Earnings summaries and quarterly performance for First Watch Restaurant Group.

Executive leadership at First Watch Restaurant Group.

Christopher Tomasso

President and Chief Executive Officer

Eric Hartman

Chief Development Officer

Henry Hope

Chief Financial Officer and Treasurer

Jay Wolszczak

Chief Legal Officer, General Counsel and Secretary

John Jones

Chief Operations Officer

Laura Sorensen

Chief People Officer

Matt Eisenacher

Chief Brand Officer

Robert Conti

Chief Information Officer

Board of directors at First Watch Restaurant Group.

Charles Jemley

Director

David Paresky

Director

Irene Chang Britt

Director

Jostein Solheim

Director

Michael Fleisher

Director

Ralph Alvarez

Chair of the Board

Stephanie Lilak

Director

Tricia Glynn

Director

William Kussell

Director

Research analysts who have asked questions during First Watch Restaurant Group earnings calls.

Brian Vaccaro

Raymond James Financial, Inc.

6 questions for FWRG

Gregory Francfort

Guggenheim Securities

5 questions for FWRG

Jeffrey Bernstein

Barclays

5 questions for FWRG

Jon Tower

Citigroup

5 questions for FWRG

Todd Brooks

The Benchmark Company

5 questions for FWRG

Andrew Barish

Jefferies

4 questions for FWRG

Andrew Charles

TD Cowen

4 questions for FWRG

Brian Mullan

Piper Sandler

4 questions for FWRG

Sara Senatore

Bank of America

4 questions for FWRG

James Salera

Stephens Inc.

3 questions for FWRG

Jim Salera

Stephens Inc.

3 questions for FWRG

Patrick Johnson

Stifel

3 questions for FWRG

Andy Barish

Jefferies Financial Group Inc.

2 questions for FWRG

Arian Razai

Guggenheim Securities

1 question for FWRG

Isiah Austin

Bank of America

1 question for FWRG

Katherine Griffin

Bank of America

1 question for FWRG

Pratik Patel

Barclays

1 question for FWRG

Zach Ogden

TD Cowen

1 question for FWRG

Recent press releases and 8-K filings for FWRG.

