Earnings summaries and quarterly performance for ExlService Holdings.

Executive leadership at ExlService Holdings.

Rohit Kapoor

Chairman and Chief Executive Officer

Ajay Ayyappan

Executive Vice President, General Counsel and Corporate Secretary

Maurizio Nicolelli

Executive Vice President and Chief Financial Officer

Narasimha Kini

Executive Vice President, Banking & Capital Markets and Diversified Industries

Pamela Harrison

Executive Vice President and Chief Human Resources Officer

Vikas Bhalla

President and Head of AI Services and Operations

Vishal Chhibbar

Executive Vice President, International Growth Markets and Chief Growth Officer

Vivek Jetley

President and Head of Insurance, Healthcare and Life Sciences

Board of directors at ExlService Holdings.

Research analysts who have asked questions during ExlService Holdings earnings calls.

Bryan Bergin

TD Cowen

8 questions for EXLS

David Grossman

Stifel

8 questions for EXLS

Puneet Jain

JPMorgan Chase & Co.

6 questions for EXLS

Surinder Thind

Jefferies Financial Group

6 questions for EXLS

Vincent Colicchio

Barrington Research Associates

6 questions for EXLS

David Koning

Robert W. Baird & Co.

5 questions for EXLS

Margaret Nolan

William Blair & Company

3 questions for EXLS

Ellie Dyke

William Blair

2 questions for EXLS

Maggie Nolan

William Blair & Company, L.L.C.

2 questions for EXLS

Robert Bamberger

Robert W. Baird & Co.

2 questions for EXLS

Jacob Packet

Robert W. Baird & Co.

1 question for EXLS

Matt Schultz

William Blair

1 question for EXLS

Recent press releases and 8-K filings for EXLS.

