Earnings summaries and quarterly performance for Madison Square Garden Sports.

Executive leadership at Madison Square Garden Sports.

James L. Dolan

Executive Chairman and Chief Executive Officer

Alexander Shvartsman

Senior Vice President, Controller and Principal Accounting Officer

Bryan Warner

Senior Vice President, Head of Legal

David Granville-Smith

Executive Vice President

Jamaal T. Lesane

Chief Operating Officer

Victoria M. Mink

Executive Vice President, Chief Financial Officer and Treasurer

Board of directors at Madison Square Garden Sports.

Alan D. Schwartz

Director

Anthony J. Vinciquerra

Director

Brian G. Sweeney

Director

Charles P. Dolan

Director

Ivan Seidenberg

Director

Joseph M. Cohen

Director

Marianne Dolan Weber

Director

Nelson Peltz

Director

Paul J. Dolan

Director

Quentin F. Dolan

Director

Ryan T. Dolan

Director

Stephen C. Mills

Director

Thomas C. Dolan

Director

Vincent Tese

Director

Research analysts who have asked questions during Madison Square Garden Sports earnings calls.

David Joyce

Seaport Research Partners

6 questions for MSGS

Brandon Ross

LightShed Partners

5 questions for MSGS

Peter Supino

Wolfe Research

5 questions for MSGS

Joseph Stauff

Susquehanna Financial Group, LLLP

4 questions for MSGS

David Karnovsky

JPMorgan Chase & Co.

3 questions for MSGS

Benjamin Swinburne

Morgan Stanley

2 questions for MSGS

Douglas Wardlaw

JPMorgan Chase & Co.

2 questions for MSGS

Stephen Laszczyk

Citi

2 questions for MSGS

Brandon Ross

LightShed

1 question for MSGS

Daniel Duran

Morgan Stanley

1 question for MSGS

Logan Angress

Wolfe Research

1 question for MSGS

Paul Golding

Macquarie Capital

1 question for MSGS

Recent press releases and 8-K filings for MSGS.

- Madison Square Garden Sports (MSGS) is exploring a spin-off to separate the New York Knicks and New York Rangers (including their minor-league affiliates) into two distinct, publicly traded companies.

- The potential spin-off, which would likely be structured as a tax-free distribution of shares pro rata to MSG holders, aims to create shareholder value and strategic flexibility.

- The company's board unanimously approved exploring this move, partly influenced by activist investor Boyar Value Group's pressure.

- Analysts and outlets note that MSG's market valuation of roughly $7 billion has lagged the combined value of its assets, with Forbes valuing the Knicks at $9.75 billion and the Rangers at $4 billion.

- Completion is not guaranteed, there is no timetable, and the proposal requires additional considerations and league approvals.

- Madison Square Garden Sports Corp. (MSGS) board of directors has unanimously approved a plan to explore a possible spin-off.

- The proposed spin-off would separate the New York Knicks business from the New York Rangers business, creating two distinct publicly traded companies.

- The transaction is expected to be a tax-free spin-off to all Company shareholders, aiming to enhance shareholder value and provide each company with greater strategic and financial flexibility.

