Earnings summaries and quarterly performance for HARTFORD INSURANCE GROUP.

Executive leadership at HARTFORD INSURANCE GROUP.

Board of directors at HARTFORD INSURANCE GROUP.

Annette Rippert

Director

Carlos Dominguez

Director

Donna James

Director

Kathleen Winters

Director

Larry De Shon

Director

Matthew Winter

Director

Teresa Roseborough

Director

Thomas Bartlett

Director

Trevor Fetter

Lead Independent Director

Virginia Ruesterholz

Director

Research analysts who have asked questions during HARTFORD INSURANCE GROUP earnings calls.

Andrew Kligerman

TD Cowen

8 questions for HIG

Brian Meredith

UBS

8 questions for HIG

Elyse Greenspan

Wells Fargo

8 questions for HIG

David Motemaden

Evercore ISI

6 questions for HIG

Mike Zaremski

BMO Capital Markets

4 questions for HIG

Rob Cox

Goldman Sachs

4 questions for HIG

Alex Scott

Barclays PLC

3 questions for HIG

C. Gregory Peters

Raymond James

3 questions for HIG

Jian Huang

Morgan Stanley

3 questions for HIG

Joshua Shanker

Bank of America Merrill Lynch

3 questions for HIG

Michael Zaremski

BMO Capital Markets

3 questions for HIG

Ryan Tunis

Cantor Fitzgerald

3 questions for HIG

Charles Peters

Raymond James

2 questions for HIG

Gregory Peters

Raymond James Financial, Inc.

2 questions for HIG

Katie Sakys

Autonomous Research

2 questions for HIG

Meyer Shields

Keefe, Bruyette & Woods

2 questions for HIG

Robert Cox

The Goldman Sachs Group, Inc.

2 questions for HIG

Taylor Scott

BofA Securities

2 questions for HIG

Yaron Kinar

Oppenheimer & Co. Inc.

2 questions for HIG

Paul Newsome

Piper Sandler Companies

1 question for HIG

Wesley Carmichael

Autonomous Research

1 question for HIG

Recent press releases and 8-K filings for HIG.

- Over the past 10–15 years Hartford has consolidated legacy systems onto Guidewire and invested $250 million in Duck Creek for personal lines, laying the groundwork for current AI rollouts across claims, billing and customer interactions.

- Annual “invest spend” on technology and R&D has risen from about $350 million to over $500 million today and is expected to remain elevated to drive productivity and efficiency gains.

- The company aims to be cloud-native, targeting 80% of applications and data migrated to AWS by end-2027 to accelerate development and experimentation.

- Hartford’s new personal lines platform, Prevail, now serves AARP members and agency channels in 10 states—expanding to 30 states by early 2027—with all new AARP and agency business written on this system.

- The Hartford has spent over 10–15 years rebuilding core platforms—consolidating claims, rolling out Guidewire billing and a $250 million Duck Creek personal-lines system—to organize data for industrial-scale AI deployment.

- The firm is operationalizing AI on two fronts: personal productivity tools (e.g., Microsoft 365) and end-to-end process transformation to augment workforce capabilities, with pilots running for two years.

- Annual “invest spend” (R&D/tech infrastructure) has risen from $350 million to over $500 million, and management expects this elevated level to persist to drive further efficiencies.

- The new personal-lines “Prevail” platform—adapted from its AARP partnership—covers 10 states, expanding to 30 by early 2027, and all new direct and agency personal-lines business will migrate to Prevail.

- Capital allocation priorities include a 15% dividend increase, a $450 million quarterly share-repurchase target for 2026, and low emphasis on M&A.

- Hartford completed a multi-year rebuild of its core platforms—including Guidewire claim and admin systems and a $250 million Duck Creek personal lines investment—to consolidate legacy “green screens” and enable future AI deployments.

- The company is migrating its applications and data to an Amazon cloud platform, targeting 75% completion by end-2027 to support faster development, experimentation, and customer-first capabilities.

- Annual “invest spend” in technology and R&D has risen from ~$350 million five years ago to over $500 million today, with no near-term decline expected as efficiencies and analytics capabilities are expanded.

- “Prevail,” the modernized personal lines platform originally built for AARP, launched in 10 states and will expand to 30 by early 2027, covering all new agency and direct personal lines business.

- For capital allocation, Hartford increased its dividend by 15% in 2025, plans $450 million in quarterly share repurchases in 2026, and views M&A as a low priority given strong in-house execution capabilities.

- Invest in AI-driven modernization: The Hartford will execute a three-year roadmap to augment human talent and enhance customer experience by embedding AI across underwriting, operations, claims and personal productivity tools on top of its modernized data platforms.

- Expand property underwriting in small/mid market: With $3.3 billion in property underwritings, Hartford targets double-digit growth in small and middle segments while pulling back on large E&S binding to protect margins.

