Earnings summaries and quarterly performance for Goosehead Insurance.

Executive leadership at Goosehead Insurance.

Board of directors at Goosehead Insurance.

Research analysts who have asked questions during Goosehead Insurance earnings calls.

Katie Sakys

Autonomous Research

8 questions for GSHD

Michael Zaremski

BMO Capital Markets

8 questions for GSHD

Andrew Kligerman

TD Cowen

7 questions for GSHD

Brian Meredith

UBS

7 questions for GSHD

Mark Hughes

Truist Securities

7 questions for GSHD

Pablo Singzon

JPMorgan Chase & Co.

6 questions for GSHD

Paul Newsome

Piper Sandler Companies

5 questions for GSHD

Ryan Tunis

Cantor Fitzgerald

4 questions for GSHD

Thomas Mcjoynt-Griffith

Keefe, Bruyette & Woods

4 questions for GSHD

Tommy McJoynt

Keefe, Bruyette & Woods (KBW)

4 questions for GSHD

Matthew Carletti

Citizens JMP Securities

3 questions for GSHD

Andrew Andersen

Jefferies

2 questions for GSHD

Jon Paul Newsome

Piper Sandler & Co.

2 questions for GSHD

Scott Heleniak

RBC Capital Markets

2 questions for GSHD

Recent press releases and 8-K filings for GSHD.

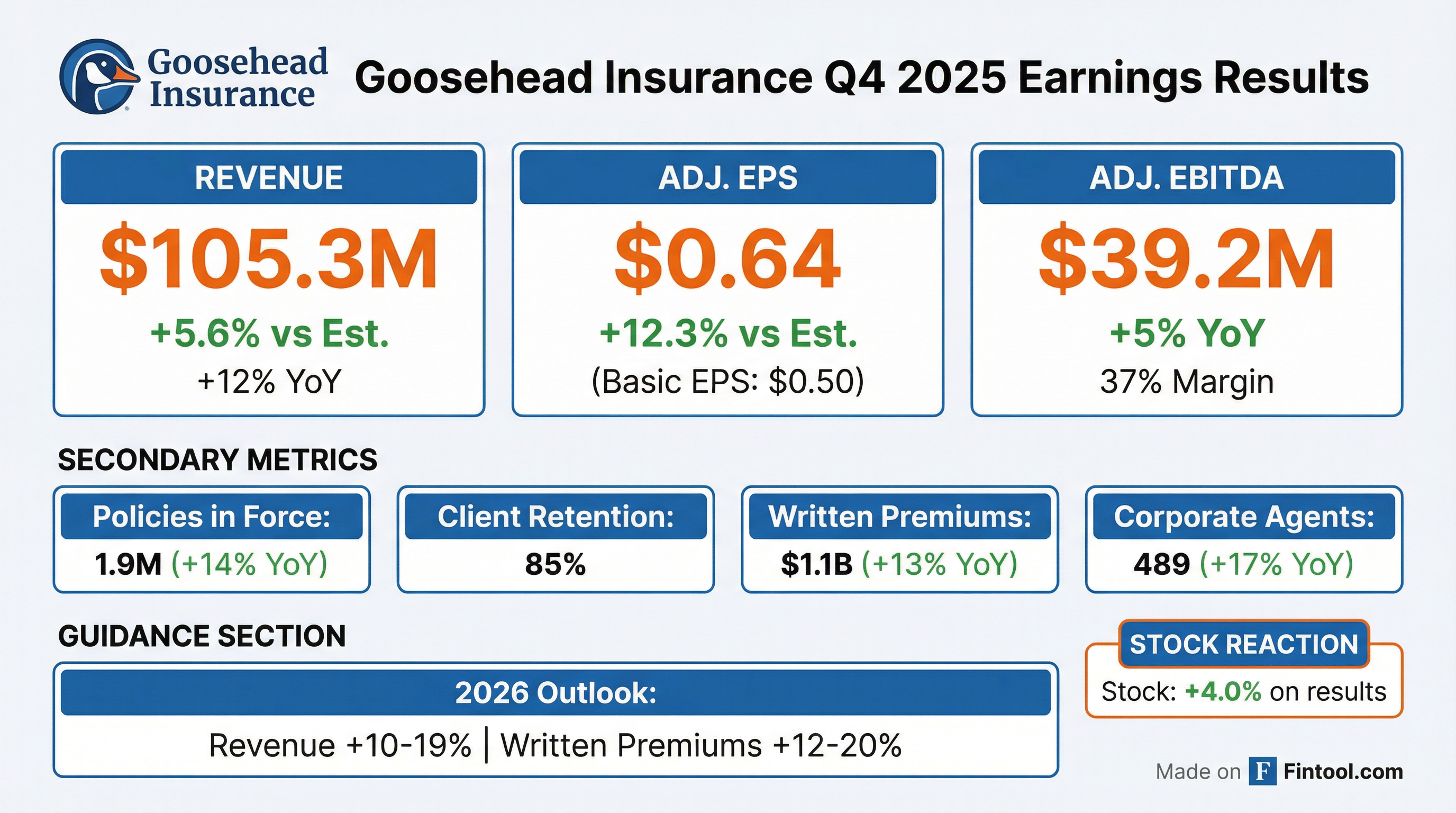

- Goosehead Insurance reported Q4 2025 total revenue of $105.3 million, a 12% increase year-over-year, and full-year 2025 total revenue of $365.3 million, up 16%. Full-year Adjusted EBITDA grew 14% to $113.6 million, achieving a 31% margin.

