Earnings summaries and quarterly performance for LPL Financial Holdings.

Executive leadership at LPL Financial Holdings.

Richard Steinmeier

Chief Executive Officer

Greg Gates

Chief Technology and Information Officer

Katharine Reeping

Chief Accounting Officer

Matthew Audette

President and Chief Financial Officer

Matthew Enyedi

Managing Director, Client Success

Robert S. Hatfield III

Secretary

Board of directors at LPL Financial Holdings.

Albert J. Ko

Director

Allison H. Mnookin

Director

Anne M. Mulcahy

Director

Corey E. Thomas

Director

Edward C. Bernard

Director

H. Paulett Eberhart

Director

James S. Putnam

Chair of the Board

Richard P. Schifter

Director

William F. Glavin Jr.

Director

Research analysts who have asked questions during LPL Financial Holdings earnings calls.

Alexander Blostein

Goldman Sachs

6 questions for LPLA

Michael Cyprys

Morgan Stanley

6 questions for LPLA

Steven Chubak

Wolfe Research

6 questions for LPLA

Devin Ryan

Citizens JMP

5 questions for LPLA

Craig Siegenthaler

Bank of America

4 questions for LPLA

Brennan Hawken

UBS Group AG

3 questions for LPLA

Dan Fannon

Jefferies & Company Inc.

3 questions for LPLA

Jeff Schmitt

William Blair & Company, L.L.C.

3 questions for LPLA

William Katz

TD Cowen

3 questions for LPLA

Ben Budish

Barclays PLC

2 questions for LPLA

Bill Katz

TD Securities

2 questions for LPLA

Daniel Fannon

Jefferies Financial Group Inc.

2 questions for LPLA

Jeffrey Schmitt

William Blair

2 questions for LPLA

Kyle Voigt

Keefe, Bruyette & Woods

2 questions for LPLA

Michael Brown

Wells Fargo Securities

2 questions for LPLA

Michael Cho

JPMorgan Chase & Co.

2 questions for LPLA

Wilma Burdis

Raymond James Financial

2 questions for LPLA

Benjamin Budish

Barclays PLC

1 question for LPLA

Chris O'Brien

Barclays

1 question for LPLA

Christopher Allen

Citigroup

1 question for LPLA

Y. Cho

JPMorgan Chase & Co.

1 question for LPLA

Recent press releases and 8-K filings for LPLA.

