Earnings summaries and quarterly performance for ILLINOIS TOOL WORKS.

Executive leadership at ILLINOIS TOOL WORKS.

Christopher A. O'Herlihy

President & Chief Executive Officer

Axel R. J. Beck

Executive Vice President

Mary K. Lawler

Senior Vice President and Chief Human Resources Officer

Michael M. Larsen

Senior Vice President and Chief Financial Officer

T. Kenneth Escoe

Executive Vice President

Board of directors at ILLINOIS TOOL WORKS.

Daniel J. Brutto

Director

Darrell L. Ford

Director

David B. Smith, Jr.

Director

E. Scott Santi

Non-Executive Chairman of the Board

Jaime Irick

Director

James W. Griffith

Director

Jay L. Henderson

Director

Kelly J. Grier

Director

Pamela B. Strobel

Director

Richard H. Lenny

Lead Independent Director

Susan Crown

Director

Research analysts who have asked questions during ILLINOIS TOOL WORKS earnings calls.

Julian Mitchell

Barclays Investment Bank

6 questions for ITW

Tami Zakaria

JPMorgan Chase & Co.

6 questions for ITW

Andrew Kaplowitz

Citigroup

5 questions for ITW

Jamie Cook

Truist Securities

4 questions for ITW

Joseph O'Dea

Wells Fargo & Company

4 questions for ITW

Sabrina Abrams

Bank of America

4 questions for ITW

Scott Davis

Melius Research

3 questions for ITW

Stephen Volkmann

Jefferies

3 questions for ITW

Steven Fisher

UBS

3 questions for ITW

Jeffrey Sprague

Vertical Research Partners

2 questions for ITW

Joe Ritchie

Goldman Sachs

2 questions for ITW

Andrew Obin

Bank of America

1 question for ITW

David Raso

Evercore ISI

1 question for ITW

David Rosso

Evercore ISI

1 question for ITW

Joseph Ritchie

Goldman Sachs

1 question for ITW

Mircea Dobre

Robert W. Baird & Co.

1 question for ITW

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

1 question for ITW

Nicole DeBlase

BofA Securities

1 question for ITW

Nigel Coe

Wolfe Research, LLC

1 question for ITW

Vladimir Bystricky

Citigroup

1 question for ITW

Recent press releases and 8-K filings for ITW.