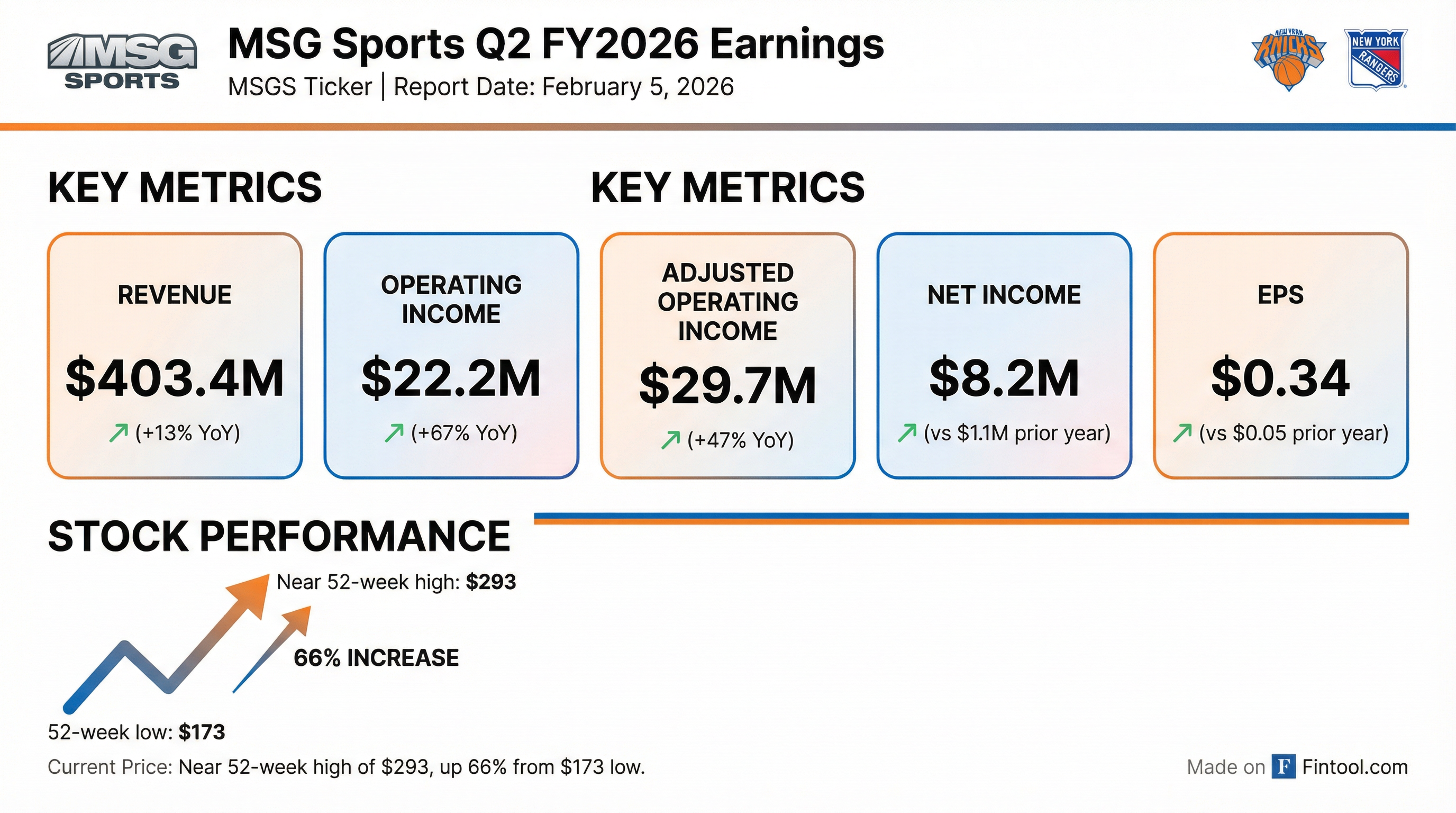

- Madison Square Garden Sports Corp. (MSGS) reported fiscal Q2 2026 revenues of $403.4 million and Adjusted Operating Income (AOI) of $29.7 million, reflecting a 20% increase in event-related revenues and a 24% increase in suites and sponsorship revenues year-over-year.

- The revenue growth was primarily driven by higher national media rights fees from new NBA deals and an increase in home games, partially offset by a 4% decrease in total national and local media rights fees due to amended local media rights agreements with MSG Networks.

- The company refinanced its credit facilities in November 2025, extending maturities to November 2030 and increasing the Knicks' facility capacity by $150 million to $425 million. As of quarter-end, MSGS held approximately $81 million in cash and had a total debt balance of $291 million.

- Madison Square Garden Sports Corp. (MSGS) generated revenues of $403.4 million and Adjusted Operating Income of $29.7 million for the fiscal 2026 second quarter.

- The company saw event-related revenues increase 20% year-over-year to $167.2 million and suites and sponsorship revenues increase 24% year-over-year to $98.5 million, driven by more home games and increased per-game spending across categories.

- National and local media rights fees decreased 4% year-over-year to $122.3 million, primarily due to amended local media rights agreements with MSG Networks, which included 28% and 18% reductions for the Knicks and Rangers, respectively, effective January 1, 2025.

- In November, MSGS refinanced its Knicks and Rangers senior secured revolving credit facilities, extending their maturity to November 2030 and increasing the Knicks' facility by $150 million to $425 million.

- The company ended the quarter with a cash balance of $81 million and a debt balance of $291 million, and stated it would not rule out a return of capital program in the future.