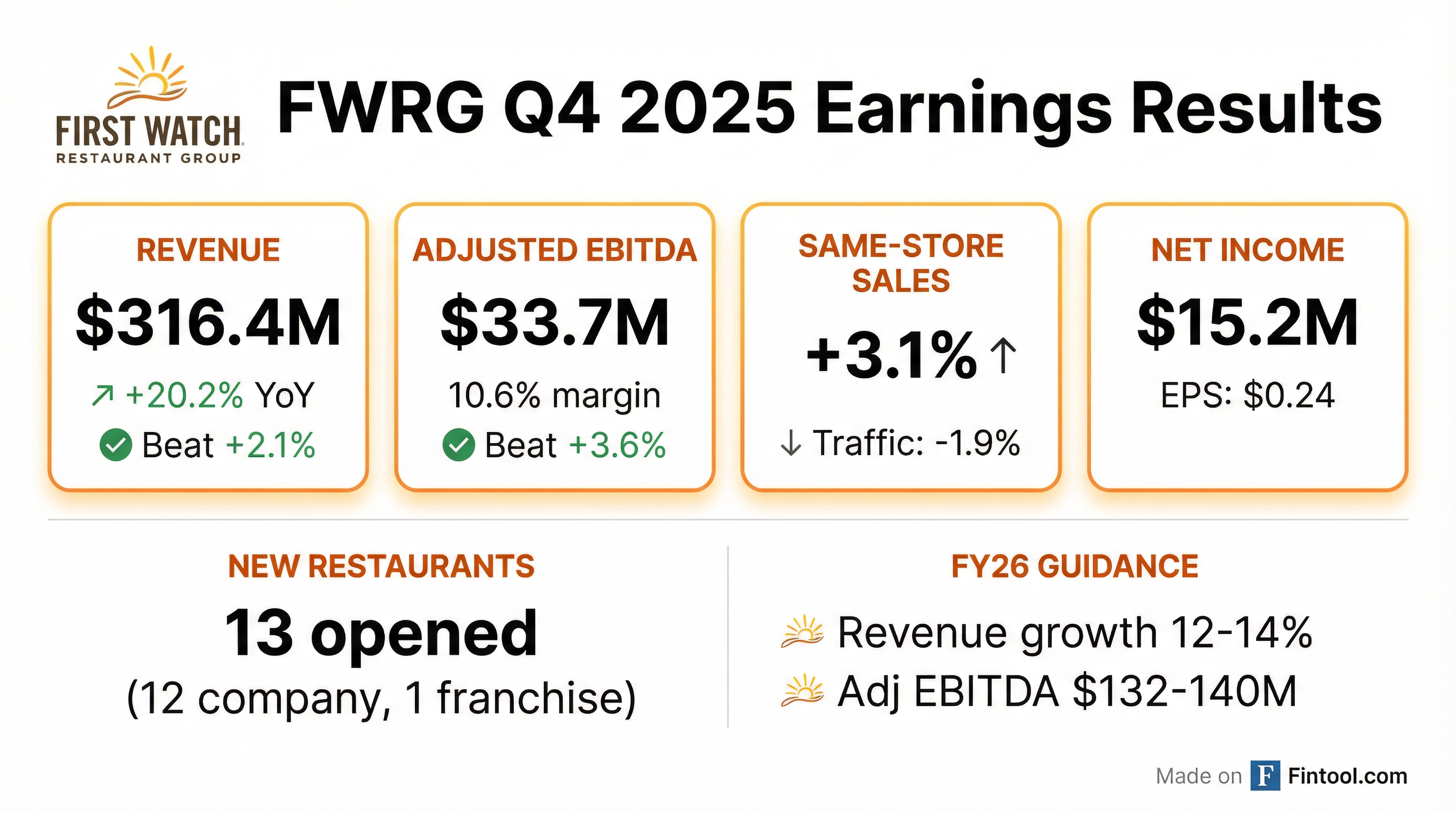

- First Watch Restaurant Group reported total revenues of $1.2 billion for fiscal year 2025, marking a 20.3% increase from 2024, with net income of $19.4 million and Adjusted EBITDA of $120.9 million.

- For Q4 2025, total revenues increased 20.2% to $316.4 million, and net income was $15.2 million.

- The company opened 64 system-wide restaurants in 2025, bringing the total to 633 system-wide restaurants across 32 states.

- For fiscal year 2026, First Watch Restaurant Group anticipates total revenue growth of 12%-14% and Adjusted EBITDA between $132 million and $140 million. The company also plans to open 59 to 63 new system-wide restaurants.

- First Watch Restaurant Group (FWRG) reported strong Q4 2025 results, with total revenues increasing 20.2% to $316.4 million and same-restaurant sales growing 3.1%. For the full year 2025, total revenue growth was more than 20% and same restaurant sales grew 3.6% with positive same restaurant traffic.

- The company achieved a restaurant-level operating profit margin of 19% in Q4 2025, a 20 basis point improvement over Q4 2024, and 18.5% for the full year 2025. Adjusted EBITDA increased 38.7% to $33.7 million in Q4 2025.

- FWRG opened a record 64 new restaurants in 2025, with the 2025 class exceeding expectations by achieving first-year sales trends 19% above their underwriting target. The company ended 2025 with 633 restaurants across 32 states.

- For 2026 guidance, FWRG anticipates same-restaurant sales growth of 1% to 3%, total revenue growth of 12%-14%, and adjusted EBITDA between $132 million and $140 million. They plan to open 59-63 new system-wide restaurants.

- Strategic initiatives for 2026 include the rollout of a new core menu (the first significant redesign in almost 10 years) and the expansion of a digital marketing initiative that previously showed a several hundred basis point lift in traffic in test geographies.

- First Watch Restaurant Group reported a 20.2% increase in total revenues to $316.4 million in Q4 2025, up from $263.3 million in Q4 2024.

- Net income for Q4 2025 was $15.2 million, compared to $0.7 million in Q4 2024, and Adjusted EBITDA increased to $33.7 million from $24.3 million in the prior year quarter.

- The company achieved 3.1% same-restaurant sales growth in Q4 2025, alongside negative 1.9% same-restaurant traffic growth.

- For fiscal year 2026, First Watch anticipates total revenue growth of 12.0%-14.0% and Adjusted EBITDA between $132.0 million and $140.0 million.

- The company plans to open a total of 59 to 63 new system-wide restaurants in fiscal year 2026.

- First Watch Restaurant Group reported strong full-year 2025 results, with total revenue growth exceeding 20% and same restaurant sales growth of 3.6%, alongside a Q4 2025 Adjusted EBITDA increase of 38.7% to $33.7 million.

- The company achieved a record 64 new restaurant openings in 2025, with the new class's first-year sales trends running 19% above their underwriting target.

- For 2026, First Watch projects same-restaurant sales growth of 1%-3%, total revenue growth of 12%-14%, and Adjusted EBITDA between $132 million and $140 million.

- CFO Mel Hope is retiring, and the company plans to expand its successful digital marketing initiative to the majority of its comparable restaurant base in 2026, following positive returns from initial tests.