- For 2026, the company expects total revenues to grow organically between 10% and 19%, and total written premiums to grow organically between 12% and 20%. Adjusted EBITDA margins are anticipated to be modestly down due to investments in AI, Digital Agent 2.0, and partnerships.

- Strategic initiatives include the launch of the Digital Agent 2.0 platform in Texas for end-to-end digital binding and the expansion of the Enterprise Sales and Partnership Network, which nearly doubled new business production in 2025. The company also introduced Lily, an AI-powered virtual phone assistant, handling hundreds of thousands of client interactions.

- In Q4 2025, Goosehead repurchased 323,000 shares of Class A stock for $22.5 million, contributing to $81.7 million in repurchases for the full year. The board authorized an additional $180 million for share repurchases.

- Goosehead Insurance reported full year 2025 total revenue of $365.3 million, a 16% increase, and Adjusted EBITDA of $113.6 million, up 14%, achieving a 31% Adjusted EBITDA margin.

- For Q4 2025, total revenue was $105.3 million, up 12%, and Adjusted EBITDA grew 5% to $39.2 million.

- The company provided 2026 guidance, expecting total revenues to grow organically between 10% and 19% and total written premiums between 12% and 20%. Adjusted EBITDA margins are anticipated to be modestly down due to investments in AI, Digital Agent 2.0, and partnerships.

- Goosehead repurchased 323,000 shares for $22.5 million in Q4 2025, totaling $81.7 million for the full year, and the board authorized an additional $180 million share repurchase.

- Strategic advancements include improved client retention, which moved from 84% in Q2 to 85% in Q3 2025, and the launch of a mobile app and AI-powered virtual assistant Lily. The Digital Agent platform is now live in Texas with end-to-end binding capabilities.

- Goosehead Insurance reported full year 2025 total revenue growth of 16% to $365.3 million and Adjusted EBITDA growth of 14% to $113.6 million, achieving an Adjusted EBITDA margin of 31%.

- For 2026, the company provided guidance for total revenue growth between 10% and 19% and total written premiums growth between 12% and 20%. Core revenue growth is expected to be in the low double digits for the first half, with acceleration in the second half.

- The company continued to improve client retention, reaching 85% in Q3 2025, and saw policies in force grow 14% to 1.9 million by year-end. Strategic investments include the launch of Lily, an AI-powered virtual phone assistant, and the expansion of its Digital Agent platform, which is live in Texas.

- Goosehead repurchased $81.7 million of Class A shares in 2025 and authorized an additional $180 million share repurchase.

- Goosehead Insurance, Inc. reported total revenues of $105.3 million for Q4 2025, a 12% increase over the prior year, and full-year 2025 total revenues increased 16%. Net income was $20.8 million for Q4 2025 and $44.5 million for the full year 2025.

- For full year 2026, the company anticipates total revenues to grow organically between 10% and 19% and total written premiums to grow between 12% and 20%.

- The company repurchased $81.7 million of shares in 2025 and expanded its share repurchase authorization by $180.0 million through May 1, 2027.

- Goosehead launched its Digital Agent 2.0 platform in Texas, providing the first end-to-end comparative insurance digital buying experience in the U.S..

- Louis Goldberg was elected to the Board of Directors, effective February 18, 2026, while Thomas McConnon will depart the Board on the same date.

- Goosehead Insurance, Inc. reported total revenues of $90.4 million for Q3 2025, an increase of 16% over the prior-year period, with core revenues growing 14% to $83.9 million.

- Net income for Q3 2025 was $12.7 million, a 1% increase from the prior year, and Adjusted EBITDA rose 14% to $29.7 million.

- Total Written Premium increased 15% to $1.2 billion, and Policies in Force grew 13% to approximately 1,853,000 in Q3 2025.

- The company repurchased $58.7 million of shares at an average price of $85.58 per share during the third quarter.

- For the full year 2025, Goosehead expects total written premiums to be between $4.38 billion and $4.65 billion, and total revenues between $350 million and $385 million.

- Goosehead Insurance, Inc. reported total revenues of $90.4 million for the third quarter ended September 30, 2025, an increase of 16% over the prior-year period.

- Net income for Q3 2025 was $12.7 million, a 1% increase from $12.6 million in the prior-year period, with Adjusted EBITDA growing 14% to $29.7 million.

- The company repurchased $58.7 million of shares at an average price of $85.58 during the third quarter of 2025.

- Total Written Premiums increased 15% to $1.2 billion in Q3 2025.

- For the full year 2025, Goosehead expects Total Revenues to be between $350 million and $385 million, and Total Written Premiums between $4.38 billion and $4.65 billion.

- Goosehead Insurance reported strong Q4 2024 financial results, with total revenue growing 49% year-over-year to $93.9 million and Adjusted EBITDA increasing 164% to $37.4 million.

- For the full year 2024, the company achieved 20% total revenue growth, 29% premium growth to $3.81 billion, and EBITDA near $100 million with a 32% margin, positioning it as a "rule of 50" company.

- The company provided 2025 guidance, projecting total revenues between $350 million and $385 million (organic growth of 11% to 22%) and premiums between $4.65 billion and $4.88 billion (organic growth of 22% to 28%).

- Market conditions are showing gradual signs of improvement, with slowing auto premium increases and some carriers beginning to open capacity for homeowners' products.

- Strategic initiatives include expanding agent forces, enhancing technology, and investing in AI; the company also completed a new $300 million term loan B offering in January 2025, using part of the proceeds for a $205 million cash dividend to shareholders.

Quarterly earnings call transcripts for Goosehead Insurance.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more