Earnings summaries and quarterly performance for EASTMAN CHEMICAL.

Executive leadership at EASTMAN CHEMICAL.

Mark Costa

Chief Executive Officer

Brad Lich

Executive Vice President and Chief Commercial Officer

Chris Killian

Senior Vice President, Chief Technology and Sustainability Officer

Iké Adeyemi

Senior Vice President, Chief Legal Officer and Corporate Secretary

Stephen Crawford

Executive Vice President, Technology Projects

Travis Smith

Executive Vice President, Additives & Functional Products, Manufacturing, WWE&C and HSE

William McLain

Executive Vice President and Chief Financial Officer

Board of directors at EASTMAN CHEMICAL.

Brett Begemann

Lead Independent Director

Damon Audia

Director

Donald Slager

Director

Eric Butler

Director

Humberto Alfonso

Director

James O'Brien

Director

Julie Holder

Director

Kim Ann Mink

Director

Linnie Haynesworth

Director

Renee Hornbaker

Director

Research analysts who have asked questions during EASTMAN CHEMICAL earnings calls.

Aleksey Yefremov

KeyBanc Capital Markets

8 questions for EMN

David Begleiter

Deutsche Bank

8 questions for EMN

Frank Mitsch

Fermium Research

7 questions for EMN

Salvator Tiano

Bank of America

7 questions for EMN

John Ezekiel Roberts

Mizuho Securities

6 questions for EMN

Vincent Andrews

Morgan Stanley

6 questions for EMN

Josh Spector

UBS Group

5 questions for EMN

Kevin McCarthy

Vertical Research Partners

5 questions for EMN

Patrick Cunningham

Citigroup

5 questions for EMN

Jeffrey Zekauskas

JPMorgan Chase & Co.

4 questions for EMN

Laurence Alexander

Jefferies

4 questions for EMN

Michael Sison

Wells Fargo

3 questions for EMN

Arun Viswanathan

RBC Capital Markets

2 questions for EMN

Duffy Fischer

Goldman Sachs

2 questions for EMN

James Cannon

UBS Securities

2 questions for EMN

Lydia Huang

JPMorgan Chase & Co.

2 questions for EMN

Michael Leithead

Barclays

2 questions for EMN

Mike Sison

Wells Fargo

2 questions for EMN

Mike Sisson

Wells Fargo Securities

2 questions for EMN

Rachel Li

Citigroup Inc.

2 questions for EMN

Turner Hinrichs

Morgan Stanley

2 questions for EMN

Aziza Fakhri

Fermium Research

1 question for EMN

Eric Zango

Citigroup

1 question for EMN

Joshua Spector

UBS

1 question for EMN

Matt

Western Standard

1 question for EMN

Patrick Fischer

Goldman Sachs

1 question for EMN

Recent press releases and 8-K filings for EMN.

- Cost reduction: Eastman delivered $100 million in savings in 2025 and targets an additional $125 million–$150 million in 2026 to bolster margins.

- Volume guidance: Advanced Materials and fibers volumes are expected to be stable year-over-year, with Q1 slightly light due to contract ratability and ongoing destocking, then ramping in the back half of the year.

- Earnings outlook: Management sees up to $6 of EPS improvement for 2026, driven by volume growth, utilization tailwinds and FX benefits, partly offset by modest price declines, higher energy costs and normalized variable compensation under wide macroeconomic uncertainty.

- Operational headwinds: The company has hedged ~50% of its natural gas exposure and is managing potential winter-storm impacts on energy costs, while discontinuing certain European crop-protection products due to regulatory bans.

