Earnings summaries and quarterly performance for MARINEMAX.

Executive leadership at MARINEMAX.

W. Brett McGill

Chief Executive Officer and President

Charles Cashman

Executive Vice President and Chief Revenue Officer

Kyle Langbehn

Executive Vice President and President of Retail Operations

Michael McLamb

Executive Vice President, Chief Financial Officer, and Secretary

Shawn Berg

Executive Vice President and Chief Digital Officer

Board of directors at MARINEMAX.

Research analysts who have asked questions during MARINEMAX earnings calls.

Joseph Altobello

Raymond James & Associates, Inc.

6 questions for HZO

Eric Wold

B. Riley Securities

5 questions for HZO

Anna Glaessgen

B. Riley Securities

4 questions for HZO

James Hardiman

Citigroup

4 questions for HZO

Michael Albanese

The Benchmark Company, LLC

3 questions for HZO

Michael Swartz

Truist Securities

3 questions for HZO

Andrew Crum

Stifel, Nicolaus & Company, Incorporated

2 questions for HZO

David Macgregor

Longbow Research

2 questions for HZO

Frederick Wightman

Wolfe Research, LLC

2 questions for HZO

Gerrick Johnson

Seaport Research

2 questions for HZO

Joe Nolan

Longbow Research

2 questions for HZO

John Healy

Northcoast Research

2 questions for HZO

Sean Wagner

Citigroup

2 questions for HZO

Brandon Rollé

D.A. Davidson

1 question for HZO

Griffin Bryan

D.A. Davidson & Co.

1 question for HZO

Joseph Nolan

Longbow Research

1 question for HZO

Recent press releases and 8-K filings for HZO.

- Donerail Group, a major shareholder of MarineMax, submitted a non-binding proposal on January 13, 2026, supplemented on February 1, 2026, to acquire MarineMax for $35.00 per share in cash.

- Donerail expressed encouragement regarding MarineMax's recent willingness to engage in a strategic review and proceed with due diligence, clarifying that MarineMax's advisors had previously instructed them to await Board authorization before negotiating a Non-Disclosure Agreement (NDA).

- Donerail is urging MarineMax shareholders to vote AGAINST CEO Brett McGill's election at the March 3, 2026, Annual Meeting, citing concerns about his underperformance and suitability to oversee a potential sale process.

- MarineMax, Inc. (HZO) has responded to a public letter from The Donerail Group concerning an unsolicited indication of interest to acquire the Company.

- The MarineMax Board of Directors, with the assistance of independent financial and legal advisors, is evaluating Donerail's interest, funding sources, and execution certainty.

- MarineMax has engaged with Donerail through three substantive calls and provided a standard non-disclosure agreement (NDA) nearly two weeks ago.

- Donerail has not yet executed or commented on the NDA, despite publicly expressing a desire for non-public information.

- Fraser Yachts, a wholly owned subsidiary of MarineMax, announced a strong start to 2026, completing 12 superyacht sales in just 12 days during January.

- The transactions included a balanced mix of brokerage and new-build activity, with Fraser securing contracts for three new superyacht construction projects.

- Fraser's CEO noted that these results reflect sustained demand for high-quality superyachts and healthy activity at the top end of the market.

- Over the past four months, Fraser brokers completed more than 30 superyacht transactions, and in 2025, Fraser marked its 15th consecutive year as the most active superyacht brokerage by sales volume.

- MarineMax has issued a statement in response to The Donerail Group's public letter to shareholders, disputing claims of unproductive engagement and affirming its commitment to evaluating Donerail's unsolicited indication of interest to acquire the Company.

- The company highlights its performance despite macroeconomic headwinds, noting solid operating results and total shareholder return outperformance relative to its closest peer, OneWater Marine, Inc., over the past one-, two-, three-, four- and five-year periods.

- MarineMax emphasizes strong leadership under CEO Brett McGill, who has overseen more than double revenue and Adjusted EBITDA, and maintained gross margins above 30% for 21 consecutive quarters.

- The Board has undergone significant refreshment, with five new independent directors appointed since 2021 and seven directors transitioning off since 2024.

- The Donerail Group, a significant shareholder of MarineMax, has issued an open letter discussing its $35.00 per share all-cash offer to acquire the company.

