Earnings summaries and quarterly performance for LENNOX INTERNATIONAL.

Executive leadership at LENNOX INTERNATIONAL.

Alok Maskara

Chief Executive Officer

Chris Kosel

Vice President, Chief Accounting Officer and Controller

Daniel Sessa

Executive Vice President, Chief Human Resources Officer

Joseph Nassab

Executive Vice President, President, Building Climate Solutions

Michael Quenzer

Executive Vice President, Chief Financial Officer

Monica Brown

Executive Vice President, Chief Legal Officer and Secretary

Prakash Bedapudi

Executive Vice President, Chief Technology Officer

Sarah Martin

Executive Vice President, President, Home Comfort Solutions

Board of directors at LENNOX INTERNATIONAL.

Research analysts who have asked questions during LENNOX INTERNATIONAL earnings calls.

Brett Linzey

Mizuho Securities

8 questions for LII

Deane Dray

RBC Capital Markets

8 questions for LII

Jeffrey Hammond

KeyBanc Capital Markets

8 questions for LII

Julian Mitchell

Barclays Investment Bank

8 questions for LII

Nigel Coe

Wolfe Research, LLC

8 questions for LII

Noah Kaye

Oppenheimer & Co. Inc.

8 questions for LII

Ryan Merkel

William Blair & Company

8 questions for LII

Christopher Snyder

Morgan Stanley

7 questions for LII

Jeffrey Sprague

Vertical Research Partners

6 questions for LII

Damian Karas

UBS

5 questions for LII

Steve Tusa

JPMorgan Chase & Co.

5 questions for LII

Tommy Moll

Stephens Inc.

5 questions for LII

Joe O'Dea

Wells Fargo

4 questions for LII

Joe Ritchie

Goldman Sachs

4 questions for LII

Joseph O'Dea

Wells Fargo & Company

4 questions for LII

C. Stephen Tusa

JPMorgan Chase & Co.

3 questions for LII

Joseph Ritchie

Goldman Sachs

3 questions for LII

Thomas Moll

Stephens Inc.

3 questions for LII

Amit Mehrotra

UBS

2 questions for LII

Jeff Sprague

Vertical Research

2 questions for LII

Nicole DeBlase

Deutsche Bank

2 questions for LII

Nicole DeBlase

BofA Securities

2 questions for LII

Stephen Volkmann

Jefferies

2 questions for LII

Recent press releases and 8-K filings for LII.