- Grow Prevail agency platform and employee benefits: The company plans to be live in 30 states by early 2027 with its Prevail personal lines chassis and is extending its absence, dental and vision offerings to employers under 500 lives.

- Maintain disciplined underwriting and capital return: Hartford sustains sub-90% combined ratios in small business, targets 6–7% group benefits margins, and intends to deploy excess capital through dividend increases and share buybacks.

- The Hartford will accelerate investments in tech- and AI-enabled capabilities, target double-digit property underwriting growth (from ~$3.3 billion in place) and expand its Prevail personal lines platform to 30 states by early 2027.

- The firm plans to deepen its employee benefits offering with full absence management and new dental, vision and supplemental health solutions for employers under 500 lives via a recent partnership.

- AI investments span both personal productivity tools and end-to-end AI-first workflows in underwriting, operations and claims (including a Google partnership), with ROI expected in top-line growth, operating leverage and improved loss cost selection.

- Commercial lines renewal prices moderated to 6.1% in Q4, property pricing is softening fastest while liability trends remain high-single digits; small business maintains over 75% of quotes on the glass and a sub-90% combined ratio.

- Hartford reiterated five key strategic priorities: continued tech- and AI-enabled investments, expanding property underwriting (currently $3.3 billion with double-digit growth targeted for 2026), deploying its Prevail agency chassis in 30 states by early 2027, broadening employee benefits (adding dental/vision for employers under 500 lives), and defending its top-three market position through digital enhancements.

- The company has modernized core claim and administrative platforms over the past 10–12 years, organized its data for AI integration, trained over 6,000 employees on productivity tools, and is rolling out end-to-end AI workflows in underwriting, operations, and claims to augment talent and enhance the customer experience.

- Commercial lines pricing remains healthy, with renewal written price increases ex-comp of 6.1 % in Q4 (down from 7.3 % in Q3); property pricing is softening fastest (60 % of property in small/middle markets holds up better), while liability trends stay in the high single digits.

- In group benefits, Hartford continues to outperform its 6–7 % after-tax margin target, driven by favorable incident assumptions and faster claimant recoveries, leveraging its underwriting expertise and broker relationships for consistent results.

- Management expects above-market growth and superior ROEs to drive market share gains, with excess capital earmarked for dividend increases and share buybacks, underscoring its capital-efficient strategy.