- Madison Square Garden Sports Corp. (MSGS) reported Q2 2026 revenues of $403.4 million and Adjusted Operating Income (AOI) of $29.7 million, reflecting a 20% increase in event-related revenues and a 24% increase in suites and sponsorship revenues year-over-year.

- The company experienced strong operational momentum, with a 94% combined season ticket renewal rate for the Knicks and Rangers, and higher per-game revenues across all in-game categories, including ticketing, food, beverage, and merchandise.

- MSGS refinanced its credit facilities in November 2025, extending maturities to November 2030 and increasing the Knicks' revolving credit facility capacity by $150 million to $425 million, enhancing financial flexibility.

- National and local media rights fees decreased 4% year-over-year to $122.3 million, primarily due to amended local media rights agreements with MSG Networks, which included 28% and 18% reductions for the Knicks and Rangers, respectively, effective January 1, 2025.

- Madison Square Garden Sports Corp. (MSGS) reported revenues of $403.4 million for the fiscal second quarter ended December 31, 2025, an increase of 13% compared to the prior year period.

- Operating income for the quarter grew 67% to $22.2 million, and adjusted operating income increased 47% to $29.7 million year-over-year.

- The revenue growth was primarily driven by higher ticket-related revenues, league distributions (including increased national media rights fees from new NBA agreements), suite revenues, sponsorship and signage revenues, and food, beverage and merchandise sales.

- These increases were partially offset by lower local media rights fees due to amendments to agreements with MSG Networks.

- The company also benefited from a combined four additional New York Knicks and New York Rangers games played at Madison Square Garden Arena during the fiscal 2026 second quarter.

- Madison Square Garden Sports Corp. reported revenues of $403.4 million for the fiscal 2026 second quarter, an increase of 13% compared to the prior year period.

- For the quarter ended December 31, 2025, operating income grew 67% to $22.2 million, and adjusted operating income increased 47% to $29.7 million.

- The revenue increase was primarily driven by higher ticket-related revenues, increased league distributions (due to new NBA national media rights deals), suite revenues, sponsorship and signage revenues, and food, beverage and merchandise sales, partially offset by lower local media rights fees.

- The company benefited from four additional New York Knicks and New York Rangers games played at Madison Square Garden Arena during the fiscal 2026 second quarter, which contributed to increased in-game revenue categories.

- On November 6, 2025, New York Knicks, LLC, a wholly owned subsidiary of Madison Square Garden Sports Corp., entered into the 2025 Knicks Credit Agreement.

- This agreement establishes a senior secured revolving credit facility of up to $425,000,000 with a maturity date of November 6, 2030.

- The new facility refinanced $267,000,000 in borrowings outstanding under the previous credit agreement, with the same amount remaining outstanding as of November 6, 2025.

- Knicks LLC is required to maintain a minimum debt service ratio of at least 1.5:1.00 under the terms of the agreement.

- Madison Square Garden Entertainment (MSGS) reported Q1 2026 revenues of $158.3 million, an increase of 14% versus the prior year quarter, and Adjusted Operating Income (AOI) of $7.1 million, up $5.2 million from the prior year quarter.

- The company achieved a record number of concerts at the Garden in Q1 and expects record revenues for the Christmas Spectacular, with 215 shows planned for the season and advanced ticket revenues pacing up double digits.

- MSGS repurchased approximately $25 million of Class A common stock during the quarter, with $45 million remaining under its current buyback authorization, and expects to generate substantial free cash flow in fiscal 2026.

- The company is making progress to finalize a major residency for fiscal 2027 at the Garden, which is anticipated to drive future concert growth.

- Sphere Entertainment reported third-quarter revenues of $262.5 million, a 15% increase year-over-year, primarily driven by strong performances at its Sphere venue, but missed Wall Street expectations of $320 million.

- The company posted an operating loss of $129.7 million and an actual loss of $2.80 per share, marking six consecutive quarters of earnings per share losses.

- Revenue growth at the Sphere venue, which was up 37%, was partially offset by a 12% revenue decline at MSG Networks due to a 13.5% drop in subscriber count.

- Despite a 64.5% year-to-date stock gain, financial indicators reveal ongoing challenges, including a negative net margin and an Altman Z-Score of 1, indicating potential financial distress.

Fintool News

In-depth analysis and coverage of Madison Square Garden Sports.

Quarterly earnings call transcripts for Madison Square Garden Sports.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more