Earnings summaries and quarterly performance for Energy Transfer.

Research analysts who have asked questions during Energy Transfer earnings calls.

Keith Stanley

Wolfe Research, LLC

8 questions for ET

Manav Gupta

UBS Group

8 questions for ET

Michael Blum

Wells Fargo & Company

8 questions for ET

John Mackay

Goldman Sachs Group, Inc.

7 questions for ET

Theresa Chen

Barclays PLC

7 questions for ET

Jean Ann Salisbury

Bank of America

6 questions for ET

Jeremy Tonet

JPMorgan Chase & Co.

5 questions for ET

Gabriel Moreen

Mizuho Financial Group, Inc.

4 questions for ET

Spiro Dounis

Citigroup Inc.

4 questions for ET

Elvira Scotto

RBC Capital Markets

2 questions for ET

Gabe Moreen

Mizuho Securities USA

2 questions for ET

Jason Gabelman

TD Cowen

2 questions for ET

Julien Dumoulin-Smith

Jefferies

2 questions for ET

Zackery Everen

Tudor Pickering Holt & Co.

2 questions for ET

Eli

JPMorgan Chase & Co.

1 question for ET

Jean Ann

Bank of America

1 question for ET

Teresa Chen

Barclays

1 question for ET

Zach Guan

Tudor, Pickering, Holt & Co.

1 question for ET

Zackery Van Everen

Tudor, Pickering, Holt & Co.

1 question for ET

Zack Van

TPH

1 question for ET

Zack Van Everen

TPH&Co.

1 question for ET

Recent press releases and 8-K filings for ET.