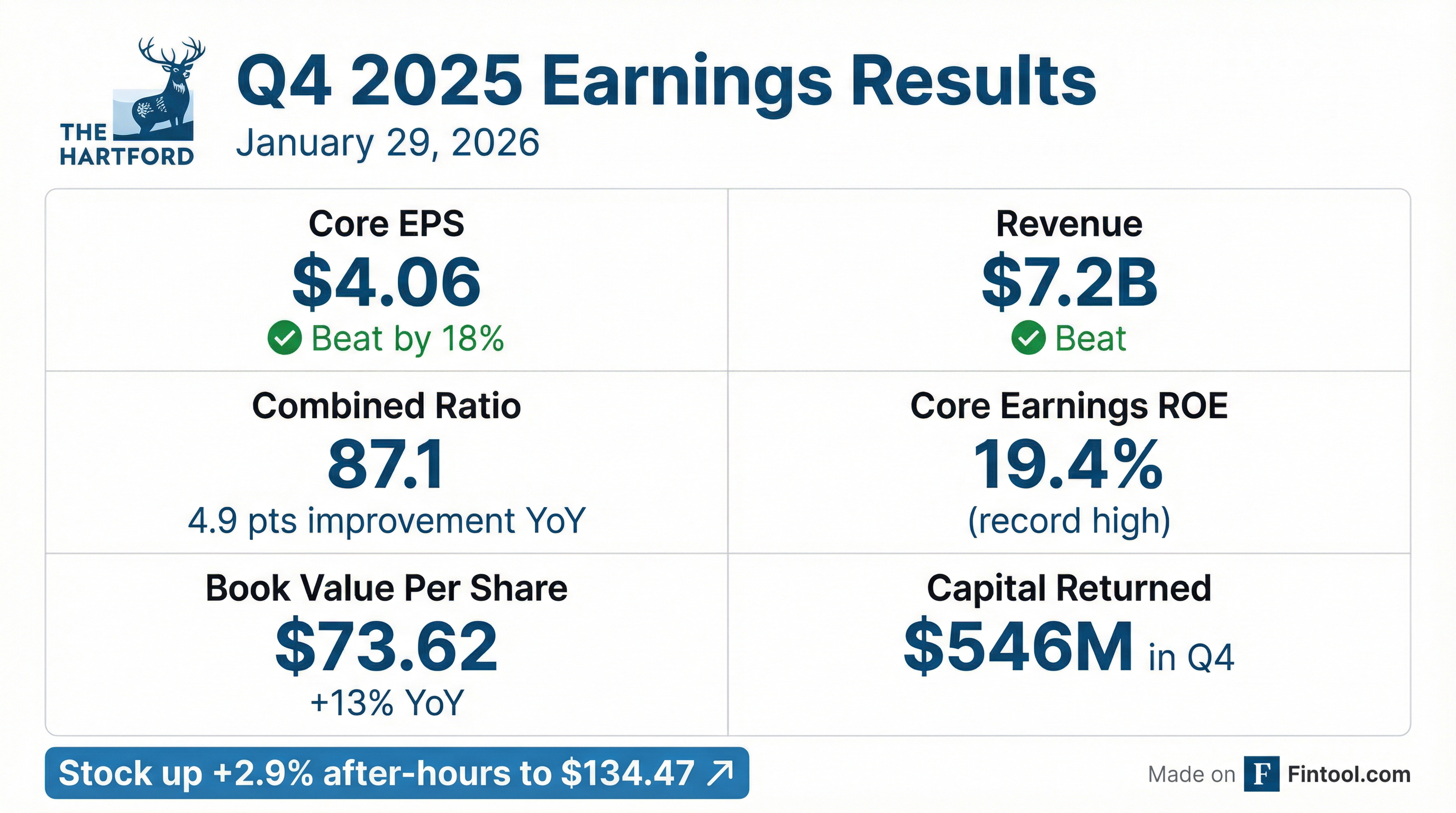

- Core earnings for Q4 were $1.1 billion ($4.06 per diluted share), driving full-year core earnings of $3.8 billion and a 19.4% ROE for 2025.

- Business Insurance delivered 7% written premium growth with $915 million of core earnings and an underlying combined ratio of 88.1%; small business grew premiums 9% at a 87.3% ratio and renewal pricing up 4.3% all-in (7.7% ex-workers’ comp).

- Personal Insurance posted $214 million of core earnings, improved its underlying combined ratio to 84.3%, achieved auto pricing +10.4% and homeowners +11.9%, and saw agency premium growth of 15% despite a 2% overall decline.

- P&C reserve development was $177 million favorable (ex-A&E); Asbestos & Environmental reserves increased by $165 million (Asbestos $122 million, Environmental $43 million); Q4 catastrophe results were a $1 million benefit, with full-year CATs at 4.2 points and reinsurance renewals lowering costs on a risk-adjusted basis.

- Continued investment in AI and digital platforms is enhancing claims (medical record summarization), underwriting, and operations, underpinning the firm’s multi-year innovation agenda.

- Delivered $3.8 billion in full-year core earnings with a 19.4% core earnings ROE in 2025; Q4 core earnings were $1.1 billion or $4.06 per share.

- Business insurance saw 8% written premium growth for the year and an 88.5 underlying combined ratio; in Q4, premiums grew 7% with an 88.1 combined ratio.

- Personal insurance posted Q4 core earnings of $214 million, an 84.3 underlying combined ratio, and achieved pricing increases of 10.4% (auto) and 11.9% (home).

- Employee benefits delivered a full-year core earnings margin of 8.2% and Q4 margin of 7.6% on $138 million of core earnings, led by life and disability results.

- Net investment income in Q4 was $832 million (up 17%), portfolio yield of 4.6%, LP returns of 11.4%; repurchased $400 million of shares in Q4 and plans to buy back $450 million per quarter in 2026.

- Core earnings were $1.148 B, up 33% YoY, driving EPS of $4.06, +38% YoY

- P&C net written premiums grew 5% in Q4 (7% in Business Insurance); full-year growth was 7% (8% Business, 4% Personal)

- Combined ratios improved in Q4: Business Insurance at 83.6 (underlying 88.1); Personal Insurance at 79.6 (underlying 84.3)

- Returned $546 M to shareholders in Q4 via $400 M share repurchases and $146 M dividends; net investment income was $832 M

- Core earnings were $1.1 billion (Q4) or $4.06 per diluted share, with full-year core earnings of $3.8 billion and a 19.4% ROE.

- Business Insurance achieved 7% written premium growth in Q4, an underlying combined ratio of 88.1, with Small Business up 9% (CR 87.3); renewal pricing was 4.3% all-in (7.7% ex workers’ comp).

- Personal Insurance delivered core earnings of $214 million, an underlying combined ratio of 84.3, Q4 pricing up 10.4% for auto and 11.9% for homeowners, and agency premium growth of 15%.

- P&C reported net favorable prior-accident-year development of $177 million, increased A&E reserves by $165 million, and saw a $1 million Q4 CAT benefit (full-year CAT at 4.2 points).

Fintool News

In-depth analysis and coverage of HARTFORD INSURANCE GROUP.

Quarterly earnings call transcripts for HARTFORD INSURANCE GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more