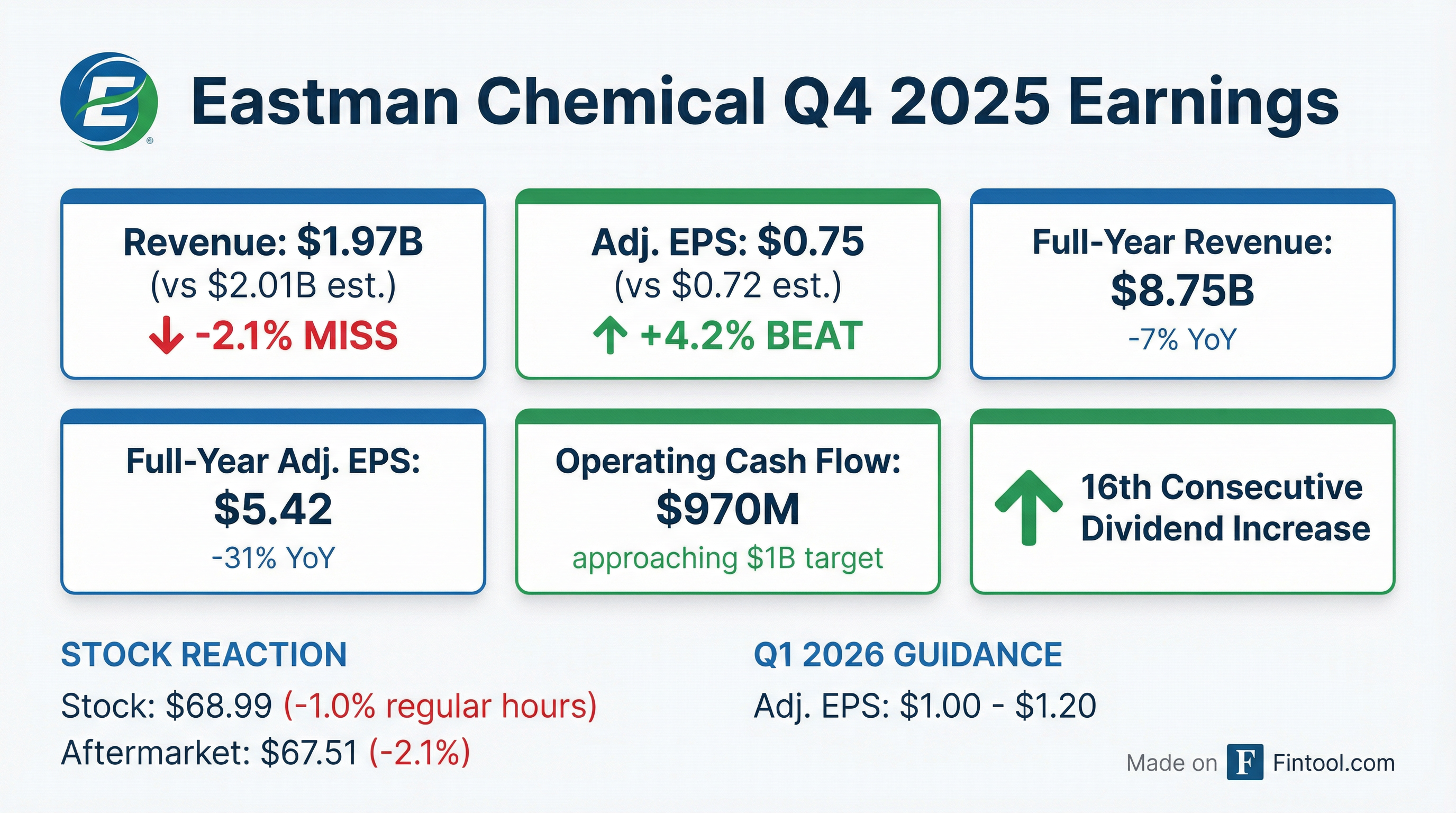

- Eastman reported Q4 2025 revenue of $1.97 billion, down 12% YoY, and Q4 adjusted EBIT of $134 million (6.8% margin) vs. $305 million (13.6%); Q4 adjusted EPS was $0.75 vs. $1.87.

- All segments saw revenue declines, notably Fibers down 27% to $234 million, and Chemical Intermediates posted an adjusted EBIT loss of $28 million in Q4.

- Company achieved substantial cost reductions and high methanolysis yields, expecting this to deliver ~$30 million of incremental earnings in 2026.

- For 2026, targets $125 million–$150 million in cost savings, reduces capital expenditures to ~$400 million, and forecasts Q1 adjusted EPS of $1.00–$1.20, with operating cash flow similar to 2025.

- Delivered cost reductions of $100 million in 2025, exceeding targets, and targeting $225–$250 million over two years

- Advanced Materials to benefit from 45% revenue growth in circular/polyester products with $30 million incremental contribution and ramping rPET volumes

- Identified up to $5.50–$6.00 potential EPS improvement in 2026 driven by cost actions, volume growth, utilization gains, and FX tailwinds, subject to macro uncertainty

- Emphasized advantages of chemical recycling over mechanical methods as rPET quality degrades faster, with major brand contracts (including Pepsi) advancing demand

- Debottlenecking Kingsport methanolysis plant by 130% to defer second-unit capital while maintaining project optionality

- Fibers segment stabilized volumes after tariff and demand headwinds with a $30 M tariff-driven EBIT decline and $20 M cellulosics headwind; modest price declines and a lighter Q1 are expected, ramping through year-end, supported by a $125–150 M cost reduction goal for 2026 (up from $100 M in 2025)

- Chemical Intermediates advancing the E2P project to convert bulk ethylene into propylene, targeting $50–100 M in EBIT improvement and a payback of under two years, while North American demand benefits from tariff protection versus challenged export markets

- Advanced Materials poised for volume recovery via destocking and circular-economy innovation (rPET), driving $30 M of incremental revenue (up 45%) and capturing a share of the $125–150 M corporate cost savings

- Q1 2026 guidance reflects recovery from Q4 with higher energy costs and modest price resets in CI and fibers, but anticipates a $25–50 M utilization tailwind (versus a $100 M headwind in 2025)

- Kingsport rPET start-up is expected to contribute 4–5% revenue growth in 2026, supported by contracts with PepsiCo and other major brands

- Q4 sales were $1,973 million, down 12% year-over-year, and full-year revenue was $8,752 million, down 7% versus 2024.