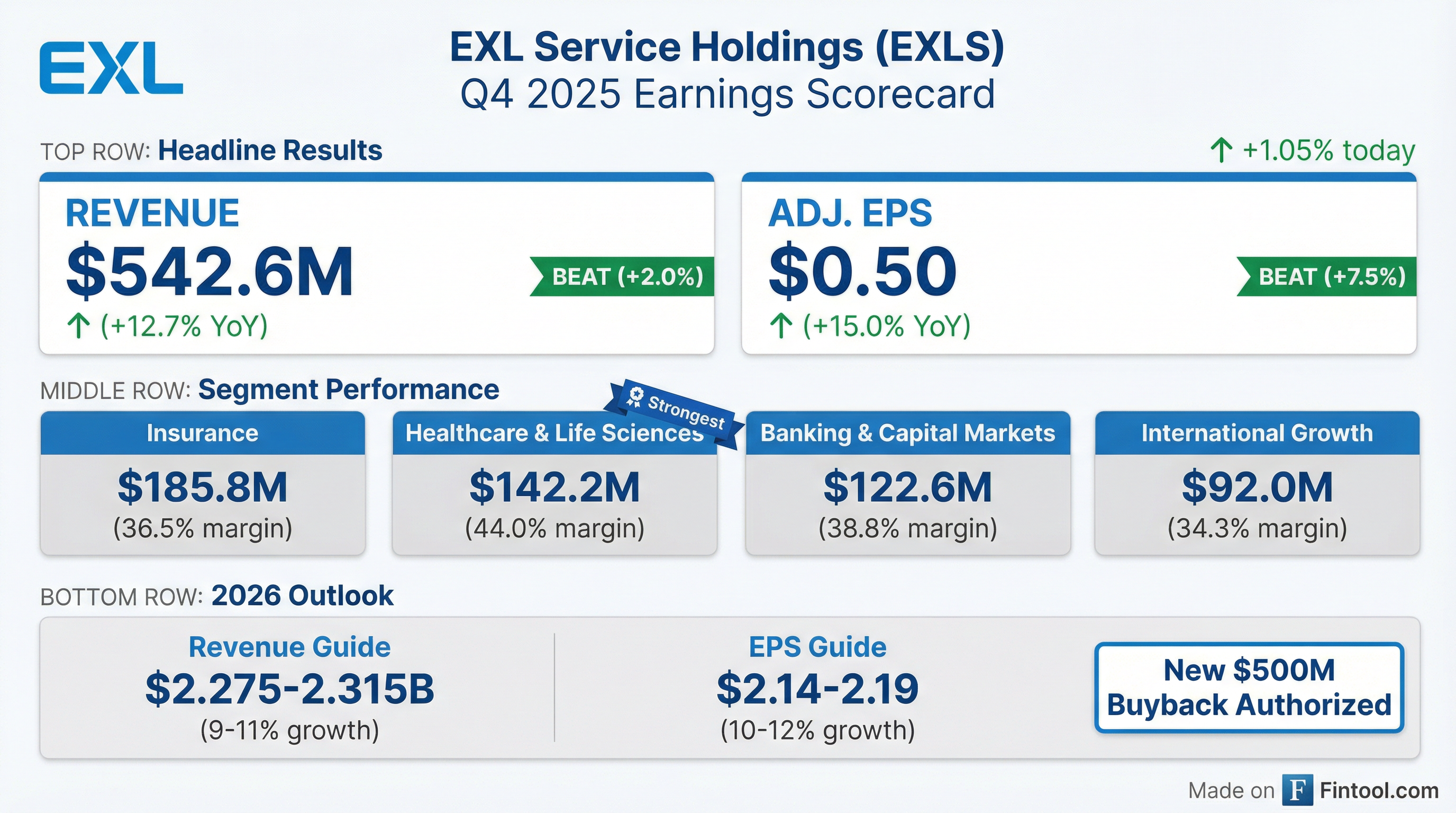

- ExlService Holdings reported Q4 2025 revenue of $542.6 million and adjusted EPS of $0.50, contributing to full-year 2025 revenue of $2.09 billion and adjusted EPS of $1.95.

- The company's Data and AI-led revenue grew 21% year-over-year in Q4 2025, now representing 57% of total revenue, reflecting strong market demand and strategic execution.

- For 2026, EXLS expects revenue in the range of $2.275 billion to $2.315 billion (9%-11% constant currency organic growth) and adjusted diluted EPS between $2.14 and $2.19 (10%-12% increase over 2025).

- The Board of Directors authorized a new $500 million common stock repurchase program, effective February 28, 2026, and the company generated $351 million in cash flow from operations in 2025.

- ExlService Holdings (EXLS) reported strong financial results for Q4 and full-year 2025, with Q4 revenue of $542.6 million, up 12.7% year-over-year, and Adjusted EPS of $0.50, a 15% increase. For the full year, revenue reached $2.09 billion, growing 13.6%, and Adjusted EPS was $1.95 per share, up 18%.

- The company's strategic focus on Data and AI-led services is evident, with this segment representing 57% of total revenue in Q4 2025 and growing 21% year-over-year. EXL emphasizes its integrated approach to AI, deep domain expertise, and ability to embed AI into client workflows as key competitive advantages.

- For 2026, EXL expects revenue to be in the range of $2.275 billion to $2.315 billion, indicating 9%-11% year-over-year growth, and anticipates Adjusted EPS between $2.14 and $2.19, reflecting a 10%-12% increase.

- EXL generated $351 million in cash flow from operations in 2025, a 30.6% increase year-over-year, and authorized a new $500 million common stock repurchase program effective February 28, 2026. Over 75% of the company's revenue is recurring or annuity-like, contributing to revenue stability.

- ExlService Holdings (EXLS) reported Q4 2025 total revenue of $542.6 million, representing a 12.7% year-over-year growth, and adjusted diluted EPS of $0.50, an increase of 15% year-over-year.

- For the full year 2025, the company achieved total revenue of $2.09 billion, growing 13.6% year-over-year, with adjusted diluted EPS reaching $1.95, an 18% increase year-over-year.

- EXLS provided 2026 guidance, projecting revenue between $2,275 million and $2,315 million (9-11% growth) and adjusted diluted earnings per share between $2.14 and $2.19 (10-12% growth).

- The company added 21 new clients in Q4 2025 and a total of 65 new clients for the full year 2025, with the employee count standing at 65,351 as of Q4 2025.

- ExlService Holdings (EXLS) reported strong financial results for Q4 and full-year 2025, with Q4 revenue of $542.6 million and full-year revenue of $2.09 billion, marking 12.7% and 13.6% year-over-year growth, respectively.

- Adjusted EPS for Q4 2025 was $0.50, up 15% year-over-year, and full-year 2025 adjusted EPS reached $1.95, an 18% increase.

- The company's Data and AI-led revenue grew 21% year-over-year in Q4 2025, now comprising 57% of total revenue, driven by strong market demand for its AI services and solutions.