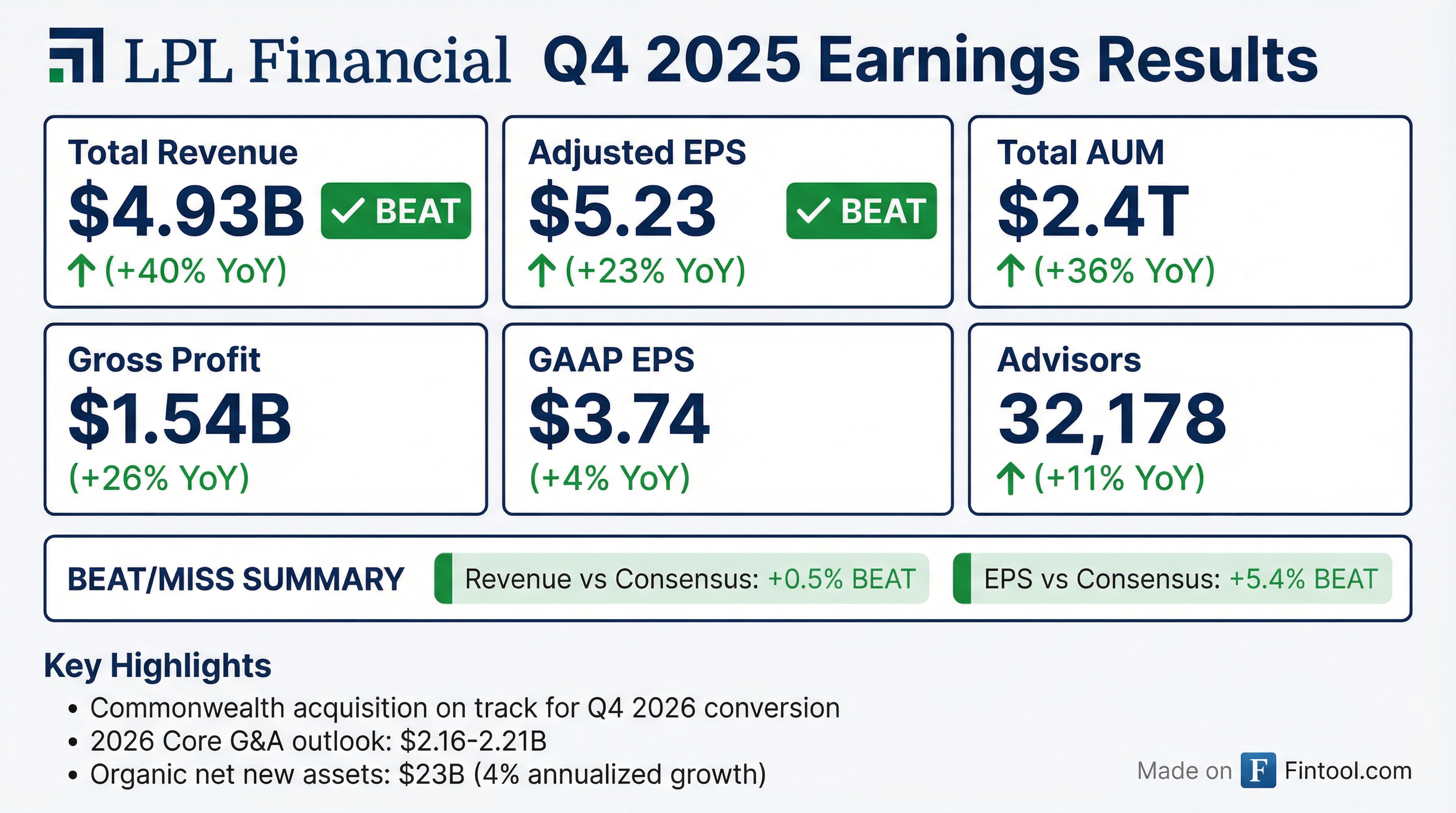

- LPL Financial Holdings Inc. reported record adjusted EPS of $5.23 for Q4 2025 and $20.09 for the full year 2025.

- Total assets reached a record $2.4 trillion in Q4 2025, driven by $23 billion in organic net new assets for the quarter and $147 billion for the full year, reflecting an 8% organic growth rate.

- The acquisition of Commonwealth Financial Network is progressing, with advisor onboarding on track for Q4 2026, expecting 90% retention of client assets and an estimated run rate EBITDA of $425 million once fully integrated.

- Core G&A for 2025 was $1.852 billion, and the company projects 2026 Core G&A to be between $2.155 billion and $2.210 billion including Commonwealth.

- The company's leverage ratio was 1.95x at the end of Q4 2025, and it may resume share buybacks earlier than initially planned due to being ahead of schedule on deleveraging.

- LPL Financial reported record adjusted EPS of $5.23 for Q4 2025, marking a 23% increase from the prior year, and a full-year 2025 record of $20.09.

- Total assets grew to a record $2.4 trillion in Q4 2025, supported by $23 billion in organic net new assets for the quarter (4% annualized growth) and $147 billion for the full year (8% growth).

- The acquisition of Commonwealth Financial Network, the largest in LPL's history, is on track for onboarding in Q4, with an estimated run rate EBITDA of approximately $425 million upon full integration and an expected 90% retention of client assets.

- For 2026, Core G&A is projected to be between $2.155 billion-$2.21 billion, including Commonwealth, and the company is considering resuming share repurchases earlier than initially planned.

- LPL Financial's Total Advisory and Brokerage Assets reached $2,371 billion by the end of 2025, with Advisory assets comprising 59% of the total.

- For Q4 2025, the company reported an Adjusted EPS of $20.09 and an Adjusted pre-tax margin of 38%.

- The acquisition of Commonwealth Financial Network was completed on August 1, 2025, for approximately $2.7 billion, adding ~$330 billion in client assets and ~3,000 advisors. This acquisition is projected to generate a run-rate EBITDA of ~$425 million post-integration.

- In 2025, LPL Financial returned capital to shareholders, executing $94 million in share repurchases and distributing $100 million in dividends.

- The 2026 Core G&A outlook is set between $2,155 million and $2,210 million, incorporating an estimated $380-390 million from the Commonwealth acquisition.

- LPL Financial reported record adjusted earnings per share (EPS) of $5.23 for Q4 2025, an increase of 23% from a year ago, contributing to a record adjusted EPS of $20.09 for the full year 2025.

- Total assets increased to a record $2.4 trillion in Q4 2025, driven by $23 billion in organic net new assets for the quarter, representing a 4% annualized growth rate, and $147 billion for the full year, an 8% growth rate.