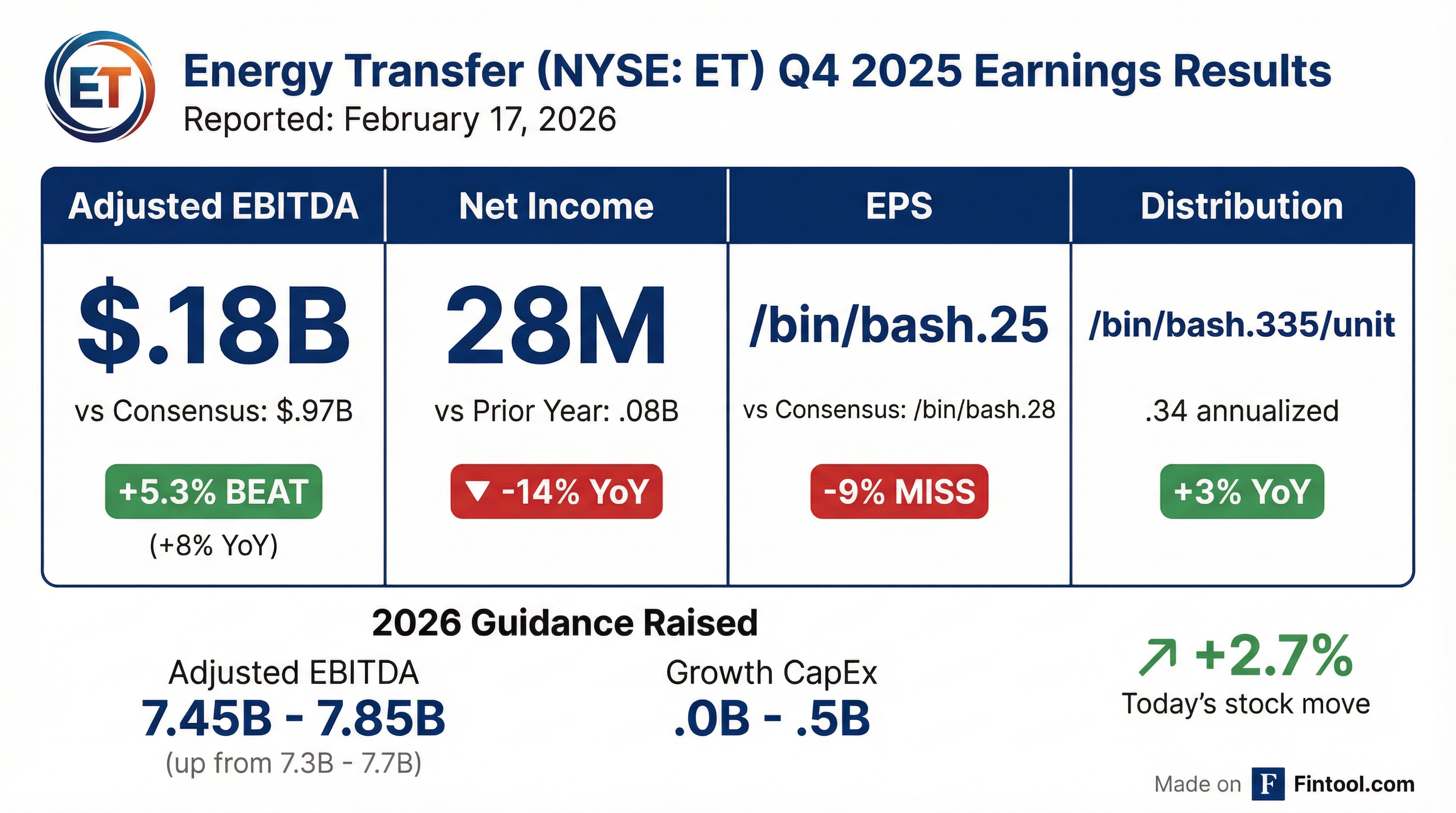

- Energy Transfer reported record full-year 2025 Adjusted EBITDA of nearly $16 billion, a 3% increase over 2024, and Q4 2025 Adjusted EBITDA of approximately $4.2 billion.

- The company raised its 2026 Adjusted EBITDA guidance range to $17.45 billion-$17.85 billion, primarily due to USA Compression's acquisition of JW Power Company.

- Operationally, Energy Transfer achieved record volumes across its interstate, midstream, NGL, and crude segments for 2025, alongside record NGL exports from its Nederland and Marcus Hook terminals.

- Key growth projects include the upsized Desert Southwest Pipeline Project (expected in service Q4 2029), the Hugh Brinson Pipeline (Phase one expected Q4 2026), and expansions at Nederland and Marcus Hook terminals, with a focus on meeting demand from data centers and power plants.

- Energy Transfer reported a record Adjusted EBITDA of nearly $16 billion for full year 2025, an increase of 3% over 2024, and $4.2 billion for Q4 2025. Distributable Cash Flow (DCF) attributable to partners was $8.2 billion for full year 2025 and approximately $2 billion for Q4 2025.

- The company updated its 2026 Adjusted EBITDA guidance to a range of $17.45 billion to $17.85 billion, up from the previous range of $17.3 billion to $17.7 billion, primarily due to the USA Compression's acquisition of JW Power Company.

- Energy Transfer is undertaking significant growth projects, including the upsized Desert Southwest Pipeline Project (48-inch diameter, 2.3 Bcf per day capacity, expected in-service Q4 2029) and the Hugh Brinson Pipeline (Phase one expected in-service Q4 2026).

- The company is also expanding its NGL and refined products segment with ongoing construction at the Nederland and Marcus Hook terminal expansions, and Frac IX at Mont Belvieu. They have secured long-term agreements to deliver natural gas to Oracle's data centers and for power plant loads in Oklahoma, totaling approximately 190 million cubic feet per day expected online in Q2 2026.

- Energy Transfer suspended the development of the Lake Charles LNG project, focusing instead on projects with a more attractive risk-return profile, while exploring other uses for the terminal.

- Energy Transfer reported record Adjusted EBITDA of nearly $16 billion for full year 2025, a 3% increase over 2024, and $4.2 billion for Q4 2025. Distributable Cash Flow (DCF) attributable to partners was $8.2 billion for full year 2025 and $2 billion for Q4 2025.

- The company achieved record operational volumes across its interstate, midstream, NGL, and crude segments for full year 2025, including record NGL exports from Nederland and Marcus Hook terminals. Q4 2025 also saw record NGL fractionation throughput, LPG exports, Nederland Terminal volumes, and crude transportation throughput.

- Organic growth capital spending for full year 2025 was approximately $4.5 billion, with 2026 organic growth capital guidance projected to be between $5 billion and $5.5 billion.

- Key projects include the Desert Southwest Pipeline Project, upsized to 48 inches with capacity up to 2.3 Bcf per day and an expected cost of approximately $5.6 billion by Q4 2029, and the Hugh Brinson Pipeline, with mainline construction approximately 75% complete and Phase I expected in service in Q4 2026.

- Q4 2025 results included a net negative impact of approximately $90 million from one-time items, with over $70 million of this expected to be recouped in Q1 2026.

- Energy Transfer LP reported net income attributable to partners of $928 million and Adjusted EBITDA of $4.18 billion for the fourth quarter of 2025, with Adjusted EBITDA increasing 8% compared to the same period last year.

- The Partnership announced a quarterly cash distribution of $0.3350 per common unit for the quarter ended December 31, 2025, which is an increase of more than 3% compared to the fourth quarter of 2024.

- Energy Transfer updated its 2026 Adjusted EBITDA guidance to a range of $17.45 to $17.85 billion and expects to invest $5.0 billion to $5.5 billion in growth capital for 2026.