- For 2026, EXLS issued revenue guidance of $2.275 billion to $2.315 billion, reflecting 9%-11% constant currency organic growth, and anticipates adjusted operating margin to remain flat.

- EXLS is strategically focused on expanding its AI capabilities, with Q4 2025 seeing dollar volume of wins more than double any other quarter in the year, and plans for M&A to further its AI strategy and geographic reach.

- EXL reported Q4 2025 revenue of $542.6 million, a 12.7% increase year-over-year, and full-year 2025 revenue of $2.09 billion, up 13.6% year-over-year.

- Q4 2025 Diluted EPS (GAAP) was $0.38 and Adjusted Diluted EPS (Non-GAAP) was $0.50. For the full year 2025, Diluted EPS (GAAP) was $1.54 and Adjusted Diluted EPS (Non-GAAP) was $1.95.

- For full year 2026, EXL provided guidance expecting revenue between $2.275 billion and $2.315 billion and adjusted diluted EPS between $2.14 and $2.19.

- The Board of Directors authorized a $500 million common stock repurchase program, effective February 28, 2026, for a two-year period.

- ExlService Holdings (EXLS) announced Q4 2025 revenue of $542.6 million, an increase of 12.7% year-over-year, and full-year 2025 revenue of $2.09 billion, up 13.6% year-over-year.

- For Q4 2025, diluted EPS (GAAP) was $0.38 and adjusted diluted EPS (Non-GAAP) was $0.50; for full-year 2025, these figures were $1.54 and $1.95, respectively.

- The company provided full-year 2026 guidance, projecting revenue between $2.275 billion and $2.315 billion and adjusted diluted EPS between $2.14 and $2.19.

- A $500 million common stock repurchase program was authorized by the Board of Directors, effective February 28, 2026, for a two-year period.

- EXL has been granted 10 new U.S. patents in the last year for innovations in data and AI, strengthening its position as a leader in the field.

- These advancements power solutions for clients across multiple industries, including insurance, healthcare, retail, utilities, and financial services.

- The patented innovations focus on making data agentic AI-ready through EXLdata.ai™, automating and orchestrating workflows with EXLerate.ai™, and fine-tuning domain-specific LLMs.

- EXLdata.ai, an agentic AI-native suite of data solutions, was launched in October 2025.

- A significant patent is for EXL Insurance LLM™, the first industry-specific large language model created to augment claim adjudication outcomes for bodily injury claims.

- On December 15, 2025, ExlService Holdings, Inc. (EXL) repurchased 1,551,970 shares of its common stock from Orogen Echo LLC for an aggregate purchase price of $63,373,143.

- The purchase price per share was $40.834, based on the volume weighted average price over the five days prior to settlement.

- This repurchase was conducted under a Stock Purchase Agreement separate from EXL's existing $500 million share repurchase program.

- Vikram Pandit, CEO of The Orogen Group, will remain on EXL's board as Lead Independent Director.

- EXLS reported Q3 FY25 total revenue of $529.6 million, marking a 12.2% year-over-year reported growth and 12.3% constant currency growth.

- Adjusted diluted EPS for Q3 FY25 was $0.48, an increase of 10.8% year-over-year, while the adjusted operating margin was 19.4%, a 50 basis point decline year-over-year.

- The company updated its full-year 2025 guidance, raising revenue expectations to $2,070 - $2,080 million (from $2,050 - $2,070 million) and adjusted diluted earnings per share to $1.88 - $1.92 (from $1.86 - $1.90).

- In Q3 FY25, EXLS added 21 new clients and increased its employee count by 2,500 from Q2'25 to a total of 63,636.

- EXLService Holdings Inc. reported Q3 2025 revenue of $529.6 million, a 12.2% year-over-year increase on a reported basis, and adjusted EPS of $0.48, up 10.8% year over year.

- The company's data and AI-led revenue grew 18% year over year, now accounting for 56% of total revenue, underscoring the rising demand for AI-driven solutions.

- EXL launched EXLdata.ai, an Agentic AI suite of data solutions designed to help clients make their enterprise data AI-ready, addressing a significant barrier to AI adoption.

- For the full year 2025, EXL raised its revenue guidance to a range of $2.07 billion to $2.08 billion and its adjusted EPS guidance to $1.88 to $1.92, reflecting strong year-to-date performance and continued momentum.

- Management expressed confidence in sustaining double-digit top-line growth into 2026, supported by exceptionally high renewal rates and a healthy new business pipeline.

Quarterly earnings call transcripts for ExlService Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more