Earnings summaries and quarterly performance for Canada Goose Holdings.

Research analysts who have asked questions during Canada Goose Holdings earnings calls.

Brooke Roach

Goldman Sachs Group, Inc.

7 questions for GOOS

Oliver Chen

TD Cowen

7 questions for GOOS

Jonathan Komp

Robert W. Baird & Co.

5 questions for GOOS

Alexander Perry

Bank of America

3 questions for GOOS

Ike Boruchow

Wells Fargo

3 questions for GOOS

Adrienne Yih-Tennant

Barclays

2 questions for GOOS

Lucas Hudson

Bank of America

2 questions for GOOS

Rick Patel

Raymond James Financial

2 questions for GOOS

Suraj Malhotra

Raymond James

2 questions for GOOS

Alexander Conway

JPMorgan Chase & Co.

1 question for GOOS

Jay Sole

UBS

1 question for GOOS

Michael Vu

Barclays

1 question for GOOS

Rakesh Patel

Raymond James

1 question for GOOS

Yanling Wong

Evercore ISI

1 question for GOOS

Recent press releases and 8-K filings for GOOS.

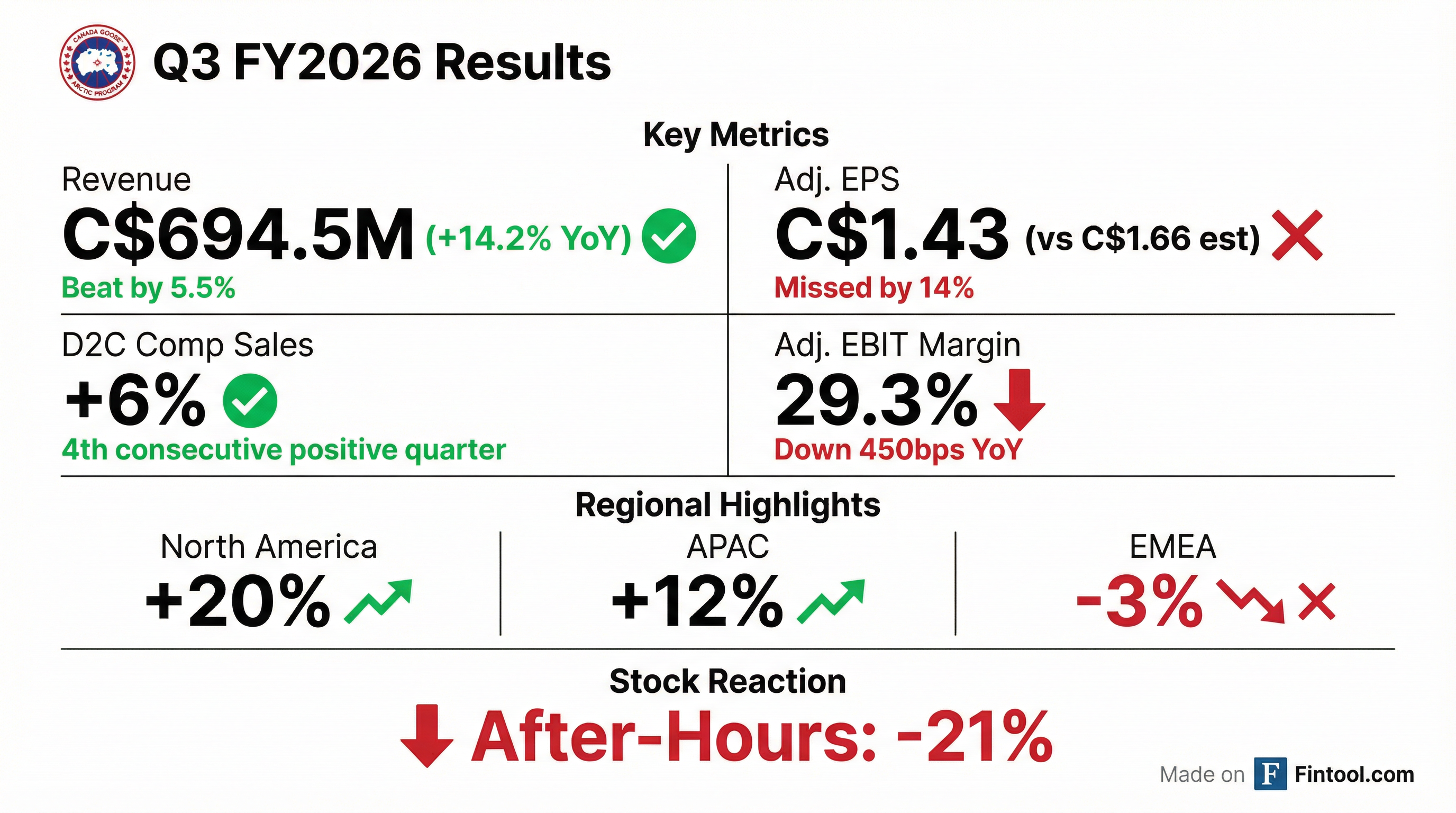

- For Q3 fiscal year 2026, Canada Goose reported a 13% year-over-year increase in revenue to CAD 695 million, driven by strong growth in both Direct-to-Consumer (D2C) and wholesale channels, particularly in North America and Asia Pacific.

- The D2C segment saw revenue growth of 13% and comparable sales increased by 6%, marking the fourth consecutive quarter of positive comparable sales growth.

- Adjusted EBIT margin contracted by 450 basis points year-over-year to 29.3%, primarily due to a product mix shift, increased SG&A (including a CAD 15 million one-time bad debt provision and CAD 13 million in planned marketing investments), and store labor productivity issues.

- Adjusted net income attributable to shareholders was CAD 142 million, or CAD 1.43 per diluted share.

- The company is committed to rebuilding profitability and expects meaningful margin expansion in fiscal 2027 through initiatives such as improved store labor management, marketing efficiency, retail network optimization, and planned price changes.

- Canada Goose reported Q3 fiscal 2026 revenue of CAD 695 million, an increase of 13% year-over-year, driven by strong growth in both D2C and wholesale channels.

- Direct-to-Consumer (D2C) revenue grew 13%, with comparable sales up 6%, marking the fourth consecutive quarter of positive comparable sales growth.

- Adjusted EBIT for Q3 fiscal 2026 was CAD 204 million, resulting in an adjusted EBIT margin of 29.3%, which is 450 basis points lower than the previous year.