- Strategic developments include the suspension of the Lake Charles LNG export project to focus on natural gas pipeline infrastructure, and the increase in capacity for the Transwestern Pipeline's Desert Southwest expansion project to up to 2.3 Bcf/d with an estimated cost of approximately $5.6 billion.

- Energy Transfer reported Q4 GAAP EPS of $0.25, which was down from the prior year, while revenue rose 29.6% year-over-year to $25.32 billion.

- Adjusted EBITDA increased 8% to $4.18 billion and distributable cash flow attributable to partners grew to $2.04 billion.

- The company raised its quarterly dividend to $0.335 (annualized payout of $1.34), carrying a ~7.1% yield and a dividend payout ratio above 100% (~107.2%). Financial metrics indicate a leveraged capital structure (debt-to-equity roughly 1.5–1.9) and an Altman Z-Score signaling elevated distress risk.

- Energy Transfer reported Adjusted EBITDA of $4.18 billion for the fourth quarter of 2025, an 8% increase compared to the same period last year, and Distributable Cash Flow attributable to partners of $2.04 billion.

- Net income attributable to partners for the three months ended December 31, 2025, was $928 million, with net income per common unit (basic) at $0.25.

- The Partnership announced a quarterly cash distribution of $0.3350 per common unit for the quarter ended December 31, 2025, marking an increase of more than 3% compared to the fourth quarter of 2024.

- Energy Transfer updated its 2026 Adjusted EBITDA guidance to a range of $17.45 billion to $17.85 billion, an increase from the previous range, and expects to invest $5.0 billion to $5.5 billion in growth capital for 2026.

- Operational highlights for Q4 2025 included record NGL fractionation volumes (up 3%) and record crude oil transportation volumes (up 6%), alongside a 12% increase in NGL and refined product terminals volumes. The company also suspended the Lake Charles LNG export project in December 2025 to prioritize pipeline infrastructure projects.

- Energy Transfer LP announced an increase in its quarterly cash distribution to $0.3350 per common unit for the fourth quarter ended December 31, 2025, equating to $1.34 on an annualized basis.

- This distribution marks an increase of more than 3 percent compared to the fourth quarter of 2024.

- The cash distribution is scheduled to be paid on February 19, 2026, to unitholders of record as of February 6, 2026.

- Energy Transfer also plans to release its fourth quarter 2025 earnings on Tuesday, February 17, 2026, before market open, and will host a conference call at 8:00 a.m. Central Time/9:00 a.m. Eastern Time on the same day.

- Energy Transfer LP completed a public offering of $3,000,000,000 aggregate principal amount of senior notes on January 27, 2026.

- The offering included three series of notes: 4.550% Senior Notes due 2031, 5.350% Senior Notes due 2036, and 6.300% Senior Notes due 2056, with each series having an aggregate principal amount of $1,000,000,000.

- These notes were issued under an Indenture dated December 14, 2022, as supplemented by the Tenth Supplemental Indenture dated January 27, 2026.

- Energy Transfer LP announced the pricing of a $3.0 billion offering of senior notes on January 12, 2026.

- The offering includes $1.0 billion of 4.550% senior notes due 2031, $1.0 billion of 5.350% senior notes due 2036, and $1.0 billion of 6.300% senior notes due 2056.

- The sale is expected to settle on January 27, 2026, with net proceeds of approximately $2.97 billion (before offering expenses).

- The company intends to use the net proceeds to refinance existing indebtedness, including commercial paper and borrowings under its revolving credit facility, and for general partnership purposes.

- As of September 30, 2025, after giving effect to this offering, Energy Transfer LP would have had $51.9 billion in total senior debt and $3.8 billion in total junior subordinated debt, with an additional $5.0 billion debt capacity under its revolving credit facility.

- Energy Transfer plans to invest $5.0 billion to $5.5 billion in growth capital in 2026, focusing on natural gas infrastructure while suspending its Lake Charles LNG project due to global oversupply concerns.

- The company projects consolidated adjusted EBITDA of $17.3 billion to $17.7 billion for 2026 and targets mid-teens returns on prioritized projects.

- Management aims to maintain leverage around 4.0–4.5 times EBITDA and targets long-term annual distribution growth of 3%–5%.

- For 2025, Energy Transfer expects capital expenditures of about $5.0 billion and adjusted EBITDA of roughly $16.1 billion to $16.5 billion.

- The company's market capitalization is near $56.38 billion, and its Altman Z-Score of 1.32 places it in the 'distress' zone.

Quarterly earnings call transcripts for Energy Transfer.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more