- Donerail is urging shareholders to vote AGAINST the election of CEO Brett McGill as a Director at MarineMax's upcoming Annual Meeting on March 3, 2026.

- Donerail's opposition is based on concerns regarding alleged board entrenchment, nepotism, and obstruction of shareholder engagement, as well as CEO Brett McGill's track record of underperformance.

- Donerail suggests that if Mr. McGill fails to receive majority shareholder support, he should step down as CEO, and CFO Michael McLamb should be appointed interim CEO.

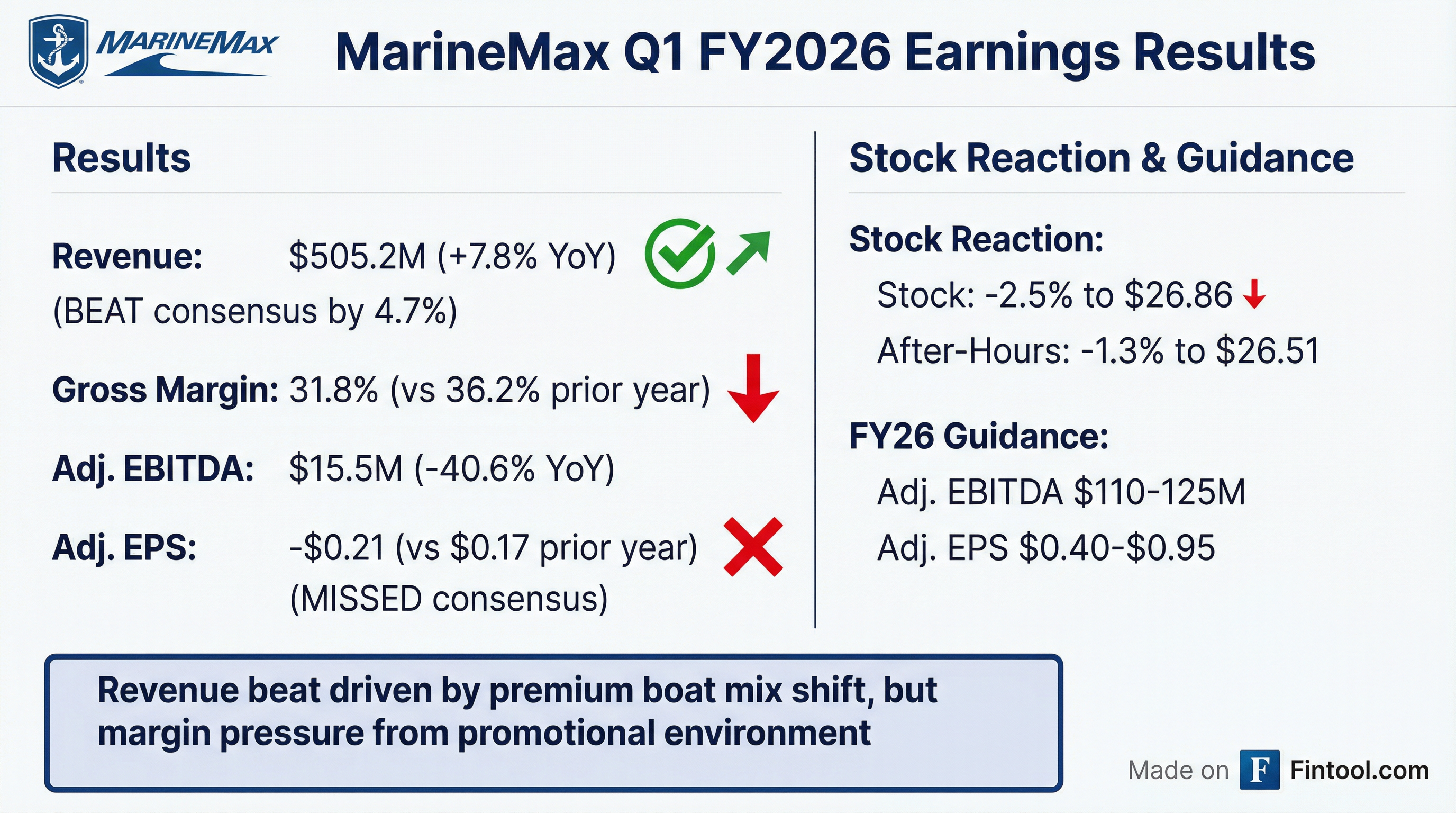

- MarineMax reported a net loss per share of $0.36 and an adjusted net loss per share of $0.21 for the first quarter of fiscal 2026, with Adjusted EBITDA at $15.5 million.