- GAAP EBIT in Q4 was $64 million (adjusted EBIT $134 million), and diluted EPS was $0.92 (adjusted EPS $0.75).

- Operating cash flow approached $1 billion for the year ($970 million), and the company returned approximately $500 million to shareholders via dividends and share repurchases, raising the dividend for the 16th consecutive year.

- Achieved ~$100 million in cost savings (above a $75 million goal) and generated $60 million of incremental earnings from the Kingsport methanolysis facility in 2025.

- 2026 priorities include $125–150 million of additional cost reductions, stable cash flow, and targeted commercial actions to drive earnings improvement.

- Full-year sales revenue $8.75 billion (down 7% YoY) and adjusted EPS $5.42 (vs $7.89 in 2024); Q4 revenue $1.97 billion (down 12%) with adjusted EPS $0.75 (vs $1.87).

- Operating cash flow approached $1.0 billion in 2025 versus $1.29 billion in 2024.

- Delivered approximately $100 million in cost reductions (above $75 million target) and Kingsport methanolysis facility produced >2.5× recycled content, contributing $60 million of incremental earnings.

- Increased dividend for the 16th consecutive year and returned approximately $500 million to shareholders through dividends and share repurchases.

- Forecasts Q1 2026 adjusted EPS of $1.00–$1.20 and expects operating cash flow similar to 2025.

- Q4 earnings: Advanced Materials & Additives expected in line, Chemical Intermediates below breakeven, fibers destocking deeper; EPS anticipated below $0.75 versus prior $0.75–1.00 range.

- Inventory management: decisive destocking actions in Q3 amid customer destocking and lengthy specialty plastics supply chains; inventories should be at optimal levels by end-2025.

- Cash and liquidity: on track to approach $1 billion in cash for full-year 2025, with Q3 inventory reductions converting to cash in 2026.

- CapEx and cash-flow guidance: 2025 CapEx of $550 million, 2026 base CapEx run‐rate of $400–500 million, targeting flat-to-growing free cash flow and a $400 million dividend run-rate.

- Circular recycling investment: Kingsport methanolysis facility targeting 130 percent throughput via debottlenecks; second-plant expansion paused pending DOE review to optimize capital efficiency.

- Q4 earnings are now expected below $0.75/share (vs. prior $0.75–$1 range) due primarily to weaker Chemical Intermediates demand, a prolonged turnaround and continued fibers destocking.

- Overall demand is lighter than anticipated but has been largely offset by strong cost control and high utilization; Specialties segments are in line with prior guidance while CI is now forecast to be below break-even.

- Inventory actions taken in Q3 position the company to generate approaching $1 billion of cash in 2025, with 2026 free cash flow set to be flat to growing on a $400 million CapEx run rate and $100 million of self-help cost savings.

- The Kingsport methanolysis facility is targeting a 130% debottleneck, with the proposed Longview expansion paused pending DOE discussions; further low-CapEx expansions are being evaluated to meet customer demand and enhance circular-recycling capacity.

- CFO Willie McLain expects Q4 EPS to come in below the prior guidance of $0.75–$1.00, primarily driven by weaker demand and extended turnaround in the Chemical Intermediates and Fibers segments.

- Demand in Advanced Materials and Additives & Functional Products is lighter than anticipated but is being offset by strong cost control and plant utilization; Chemical Intermediates is now forecasted slightly below break-even for Q4.

- Inventory reduction actions in specialty plastics and fibers, combined with ongoing cost‐structure improvements, are on track to generate ~$1 billion of cash in 2025; the company realized $75 million of savings in 2025 and targets an additional $100 million in 2026.

- The Kingsport methanolysis plant is operating robustly and is being optimized toward 130% capacity, underpinning growth in circular packaging applications and informing plans for future low-capex recycling expansions.

- Expects Q4 2025 to be weaker than Q3 due to normal seasonality and inventory destocking; forecasts a rebound in Q1 2026 driven by asset utilization tailwinds, seasonal demand recovery, methanolysis plant ramp-up, and cost actions.

- Targets $75 million of net cost savings in 2025 and has raised the 2026 net savings goal to $100 million (over $300 million gross) through productivity improvements, footprint optimization, and AI deployment.

- Anticipates a meaningful increase in revenue and EBITDA from the circular polyester methanolysis plant, alongside innovation growth in advanced materials (HUD, EV interlayers, Aventa) and tariff-driven benefits in specialty polyesters.

- Maintains partnership with Pepsi for Renew™ recycled PET, able to supply baseload demand from Kingsport and deliver average recycled content of 50–75 percent per product.

Quarterly earnings call transcripts for EASTMAN CHEMICAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more