- The acquisition of Commonwealth Financial Network is progressing, with onboarding of advisors on track for Q4 2026, and the company continues to expect approximately 90% retention of client assets.

- For 2026, LPL Financial anticipates Core G&A to be in the range of $2.155 billion to $2.21 billion, which includes the full-year impact of expenses related to Commonwealth.

- The company ended Q4 2025 with a leverage ratio of 1.95x and may revisit resuming share buybacks later in 2026, ahead of schedule.

- LPL Financial reported net income of $301 million and diluted EPS of $3.74 for Q4 2025, with adjusted EPS increasing 23% year-over-year to $5.23. For the full year 2025, adjusted EPS grew 22% year-over-year to $20.09.

- Total advisory and brokerage assets reached $2.4 trillion in Q4 2025, a 36% year-over-year increase, with $23 billion in organic net new assets for the quarter and $147 billion for the full year.

- The company declared a $0.30 per share dividend to be paid on March 24, 2026.

- LPL Financial's 2025 Core G&A was $1,852 million, below its outlook range, and the 2026 Core G&A outlook (including Commonwealth) is projected to be $2,155-2,210 million. The conversion of Commonwealth Financial Network is expected in Q4 2026.

- For the fourth quarter of 2025, LPL Financial Holdings reported net income of $301 million and diluted earnings per share (EPS) of $3.74, with adjusted EPS increasing 23% year-over-year to $5.23.

- Full year 2025 results included net income of $863 million and diluted EPS of $10.92, while adjusted EPS increased 22% year-over-year to $20.09.

- Total advisory and brokerage assets increased 36% year-over-year to $2.4 trillion in Q4 2025, and total organic net new assets were $23 billion for the quarter and $147 billion for the full year.

- The conversion of Commonwealth Financial Network is on track to complete in the fourth quarter of 2026.

- LPL's CEO, Rich Steinmeier, highlighted the ongoing integration of Commonwealth Financial Network, the largest transaction in the wealth space in some time, with 80% advisor retention towards a 90% target.

- The company is actively pursuing $1.5 trillion market opportunities in outsourced wealth solutions for banks/credit unions and product manufacturers/insurance providers, with the Prudential solution showing strong results including 9% advisor census improvement and nearly $3 billion in M&A over three quarters.

- LPL is strategically building capabilities, such as an enhanced alternatives platform and integrated banking, to target the $5 trillion high-net-worth and ultra-high-net-worth segment, a market historically outside its reach.

- Despite a recent slowdown in advisor movement and recruiting due to the Commonwealth integration, LPL expects to return to full recruiting capacity soon, aiming to sustain industry-leading organic growth, and is focused on improving operating margin through efficiency and investments expected to pay off in 2026, 2027, and 2028.

- LPL's CEO, Rich Steinmeier, outlined the company's elevated ambition to become the best firm in wealth management, expanding its market focus beyond the independent broker-dealer (IBD) segment.

- A key highlight was the acquisition of Commonwealth Financial Network, the largest transaction in LPL's history, which involved retaining 3,000 advisors and integrating capabilities.

- LPL is strategically developing new capabilities, such as an advanced alternatives platform and integrated banking services, to target the $5 trillion high-net-worth and ultra-high-net-worth segments.

- The company is committed to a multi-year journey of operating margin improvement, driven by enhanced monetization and efficiency, including recent pricing adjustments to advisory platform fees and brokerage account fees.

- LPL's CEO, Rich Steinmeier, outlined the firm's elevated ambition to be the best firm in wealth management, expanding its market focus beyond the traditional independent broker-dealer segment.

- The company is integrating its acquisition of Commonwealth Financial Network, the largest transaction in the wealth space in some time, and has achieved 80% advisor retention towards a 90% target.

- A core strategic priority is improving operating margin, which has driven pricing changes, including reduced advisory platform fees and increased brokerage account fees, aimed at enhanced monetization and efficiency.

- LPL is focused on building new capabilities, such as a mature liquidity and succession solution and an enhanced ClientWorks platform, and expects to return to full recruiting capacity after temporarily allocating resources to the Commonwealth integration.

- LPL Financial Holdings Inc. (LPLA) acquired a minority ownership stake in Private Advisor Group, which manages $41.3 billion in assets under management (AUM) as of June 30, 2025.

- Republic Capital Group served as the investment banking advisor to Private Advisor Group for this transaction.

- The investment strengthens the strategic ties between LPL and Private Advisor Group, broadening Private Advisor Group's ownership structure and aiming to expand advisor support programs and resources.

Quarterly earnings call transcripts for LPL Financial Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more