- The margin contraction was primarily due to a CAD 66 million increase in SG&A, including a CAD 15 million one-time bad debt provision and a CAD 9 million non-recurring foreign exchange gain from the prior year, as well as a product mix shift.

- The company is committed to returning to margin expansion in fiscal 2027 through actions focused on operating efficiency, marketing efficiency, retail network optimization, and gross margin improvements, including planned price changes.

- Canada Goose reported Q3 fiscal 2026 revenue of CAD 695 million, an increase of 13% year-over-year, driven by 13% growth in Direct-to-Consumer (D2C) revenue with 6% comparable sales growth, and 14% growth in wholesale revenue.

- Adjusted EBIT for Q3 fiscal 2026 was CAD 204 million, resulting in an adjusted EBIT margin of 29.3%, which represents a 450 basis point decline compared to the previous year.

- The decline in adjusted EBIT margin was primarily attributed to increased Selling, General, and Administrative (SG&A) expenses, which grew by CAD 66 million to CAD 314 million (45% of revenue), including CAD 24 million from discrete items such as a bad debt provision and a non-recurring foreign exchange gain from the prior year, as well as planned marketing investments and store labor costs.

- The company is committed to returning to margin expansion in fiscal 2027, with planned actions focusing on operating efficiency (including store labor and marketing efficiency), retail network optimization, and gross margin improvements through initiatives like planned price changes.

- Canada Goose Holdings Inc. reported a 14.2% increase in revenue to $694.5 million CAD for the third quarter ended December 28, 2025, and an 11.5% increase to $1,074.9 million CAD for the three quarters ended December 28, 2025.

- For the three quarters ended December 28, 2025, the company recorded a net loss of $4.9 million CAD, a significant decline from the $75.9 million CAD net income in the prior year, resulting in a diluted loss per share of $0.06 CAD compared to earnings of $0.69 CAD per share.

- Direct-to-Consumer (DTC) revenue grew by 14.1% to $591.0 million CAD in Q3 2026, driven by 6.3% comparable sales growth and retail expansion, while Wholesale revenue increased by 16.6% to $88.3 million CAD due to delayed shipments.

- Selling, general & administrative (SG&A) expenses as a percentage of revenue unfavorably increased to 45.2% in Q3 2026 from 40.7% in Q3 2025, primarily due to bad debt provisioning related to a wholesale partner in the United States.