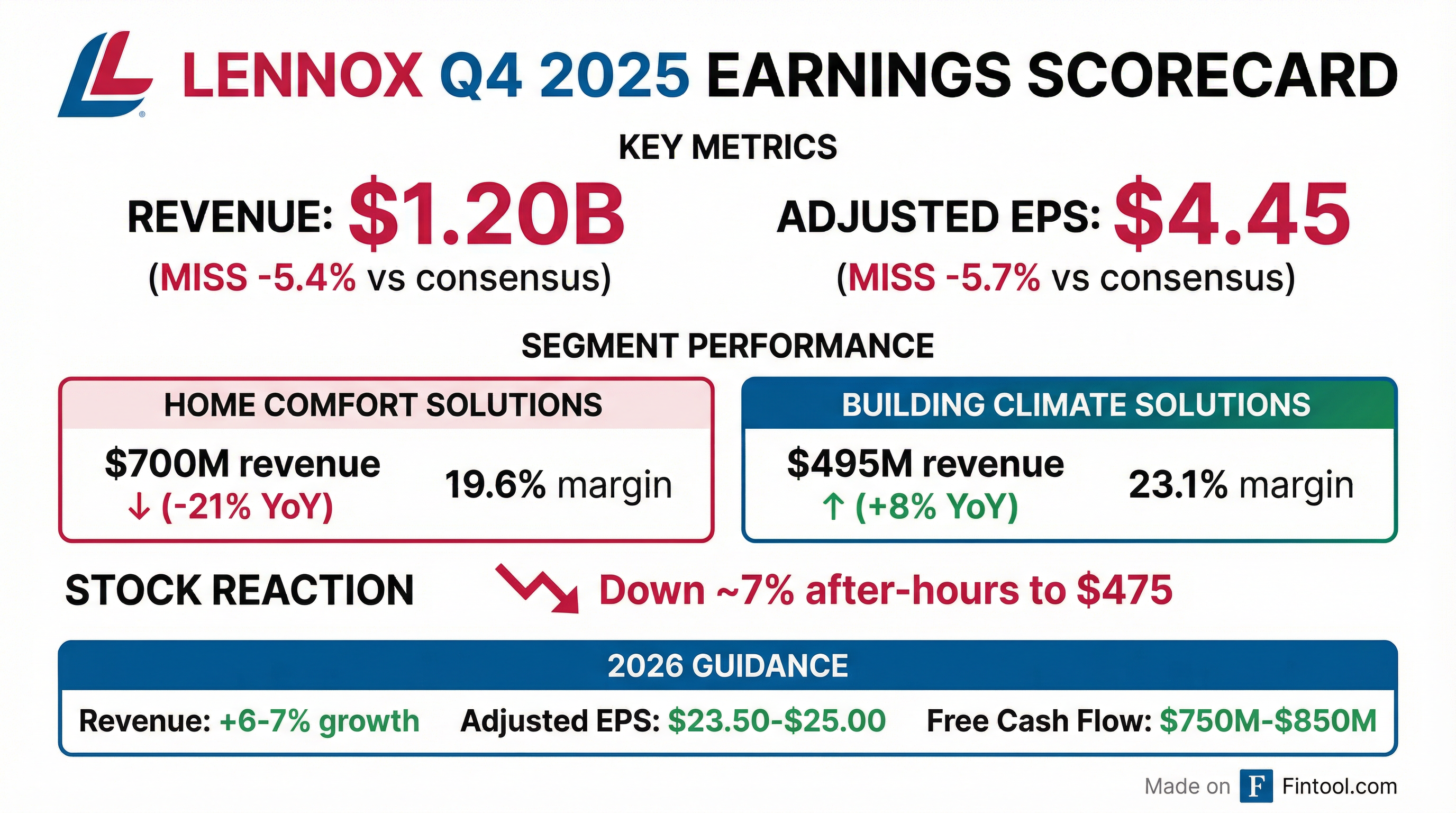

- Lennox (LII) reported Q4 2025 revenue down 11% and adjusted EPS of $4.45. For the full year 2025, revenue was down 3%, but the company achieved a record 20.4% segment margin and adjusted EPS of $23.16, a 2% increase over the prior year's $22.70.

- The company provided full-year 2026 guidance, expecting total company revenue growth of 6%-7%, adjusted EPS between $23.50 and $25, and free cash flow between $750 million and $850 million. This guidance anticipates a return to revenue growth and a fourth consecutive year of EBIT margin expansion, estimated at about 20 basis points.

- In 2025, LII generated $640 million in free cash flow , repurchased $482 million of shares, and deployed $545 million on bolt-on acquisitions and joint venture investments. The company plans to invest $250 million in capital expenditures in 2026.

- LII transitioned from LIFO to FIFO inventory accounting, which increased its 2025 full-year EPS by approximately $1. The company also noted that channel destocking, a significant headwind in 2025, is expected to largely conclude by Q2 2026.

- For full-year 2025, Lennox International reported adjusted earnings per share of $23.16, a 2% increase from the prior year, and a record 20.4% segment margin, despite a 3% decline in full-year revenue. In Q4 2025, adjusted EPS was $4.45 and segment margin was 17.7%, with revenue down 11%.

- The company is initiating full-year 2026 guidance with expected adjusted EPS of $23.50-$25 and total company revenue growth of 6%-7%, driven by stabilizing end markets and normalized channel inventories.

- Free cash flow for 2025 was $640 million, exceeding prior guidance, and is expected to be between $750 million and $850 million in 2026.

- Lennox International adopted the FIFO inventory accounting method, which increased full-year 2025 EPS by approximately $1.

- Lennox International reported Q4 2025 adjusted EPS of $4.45 and full-year 2025 adjusted EPS of $23.16, achieving a record 20.4% segment margin for the full year despite an 11% revenue decline in Q4 and 3% for the full year due to weak markets and destocking.

- The company provided 2026 guidance including total company revenue growth of 6%-7% and adjusted EPS between $23.50 and $25.

- Free cash flow for 2025 was $640 million, exceeding prior guidance, and is expected to be between $750 million and $850 million in 2026.

- Strategic investments for 2026 include $250 million in capital expenditures to advance key priorities and the continuation of its self-help transformation plan, with $75 million in productivity and cost action savings expected.

- For Q4 2025, Lennox reported revenue of $1.2 billion, an 11% decrease year-over-year, and an adjusted EPS of $4.45. The segment profit margin increased by 110 basis points year-over-year to 17.7%.

- For Full Year 2025, revenue was $5.2 billion, a 3% decrease year-over-year, with an adjusted EPS of $23.16. The segment profit margin for the full year was 20.4%, up 90 basis points year-over-year.

- Lennox provided 2026 financial guidance, projecting total revenue growth of 6% - 7%, adjusted EPS between $23.50 and $25.00, and Free Cash Flow of $750 million to $850 million.