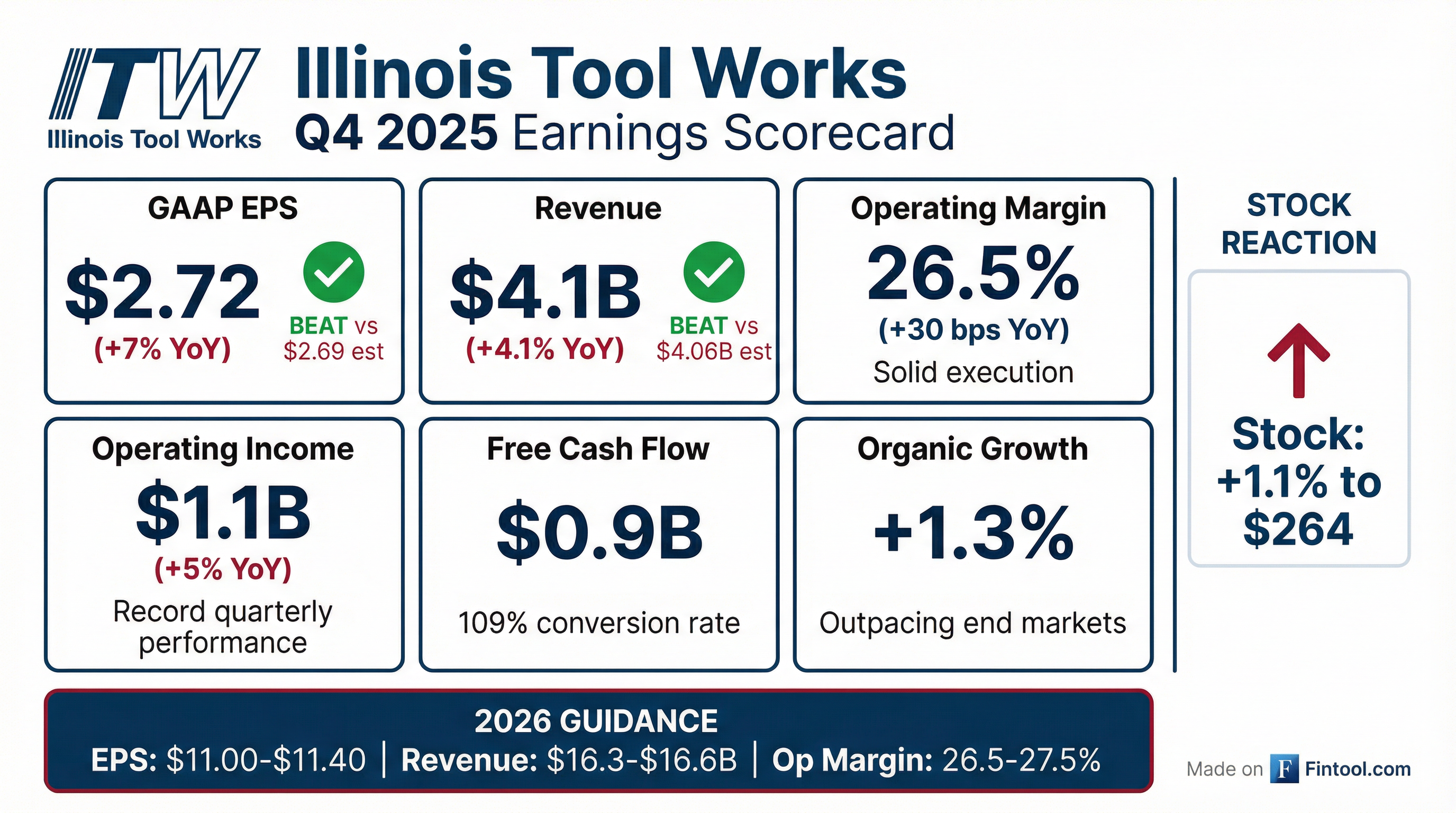

- Revenue +4.1% in Q4 (organic +1.3%, FX +2.5%, acquisitions +0.3%); GAAP EPS of $2.72 (+7%)

- Q4 operating margin at 26.5% (record); segment margins 27.7% (+120 bp; Enterprise Initiatives +140 bp)

- 2025 strategic progress: CBI-fueled growth 2.4% (+40 bp) and patent filings +9%

- 2026 outlook: total revenue +2–4%, organic +1–3%, EPS $11–11.40 (midpoint $11.20; +7%), and ~100 bp margin expansion

- Capital return: $375 M share buyback in Q4; plan $1.5 B repurchases in 2026; free cash flow conversion >100%

- ITW’s Q4 revenue grew 4% with $2.72 GAAP EPS (+7% YoY); operating income was $1.1 billion and segment margins reached 27.7%, up 120 bps.

- Full-year CBI-fueled revenue growth was 2.4%, patent filings rose 9% in 2025, and ITW invested ~$800 million in internal projects while returning $3.3 billion to shareholders, marking its 62nd consecutive dividend increase.

- For FY 2026, ITW guides to 1%–3% organic growth (2%–4% total), $11.20 EPS midpoint (+7%), and ~100 bps operating margin expansion to 26.5%–27.5%; free cash flow conversion is expected to exceed 100%.

- ITW plans to repurchase $1.5 billion of shares in 2026 as part of its capital allocation strategy.

- ITW delivered 4.1% total revenue growth in Q4 2025, driven by 1.3% organic growth, currency tailwinds (2.5%) and acquisitions (0.3%).

- Q4 GAAP EPS rose 7% to $2.72, with operating income up 5% to $1.1 billion and record segment operating margin of 27.7%.

- 2026 guidance calls for 1%–3% organic growth, 2%–4% total revenue growth, and GAAP EPS of $11.00–$11.40 (midpoint $11.20), with ~100 bps of operating margin expansion.