- Canada Goose reported a 14.2% increase in total revenue to $694.5 million (CAD) for the third quarter of fiscal 2026 ended December 28, 2025, or 13.2% on a constant currency basis, driven by strong performance in the US and Mainland China.

- Net income attributable to shareholders for the quarter was $134.8 million, or $1.36 per diluted share, while Adjusted EBIT reached $203.7 million with an Adjusted EBIT margin of 29.3%.

- The company achieved four consecutive quarters of positive DTC comparable sales growth, with an increase of 6.3% in the third quarter.

- Net debt significantly decreased to $413.0 million as of December 28, 2025, down from $546.4 million at the end of the third quarter of fiscal 2025.

- Daniel Binder has been appointed President, Asia Pacific, effective April 2026, while continuing as Chief Transformation Officer, and will step down as Executive Vice President, Global Stores.

- Niclas Ekerot joins Canada Goose as SVP, Global Stores, effective immediately, bringing over 25 years of luxury retail experience.

- Jonathan Sinclair has stepped down as President, Asia Pacific, but will remain engaged with the company as a board member for its regional subsidiaries.

- Ana Mihaljevic, President of North America, will leave the company in February to pursue new opportunities, with Carrie Baker overseeing the market on an interim basis.

- Canada Goose reported Q2 Fiscal 2026 revenue of CAD 273 million, a 2% increase year-over-year (down 1% on a constant currency basis), but adjusted EBIT was a loss of CAD 14 million compared to a profit of CAD 3 million in the prior year.

- Direct-to-consumer (D2C) comparable sales grew 10% year-over-year across all regions, with D2C revenue increasing 21% on a constant currency basis, marking 10 consecutive months of positive comps.

- The company's gross margin expanded to 62.4% , but adjusted net loss attributable to shareholders was $13 million, or $0.14 per share, due to planned investments in marketing and stores.

- Strategic initiatives included revenue from new products representing approximately 40% of D2C sales , and the company improved its balance sheet with inventory down 3% to $461 million and net debt reduced to $707 million.

- Canada Goose reported Q2 Fiscal 2026 revenue of $272.6 million (CAD), an increase of 1.8% year-over-year, driven by strong Direct-to-Consumer (DTC) performance with revenue up 21.8% to $126.6 million and 10.2% DTC comparable sales growth.

- The company recorded a net loss attributable to shareholders of $15.2 million (CAD), or ($0.16) per basic and diluted share, for Q2 Fiscal 2026, a decline from a net income of $5.4 million, or $0.06 per share, in the prior year period.

- This decline in profitability was largely influenced by a $17.6 million operating loss for the quarter and a $100.6 million increase in Selling, General and Administrative (SG&A) expenses for the two quarters ended September 28, 2025, which included a $43.8 million financial award related to an arbitration proceeding with a former supplier.

- As of September 28, 2025, inventory decreased 3% year-over-year to $460.7 million (CAD), and net debt was reduced to $707.1 million (CAD).

- Canada Goose Holdings Inc. reported total revenue of $272.6 million for the second quarter of fiscal 2026, an increase of 1.8% compared to the prior year, with DTC revenue growing 21.8% to $126.6 million and DTC comparable sales growth of 10.2%.

- The company recorded a net loss attributable to shareholders of $15.2 million, or $0.16 per basic and diluted share, and an adjusted net loss attributable to shareholders of ($13.3) million, or ($0.14) per basic and diluted share for the quarter ended September 28, 2025.

- Inventory decreased 3% year-over-year to $460.7 million, and net debt stood at $707.1 million as of September 28, 2025.

- Canada Goose announced an early renewal of its Normal Course Issuer Bid, commencing November 10, 2025, to purchase up to 4,578,677 subordinate voting shares.

- Canada Goose reported strong Q1 performance for fiscal year 2025, with 22% year-over-year revenue growth and 15% comparable sales growth. The company aims to return to historical peak operating margins, currently at 40% in D2C and 33% in wholesale, with a focus on gross margin dollar expansion.

- The company's strategic initiatives, including product evolution beyond parkas into year-round luxury apparel, enhanced DTC retail execution, and increased, more consistent marketing investments, are driving current momentum. Inventory has improved for the seventh consecutive quarter.

- The wholesale channel has undergone a reset and is now positioned for regrowth, with cleaner inventory and improved brand presentation. North America and China are showing strong DTC performance, driven by execution improvements and product evolution. Management maintains a cautious outlook on the general consumer, despite the brand's strong performance, acknowledging broader weakness trends in the luxury market.

Quarterly earnings call transcripts for Canada Goose Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more