- First Watch Restaurant Group (FWRG) reported total revenue growth of over 20% and same restaurant sales growth of 3.6% for the full year 2025, with Q4 2025 total revenues increasing 20.2% to $316.4 million and same-restaurant sales growing 3.1%. Restaurant-level operating profit margin was 18.5% for the full year 2025 and 19% for Q4 2025.

- The company opened a record 64 new restaurants in 2025, bringing the total to 633 restaurants across 32 states, with the 2025 class exceeding first-year sales targets by 19%.

- For 2026, FWRG projects same-restaurant sales growth between 1% and 3%, total revenue growth of 12%-14%, and Adjusted EBITDA of $132 million-$140 million. The company plans to open 59-63 new system-wide restaurants.

- Key strategic initiatives for 2026 include the recent launch of a new core menu, the expansion of digital marketing to a majority of comparable restaurants, and a disciplined approach to pricing, with no new pricing taken at the start of 2026.

- First Watch Restaurant Group reported total revenues of $1.2 billion for fiscal year 2025, an increase of 20.3%, with net income of $19.4 million and Adjusted EBITDA of $120.9 million.

- For Q4 2025, the company achieved total revenues of $316.4 million, up 20.2%, with net income of $15.2 million and Adjusted EBITDA of $33.7 million.

- The company provided an outlook for fiscal year 2026, projecting same-restaurant sales growth of 1% to 3%, total revenue growth of 12% to 14%, and Adjusted EBITDA between $132 million and $140 million.

- Chief Financial Officer Mel Hope announced his intent to retire later in 2026, and will remain in his role until a successor is in place to ensure a seamless transition.

- First Watch Restaurant Group reported total revenues of $1.2 billion for fiscal year 2025, a 20.3% increase from 2024, with net income of $19.4 million and Adjusted EBITDA of $120.9 million.

- For Q4 2025, total revenues increased 20.2% to $316.4 million, with net income of $15.2 million and Adjusted EBITDA of $33.7 million.

- The company achieved same-restaurant sales growth of 3.6% for fiscal year 2025 and 3.1% for Q4 2025.

- First Watch opened 64 system-wide restaurants in 2025, contributing to a total of 633 system-wide restaurants.

- For fiscal year 2026, the company anticipates total revenue growth of 12%-14% and Adjusted EBITDA in the range of $132 million to $140 million.

- First Watch Restaurant Group experienced softer comparable sales in Q4 2025 compared to the prior quarter, though it achieved positive traffic for the full year 2025 and positive same restaurant sales each month of Q4.

- Since going public, the company has grown revenues by 65% and EBITDA by 75% over the last three years, doubling its EBITDA and adding approximately 250 restaurants.

- The company continues its unit expansion at an approximate 10% annual rate, maintaining its total addressable market estimate of 2,200 stores from its current base of over 600 stores.

- For FY 2025, the company reported full-year inflation of about 6% on commodities and a 4% increase in overall labor costs, while new restaurants target an ROI of 18%-20%.

- Key strategic efforts in 2025 included implementing a data-driven marketing approach and optimizing third-party delivery partnerships, which led to significant double-digit growth in the delivery channel.

- First Watch Restaurant Group (FWRG) reported positive same restaurant sales for each month of Q4 2025 and positive traffic for the full year, despite softer comparable sales than Q3 2025.

- The company has demonstrated strong growth, with revenues up 65% and EBITDA up 75% over the last three years, and has doubled its EBITDA and added approximately 250 restaurants since going public.

- FWRG continues its disciplined new unit expansion at a 10% annual rate, targeting a Total Addressable Market of 2,200 restaurants, with new units delivering 18%-20% ROI.

- Strategic initiatives in 2025 included leveraging customer data for targeted marketing and reworking third-party delivery partnerships, which led to significant double-digit growth in that channel.

- In 2025, FWRG managed full-year commodity inflation of approximately 6% and a 4% increase in overall labor costs, while maintaining restaurant-level operating profit margins of 18%-20%.

- First Watch Restaurant Group, Inc. reported preliminary operational metrics for the fourth quarter and fiscal year ended December 28, 2025.

- For fiscal year 2025, the company achieved same-restaurant sales growth of +3.6% and same-restaurant traffic growth of +0.5%.

- The company opened a record 64 new system-wide restaurants during 2025, bringing the total to 633 system-wide restaurants as of December 28, 2025.

- CEO Chris Tomasso noted that new restaurant classes from 2024 and 2025 are outperforming expectations, and the pipeline for 2026 is strong.

Fintool News

In-depth analysis and coverage of First Watch Restaurant Group.

Quarterly earnings call transcripts for First Watch Restaurant Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more