- Returned capital aggressively, repurchasing $375 million of shares in Q4 and planning $1.5 billion of buybacks in 2026; free cash flow conversion above 100% and dividend increased for the 62nd consecutive year.

- Revenue of $4.1 B, up 4% year-over-year; organic growth of 1.3% (FX/acquisitions +2.8%).

- GAAP EPS of $2.72, a 7% increase YoY; operating margin expanded to 26.5% (+30 bps).

- Free cash flow of $0.9 B with a 109% conversion rate; $375 M returned via share repurchases.

- 2026 guidance: GAAP EPS of $11.00–11.40, revenue of $16.3–16.6 B, and operating margin of 26.5–27.5%.

- Illinois Tool Works delivered Q4 2025 revenue of $4.1 billion, up 4.1% year-over-year, and GAAP EPS of $2.72, up 7%.

- Full-year 2025 revenue reached $16 billion, a 0.9% increase, with GAAP EPS of $10.49, above prior guidance.

- The company generated Q4 free cash flow of $0.9 billion (109% conversion) and repurchased $375 million of shares in the quarter.

- ITW’s 2026 guidance calls for 2–4% revenue growth, GAAP EPS of $11.00–11.40, and approximately $1.5 billion in share repurchases.

- Q4 2025 revenue of $4.1 billion (+4.1 %) and GAAP EPS of $2.72 (+7 %), with operating margin of 26.5 %

- Full-year 2025 revenue of $16.0 billion (+0.9 %) and GAAP EPS of $10.49

- Generated operating cash flow of $3.1 billion and free cash flow of $2.7 billion in 2025, returning $3.3 billion to shareholders, including $375 million in share repurchases in Q4

- Issued 2026 guidance: revenue growth of 2–4 %, operating margin of 26.5–27.5 %, and GAAP EPS of $11.00–11.40 (7 % growth at midpoint)

- Q4 revenue of $4.09–4.10 billion (up ~4.1%) and adjusted EPS of $2.72, with profit rising to $790 million and organic revenue up 1.3% as margins improved.

- Fiscal 2026 guidance for EPS of $11.00–11.40 and revenue growth of 2%–4% (1%–3% organic).

- Continued dividend growth with 62 consecutive years of increases; current payout ratio of 62% of expected earnings exceeds long-term comfort zone.

- GAAP EPS of $2.81 in Q3, topping expectations, with revenue up 2% year-over-year to $4.06 billion

- Record operating margin of 27.4%, and operating income rose 6% to $1.1 billion

- Free cash flow increased 15% year-over-year to $904 million, achieving a 110% conversion rate

- Narrowed full-year GAAP EPS guidance to $10.40–$10.50 and revenue growth outlook of 1–3% (organic 0–2%)

- Returned $375 million to shareholders via buybacks in Q3 and plans $1.5 billion of repurchases in 2025

- ITW’s Q3 2025 revenue rose 3% excluding a 1% PLS headwind, driven by 1% organic growth and a 2% FX tailwind.

- GAAP EPS was $2.81, operating income grew 6% to $1.1 billion, and operating margin expanded 90 bps to 27.4%; free cash flow rose 15% to >$900 million with 110% conversion.

- Full-year 2025 guidance narrowed, with organic growth 0–2%, total revenue up 1–3%, operating margin 26–27%, and GAAP EPS $10.40–$10.50.

- ITW announced its 62nd consecutive dividend increase of 7% and has repurchased >$1.1 billion of shares YTD.

- Revenue of $830 M, up 7% YoY, with organic growth of 1% in end markets that declined low-single digits.

- Operating income rose to $1.11 B (+6%), and operating margin expanded 90 bps to 27.4%.

- GAAP EPS of $3.91, up 6% YoY; EPS ex-divestiture gain was $2.65.

- Free cash flow grew 15% with a 110% conversion rate, and the quarterly dividend was increased by 7% (62nd consecutive year).

Quarterly earnings call transcripts for ILLINOIS TOOL WORKS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more