- The company completed a LIFO to FIFO accounting conversion, which increased 2024 FY EPS by $0.12 and Q1-Q3 2025 EPS by $0.55.

- In 2025, Lennox deployed capital through ~$482 million in share repurchases and ~$545 million in M&A execution.

- Lennox International Inc. reported Q4 2025 revenue of $1.2 billion, an 11% decrease year-over-year, and GAAP diluted EPS of $4.07, with Adjusted diluted EPS down 22% to $4.45.

- For the full year 2025, revenue was $5.2 billion, down 3% year-over-year, while Adjusted diluted EPS increased 2% to $23.16.

- The company provided full year 2026 guidance, projecting revenue to increase by approximately 6% to 7% and Adjusted earnings per share to be in the range of $23.50 to $25.00.

- These financial results reflect a change in accounting method from LIFO to FIFO, effective in Q4 2025.

- Lennox International reported Q4 2025 revenue of $1.2 billion, an 11% decrease year-over-year, with GAAP diluted EPS of $4.07 and Adjusted diluted EPS of $4.45, down 22%.

- For the full year 2025, revenue was $5.2 billion, a 3% decrease, and GAAP diluted EPS was $22.79, with Adjusted diluted EPS at $23.16, up 2%.

- The company provided full-year 2026 guidance, anticipating revenue to increase by approximately 6% to 7% and Adjusted earnings per share to be within the range of $23.50 to $25.00.

- These financial results reflect a change in accounting method from LIFO to FIFO, effective 4Q 2025.

- Lennox also reported share repurchases totaling $150 million in Q4 2025 and $482 million for the full year 2025.

- Lennox (NYSE: LII) is investing in its commercial HVAC business to enhance product availability, expand distribution capacity, and elevate the overall customer experience.

- Key investments include the opening of a 763,000-square-foot Regional Distribution Center in Edgerton, Kansas, and ensuring the Saltillo, Mexico factory is fully operational, which together enable the delivery of more than 90% of commercial rooftop units and accessories within one day.

- The company also relaunched Commercial Quick Quote on LennoxPros for instant quotes and real-time inventory, and expanded commercial parts and accessories availability through the acquisition of Duro Dyne and Supco.

- Lennar Corporation and TPG Real Estate announced a strategic partnership to recapitalize Quarterra, with TPG acquiring a majority interest and Lennar retaining a minority stake in the multifamily community developer.

- TPG has committed an additional $1 billion and plans to raise further capital to fund Quarterra's future growth and the development of its multifamily pipeline, with a focus on Emblem communities dedicated to attainable rental housing.

- Brad Greiwe will continue as CEO of Quarterra, which has delivered over 43,000 rental residences and has approximately 13,000 additional units in its development pipeline since its launch in 2011.

- Lennox's CEO, Alok Maskara, expressed confidence in the company's future, highlighting strong ROIC and adjusted profit margin growth from 15% to 20%.

- The company is pursuing four key growth initiatives: increasing heat pump penetration (currently under 20% vs. industry's one-third), expanding emergency replacement capabilities, strategic acquisitions (like Duro Dyne Subco for parts), and joint ventures (Samsung, Ariston) to expand its total addressable market.

- Lennox expects 2026 to show higher revenue, units sold, and Return on Sales (ROS) compared to 2025 for both its commercial (BCS) and residential (HCS) segments.

- The acquisition of Duro Dyne Subco is expected to significantly boost Lennox's parts business, aiming to increase its attachment rate from the teens to 30%-35% and achieve a 30% margin for the acquired business.

- Lennox anticipates continued price increases in 2026 across both segments due to ongoing inflation in materials and other costs.

- Lennox expects revenue, units sold, and adjusted profit margin (ROS) to be higher in 2026 than in 2025 across both its BCS and HCS segments.

- The company anticipates price increases in 2026 for both segments, driven by inflation in metal, healthcare, and tariffs, with a goal to price above inflation.

- Strategic growth initiatives include expanding in heat pumps, developing the emergency replacement business, increasing attachment rates through acquisitions (like Duro Dyne Subco for parts), and expanding its total addressable market via joint ventures (Samsung and Ariston).

- Lennox's parts business, currently over 10% of revenue, aims to reach 30-40% through acquisitions like Duro Dyne Subco, which is expected to be accretive to margin, growth, and EPS.

- Regarding inventory, destocking for the two-step channel is projected to conclude by Q2 2026, and the company expects to convert excess inventory into cash in 2026.

Quarterly earnings call transcripts for LENNOX INTERNATIONAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more