency financing agreement with multiple sales agents and forward sellers, with sales agents receiving a commission not exceeding 1.5% of the gross sales price.

- This new program replaces a prior at-the-market program, which was terminated with approximately $520.1 million in common stock remaining unsold.

- The net proceeds from the offering are intended for general corporate purposes, including working capital, debt repayment, and funding for industrial property acquisitions or development.

- EastGroup Properties, Inc. and its subsidiary entered into a Term Loan Agreement on November 19, 2025, for a total of $250.0 million in unsecured term loans.

- This new debt includes a $100.0 million Tranche A maturing April 30, 2030, and a $150.0 million Tranche B maturing March 14, 2031.

- The company achieved a weighted average effectively fixed interest rate of 4.15% per annum on the new term loans through interest rate swaps.

- The proceeds from these loans will be used for general business purposes, including acquisitions and development of real property.

- On the same date, the company also amended its $625.0 million Sixth Amended and Restated Credit Agreement and several other unsecured term loans to remove the upward 0.10% interest rate adjustment for SOFR loans.

Quarterly earnings call transcripts for EASTGROUP PROPERTIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more