- The company reaffirmed its fiscal 2026 guidance, projecting Adjusted EBITDA between $110 million and $125 million and adjusted net income per diluted share between $0.40 and $0.95.

- Inventory levels were reduced by nearly $170 million compared to the prior year, and customer deposits were flat year-over-year at the start of the March quarter, which is considered an encouraging sign.

- Retail boat margin pressure is anticipated to continue through the second fiscal quarter, with expectations for inventory levels to normalize and potential for margin recovery in the second half of the fiscal year.

- MarineMax (HZO) reported Q1 Fiscal 2026 revenue of $505 million with nearly 11% same-store sales growth, despite a low- to mid-single digit decline in unit volume.

- The company posted a net loss per share of $0.36 (reported) and $0.21 (adjusted), with Adjusted EBITDA of $15.5 million.

- Gross margins were significantly below historical levels due to industry inventory overhang and promotional activity, though higher-margin businesses contributed favorably. The company expects to maintain consolidated gross margins in the low 30% range for the year.

- MarineMax reaffirmed its Fiscal 2026 guidance, projecting Adjusted EBITDA between $110 million and $125 million and adjusted net income per diluted share between $0.40 and $0.95.

- Inventory levels were reduced by nearly $170 million year-over-year, and customer deposits were flat year-over-year, indicating positive early boat show momentum and January trends.

- For Q1 FY 2026, MarineMax (HZO) reported revenue of $505.2 million, an increase from $468.5 million in Q1 FY 2025, driven by increased comparable store sales and a shift towards larger, premium products.

- The company posted a net loss of $7.9 million and an adjusted net loss of $4.6 million for Q1 FY 2026, leading to GAAP diluted EPS of ($0.36) and adjusted diluted EPS of ($0.21).

- Gross margin for Q1 FY 2026 was 31.8%, a decrease from 36.2% in Q1 FY 2025, primarily due to an increased promotional environment and sales mix, partially offset by contributions from higher-margin businesses.

- As of December 31, 2025, cash and cash equivalents increased to $164.6 million, while inventories decreased to $867.9 million year-over-year, reflecting actions to reduce orders and increase turns.

- MarineMax issued fiscal year 2026 guidance, forecasting Adjusted EBITDA between $110 million and $125 million and Adjusted Net Income between $0.40 and $0.95 per diluted share.

- MarineMax (HZO) reported Q1 2026 revenue of $505 million, achieving nearly 11% same-store sales growth.

- For Q1 2026, the company recorded a reported net loss of $0.36 per share ($0.21 adjusted) and Adjusted EBITDA of $15.5 million.

- The company reaffirmed its Fiscal 2026 guidance, projecting Adjusted EBITDA between $110 million and $125 million and adjusted net income per diluted share between $0.40 and $0.95.

- MarineMax reduced inventory levels by nearly $170 million year-over-year in Q1 2026, and customer deposits were flat year-over-year, indicating a positive trend despite challenging market conditions.

- Management expects retail margin pressure to continue through Q2 2026, with more significant inventory improvement anticipated in the second half of the fiscal year; January trends have been solid with positive same-store sales.

- MarineMax reported fiscal 2026 first quarter revenue of $505.2 million, with quarterly same-store sales growing more than 10%.

- The company posted a net loss of $7.9 million, or $0.36 per share, and an adjusted net loss of $4.6 million, or $0.21 per share.

- Gross margin for the quarter was 31.8%, supported by strategic expansion into higher-margin businesses, despite persistent retail margin pressure in the recreational boating industry.

- MarineMax reaffirmed its full-year fiscal 2026 guidance, projecting Adjusted EBITDA between $110 million and $125 million and adjusted net income of $0.40 to $0.95 per diluted share.

Quarterly earnings call transcripts for MARINEMAX.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more